LOS 2 Managing Cash Inflows and Outflows

advertisement

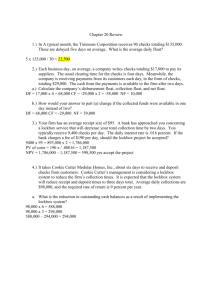

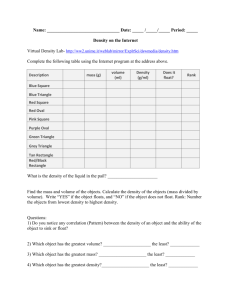

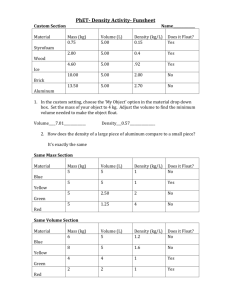

LOS 2 Managing Cash Inflows and Outflows Learning Outcome Statement (LOS) define cash management understand why it is advantageous for firms to hold cash and similar assets identify different money market instruments understand lockbox system and discuss some warnings about lockbox location decisions discuss various cash concentration strategies discuss various disbursement management strategies What is Cash? Cash is a very fluid substance. It knows no language barriers. It changes from taka to pounds to dollars, and then into other forms. Cash is king, because Cash payout is the best measure of a business's success. Cash is the life blood of a corporation. Cash appreciation is necessary for proper planning and decision making. Managed well, your company remains healthy and strong. Managed poorly, your company goes into cardiac arrest. Cash Management Cash management refers to the management of cash from the time it starts its transit to the firm until it leaves the firm in payments. Cash management encompasses the design of collection and disbursement systems for cash and the temporary investment of cash while it resides with the firm. If you haven't considered cash management an important issue, then you're probably undermining your business's short-term stability and its long-term survival. Cash Management The cash management function is a general designation for two distinct corporate activities: cash flow acceleration and liquidity account allocation. The former problem concerns procedures for speeding cash collections from customers and slowing cash disbursements to suppliers so as to optimize the firm's use of cash. The latter problem, on the other hand, takes the firm's cash flow as given and determines the minimum cash balance, the excess to be held in the form of marketable securities. Importance of Cash Management Some observations from Business Week (April 28, 2003): … cash flow is a better way to value companies … Earnings are an accounting fiction … more cash equals more value … Everything … including how much investors are willing to pay for a stock … ties back to expectations about cash … Standard & Poor's added liquidity analytics to its ratings in 2002; many companies have had their debt downgraded, primarily due to cash concerns. … money is tied up when customers don't pay their invoices, suppliers are paid too quickly or not fast enough, and inventories sit unsold … Corporate America has more than $620 billion – 35% of total sales – blocked by inefficient cash flow management. Why Hold Cash and Marketable Securities? The finance profession recognizes the three primary reasons offered by economist John Maynard Keynes to explain why firms hold cash. Speculation – creating the ability for a firm to take advantage of special opportunities. Example: purchasing extra inventory at a discount that is greater than the inventory carrying costs. Precaution – holding cash as a precaution serves as an emergency fund for a firm. If expected cash inflows are not received as expected cash held on a precautionary basis could be used to satisfy short-term obligations that the cash inflow may have been bench marked for. Because cash management services. Because cash inflows and cash outflows are somewhat unpredictable, firms generally hold some cash reserves for random, unforeseen fluctuations in cash flows. These safety stocks are called precautionary balances- the less predictable the firm's cash flows, the larger such balance should be. However, if the firm has easy access to borrowed funds-that is, if it can borrow on short notice (for example, via line of credit at the bank)- its need for precautionary balance is reduced. Why Hold Cash and Marketable Securities? Transaction – firms hold cash in order to satisfy the cash inflow and cash outflow needs that they have. Compensating Balance: It is the minimum checking account balance that a firm must maintain with a bank to help offset the costs of services such as check clearing and cash management advice. The size of the minimum cash balance depends on: How quickly and cheaply a organization can raise cash when needed? How accurately managers can predict cash requirements? (Cash Budget helpful) How much precautionary cash the managers need for emergencies? The organization’s maximum cash balance depends on: Available (short-term) investment opportunities. e.g. money market funds, CDs, commercial paper Expected return on investment opportunities. e.g. If expected returns are high, organizations should be quick to invest excess cash Transaction cost of withdrawing cash and making an investment. Demand for cash for daily transactions (Cash Budget helpful) The Money Market It is important for the student of working capital management to be familiar with the basic instruments of the money market that are used by many firms as investment alternatives to cash and larger firms as financing vehicles. While all the instruments are traded in this market are quite safe relative to other investments (such as common stocks), they differ somewhat in risk and return. Some of the popular money market instruments are Treasury bills, commercial paper, certificate of deposits, bankers’ acceptance, repurchase agreements, and eurodollars. Money Market Instruments Treasury bills – government-backed securities issued on a discount basis in minimum denomination of $10,000. Maturities range from 3 months to 1 year. Commercial paper – a short-term unsecured promissory note issued in the open market and represents the obligation of the issuing corporation, and rates are determined in part by the creditworthiness of the corporation. Typically, commercial paper is issued as a zero-coupon instrument, with a maturity of 50 days or less, but not more than 270 days. Certificate of deposits – a financial asset with maturity from a few weeks to several years issued by a bank or thrift that indicates a specified sum of money has been deposited at the issuing depository institutions. Money Market Instruments Bankers’ acceptance – a promissory note issued by a business debtor, with a stated maturity date, arising out of a business transaction. Called bankers’ acceptance because a bank accepts the ultimate responsibility to repay the loan to its holder by endorsing the note, in return for a fee. Repurchase agreements – the sale of a security with a commitment by the seller (usually government securities dealers) to buy the security back from the purchaser at a specified price at a designated future date. Basically, a RP is a collateralized loan, where the collateral is a security. Eurodollars – U.S. dollar-denominated deposits at foreign banks or foreign branches of American banks. By locating outside of the United States, eurodollars escape regulation by the Federal Reserve Board. Flotation and Check Clearing Float is the term for the dollar amount of checks that a firm could cash were they not in the mail. Float is basically the difference between bank cash and book cash. Positive (disbursement) float: bank balance > book balance (e.g. writing a cheque reduces book cash before bank cash) Negative (collection) float: bank balance < book balance (e.g. receiving and depositing a cheque increases book cash before bank cash) Must keep track of float to know true cash on hand. Flotation and Check Clearing Float management involves minimizing collection float and maximizing disbursement float. Electronic Data Interchange (EDI) may make traditional float management obsolete in the future. Collection float is composed of: Mail float (time cheques are in the postal system) Processing float (time taken for receiver of cheque to deposit it to the bank) Clearing float (time taken for banking system to clear the cheque) Flotation and Check Clearing Total Transit Time: Mail Float+ At-Firm Float+ Clearing Float. Opportunity cost of Float : Float Type Mail Float At-Firm Float Clearing Float Total Transit time Float time (Days) 4.0 0.5 1.3 5.8 Receipts (per day) Taka 2 mil. Taka 2 mil, Taka 2 mil. Total Float Float in Taka Taka 8.0 mil. Taka 1.0 mil. Taka 2.6 mil. Taka 11.6 mil. Required Return 10% Opportunity cost of float Taka 1.16 (=Taka11.6 x 10%) mil. Per year Flotation and Check Clearing Disbursement Float: The value of the checks that have been written and disbursed but have not yet fully cleared through the banking system and thus have not been deducted from the account on which they are written. Collection Float: The amount of checks that have been received and deposited but have not yet been made available to the account in which they were deposited. Net Float: The difference between disbursement Float and collection Float; the difference between the balance shown in the checkbook and the balance shown on the bank’s book. Flotation and Check Clearing Delays that cause float arise because it takes time for checks (1) to travel through the mail (mail delay), (2) to be processed by the receiving firm (processing delay), and (3) to clear through the banking system (clearing, or availability delay). Example: Suppose a firm writes, on average, checks in the amount Taka 5,000 each day, and it normally takes five days from the time the check is mailed until it is cleared and deducted from the firm’s bank account. This will cause the firm’s own checkbook to show a balance equal to Taka 25,000 = Taka 5,000 x 5 days smaller than the balance on the bank’s records; this difference is called disbursement float. Now suppose the firm also receives checks in the amount of Taka 5,000 daily, but it loses three days while they are being deposited and cleared. This will result in Taka 15,000 Flotation and Check Clearing of collection float. In total the firm’s net float- the difference between taka 25,000 positive disbursement float and the Taka 15,000 negative collection float- will be Taka 10,000, which means the balance the bank shows in the firm’s checking account is Taka 10,000 greater than the balance the firm shows in its own checkbook. Accelerating Collections Customer mails payment Company receives payment Company deposits payment Cash received time Mail delay Processing delay Clearing delay Mail float Processing float Clearing float Collection float Flotation and Check Clearing To understand this transit process, let us track the flow of cash and documents in a typical passage from one firm to another in payment of a debt. Since the most common method of remittance is by check, we will use a check remittance as an example. When the check is received by the firm, the documents enclosed with the check are removed: the check is then forwarded to the firm’s bank. The bank then sends the check to the Bangladesh Bank’s Check Clearing House, which undertakes to present the check for payment to the bank on which it was written. Flotation and Check Clearing Why should the firm care about this process? The answer is that every delay in the receipt of money by the firm lowers the firm’s returns, and therefore its shareholders’ wealth. There are several strategies that firms can use to reduce the delay in receiving funds, such as – Selection of banks with accelerated clearing capabilities Acceleration of check processing at the firm Use of electronic collection procedures Use of lockboxes Use of Lockboxes The most popular technique developed recently to reduce float is the use of what is called a lock-box. A “lockbox” is a post office box number to which some or all of the firm’s customers are instructed to send their checks. The firm grants permission to its bank to take these checks and immediately start them in the clearing process. Using lockbox banking is a cash flow improvement technique in which you have your customers' payments delivered to a special post office box instead of your business address. Judicious placement of lockboxes and instructions to customers on where to send their checks can also serve to reduce mail and clearing float substantially. Overview of Lockbox Processing Corporate Customers Corporate Customers Post Office Box 1 Corporate Customers Local Bank Collects funds from PO Boxes Envelopes opened; separation of checks and receipts Details of receivables go to firm Deposit of checks into bank accounts Firm processes receivables