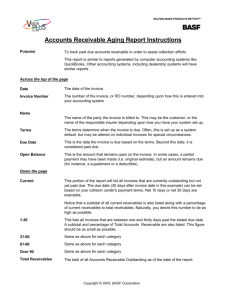

Accounts Receivable Aging

advertisement

Establish Effective Credit and Collection Policies EXTENDING CREDIT TO YOUR CUSTOMERS Advantages of Trade Credit In Your Business Encourage customers to buy more Improve customer loyalty and build good customer relations; Make your customers less sensitive to price and more focused on the services you offer Advantages of Trade Credit In Your Business You can factor or finance receivables Well designed accounts receivable management policies impress potential creditors and investors Disadvantages of Trade Credit Accounts receivable often constitute a significant portion of assets. Receivables may not be highest quality given firm’s recent financial condition. Controlling the accounts receivable process demands the development of policies that are compatible with an enterprises profit, liquidity and market share. Accounts Receivable Policy Granting credit is actually the practice of making an investment in your customers. You have to decide what customers are worthy of that investment. If you do a cost/benefit analysis and make the important decision to extend credit you need to establish procedures for credit and collecting accounts. Accounts Receivable Policy Let’s begin with the Acceptance Rejection Model linked to Excel The Acceptance/Rejection Costs model serves as a framework for evaluating decisions on changing credit policies; Accounts Receivable Policy Since the accounts receivable policy has a broad impact, it must be managed carefully and assessed frequently. Output Screen Acceptance Cost $4,449 Rejection Cost $38,400 Accept/Reject Credit: ACCEPT CREDIT Pr obabi l i t y B/ E 0.380 Problems in individual Accounts Receivable Aging accounts can be detected through analysis of your receivables by aging. A receivables aging divides each customer's account into amounts that are 0-30 days old, 31-60 days old, 61-90 days old. Number of Days Outstanding 0 - 30 30 -4 5 45 – 60 60 – 90 90 or more Total Amount Percent $45,000 $11,000 $6,500 $3,200 $1,900 $67,900 66.27% 16.64% 9.57% 4.71% 2.80% 100.00% Aging Schedule of Accounts Receivable Phase One: Review Customer Financial The Credit Check: Scope and Statements Details Phase Two: Follow Through Receivables Key Points –Examination of receivables: classification of accounts and aging. –Obtain credit reports and checkings on largest accounts. –Verify receivables. Compute collection period for each account. –Classify accounts into acceptable and unacceptable categories. Scope and Details Before acceptance into borrowing base need measurements of receivable management: Average Collection Period The delinquency ratio = past due receivables over credit sales The bad debt ratio: = write-offs over net receivables Scope and Details Check files of past due accounts. Review recent correspondence and collection efforts. Review large positions. Review Accounts Receivable Policy In Detail Broad Picture Consider sound credit policy issues Quality standards Terms Limitations Instruments and payment methods Explore collections and credit insurance as well as internal and external financing options Broad Picture Effective procedures for credit approval, collection, processing payments and past due accounts are identified Proper evaluation is emphasized analytical methods to improve the accounts receivable policy. Internal and External Constraints Accounts receivable policy requires careful evaluation of potential impact on: sales volume cash management objectives and procedures; direct and indirect costs of receivables management; and customer relations. The Core Of Accounts Receivable Management Credit Policy Credit Period Credit Terms Credit Quality Standards Discounts and Surcharges Credit Policy Factors that influence credit policy: Ability to finance the credit policy. Costs of financing receivables estimated to determine which approach is feasible; Industry credit terms. Terms tend to be alike throughout industry. However, if enterprise has a superior product or service, consider more restrictive credit terms than industry average; Credit Policy Competitive issues. credit policy often limited by competitor and customer reactions Credit Policy The size of customer base and relative risk profile of customers. Credit policy take into account major, high-risk customers and the weighting that should be given to them in relation to the total customer base Credit Policy Sales volume If a new or changing credit policy is expected to increase sales volume, ability to meet customer demand considered; Late payments and defaults. As a firms credit policy is eased, latepayment and default risk usually increase; Credit Policy Sovereign risk and credit policy on export sales. Export sales credit policy consider political, economic, and local practices. Credit Quality Standards To evaluate overall credit quality, five Cs of credit are considered. Each is weighted relative to its importance to the enterprise and the availability of information for constructing probability estimates. The Credit Report Corporate summary financial statements key ratios appropriate trend analyses Credit history showing payment timing credit limit legal The Credit Report Customers credit quality ratings reassessed on a regular basis, particularly major customers whose default could have serious financial consequences for the seller. Consider credit migration probabilities The Credit