Analyzing Financial Statements for Profitability, Liquidity, and Solvency

advertisement

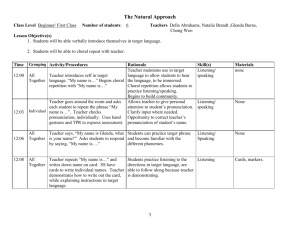

Analyzing Financial Statements for Profitability, Liquidity, and Solvency Chapter 8 © 2005 Accounting 1/e, Terrell/Terrell 8-1 Learning Objectives 1 and 2 Distinguish among profitability, liquidity, and solvency. Calculate financial ratios designed to measure a company’s profitability, liquidity, and solvency. © 2005 Accounting 1/e, Terrell/Terrell 8-2 Introduction Financial statements analysis is the process of looking beyond the face of the financial statements to gain additional insight into a company’s financial health. Ratio analysis is a technique for analyzing the relationship between two items from a company’s financial statements for a given period. © 2005 Accounting 1/e, Terrell/Terrell 8-3 Elevation Sports, Inc. Balance Sheet May 31, 2004 Assets: Current assets Cash Accounts receivable Less: Allowance for doubtful accounts Merchandise inventory Raw materials inventory Work-in-process inventory Finished goods inventory Supplies inventory Prepaid rent Prepaid insurance Total current assets © 2005 Accounting 1/e, Terrell/Terrell $9,900 – 450 $128,834 9,450 4,397 2,315 14,864 13,634 593 12,000 5,000 $190,637 8-4 Elevation Sports, Inc. Balance Sheet May 31, 2004 Property, plant, and equipment Administrative equipment $ 5,100 Selling furniture and fixtures 8,400 Production equipment 89,600 Less: Accumulated depreciation Total property, plant, and equipment Intangible assets Patents Copyrights Trademarks Total intangible assets Total assets © 2005 Accounting 1/e, Terrell/Terrell $103,100 – 17,800 $ 10,083 570 1,425 $ 85,300 $ 12,078 $288,015 8-5 Elevation Sports, Inc. Balance Sheet May 31, 2004 Liabilities and stockholders’ equity: Current liabilities Accounts payable Other accounts payable Interest payable Payroll taxes payable Sales taxes payable Income taxes payable Current portion of long-term note payable Total current liabilities Long-term liabilities: Note payable – Vail National Bank $ 60,000 Less: Current portion 15,000 Total long-term liabilities Total liabilities © 2005 Accounting 1/e, Terrell/Terrell $ 6,942 11,812 6,000 1,400 560 42,120 15,000 $ 83,834 45,000 $128,834 8-6 Elevation Sports, Inc. Balance Sheet May 31, 2004 Stockholders’ equity Paid-in capital: Common stock, $10 par value, 100,000 shares authorized, 4,000 shares issued and outstanding $ 60,000 Paid-in capital in excess of par – common stock 40,000 Total paid-in capital $100,000 Retained earnings 59,181 Total stockholders’ equity Total liabilities and stockholders’ equity © 2005 Accounting 1/e, Terrell/Terrell 159,181 $288,015 8-7 Elevation Sports, Inc. Income Statement For the Year Ended May 31, 2004 Net sales Cost of goods sold Gross profit Selling expenses $48,334 Administrative expenses 72,189 Total operating expenses Operating income Other revenues and expenses: Interest revenue $ 512 Interest expense (6,000) Total other revenues and expenses Income before income taxes Income taxes Net income Earnings per share © 2005 Accounting 1/e, Terrell/Terrell $527,146 295,834 $231,312 120,523 $110,789 (5,488) $105,301 42,120 $ 63,181 $ 15.79 8-8 Profitability Ratios Profitability is the ease with which a company generates income. Profitability ratios measure a firm’s past performance and help predict its future profitability level. © 2005 Accounting 1/e, Terrell/Terrell 8-9 Profitability Ratios This ratio measures how efficiently the company uses its assets to produce profits. Return on assets = Net income before taxes ÷ Total assets $105,301 ÷ $288,015 = 36.56% © 2005 Accounting 1/e, Terrell/Terrell 8 - 10 Profitability Ratios This ratio measures the percentage of income before income taxes produced by a given level of revenue. Profit margin before income tax = Net income before taxes ÷ Sales $105,301 ÷ $527,146 = 19.98% © 2005 Accounting 1/e, Terrell/Terrell 8 - 11 Profitability Ratios This ratio calculates the amount of sales produced for a given level of assets used. Total asset turnover = Sales ÷ Total assets $527,146 ÷ $288,015 = 1.83 times © 2005 Accounting 1/e, Terrell/Terrell 8 - 12 Profitability Ratios Return on assets Profit margin Total asset = × before income tax turnover Net income before taxes = ÷ Total assets © 2005 Accounting 1/e, Terrell/Terrell Net income before taxes ÷ Sales Sales ÷ × Total assets 8 - 13 Profitability Ratios This ratio measures the amount of after-tax net income generated by a dollar of sales. Profit margin after income tax = Net income after taxes ÷ Sales $63,181 ÷ $527,146 = 11.98% © 2005 Accounting 1/e, Terrell/Terrell 8 - 14 Profitability Ratios This ratio indicates how much after-tax income was generated for a given level of equity. Return on equity after taxes = Net income after taxes ÷ Stockholders’ equity $63,181 ÷ $159,181= 38.69% © 2005 Accounting 1/e, Terrell/Terrell 8 - 15 Profitability Ratios This ratio calculates how much before-tax income was generated for a given level of equity. Return on equity before taxes = (Net income after taxes + Income taxes) ÷ Stockholders’ equity $105,301 ÷ $159,181= 66.15% © 2005 Accounting 1/e, Terrell/Terrell 8 - 16 Liquidity Ratios An asset’s liquidity describes the ease with which it can be converted to cash. Liquidity ratios evaluate a firm’s ability to generate sufficient cash to meet its short-term obligations. © 2005 Accounting 1/e, Terrell/Terrell 8 - 17 Liquidity Ratios This ratio measures the company’s ability to meet its current liabilities with current assets. Current ratio = Current assets ÷ Current liabilities $190,637 ÷ $83,834 = 2.27 to 1 © 2005 Accounting 1/e, Terrell/Terrell 8 - 18 Liquidity Ratios This ratio is a stringent test of liquidity that compares highly liquid current assets to current liabilities. Acid-test ratio = (Cash + Receivables + Trading securities) ÷ Current liabilities ($128,384 + $9,450 + $0) ÷ $83,834= 1.64 to 1 © 2005 Accounting 1/e, Terrell/Terrell 8 - 19 Liquidity Ratios This ratio indicates the level of sales generated for a given level of working capital. Net sales to working capital = Sales ÷ (Current assets – Current liabilities) $527,146 ÷ ($190,637 – $83,834) = 4.94 times © 2005 Accounting 1/e, Terrell/Terrell 8 - 20 Liquidity Ratios It measures how quickly a company collects its accounts receivable. Accounts receivable turnover = Net credit sales ÷ Accounts receivable Net credit sales = $151,650 – $2,426 = $149,224 © 2005 Accounting 1/e, Terrell/Terrell 8 - 21 Liquidity Ratios Receivable turnover = $149,224 ÷ $9,450 = 15.79 times Average collection period = 365 ÷ 15.79 = 23.27 days © 2005 Accounting 1/e, Terrell/Terrell 8 - 22 Liquidity Ratios This ratio indicates the number of times total merchandise inventory is purchased (or finished goods inventory is produced) and sold during a period. Inventory turnover = Cost of sales ÷ Inventory © 2005 Accounting 1/e, Terrell/Terrell 8 - 23 Liquidity Ratios Inventory turnover = $295,834 ÷ ($4,397 + $13,634) = 16.41 times Average number of days Elevation Sports, Inc., holds its inventory = 365 ÷ 16.41 = 22.24 days © 2005 Accounting 1/e, Terrell/Terrell 8 - 24 Solvency Ratios Solvency is a company’s ability to meet the obligations created by its long-term debt. Solvency ratios are of most interest to stockholders, long-term creditors, and company management. © 2005 Accounting 1/e, Terrell/Terrell 8 - 25 Solvency Ratios It measures what proportion of a company’s assets is financed by debt. Assets = Liabilities + Owners’ equity 100% = Some % + © 2005 Accounting 1/e, Terrell/Terrell Some % 8 - 26 Solvency Ratios Total liabilities ÷ Total assets $128,834 ÷ $288,015 = 44.73% © 2005 Accounting 1/e, Terrell/Terrell 8 - 27 Solvency Ratios This ratio is also called the times-interest-earned ratio. It indicates a company’s ability to make its periodic interest payments. © 2005 Accounting 1/e, Terrell/Terrell 8 - 28 Solvency Ratios Coverage ratio = Earnings before interest expense and income taxes ÷ Interest expense ($105,301 + $6,000) ÷ $6,000 = 18.55 times © 2005 Accounting 1/e, Terrell/Terrell 8 - 29 Learning Objective 3 Locate industry averages. © 2005 Accounting 1/e, Terrell/Terrell 