Investing Public Funds

advertisement

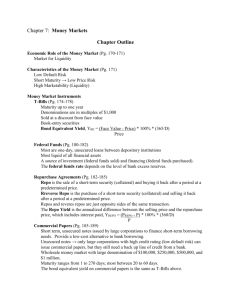

INVESTING SCHOOL FUNDS Public Funds Investment Act Workshop REGION One July 2015 What is public investing? Managing risk Putting money to work. Creating a performing asset Building a portfolio to serve the entity Utilizing markets and products for entity benefit Adding yield but not risk to the portfolio Assuring cash efficiency and security including banking arrangements Service as A Public Investor Special fiduciary duties for public funds: market and internal entity knowledge to understand risk to be conservative to be pro-active and curious effective communication skills What is PFIA Designed to Do? Provide guidelines for safety Apply to all entities Allow entities to set their own parameters WAM and maturities and authorized investments Define guidelines on investments to direct high credit quality Provide for flexibility (maturity) Provide for control on extension risk (WAM) Allow entities to adjust to changes internally and externally Our Standard of Care Prudent Person Rule Investment shall be made with judgment and care, under prevailing conditions, that a person of prudence, discretion, and intelligence would exercise in the management of the person’s own affairs, not for speculation but for investment considering the probable safety and probable income to be derived. Essentially I am more concerned with the return of my money than the return on my money A key point is “circumstances then prevailing” because conditions change internally and in the market PFIA Public Funds Investment Act Texas Government Code 2256 Public Funds Collateral Act Texas Government Code 2257 Their development reflects changing circumstances and changing needs Change is continuous in the investment arena 6 Anatomy of Change 1987 SplittingPools Bankingcreated and Investment 1989 1993 CMO added 1994 Orange County Rates drop 1995 Reaction to Bankrupt Orange County Rates rise quickly 7 1995 Reaction to Orange County Prohibition added for certain MBS/CMOs Reverse repurchase agreements restricted by term and tied to the reverse term (leverage) Training for investment officers added Broker certification requirement added “imprudent investments” original language Added maximum maturities and WAM Designation of investment officers added Written quarterly reports required Mutual funds added 8 1995 – Adding Controls State agency training added Prior authorized investments not required to be liquidated Pools require rating of AAA or equivalent Municipalities with utilities authorized to hedge State purchase and delivery of securities regulations Loss of required rating requires prudent liquidation 9 1997 Continuing Concerns Investment officer training extended to 10 hours within 12 months and every two years Delivery versus payment added as requirement and required in policy Officer ethics disclosure added Broker list creation and approval added 10 Anatomy of Change 1999 2001 2003 2005 2007 Israeli Bonds, and GICs Hedging Letters of credit Securities lending CDARS Decom Trust Hedging markets are healthy - banks look for fees 11 Anatomy of Change 2009 2011 2013 Energy Rules Eagle Ford & Barnett Shade Mineral Rights Broker hunger FDIC/FICA No PFIA change Markets crash on credit CDs out of TX DVP conflict - brokers are hungry PFCA change requires request for collateral rates still low 12 2015 Changes Investment Officer Training Changes Only Initial 10 hours of training remains the same Still 10 hours within 12 months of taking the position Continuing training for schools and cities changed Eight (8) hours every two years after initial training Period starts on first day of fiscal year Lessons from History Not all the changes made affect you or should Not all the changes are necessarily good Unique situations must be judged as such Often result of reach for yield or outside influence The devil is in the details You have to understand why the change occurred 14 PFIA Specific Requirements (Call it “Audit Risk”) • Write a Policy which: • • • • • • • • (2256.005) Emphasizes safety and liquidity Addresses diversification, yield, maturity & capability Lists authorized investments Includes procedure to monitor credit rating changes Set a maximum maturity and WAM Tell how market prices are monitored Require delivery versus payment (DVP) Review and adopt policy annually PFIA Specific Requirements Entity must write a strategy Council must review and adopt the strategy annually Council must designate investment officer(s) Designate by resolution Effective until rescinded or terminated from employment Council must provide for the training of officers Council has the option to chose officers (no necessary set position) Officers must disclose personal/business relationships Refers to personal business relationships 2nd degree of affinity or consanguinity (blood or marriage) Specific income limits are set but full disclosure is safer/easier Disclosure to TX Ethics Commission and governing body Investment Officers Must be designated by resolution Officers or employees of entity Contracted investing entity can be officers Effective until rescinded or terminated Regional Planning Commission officer can only serve RPC Training Specifics Required training Required within 12 months of appointment or position Required every two succeeding fiscal years Cities and school districts are now reduced to 8 hours each 2 years Training sources must be approved by governing board or investment committee Required training for (a) treasurer, (b) CFO (if Treasurer is not CFO) and (c) all designated investment officers PFIA Specific Requirements Provide policy for written certification To all firms wishing to sell a transaction must provide certificate Provides for the review – it is not a guarantee Counter-parties All counterparties must certify to the Policy A list of broker/dealers must be approved annually by Council Includes pools, banks, investment advisors as well as broker/dealers Or a Council designated Investment Committee Audits Annually obtain or complete an annual management audit Assuring compliance with the Policy and the PFIA Audit by independent auditor may be required if invested in more than CDs and pools PFIA Specific Requirements Reporting Must be prepared jointly by investment officers Must be signed by each Investment officer Must be submitted to Board quarterly On a timely basis Must contain detail and summary information Must conform to PFIA report requirements Must state compliance with Policy and PFIA PFIA Specific Items CDs may be bought orally Prudence is based on the whole portfolio Prudence to liquidate at loss of rating No need to liquidate if authorized at purchase Does not constitute an authorized security with lower rating Policy must include procedure for monitoring credit rating and possible liquidation Discuss and decide the reasonable action to take Chapter is sub-cumulative to other law Some Water District variations have been created Basic Public Objectives Safety of principal Liquidity Avoiding risk of over-concentration Yield Assuring that funds are available Covering known and unexpected expenses Diversification Preservation of capital Making all the funds work How do we achieve the objectives? How do I achieve Safety? Document all transactions Use competitive transactions Recognize changes in your and the markets’ situation Learn about the various securities/opportunities Use independent counter-parties Delivery versus Payment (DVP) Settlement Review and report regularly Establish controls and procedures Review contracts Establish Collateral establish equality review for practicality Independent safekeeping and reporting Diversify How do I achieve Liquidity? Create and understand your cash flow Invest to known liabilities Providing liquidity at appropriate