Basics of Credit Analysis

advertisement

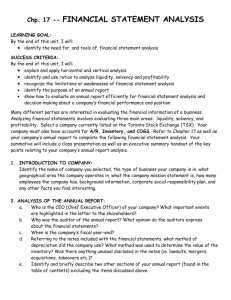

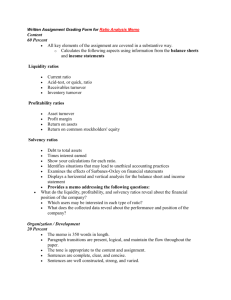

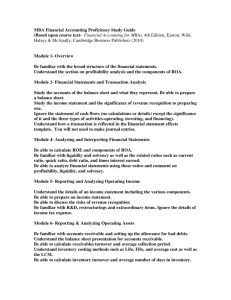

Basics of Credit Analysis Alexandru Cebotari Sources and Types of Risks Source Type or Nature International Exchange Rate Changes Host Government Regulations Political Unrest Expropriation of Assets Domestic Recession Inflation or Deflation Interest Rate Changes Demographic Changes Political Changes Industry Technology Competition Availability of Raw Materials and Labor Unionization Firm-Specific Management Competence Strategic Direction Lawsuits • A firm should continually monitor each of these and other type of risks • A loan officers task is to understand how a firm monitors its risks • Analysis of the financial consequences of these elements of risk using financial statements is an important tool • Various financial reporting standards require firms to discuss in notes to financial statements how important elements of risk affect a particular firm and the actions it takes to manage its risks • In addition to using information about risk disclosed in the notes to financial statements, loan officers typically assess the dimensions of risk using ratios of various items in the financial statements Profitability, Growth, Risk Product-Market Strategies Financial-Market Strategies Operating Decisions Investment and Asset Management Decisions Financing Decisions Dividend Decisions Managing Revenue & Expenses Managing Working Capital & Fixed Assets Managing Liabilities and Equity Managing Dividend Payout Profit Margin Ratios Efficiency Ratios Capital Structure Ratios Payout Ratios • Most financial statement-based risk analysis focuses on a comparison of the supply of cash and demand for cash • Risk analysis using financial statement data typically examines (1) short-term liquidity risk, the near term ability to generate cash to service working capital needs and debt service requirements, and (2) long-term solvency risk, the longer-term ability to generate cash internally or from external sources to satisfy plant capacity and debt repayment needs • The field of finance identifies two types of risks: (1) credit risk, a firm’s ability to make payments on interest and principle payments, and (2) bankruptcy risk, the likelihood that a firm will be liquidated Framework for Financial Statement Analysis of Risk Activity Operations Investing Financing Ability to Generate Cash Need to Use Cash Financial Statement Analysis Performed Profitability of Goods and Services Sold Working Capital Requirements Short-Term Liquidity Risk Sales of Existing Plant Assets or Investments Plant Capacity Requirements Borrowing Capacity Debt Service Requirements Long-Term Solvency Risk Analysis of Short-Term Liquidity Risk • The analysis of short-term liquidity risk requires an understanding of the operating cycle of a firm! • Current Ratio: mainly used to give an idea about the company’s ability to pay back its short-term liabilities and a sense of the efficiency of the firm’s operating cycle and its ability to turn its products into cash (ratio ≥ 1.0 preferred) • Quick Ratio: known as acid test, measures the firm’s ability to pay off its short-term debt from current liquid assets; draws a more realistic picture (trend towards 0.5) • Operating Cash Flow Ratio: using cash flow as opposed to accounting items provides a better indication of liquidity (40%ntypical of a healthy firm) • Short-term liquidity problems also arise from longer-term solvency difficulties! Financial Ratio Current Ratio Quick Ratio Operating Cash Flow Ratio Formula Measurements Current Assets / Current liabilities A measure of short-term liquidity. Indicates the ability of entity to meet its short-term debts from its current assets Current Assets less inventory / Current liabilities A more rigorous measure of short-term liquidity. Indicates the ability of the entity to meet unexpected demands from liquid current asses Cash Flows from Operations/Average Current Liabilities Measures a company's ability to pay its short term liabilities. Indicates whether the company has generated enough cash over the year to pay off short term liabilities as at the year end Analysis of Long-Term Solvency Risk • Increasing the proportion of debt in the financial structure intensifies the risk that the firm cannot pay interest and repay the principle on the amount borrowed • Analysis of long-term