Report Consider amount of credit granted and used, the industry class, and general economic conditions. Management should also regularly review critical factors chosen like financial factors and weighting assigned to each factor Credit Period The credit period is length of time credit is granted (for example, from invoice date to due date), and is normally established according to an industry standard. Credit Period The credit period has direct impact on cost of financing receivables and on collection risk. An enterprise may elect to deviate from the industry standard for one or more reasons: to obtain a competitive advantage to reflect the enterprises classification of customer quality or to adjust to longer-term economic or business changes. . Payment Terms Credit terms normally specified on contractual documents, or on customer invoice or statement. Cash before delivery (CBD) or cash on delivery (COD) required when buyer classified as poor credit risk. In cases of an unknown or one-time customer, certified check may be required when order is placed, or before goods or services delivered. Payment Terms Cash terms permit buyer payment period of about five to 10 days and used for high-turnover or perishable goods. Invoice terms often stipulate net due date and discount date calculated from various starting dates: invoice, delivery, or client acceptance dates. The terms may be quoted, for example, as 2/10, net 30 meaning a payment discount of 2% is given if the invoice is paid within 10 days. Full payment is required after 10 days but within 30 days. Payment Terms Watch Consignment sales require holder of the goods to pay the supplier only when the goods sold. Supplier retains ownership of goods until sold and may reclaim them or take legal action in cases of default. The holder must maintain segregated inventory and sales records, and provide a periodic inventory reconciliation. Discounts and Surcharges Cash discount policies may be established for a number of reasons: to conform to the industry norm to stimulate sales to expedite receipt of cash Credit Limits Credit limit categories codify total credit granted to customers in each credit quality classification. credit limits regularly reviewed. Periodic reassessments simplified by automatically reassigning customers to a higher credit limit level after specified period of satisfactory payment experience. Credit Limits Credit factors used to calculate single numerical value to assign credit limits and payment periods to different customers. Credit score tempered by informed management judgment because acceptreject decision implicitly includes economic trade-offs: to minimize rejection of an acceptable credit customer (with loss of future business) versus to accept a poor credit risk (and resulting debt losses) Credit Instruments Written payment contracts agreed to by the enterprise and customers. Instruments range from simple invoices to formal credit arrangements. When selecting an instrument to be used consider industry standards, market norms, and buyer risks. Payment Methods Example: Electronic Funds Transfer Factors to consider when determining possible payment methods are: provisions of the Federal Currency Act concerning legal tender; standard trade practices; cost of processing; cash flow implications; and impact on collection risk. Collection Policy The collections policy should specify: the employees directly responsible for maintaining the policy; cash management techniques to be used to optimize cash inflow (including prompt invoicing); a statement routine and payment processing method; a detailed procedure for handling past-due accounts Credit Insurance Collection risk can be reduced by purchasing credit insurance, thus shifting some of the risk of bad debt losses to a third party. Risk level has to be high enough to warrant the insurance premium. For example, receivables concentration Overdue Accounts Following is action of mid-sized firm: request prompt payment of the account; withhold approval or refuse to ship further goods (or provide service) until past due payments are made; withhold approval until partial payment is made; or refuse further credit. Overdue Accounts When partial payments required, policy should specify whether payments applied to oldest amounts outstanding, to smallest outstanding invoices (a process called shorting), or largest overdue amount. payments should be made against specific invoices where possible. Evaluation of Sales Policies Detailed analysis of customer sales records Phase Evaluation ofrecords Sales A detailed Three: analysis of the borrower's sales Policies are essential during the initial audit. Typical methods will reduce sales into categories that include: –Geographic analysis where sales are separated by location. Determine geographical distribution of sales and concentration. –Product analysis. Size of package, and grade. –Class of trade. –Price. –Method: mail, telephone, direct selling. –Terms: cash or charge. Order size. Product Analysis and Product Policies Detailed analysis of product analysis and product policies are essential during workout Phase Four: Product Analysis Product Policies should be reviewed and generally and Product Policies include: –Sales volume, –Type and number of competitors, –Technical opportunity, –Patent protection, –Raw materials required, –Production load, –Value added –Similarity to major businesses –Effect on other products.