time Always have a small cash buffer for emergencies Buy high quality securities High quality assures a secondary market How do I achieve Diversification? Create competition in every transaction Diversification by type of security Never rely on one institution or broker Do not allow a broker to do competitive bidding for you Knowledge of the securities Use securities that make sense for the period Diversification maturity Create a ladder to meet your liabilities How do I achieve Yield? Invest to your cash flow needs Knowing your securities and use appropriate ones Assure there is always competition Use time and attention for the portfolio Know your alternatives and compare them Use the alternatives available Commonalities SAFETY LIQUIDITY DIVERSIFICATION YIELD cash flow cash flow cash flow cash flow information information information Information controls controls diversification diversification competition competition controls diversification diversification documentation contracts competition documentation procedures credit quality procedures credit quality Change Market conditions change constantly Internal situations change Know the “circumstances then prevailing” The best weapon is information Do not single-source information Have a reasonable process for downgrades Ongoing disclosure to governing boards will help Changes in tenured individuals Board proclivities for risk change New or different types of funds may change (bond $$) Weather events may influence need for liquidity Legislation changes Adapting to Change Competitive process will keep you on top of the market Periodic review of policies and procedures will keep policy dynamic Training will keep you up-to-date Expecting change allows you to adapt Today’s Major Change Factor • • • Interest rates control you and your strategies Know what you can control Know the rates generally Public entities operate primarily in this area of the curve. Rates Drop with Oil, Economy, and Dollar 3.50% 3.00% 2.50% P e r c e n t Mar-15 2.00% Feb-15 Short end moves up slightly Dec-14 1.50% Nov-14 Jun-14 1.00% 0.50% 0.00% 3mo 6mo 1yr 2yr 5yr 10yr End of Month Rates - Full Yield Curve – Fed Funds to 30yr 30yr What is Changing? Why? • What is driving the rates and markets currently? • What factors will change outlooks? Investment Process/Cycle The process is cycle to verify circumstances then prevailing have not changed The process exists for all types of investing The process requires ongoing systematic review Step 1: Cash Flow Identifies when you need money to pay bills Protects your liquidity Improves investment returns Establishes parameters for policy guidelines Maximum maturity Maximum weighted average maturity Risk benchmark Promotes safe maturity extensions Defines your portfolio Cash Flow Analysis What? Study of how cash moves through an entity Study of how and when money flows Capture revenues & expenditures for analysis over time Problem periods Opportunities Basis for cash projections Cash Flow Analysis Why? Protects your liquidity Improves investment returns Establishes parameters for policy guidelines Maximum maturity Maximum weighted average maturity Risk benchmark Promotes safe maturity extensions Cash is the gas that makes an entity go Cash flow analysis makes the portfolio go Defines your portfolio Cash Flow Sets Time Horizons Knowing cash flows/horizons allows you to act pro-actively Provides comfort that necessary funds are available Allows some extension by recognizing future flows Yield is not the end-game but an added benefit Defines the portions of your portfolio And from that the strategy for each Debt Service Time Horizons A $2mm debt payment is scheduled out 6 months $400,000 is paid in each month to meet debt service Staying liquid over the 6 months earns $14,000 Investing each successive month at rates shown earns $16,333 Horizon Yield Overnite 2.0 % 1 month 2.1 % 2 months 2.2 % 3 months 2.3 % 4 months 2.4 % 5 months 2.5 % Two Approaches Both approaches have same goal Traditional approach details Present viable information for decision-making Develop parameters for portfolio structure Limiting liquidity risk Define all variables Build on extensive historical data Extensive analytics for forecasting Expense Orientation approach simplifies Limit the elements being analyzed Designed to get going faster Traditional Cash Flow Capture more detailed information Capture historical data before analysis Continue use of 80-20% rule or add categories Total revenues minus total expenses Multiple years will highlight and smooth aberrations End result is same cash balance data Major Category History Revenues Taxes Jan Feb Mar Apr May Jun Jul 8,500,000 7,000,000 3,500,000 750,000 1,000,000 2,000,000 1,000,000 State $$ 250,000 200,000 200,000 200,000 250,000 300,000 300,000 Svc Fees 150,000 150,000 250,000 275,000 400,000 400,000 400,000 2,000,000 350,000 433,000 400,500 600,000 700,000 750,000 10,900,000 7,700,000 4,383,000 1,625,500 2,250,000 3,400,000 2,450,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 Contracts 300,000 300,000 350,000 450,000 645,000 875,000 750,000 Capital 300,000 200,000 400,000 500,000 400,000 450,000 500,000 Utility Total Expenses Salaries Debt Svc Total Net Cash 2,000,000 2,600,000 2,500,000 4,750,000 2,950,000 3,045,000 3,325,000 3,250,000 8,300,000 5,200,000 -367,000 -1,324,500 -795,000 75,000 -800,000 Multi-year History Smoothes Layering each year’s history allows an average Building off history allows you to compute monthly % Historical % used on new budget creates a forecast Tie the summary sheet to detail sheets per year Layering sheets allows for research on aberrations The 80-20 Rule Regardless of approach Capturing every detail can be overwhelming in detail Can be difficult to maintain 80% of expenses come from 20% of expense categories 80% of revenues come from 20% of revenue sources Payroll and fringes probably account for 80% Taxes, state payments or fees probably account for 80% Capture the key elements Summarize remaining “other” amounts and focus Let’s Flow A key to cash flow analysis is to START You can create the basic cash flow now – a base line Eliminating the need for years of data Data farming too often an excuse not to act How much is your payroll each month? How much is your accounts payable each month? When are your debt service payments? How much? Add a ‘liquidity buffer’ for the unexpected A Debt Service Example This entity has two debt service payments: February and August. Funds for debt service flow in from tax payments first 6 months. Balances build in these front months. Keeping funds liquid leaves them at the lowest possible rate. We need to make these funds work. Using the Information An overview of the cash flow needs allows the investor to look ahead. The flow in Jan. alone covers the February payment. The net balances of each other month can be invested 11, 9, 8 and 6 months. A General Fund Sample We use the excess balances not needed for the next month and extend. Three excess balances result in 3-month investments. The cash flow knowledge allows Sept. to be extended to 8-month investment. Either route gets you to… 10,000,000 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 Core 1,000,000 0 1 2 3 4 5 6 7 8 9 10 11 12 A view to the balances of cash throughout the year The net cash shows the peaks and valleys on balances Normally there is a minimum balance across the year On this graph the entity has historically never gone less than $2,000,000. - this is our ‘core’ Cores can be invested longer knowing that there is little chance of using that cash Maturity and WAM The Investment Policy and its controls are often based on cash flow The maximum maturity (flexibility) allows the entity to extend and reflects a core and longer time horizon The weighted average maturity (control) controls for over-extension Information for Maximum Maturity A. B. 80 80 60 60 40 40 20 20 core ? 