solvency risk must begin with an analysis of short-term liquidity risk • Firms must survive in the short-term if they are to survive in the long-term! • Interest Coverage Ratio: gives a sense of how far earnings can fall before a firm will start defaulting on its payments (risky if ≤ 2.0) • Long-Term Debt to Long-Term Capital Ratio: way of looking at the debt structure and determine what portion of total capitalization is comprised of long-term debt (what if ≥ 1?) Financial Ratio Debt ratio Capitalization ratio Debt to Capital Ratio Formula Measurements Total Liabilities / Total assets Measures percentage of assets provided by creditors and extent of using gearing Total assets / Total shareholders’ equity Measures percentage of assets provided by shareholders and the extent of using gearing Total Debt/(Total Shareholders’ Equity + Total Debt) The debt-to-capital ratio gives users an idea of a company's financial structure, or how it is financing its operations, along with some insight into its financial strength. Times interest earned Operating profit before income tax + Interest expense / Interest expense + Interest capitalized Measures the ability of the entity to meet its interest payments out of current profits. Models of Bankruptcy Prediction Univariate Analysis The six ratios with the best discriminating power (and the nature of the risk each ratio measures) were as follows: • Net Income plus Depreciation, Depletion, and Amortization/Total Liabilities (long-term solvency risk) • Net Income/Total Assets (profitability) • Total Debt/total Assets (long-term solvency risk) • Net Working Capital/Total Assets (short-term liquidity risk) • Current Assets/Current Liabilities (short-term liquidity risk) • Cash, Marketable Securities, Accounts Receivable/Operating Expenses excluding Depreciation, Depletion and Amortization (short-term liquidity risk) Multivariate Bankruptcy Prediction Models Altman’s Z-Score: Net Working Capital Re tained Earnings Z score 1.2 1.4 Total Assets Total Assets Earning Before Interest and Taxes Market Value of Equity 3.3 0 . 6 Book Value of Liabilitie s Total Assets Sales 1.0 Total Assets We can convert the Z-score into a probability of bankruptcy using the normal density function within Excel. The formula is: =NORMSDIST(1-Z score). Altman developed this model so that higher positive Z-scores mean lower probability of bankruptcy. The principle strengths of MDA are as follows: • It incorporates multiple financial ratios; • It provides the appropriate coefficients fro combining the independent variables; • It is easy to apply once the initial model has been developed. Each ratio captures a different dimension of profitability or risk: • Met Working Capital/Total Assets: the proportion of total assets comprising relatively liquid net current assets (current assets minus current liabilities). It is a measure of short-term liquidity risk. • Retained Earnings/Total Assets: accumulated profitability. • EBIT/Total Assets: this ratio measures current profitability. • Market Value of Equity/Book Value of Liabilities: this is a form of debt/equity ratio, but it incorporates the market’s assessment of the value of the firm’s shareholders’ equity. This ratio measures long-term solvency risk and the market’s overall assessment of the profitability and risk of the firm. • Sales/Total Assets: this ratio is similar to the total assets turnover ratio and indicates the ability of a firm to use assets to generate sales. In applying this model, Altman found that Z-scores of less than 1.81 indicated a high probability of bankruptcy, while Z-scores higher than 3.00 indicates a low probability of bankruptcy. Scores between 1.81 and 3.00 were in the gray area. Logit Analysis Probability of Bankruptcy of a Firm: 1 p 1 ey y = -1.32 – 0.407*SIZE + 6.03*TLTA – 1.43*WCTA + 0.0757*CLCA – 2.37*NITA – 1.83*FUTL + 0.285*INTWO – 1.72*OENEG – 0.521*CHIN, SIZE = ln (Total Assets/GNP Deflator) TLTA = Total Liabilities/Total Assets WCTA = (CA-CL)/Total Assets CLCA = Current Liabilities/Current Assets NITA = Net Income/Total Assets FUTL = Funds (Working Capital) from Operations/Total Liabilities INTWO = one if Net Income (NI) was negative in the last two years and zero otherwise OENEG = one if owners’ equity is negative and zero otherwise CHIN = [NI (this year) – NI (last year)]/[|NI (this year)| + |NI (last year)|] Earnings Manipulation • Beneish developed a probit model to identify the