Bank clears checks Post Office Box 2 Corporate Customers Sample of Lockbox Process The Decision to Establish a Lock-Box Essentially the decision to establish a lock-box is based on the "yield" that could be realized on the freed funds vis-à-vis the cost of the arrangement. The equation is: Where, V = yearly dollar volume of credit sales; t1 = new float period; t2 former float period; T = applicable corporate income tax rate; H = the total number of checks sent to the lock-box yearly; h = handling fee, usually, 2-7 cents per item; c = the check cashing fee, usually about 10-15 cents per item; W = the total number of wire transfers per year; w = the wire transfer cost; M = minimum balance (M). The Decision to Establish a Lock-Box Suppose a firm in New York does business with firms in Los Angeles area, and the following values for the variables hold. Should the firm utilize lock-box in Los Angeles? V = $18,000,000 per year t2= 9 days t1 = 3 days i = .08 T = .50 H = 3000 items per year (expected) h = $0.04 c = $0.12 W = 260 w = $3 M = $60 per item = $180,000 Problems with Lockboxes While lockboxes are very useful, not all firms will find them of advantage. These boxes give customers two mailing addresses: the lockbox (for checks) and the firm’s usual business address (for all other documents) which may lead to misrouting of documents to the box that the firm would prefer to go directly to its business. In many financial institutions, the individuals in the lockbox area are the newest employees, part-timers, poorly supervised, poorly paid, not well-trained, and are vulnerable to temptation, and that has led to the latest fraud wave. Problems with Lockboxes Authorities have uncovered a large number of instances where employees working in lockbox areas have been paid a fee by criminals to turn over copies of the checks sent to the lockbox. The copies equip the thieves to create counterfeit checks account holder's name, address, phone number, account number, bank name, bank routing number, check number and an example of an accepted signature on the account. Cash Concentration Strategies Once the remittances from the firm’s customers have been received and cleared, the resulting cash balances are available in the firm’s lockbox (depository) banks. It is useful for the firm to gather these balances from the lockbox banks into a central bank account. The process of collecting funds is called cash concentration. There are two reasons why cash concentration is advantageous: 1. 2. The collection process results in a larger pool of funds, which can be invested in an interest-earning investment. With all cash in a central location, keeping track of the cash (controlling the cash) is considerably simplified. Disbursement Management Disbursement management addresses the efficient paying out of this cash once it is concentrated. The firm’s objective in disbursement management is to retain the cash for as long as possible. In this way, the firm will have the maximum amount of funds available for investment and transactional purposes. But there are some problems if we retain the cash for long time. Because the maximization of disbursement period will not go unnoticed by sophisticated creditors for very long. When it is noticed, it will negatively affect relations with these creditors, reducing the firm’s bargaining power with them. Delaying Disbursements Firm prepares check to supplier Post Office processing Delivery of check to supplier Deposit goes to supplier’s bank Bank collects funds 1. Write check on a distant bank. 2. Hold payment for several postmarked in office. 3. Call supplier firm to verify statement accuracy for large amounts. 4. Mail from distant post office. 5. Mail from post office that requires a great deal of handling. days after Disbursement Management Moreover, practice of lengthening disbursement float is regarded as being somewhat unethical, rather than as a legitimate business strategy. Firms that use this strategy will find their reputations with potential suppliers and others damaged. The firm has several available sets disbursement management, such as: Management of disbursement float Use of zero-balance accounts Use of controlled disbursing of techniques for Disbursement Management Float is defined as the difference between the book balance and the bank balance of an account. The time between the moment you write the check and the time the bank cashes the check there is a difference in your book balance and the balance the bank lists for your checking account. That difference is float. This float can be managed. If you know that the bank will not learn about your check for five days, you could take the $100 and invest it in a savings account at the bank for the five days and then place it back into your checking account "just in time" to cover the $100 check. Disbursement Management Time Book Balance Bank Balance Time 0 (make deposit) $500 $500 Time 1 (write $100 check) $400 $500 Time 2 (bank receives check) $400 $400 Float is calculated by subtracting the book balance from the bank balance. Float at Time 0: $500 - $500 = $0 Float at Time 1: $500 - $400 = $100 Float at Time 2: $400 - $400 = $0 Disbursement Management (Payables Concentration) Zero-Balance Accounts - A checking account in which a balance of zero is maintained by automatically transferring funds from a master account in an amount only large enough to cover checks presented. A zero-balance account is used by corporations to eliminate excess balances in separate accounts and maintain greater control over disbursements. It is a special checking account used for disbursements that has a balance equal to zero when there is no disbursement activity. Controlled Disbursement Account - It helps you manage your company's daily cash position by providing you with early morning notification of check clearings and same-day funding capabilities. A controlled disbursement account lets you maximize your investment and borrowing opportunities while gaining control over outgoing cash flow. Disbursement Management (Payables Concentration) It is a checking account in which funds are not deposited until checks are presented for payment, usually on daily basis. 5