0 They can not invest longer than one year = maximum maturity 1 yr Entity B has a core so they can invest longer core Entity A has no core – starting and ending the cycle at zero 0 Possibly B could create a maximum maturity of 2 years You must understand what the core is made up and if might change Cash Flowing Capital Projects A recurring problem: obtaining information A large nonrecurring expenditure A unique cash flows for some entities Work with departments for expenditure plans before $$ arrives Bond document may have draft plan Get regular updates from departments and engineers to modify plans Some projects are repetitive and history of old funds shows pattern Explaining the importance of cash flow helps generate support Impact of additional earnings Verify arbitrage impacts CIP Trends Use multiple historical issues of the same type fund 1 streets water mains land acquisition 2 3 4 5 6 7 Use for projections on the same type projects in the future 8 1 9 2 3 4 5 6 7 8 9 6 7 8 9 Streets - 2009 800 600 400 200 0 800 600 400 Trend often appear over the 200 0 frame of the total project time 1 Streets - 2007 800 600 400 200 0 2 3 4 5 Street Streets Composite Projection – New 2005 Funds Cash Flow Investing We focus on a monthly expenditure need Eliminate the need to invest to each liability Meet the monthly need with one early investment Place the maturity before the first known liability Use liquid options or short investments to target each liability in month Reduces cost of safekeeping but still increases portfolio effectiveness Translating the Information into Action Entity needs $3 million a month for A/P and payroll costs. Investment matures on 2nd and is available for rest of month. S 1 M 2 T 3 W 4 TH 9 10 11 S 5 6 12 13 14 19 20Payroll 21 Payables $250,000 8 F Payroll $1mm 7 Payables $250,000 15 16 17 18Payables $1mm $250,000 22 23 24 25 Payables $250,000 26 27 28 Cash Flow Structure Creates the Portfolio Maturity Date Amount Liquid (now to 6 mos.) $3,000,000 6 months $ 500,000 7 months $ 500,000 8 months $ 500,000 9 months $ 500,000 10 months $ 500,000 11 months $ 500,000 12 months $ 500,000 14 months $1,000,000 18 months $1,000,000 24 months $1,000,000 $9,500,000 Summary Cash flow analysis should be straightforward Undue maintenance needs will render it cumbersome and un-usable Cash flow must be done to set policy controls Cash flow should result in information not statistics Cash flow will pay for itself in good investing decisions Maintenance is minimal Perhaps one-half hour every quarter Cash Flow Questions A continuing money balance is a ______ . Cash flow sets my ________ and ______ . What level of analysis is most productive? The key action is to _____ . Multi-year averaging eliminates _____________ . Step 2: Identify Risks Risks occur in every investment Risks occur within the custody area Risks occur with counter-parties Identify your risk tolerance level Risk Exists in all securities and all markets You can not avoid risk You can manage risk Risk can be used to your advantage Measured risk will increase yield Use credit ratings and limitations for control “Market” Risks Who is this “market” anyway? You are the market Encompasses all investors Their actions and expectations control actions Built on investors expectations General ‘Market’ Risk Market risk is based on the market price Diversifying reduces your exposure High credit quality reduces exposure Money will flow from one sector to another for safety or yield High quality retains its value (i.e. UD $ as reserve currency) In fixed income markets When prices go up – rates go down So, a bull market has rates dropping Credit Risk Credit risk is the risk of issuer failure Authorized investments normally face little credit risk Most statutes require AAA ratings or equivalents Limit the maturity to further manage risk Recognize the media loves a scare – don’t react without cause Do your homework on why prices are moving Talk to several sources and reason it through Create diversification limits Understand issuers restraints and strengths Inability to pay interest or principal Measure and control the inherent risk in securities Use CP but restrict to dual ratings and stay under 90 days For example: FHLMC and FNMA conservatorship raises credit Measure and monitor bank credit Monitor bank credit on ongoing basis Use independent bank ratings agencies (Veribanc, Prudent Man) Monitor collateral market value How to Manage Credit Risk Restrict the portfolio to the highest rating Diversify Limit maximum maturities Monitor credit ratings regularly Watch market news Two views are better than one Utilize credit rating agencies Watch for major sector moves or news Require dual ratings Set % of portfolio limits for riskier securities Understand when they are being political too! Understand the rating definitions Procedures for Downgrades Have a procedure for down-grades including: Disclosure to supervisor or governing board Consider the conditions of the downgrade Consider your maturity on the security Immediate sales often do not make sense Understand what the ratings mean Investment grade goes to BBB- at S&P Investment grade goes to BBB at Fitch Investment grade goes to Baa at Moody’s Monitoring Ratings Create a control in policy or procedure for downgrades Authorized investments requiring credit rating (such as CP) need to be monitored constantly Create your process based on your risk tolerance: The Investment Officer shall monitor, on no less than a monthly basis, the credit rating on investments in the portfolio requiring a rating based upon information from a nationally recognized rating agency. THEN EITHER: If any security falls below the minimum rating required by Policy, the Investment Officer shall notify the ------- of the loss of rating, conditions affecting the rating and possible loss of principal with liquidation options available within two days. OR: If any security falls below the minimum rating required by Policy, the Investment Officer shall immediately sell the security, if possible, regardless of a loss of principal. Know Your Ratings S&P Moody’s Fitch AAA Aaa aaa Very high credit & strong capacitylow default expectation AA Aa aa Somewhat susceptible to adverse conditions – low default risk A A a Adequate capacity but subject to adverse conditions BBB Baa bbb Lowest investment grade BBB- Ba b Extremely strong capacity – very low expectation of default Many pools and funds are not rated on these but on ‘volatility’ ratings such as V-1. Money market instruments (like CP) have similar levels but different ratings (A1/P1). Liquidity Risk Liquidity Risk The risk of not having cash when needed The inability to sell security when needed for cash Liquidity is reduced with longer maturities Liquidity is reduced in smaller issues Some agency paper is sold in small issues and you could own the whole issue – no problem if you can hold to maturity Public funds’ biggest perceived risk Danger that it forces many to stay TOO liquid The Lure of Lazy Liquidity It is December 2010, Pools yield 0.16% 6 month CD yields 0.60% ( FDIC 0.85%) 1 year CD yields 0.75% (FDIC 0.85%) In 6 months $1mm= Pool = $800 in 6 months 6 Mo CD = $3,000 - $4,250 You just had a $3,450 opportunity loss Managing Liquidity Risk Don’t be liquidity dependent Do your cash flow and invest to it Be practical and prepare for the unexpected Use liquid investments Stick with the program Create a liquidity buffer Being totally liquid puts you at the lowest rates High credit quality always increases liquidity Watch the size of the issues On agencies the small issues will not be as liquid Price and Volatility Market Risk The risk that market prices will fall Lower prices threatens liquidity Risk that