financial characteristics of firms likely to engage in earnings manipulation y 4.840 0.920 * ( DSRI ) 0.528 * (GMI ) 0.404 * ( AQI ) 0.892 * ( SGI ) 0.115 * ( DEPI ) 0.172 * ( SAI ) 0.327 * ( LVGI ) 4.670 * (TATA) • Probit converts y into a probability using standardized normal distribution. The command NORMSDIST within Excel, when applied to a particular value of y, converts it to the appropriate probability value Beneish’s eight factors and the rationale for their inclusion are as follows: Index Rationale Days Sales in Receivables Index (DSRI) A large increase in accounts receivables as a percentage of sales might indicate an overstatement of accounts receivables and sales to boost earnings Gross Margin Index (GMI) Firms with weaker profitability a more likely to engage in earnings manipulation Asset Quality Index (AQI) An increase in the proportion indicates an increased efforts to defer costs Sales Growth Index (SGI) The need for low-cost external financing might motivate sales manipulation Depreciation Index (DEPI) Slowing of the rate of depreciation and thereby increasing earnings Selling and Administrative Expense Index (SAI) ≥ 1 indicates increased marketing expenditures and expected increased sales Leverage Index (LVGI) Increase in the proportion of debt might entail a violation of debt covenants Total Accruals to Total Assets (TATA) Indicates the volume of earnings resulting from accruals instead of from cash flows Profitability Analysis The analysis of profitability addresses two broad questions: • How much risk economic and strategic factors pose for the operations of a firm, its profitability and long-term solvency ? We use the Rate of Return on Assets (ROA) to answer this question. • Can the firm generate the expected return on the capital invested by the lenders and shareholders without compromising the future of the firm? That is, how much of ROA is left to shareholders (owners) after subtracting the amounts owed to lenders. Rate of Return on Assets ROA Net Income Interest Expense * (1 Tax Rate) Minority Interest in Earnings Average Total Assets ROA Pr ofit M arg in for ROA Assets Turnover Pr ofit M arg in for ROA Net Income Interest Expense * (1 Tax Rate) Minority Interest in Earnings Sales Asset Turnover Sales Average Total Assets Average Median ROA, Profit Margin for ROA, and Assets Turnover for 23 industries for 1990 to 2004 Economic Factors Affecting the Profit Margin/Assets Turnover Mix Area in Capital Competition Exhibit Intensity Strategic Focus A High Monopoly Profit Margin for ROA B Medium Oligopoly Both Low Pure Competition Assets Turnover C Profitability Ratios Financial Ratio Formula Measurements Return on Total Assets Operating profit before income tax + interest expense/ Average total assets Measures rate of return earned through operating total assets provided by both creditors and owners Return on ordinary shareholders’ equity Operating profit & extraordinary items after income tax minus Preference dividends / Average ordinary shareholders’ equity Measures rate of return earned on assets provided by owners Gross Profit Margin Gross Profit / Net Sales Profitability of trading and mark-up Profit Margin Operating profit after income tax / Net Sales Revenue Measures net profitability of each dollar of sales Total Assets Turnover Financial Ratio Receivables turnover Inventory turnover Total Asset turnover ratio Turnover of Fixed Assets Formula Measurements Net sales revenue / Average receivables balance Measures the effectiveness of collections; used to evaluate whether receivables balance is excessive Cost of goods sold / Average inventory balance Indicates the liquidity of inventory. Measures the number of times inventory was sold on the average during the period Net sales revenue / Average total assets Measures the effectiveness of an entity in using its assets during the period. Net Sales / Fixed Assets Measure the efficiency of the usage of fixed assets in generating sales Return on Common Shareholders’ Equity (ROCE) Return on Assets Return to Creditors Return to Preferred Shareholders Return to Common Shareholders ROCE Pr ofit M arg in for ROCE Assets Turnover Financial Leverage ROCE Net Income to Common Shareholde rs Average Common Shareholde rs ' Equity Pr ofit M arg in for ROCE Assets Turnover Net Income to Common Shareholde rs Sales Sales Average Total Assets Financial Laverage Average Total Assets Average Common Shareholde rs ' Equity