8 - 30 Industry Averages This chapter emphasizes the Almanac of Business and Industrial Financial Ratios. The Almanac includes all companies, public and private. Information provided in the Almanac for each industry is four pages. It consists of two tables. © 2005 Accounting 1/e, Terrell/Terrell 8 - 31 Industry Averages Table I provides an analysis of all companies in the particular industry, regardless of whether they had any net income for the year. Table II provides the same information items as Table I, but it considers only companies that showed a net income for the year. © 2005 Accounting 1/e, Terrell/Terrell 8 - 32 Learning Objective 4 Evaluate a company’s ratios using a comparison to industry averages. © 2005 Accounting 1/e, Terrell/Terrell 8 - 33 Comparison of Elevation Sports, Inc., to Industry Averages Ratio Return on assets Profit margin before income taxes Total asset turnover Profit margin after income tax Return on equity after income taxes Return on equity before income taxes Current ratio Quick ratio Net sales to working capital Receivables turnover Inventory turnover Debt ratio Coverage ratio © 2005 Accounting 1/e, Terrell/Terrell Elevation Sports, Inc. Total Industry Industry with Assets $250-$500,000 36.6% 20.0% 1.8 12.0% 39.7% 43.5% 2.3 1.7 4.9 15.8 16.4 44.7% 18.6 10.1% 4.2% 1.9 3.4% 19.3% 23.9% 1.6 0.4 7.3 28.6 2.5 65.8% 5.3 16.1% 6.1% 2.3 5.7% 40.5% 43.1% 1.9 0.5 5.9 31.7 2.1 68.2% 6.7 8 - 34 Company Analysis Compare ratios to the industry averages. Look for company trends. Consider the industry environment. Draw conclusions. © 2005 Accounting 1/e, Terrell/Terrell 8 - 35 Learning Objective 5 Use ratio values from consecutive time periods to evaluate the profitability, liquidity, and solvency of a business. © 2005 Accounting 1/e, Terrell/Terrell 8 - 36 Trend Analysis of Selected Ratios Ratio 2002 2001 2000 1996 Return on assets Profit margin before taxes Total asset turnover Profit margin after taxes Return on equity after taxes Return on equity before taxes Current ratio Quick ratio Net sales to working capital Receivables turnover Inventory turnover Debt ratio Total liabilities to net worth 137.4 142.5 96.4 147.5 137.9 136.7 91.7 515.8 126.5 0 144.5 94.6 91.7 150.4 141.3 106.4 146.3 145.1 144.2 95.4 69.3 140.3 0 135.3 87.1 81.2 153.7 150.1 102.4 155.4 158.3 156.8 84.0 131.4 147.7 0 129.0 99.2 98.7 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 0 100.0 100.0 100.0 © 2005 Accounting 1/e, Terrell/Terrell 8 - 37 Learning Objective 6 Draw conclusions about the credit-worthiness and investment-attractiveness of a company. © 2005 Accounting 1/e, Terrell/Terrell 8 - 38 Draw Conclusions The evaluation process by nature depends upon individual perception. 1. Family Dollar Stores, Inc., is an industry leader in profitability and solvency. 2. Family Dollar has improved the distribution element of its supply chain. © 2005 Accounting 1/e, Terrell/Terrell 8 - 39 Draw Conclusions 3. Part of the company profitability and liquidity will depend upon its increasing the inventory turnover ratio. 4. If we choose to invest in a general merchandise discounter, Family Dollar Stores, Inc., might be one to consider. © 2005 Accounting 1/e, Terrell/Terrell 8 - 40 Learning Objective 7 State the limitations of ratio analysis. © 2005 Accounting 1/e, Terrell/Terrell 8 - 41 Limitations of Ratio Analysis 1. Attempting to predict the future using past results depends upon the predictive value of the information used. 2. The financial statements used to compute the ratios are based on historical cost. 3. Figures from the balance sheet used to calculate the ratios are year-end numbers. © 2005 Accounting 1/e, Terrell/Terrell 8 - 42 Limitations of Ratio Analysis 4. Industry peculiarities create difficulty in comparing the ratios of a company in one industry with those of a company in another industry. 5. Lack of uniformity concerning what is to be included in the numerators and denominators make comparisons extremely difficult. © 2005 Accounting 1/e, Terrell/Terrell 8 - 43 End of Chapter 8 © 2005 Accounting 1/e, Terrell/Terrell 8 - 44