if sold you recognize a loss of principal Can you take a loss by policy? “Unrealized” loss versus “realized” loss Volatility Risk (VIX = the risk index) The risk of significant changes in market prices Higher the volatility = higher risk Volatility increases with longer maturities, low credit and structured securities Managing Market & Volatility Risk To manage these inter-related risks: Invest to your cash flow needs in the short-end Purchase high credit quality Establish maximum maturities suitable to sector Ex: keep commercial paper under 90 days Maintain a shorter weighted average maturity Minimize embedded options diversify Event Risk Event Risk An unforeseen change that affects markets. Moves markets especially with uncertainty Event risk is everywhere Lehman, AIG, Stanford, Madoff Europe Health care Weather impacts on commodities Auto industry Afghanistan Political change Sovereign and local deficits/defaults Managing Event Risk Diversification is the key Not all eggs in one basket Diversify banks, pools, funds, market sectors Prepare for the worst Imagine the worst and have a plan for it Extension Risk Extension Risk Risk that securities lengthen in maturity unexpectedly Primarily found in mortgage backed securities When mortgage rates rise people do not refinance When people don’t refinance the pay-down horizon extends Callables can have a short-term extension risk Only if you buy it assuming a call Always assume your risk is holding to maturity Reporting must reflect stated maturity to show total risk Managing Extension Risk Use mortgage-backed securities only in suitable long portfolios Portfolios always have to be able to hold to maturity Diversify among market sectors Report WAM based on stated maturity Maximum risk is if it goes to maturity Amortize callables to the call Reflects the risk of the call for amortization cost Reinvestment Risk Re-Investment Risk Risk that reinvestment will be at lower rates Primarily in callable securities Do not assume a call when they are called as rates fall Reinvestment of proceeds will be at lower rates If not called will it affect your liquidity? You will be rewarded for the callable risk Using risk to your advantage Managing Reinvestment Risk Diversify and use some callables Consider call risk to add yield Insure initial yield covers reinvestment risk Amortize to call Creates a par bond which is more valuable If it is called there is not a principal loss Managing Collateral Risk MAJOR NEW ISSUES IN COLLATERAL FDIC and collateral issues Bank Collateral Securities pledged to repay a debt Deposits protected by FDIC and collateral Covered by Public Funds Collateral Act (Local Government Code, Chapter 2257) Manage the risk by answering: What is acceptable collateral to me? Is there enough of it? Is the collateral mine – can I prove it? Big Changes in Collateral Basel III Accords Quality level on the pledged collateral Reduces bank ratings Pushing banks away from securities Forcing the LOC Who is Covered by FDIC Insurance Based on Tax Identification Number Based on Type of Account within the entire holding company of the bank FDIC defines only two types of accounts Non-interest bearing accounts have $250,000 Interest earning accounts are combined for $250,000 Based on Location of city and bank If the bank’s HQ is in your same state then both type accounts receive FDIC insurance If the bank’s HQ is not in your state all accounts types together receive only $250,000 FDIC Coverage Only “public units” can have collateral pledged “Public unit” is a FDIC definition not a state definition Must created under express authority of law Must have some function of government delegated Must execute exclusive control of its funds for exclusive use Special cases of public “corporations” 4a and 4b corporations Water supply corporations Dependent on several factors 12 C.F.R. Part 330.15 FDIC Insurance Exception accounts “Testamentary Accounts” (I&S accounts) Funds set aside to discharge a debt Applies to the debt holders Coverage is $250,000 for each bond holder FDIC Coverage Search on: public unit insurance Is your collateral report coming from the custodian? If not how secure is it? Using a Rating Service Rating services rate ‘CAMELS’ Capital Assets Management Equity Liquidity Systems Bank Rating Services: -Best -Highline --Veribanc Managing Collateral Risk Define the authorized collateral (in policy and RFP) Obligations of the US Government, its agencies and instrumentalities, including mortgage backed securities with CMOs passing the bank test Monitored and maintained by the bank at all times. Choose and understand your options within law Surety bonds Treasury Notes and Bills US Agencies Rated Municipals Letters of Credit Custodian Duties In any event of default Take control of collateral Hold the collateral under your instructions Sell the collateral if applicable Paying your 100% portion Return excess to bank The Fed as Custodian Perhaps the best custodian Standard Pledgee Agreement Form is used The Fed will not sign a collateral agreement Supplements the Collateral Agreement Reference the Circular 7 in your agreement Fed will ask for authority to use e-mail to contact you Recent Circular 7 Change Notification Little impact but a good lesson The pledgee is responsible Contract must require bank to monitor and maintain colalteral levels Treatment of principal Principal will be held in non-interest bearing account until the earliest of: Treatment of MBS (amortizing book-entry security) New securities are substituted Principal is released by Pledgee (public entity) Principal collected by pledgee on event of default Principal will be held in non-interest bearing account until the earliest of same three conditions Treatment of interest Interest goes to the Pledgor (bank) unless written notification of event of default Federal Reserve as custodian Circular 7 Pledgee Agreement Authorizing use of e-mail for contact purposes Surety Bonds Surety bonds are insurance policies Verify: Company (and its strength) Recipient (is it the District?) Terms (tie it to the contract) Letters of Credit Initiated for State CD business LOC normally issued by FHLB backed by pledged unrestricted securities or bank credit Created to replace collateral and PFCA Collateral Pooling Final Rules Published 10/10 Voluntary – bank and public entity Not applied to counties or higher education Exclusion of higher ed. not in 2257 Collateral Pooling Why It Doesn’t Work in Texas Comptroller controls the contract Comptroller holds the collateral Comptroller has set collateral unacceptable to banks Entity bears more responsibility: for low level of collateral overall Entity must report big changes in balances For monitoring bank reporting on balances Repurchase Agreement “Collateral” Differentiating collateral types in your policy Collateral is a mis-nomer This must be a buy-sell transaction The entity owns the securities The same requirements apply Define the authorized collateral types Establish the required margin (102%) Establish 3rd party safekeeping Managing Risk Custody and Safekeeping Risk Risk to your proof of ownership Proving your ownership Risk of a custodian restricting access Key safety points Independence Reporting to you directly Custodian should verify authorized collateral and margin Applies to: collateral pledged to you (custody) securities you own (safekeeping) Custodians Custodian has fiduciary responsibilities Safekeeping agents simply hold securities Usually you agree to/approve a custodian Usually you chose custodian Key factors for both: Independence on trades or pledgor Custodians and agents should report directly to you What is a Safekeeping Account? Not a “bank account” for funds Places assets in care of an agent Used to hold YOUR owned securities ‘Street-name’ safekeeping In your entity’s name Totally electronic Generic ‘nominee’ name to ease transactions/transfers Client is actual owner – nominee holds title Fees are required Hard-dollar: Usually not charged through account analysis Typical Safekeeping Costs Clearing Safekeeping FRB DTC FRB or DTC Par or cusip Income Distribution Coupons paid Maturities calls How are they charged? Why is it important to know? When do you use this information? How can you reduce the fees? Safekeeping Services Safekeeping need not be at banking services bank Banking services bank is convenient Other banks may be needed or less expensive A second bank requires ongoing transfers and an account Agreements Depository Agreement covers safekeeping services Includes a collateral agreement if funds are over FDIC Master Agreements are for banking services Safekeeping agreements for safekeeping only Will probably involve collateral as funds move through account Controlling Portfolio Risks Risk of over extension Set a maximum weighted average maturity Set a maximum maturity Always use competitive transactions Only way to assure ‘market’ price Always use delivery versus payment (DVP) Always diversify to spread risk Always report on a timely basis with info not just detail Show asset allocations by maturity and market sector Non-Market Risks Counterparty risk Banking risks Broker background checks FINRA registration Independent safekeeping outside brokerage Reconciliation within 30 days Verify availability of funds Continuously monitor cost of services with account analysis Employee risk Separation of duties Oversight and cross training Cash controls like numbered receipts, safes, assigned tills Technology’s Risks Employee controls Pin numbers and separation Limited access to cash and programs Sole use PC for bank transactions Bank fraud controls Filters/blocks on ACH Payee positive pay Step 3: Set Strategy Macro strategy Policy statement from passivity or proactivity Includes setting WAM and maximum maturity Requires annual review Must be flexible enough to adjust to market and internal conditions Market Strategy Changes daily and requires market information PFIA Required Strategy A strategy should be written And preferably adopted by governing body Set strategy by portfolio(s) Or one commingled portfolio Including in the policy ties the two closely Should describe how you achieve: Objective of investments Suitability of instruments Safety Liquidity Diversification Yield Sample Strategy for a Short, Passive Portfolio The [City] maintains one commingled portfolio for investment purposes which incorporates the specific needs and unique characteristics of the funds grouped represented in the portfolio. Income is distributed to each specific fund based on its participation in the portfolio. The primary objective is liquidity and reasonable yield. Authorized securities or the pool used will be of the highest credit quality. When not matched to a liability it will be short term and liquid. The portfolio will be diversified to avoid market and credit risk. Diversification requirements can be met through a pool. Maximum WAM is 120 days. Sample Debt Service Strategy The investment strategy for debt service funds shall have as its primary objective the assurance of available funds adequate to fund debt service obligations on a timely basis. Successive debt service dates will be fully funded before any extension of investments are made. Successive funding is critical Too often these funds are kept liquid losing yield Benefits of Commingling Think through the portfolio structure Radically different fund types need a separate policy Separate portfolios Require separate accounting May cause liquidity problems Can reduce yield by requiring liquidity balances Commingled portfolios Can still address unique needs of funds Smaller liquidity needs may allow more extensions Reporting is simpler Addressing More ‘Action’ Pro-active portfolios may change their ladders Addressing sales and swaps Securities may be sold before they mature if market conditions present an opportunity to benefit… The investment officer will continuously monitor market conditions… Addressing loss A loss may be taken on a swap of securities if the loss is regained within a three-month horizon on the trade. No realized loss may be taken on a straight sale of a security. Step 4: Policy Development Your first line of defense Single most important element in your program Pollicies are working dynamic documents Must be reviewed and adopted annually by Board Policies show prudence and pro-active management to Rating agencies, capital markets and citizens Policy Objectives Policies combine legal and procedural elements Be concise and clear Policy is not a manual Create flexibility with limits for changing conditions Allows you to react to cash flows and markets Create controls Creates authorizations and responsibilities Who is authorized to do what? What must each entity do and when? Policies are Built on Fundamentals Not a boilerplate document – tailor to your needs Cash flow Sets maximum maturity Sets maximum weighted average maturity Sets benchmarks Risk tolerance identification Chooses the authorized securities Sets internal controls Initial Key Questions Portfolio structure Commingling all funds or separation by type of funds? Accounting and Reporting Needs Separate entities and funds and responsibilities Scope of authority Designation of authority by governing body Training needs and budgets Brokers and critical competition Governing body interpretation of risk What performance do they expect? Does risk and conservative action mean the same to them?? Steps to Writing the Policy Internal review Cash flow Resources available (tech and personnel) Accounting needs Market information systems Banking arrangements and contracts Safekeeping Supervision and oversight Legal and statutory review Be aware of different type entities Being legal doesn’t mean it’s reasonable Beware of special interests in the law Input to the Policy Legal References for controlling statues/ordinances Governing body Prioritizing in their reviews Internal staff Accounting staff TEA LOCAL Investment Authority Approved Instruments Objectives Safety, Liquidity, Diversity Monitoring market prices Monitoring credit changes Funds/Strategies Safekeeping and Custody Broker/Dealers Soliciting CDs Interest rate risk Internal Controls Operating funds Agency Funds Debt Service Funds Capital Projects Legal and Local Policies Possible Additions to Local Scope Annual review Investment officers Standard of Care Collateral Broker Requirements If not policy inclusion – procedural control Policy: Objectives Do more than just state the objectives Safety, liquidity, diversification and yield Define objectives at macro level Tie the investments to the cash flow Sets the tone for active-passive choice If safety is your goal Tight limits, extreme credit limits, etc. If safety with yield is your goal Wider security choices and longer terms Yield versus Rate of Return Beware of the specificity of the terms Connotes intent to market participants/brokers Yield Buy-and-hold, not a trading portfolio, conservative “Yield” based on purchase price and remains to maturity Rate of Return Market driven, active management, often indexed “market return” based on the market price as it changes over time Policy: Assigning Responsibilities Clarification for each involved party Concise listing aides comprehension Summary in one place avoids confusion Statutory and policy requirements outlined Designating responsibilities Governing body Investment officers Investment committee Auditors Advisers Sample Responsibilities The Investment Officer The [--position----] is designated as the Investment Officer and is responsible for all investment decisions and activities. The Officer will receive training… The officer will develop procedures and controls… The officer will not be personally liable if the policy and procedures are followed. The officer will prepare monthly and quarterly reports… The officer will disclose any conflicts… Policy: Ethics and Disclosure Ethics and Conflicts of Interest Standards and Disclosure Officers will refrain from personal business that would conflict with proper and impartial execution of their duties. All personal and business relationships with entities doing business with the City will be disclosed. Policy: Authorized Investments Limit specifically by investment type Require legal changes require local governing body re-adoption Set a maximum maturity by type Set credit requirements Need not include all legally authorized types Tailor the list to your entity’s needs Sample Language Define the security Obligations of the US Government, its agencies and instrumentalities, excluding mortgage backed securities, with a stated maturity not to exceed ---- years. “Stated” maturities are critical in callables, etc. A1/P1 or equivalent rated commercial paper, rated by two nationally recognized rating agencies not to exceed 90 days to stated maturity. Set your maximum maturity to recognize market risk With CP the market risks increases measurably after 90 days The Special Case for CDs Special case of the CD Policy must differentiate types because of risk Depository certificates of deposit Relationship with a bank Usually restricted to the state FDIC and collateral protection Brokered/negotiated certificates of deposit A security which trades on secondary market (cusip) Needs additional monitoring requirements added to policy No extended FDIC coverage on merger requires extra precautions Depository CD Limitations will differ with state statutes May be afforded collateral Define collateral requirements in policy section On merger or acquisition if bank FDIC will be extended Coverage will extend to first maturity date Sample: Insured or collateralized CD of banks doing business in the state and collateralized in accordance with this policy, not to exceed --- years. Brokered CDs This is a security traded like any security Can be written outside States Often pushed as safe held by broker – contradicts DVP No collateral is available Stay under FDIC coverage On merger or acquisition there is no extension of FDIC coverage Must be monitored weekly (Friday am) FDIC insured brokered certificates of deposit securities from a bank in any US state, delivered versus payment to the [City] safekeeping agent, not to exceed one year to maturity. Before purchase, the Investment Officer must verify the FDIC status of the bank on fdic.gov (bankfind) to assure that the bank is FDIC insured. Brokered CDs need special attention – mergers and acquisitions can leave you overthe-limit. Not the same as YOU being in two banks that merge or acquired. Internal Control for Brokered CDs FDIC handles these two types of CDs differently Protect yourself FDIC provides NO reprieve for mergers and acquisitions The Investment Officer, or Investment Adviser, shall monitor, on no less than a weekly basis, the status and ownership of all banks issuing brokered CDs owned by the [City] based upon information from the FDIC. If any bank has been acquired or merged with another bank in which brokered CDs are owned, the Investment Officer, or Adviser, shall immediately liquidate any brokered CD which places the [City] above the FDIC insurance level. Are bank accounts authorized? You make an investment decision with funds in a bank Should it be an authorized investment for clarity? Account for low rate environments when a large % may be needed Account for funds left in the ECR as an investment Define for use accounts in all state banks FDIC insured or collateralized interest bearing accounts in any bank in the state, collateralized in accordance with this Policy Security Diversification Tables An optional control to assure diversification Security Treasuries Agencies/Instrum Depository CD % by bank CP % by issuer Constant $ Pools % of pool MMMF Bank Accounts Max % of Ptf. 80 % 70 % 25 % 10 % 20 % 10 % 100 % 10 % 40 % 60 % These are ‘maximums’ not designations. Allow for changing conditions. Policy: Internal Controls Section Internal controls define and assign Responsibility for creating controls Responsibility for auditing controls The Investment Officer will create and maintain internal procedures to control fraud, collusion, errors,… Monitoring Ratings Authorized investments requiring credit rating (such as CP) need to be monitored Add to the policy a process and/or action for monitoring the ratings Two alternatives based on your risk tolerance: The Investment Officer shall monitor, on no less than a weekly basis, the credit rating on investments in the portfolio requiring a rating based upon information from a nationally recognized rating agency….. If any security falls below the minimum rating required by Policy, the Investment Officer shall notify the ------- of the loss of rating, conditions affecting the rating and possible loss of principal with liquidation options available within two days. If any security falls below the minimum rating required by Policy, the Investment Officer shall immediately sell the security, if possible, regardless of a loss of principal. Policy: Safekeeping Its criticality merits its own policy section Total control requires independent safekeeping Require receipts to be matched and maintained Securities owned by the [entity] will be safe-kept at the banking services depository or an approved custodian and all securities will be settled delivery versus payment (DVP) to assure proof of ownership. The safekeeping bank will not be used as a broker in order to guarantee DVP settlement. Policy: Bank Collateral Section Collateral is pledged – you do not own it Dictate what can be pledged Your list can restrict legally authorized securities Dictate margin requirements Industry standard is 102% but states vary considerably Remember value is market value not par Dictate independent custody Dictate reporting requirements Require that custodian – not bank – sends report direct to your entity Policy: Owned Collateral Section Repo collateral is owned by the entity Require the ‘Bond Market Master Repurchase Agreement’ Dictate what will be authorized collateral You set the requirements Dictate the margin Agreement and industry standard is 102% Dictate independent custody Policy: Counterparty Section Counterparties include brokers, banks and pools Requirements are set because they are selling you a transaction Covering any body which is selling a transactions Broker/dealers, banks, pools Establish qualifications Establish monitoring Establish a reasonable number of counterparties Dependent on your time and need Policy: Adoption Investment Policy and Strategy Adoption Adoption assures that the governing body is on board Annual adoption by resolution is required The Policy and strategy shall be reviewed and adopted no less than annually by the [City Council]. A written resolution approving that review and noting any changes to the Policy or strategy will be recorded by the Council. Step 5: Procedures and Controls Procedures support the Policy Controls are needed to manage risk Keep them short and practical Key areas: Collateral and safekeeping Trading procedures and counter-parties Settlement by delivery versus payment Control and Procedural Areas Signatories Custodians Ethics Investment decisions Investment procedures Accounting and reporting Wires Documentation Strategy Reporting Procedures Investment reporting is about performance Statutes may address reporting – you must address it Set the standards and requirements Timing – monthly and/or quarterly Amortization and accruals required Pricing by independent entity/service Especially subjective MBS pricing Use of a benchmark for risk measurement Reporting Procedures/Controls Detail information Detail on each position/investment Beginning and ending book and market Description, par, maturity, yield, and book and market value Earnings (accruals plus net amortization) Summary information Sum of book and market values plus realized gain/loss Total earnings for portfolio Change in market value (to measure volatility) Overall weighted average maturity (WAM) Performance reporting Benchmark performance for the period Overall portfolio yield for the period Counterparty Control Investment officers must monitor the counter-parties Annual review of registrations State and FINRA registrations CRD annual check for any actions taken against the firm/individual FINRA.org – ‘Broker Check’ Annual review of their usefulness How many times have they given the best price level Annual review of financials Not really necessary because of DVP – no true risk represented Critical if you allow broker safekeeping (high risk) Broker/Dealer Controls Limit the number of broker/dealers for efficiency Minimum activity or a small portfolio rarely need more than 3 Always have three to assure competition More active portfolios in different markets may need 5-7 Don’t let brokers take up your whole day Certification requirement? Texas requires counter-parties to read and certify review of the policy Good control that the counter-party knows your guidelines Broker/Dealer Requirements Gather and maintain background information only firm information contact broker information delivery instructions public client references Annual audited financials (if required) Certification of policy Differentiate between secondary and primary brokers Non-Primary Brokers Identify market sector involvement Must sync with your needs FINRA Broker Check Finra.org Self regulatory Annual check CRD# or name Depositories Controls Designation of depository optional Banking is a key element of investing By depository law must be competitively bid at least every five years Primary banking services depository Recognize right to use other depositories for investments Incorporate right to go outside ETJ Entity reserves the right to designate a primary banking services depository outside its ETJ. Satisfies legal requirement for a resolution to so state. Investing: Part of Cash Management Invoicing and Collection Cashiering Investments Debt Issuance Various components of the cash management process. Safekeeping Disbursements Banking Are the controls in place for each? Name three for each. Step 6: Structure a Portfolio Built on your cash flow Built around your risk tolerance Built on alternative securities Dependent on market and internal conditions Structures: laddering or otherwise Rate anticipation ideas Structuring a Portfolio requires an Economic View In today’s Economic Landscape what is Going On ? Step 7: Reporting Aides your monitoring Detail on all aspects of portfolio Summary is critical to spot trends and risk Measuring risk is a primary functions Too long? Too short? Not diversified? Reflective of policy objectives? Banking Impacts Your Treasury A key element of Treasury Structure of accounts Type and use of accounts Services Timely receipt of funds Safety of funds Investment alternatives Fraud services and cost efficiencies Collateral safety Depository Law Local Government Code Chapter 105 For cities and school districts Banks, CU or savings associations Resolution for ETJ banks required (105.011b2) Notice required (21 days from deadline) Allows for more than one depository (105.015) Term limit of 5 years (105.017) Deposit of funds in 60 days Collateral portions superceded by PFCA (Govt Code 2257) Special Depositories Local Government Code Chapter 131 In case of a bank failure or business suspension or regulatory take-over Local government can name special depository Special depository is to pay entity all funds due within three years TEA Process The TEA process involves either a Bid or RFP. What are the benefits of each? TEA Contract Required form. Ties to RFP/Bid. Two years plus two year extension. Key choice of collateral. Paying for Banking It all goes back to the cost It all depends on interest rates Fee Basis Paying the service fees directly in cash Compensating Balance Providing a balance which earns interest that then pays the fees The earnings credit rate (ECR) is used to earn the interest Compensating Balance The balance is maintained and earns interest The interest rate is the ECR The interest is used to pay the fees Earnings Credit Rate Applies only to the required balance Fees = (comp balance x ECR)/12 Currently 100% FDIC insured Generates a FDIC fee (varies 0.10-0.13%) Until January 1, 2013 – extension status unknown Calculating a ‘Comp Balance’ Daily Ledger Balances - Federal Reserve Requirement (10%) - Average Daily Float Average Collected Balance x Earnings Credit Rate (1.25%) (annualized) Net Monthly Earnings Account Analysis Your Invoice Lists each service used States cost of each service States amount of service used in period Calculates fee basis of service Calculates compensating balance for service Based on a reduced ‘earnings credit rate’ (ECR) Totals all fees Computes excess/(deficit) District earned $4,078 but needed only $ 2,569 Left $1,509 behind Volume * price = Fee or Balance Required Create a monthly CHECKLIST for your analysis fees. BASED ON FEES SET BY CONTRACT Mo. From the monthly account analysis, input the volumes for each service. Match the total fees in the spread sheet to the account analysis. Service Description Vol Contract Fee Cost Master Account Maintenance Fee 8.0000 0.00 Subsidiary Account Maintenance 8.0000 0.00 Money Market Account Maintenance Fee 8.0000 0.00 0.00 Investment Sweep Maintenance 50.0000 0.00 Dr/Cr Sweep Transaction Fee 0.0000 0.00 ZBA Account - Subsidiary 8.0000 0.00 0.00 Checks/Debits Posted 0.0500 0.00 Branch Credits Posted - Electronic 0.1000 0.00 Automated Services - Balance & Detail Acct Balance Report If they do not match then a fee is wrong. Total 0.00 Online Access Maintenance Fee 5.0000 0.00 Online Access Subscription Fee 5.0000 0.00 Previous day Reporting 10.0000 0.00 Previous Day Dr/Cr Items 10.0000 35,210.00 Image Capture Per Item 0.0300 0.00 Image Retention Per Item 0.0200 0.00 20.0000 0.00 Branch Credits Posted 0.5000 0.00 Branch Immediate Verification 0.1000 0.00 Branch Deposits Check it! Commercial Account Maintenance TOTAL FEES AT CURRENT MONTH VOLUMES A critical monthly responsibility ECR Rates Matter Pool rates are about 0.10%-0.15% ECR rates are 0.55%-0.70% Impact on balance and FDIC pass-through Should comp balance be on your investment report? Fee $ 1,500 $ 1,500 ECR 0.20% 0.70% $ 9,000,000 $ 2,500,000 $ 9,000 $ 2,500 Balance Req. FDIC Fee The 3% Threshold Fed Funds Below 3% Above 3% 0.07% 2.00% $ 1,500 $ 1,500 $ 2,500,000 $ 900,000 Outside % 0.15% 4.00% Outside Earn $ 312 $ 3,000 ECR Fees/Earn. Bal. Required Above 3% ECR will be half Fed Funds Evaluating Banks Services Fees Basic versus enhanced services Does the bank keep up with technology? Transition or retention incentives? Adjust for bundled services Compare apples to apples Earnings Look at ECR, interest bearing, MMA and sweeps Carry-Over Management Managed by you monthly Insist on quarterly/semi-annual carry-over Adjust your balances monthly before close Managed by an automatic sweep Sweep excess funds to a money market fund or account Have the sweep set at either: Compensating balance amount Zero The Value of a “Carry-over” Daily ledger - Federal Reserve -Daily Float Average Collected x ECR $ 550,000 $ 66,000$ 35,000$ 449,000 3.25%/12 Earnings on ECR Fees Excess Paid $ $ $ 1,216 1,000 216 Excess earnings are retained by the bank - with “carry-over there is no settlement monthly The Value of a “Carry-over” Daily ledger - Federal Reserve -Daily Float Average Collected x ECR $ 396,384 $ 66,000$ 35,000$ 295,384 3.25%/12 Earnings from ECR Fees to be Paid Deficit $ $ $ 1,000 800 200- With a carry-over to the next month balance is reduced and a deficit balances prior month excess. Bank Focus #1: Safety & Fraud Same old issues: safety and service Collateral and margins FDIC coverage Bank credit Delivery versus payment settlement Independent transactions and parties New approaches Electronic processing Payee positive pay Courier options Pooling of collateral Security sign-ons (PINS and secure-cards) Online investment access Positive Pay A requirement for safety Relieves liability for fraudulent checks received Add payee positive pay for double fraud protection City sends bank the check register Data base of valid checks screens all checks received Check number and amount standard New developments on payee and signatures City gets option to review and approve Without positive pay City retains liability Stored Value Cards Originally for payroll alternative (“pay card”) Creates a debit card for employees Internal Payroll Processed as direct deposit Funds go to the card Point of sale, bank or ATM use Stops liability for lost checks Cuts cost of checks $0.06 versus $0.03 Reconciliation (ARP) Serial Sort physical checks returned in order Phasing out with Check 21 Partial Reconciliation paid check report Full Reconciliation matches issued and paid outstanding items, voids & cancels Deposit Reconciliation Location identification Combining with Positive Pay Price savings Staff time savings Mobile Access Smart phone applications Retrieve balance and transaction detail Positive pay exceptions Event messaging Usually no cost Security considerations Bank Focus #2: Expediting funds Move funds and documents as expeditiously and efficiently as possible Use technology to minimize cost Use technology to increase access to funds for longer earning period Use physical and electronic services May require changing internal processes Electronic Processing Source: Wells Fargo E-Box Electronic receivables Consolidating receivables Collection of invoices electronically Combines online bill payments to single stream Truncated Checks Key to eliminating paper documents Replaces checks with digital images xx “substitute checks” IRD (image replacement documents) Your Tools for Expediting Physical Minimization Electronic Maximization Moving away from documents Capturing documents electronically Minimizing physical handling Imaging Wires ACH Sweeps Remote Deposit Payment/receivable processing Smart safes Monetary Rewards Availability schedules and policies Staff time Sweeps Account A Money Market Fund Account B Master Account O/Nite Sweep Account C Account D Sweeps expedite funds plus allow you to automatically drill down to a comp balance or to zero balance Remote Check Acceptance On-site scanning of checks received Transmission of scanned image: check and coupons Customization of fields Imaged and archived information Scan and send from cashier or back office Savings Float savings on deposit speed Courier (or staff transit) savings Liability savings Extended deposit times (9:00pm) Remote Deposit New delivery system Minimal internal disruption Usually less costly clearing Process Your cashiers total checks Cashiers scan checks Checks retained (7 days) then shredded Transmit to bank Same day deposit and clearing Clearing reported on next day reports Smart Safes Available through banks or courier services Deposit directly into smart safe Sealed bags created Deposit slip created on-site Electronic transmission to courier Courier periodic pick-up Daily credit RCK – Represented Check Transforming NSF consumer checks to ACH NSF checks are not represented next day NSF checks converted to ACH ACH direct debits are processed on a specific date Increased collections benefit Image Lockboxes Image lockbox consolidates High volume, low dollar payments (retail lockbox) Utility payments or tax payments Low volume, high dollar payments (wholesale lockbox) Image lockboxes truncate and speed receipts Checks received at unique post office box Box cleared up to 8 times a day Processing 24/6 All transactions are imaged Images/Records sent to you electronically Records post directly to general ledger Vaults and Deposits Vault services are expensive Reduce through internal planning Check rolling and strapping alternatives/discounts Online vault provide for coin/currency orders Deposit location tracking groups info, aides recon Analyze your own coin/currency flows and ‘orders’ Service List Alerts Research and confirmations Signature control Creation versus retrieval Intra-day versus prior day Maintenance charges Module charges Fax and phone charges Deposit corrections Standard versus optional reports File versus detail transmissions Tech Drives Future Services ACH key to many services Banks move to service providers Consolidation of transactions Consolidating Payments E-Payables Then Invoice preparation and mailing Manual sorts, opening and extracting Manual batching and balancing Armored car delivery Check clearing availability Now Generate payables file for ACH/wire/print/mail service Receive a file of bills paid Virtual Payables Single Use Accounts (SUA) Non-plastic card electronic payment (virtual card) Expiration date control Can increase rebate potential Supplier receives payment immediately – payor pays on statement date Steps Checks Virtual Card 1 Receive invoice Receive invoice 2 Approve invoice Approve invoice 3 Cut check Generate single use account online 4 Mail check to vendor Email payment info to vendor 5 Vendor cashes check Vendor swipes virtual card online 6 Manual reconciliation Automatic reconciliation Check Outsourcing Industry cost to print check = $5-12 Print to mail services: bank prints and mails at bulk rate Send file of checks to bank Instead of to the printer in-house Bank prints checks with your logo/specs Bank utilizes sort for postage discount Eventually move to ACH payments E-checks Electronic checks Electronic version if paper check Check payor provides ABA routing # Account number Name on account E-Receivables Tied to an image lockbox Scan the check and the document at bank site Checks and documents imaged and captured Combines with all receivables Transmitted to your g/l with detail Info archived at bank ACH e-Lockbox Collects payments from third-party bill pay services and PC banking Captured prior to posting to DDA Captures vendor info and addenda Consolidates in ACH receiver system Sent to you for direct application to A/R E-Commerce and E-Funding E-Payables and E-Receivables Converting paper to electronic transactions EDI: Not a technology – a change in process Electronic data interchange Extending bank operations Major cost-savings developments Purchasing Cards Limits purchases on SCI product types Limits use by day or week Agreement issues Liability for unauthorized use Billing disputes and chargebacks Credit limits Proprietary information Arbitration Termination and revocation Controlled Disbursement Outdated? Use of alternatives limit use Sweeps eliminate usefulness Cost is lower to sweep Using remote bank to clear checks Cash management purposes - not delay Elimination with electronic capture Additional costs make it less than worthwhile Merchant Card Processing Processing Visa, MC, Discover Access to funds Key element is PCI Compliance Compare to State Contract Training Information Credit and debit cards Merchant Services Fees Merchant Service Providers Payment Company Fees Can be banks or other providers Differ by type “merchant” Merchant Service Provider Fees Set $ fee and % fee Dependent on your size/volume of payments Remember Investing is Risk Management! Linda Patterson Patterson & Associates linda@patterson.net