Final Exam Comprehensive Day Class FA08

advertisement

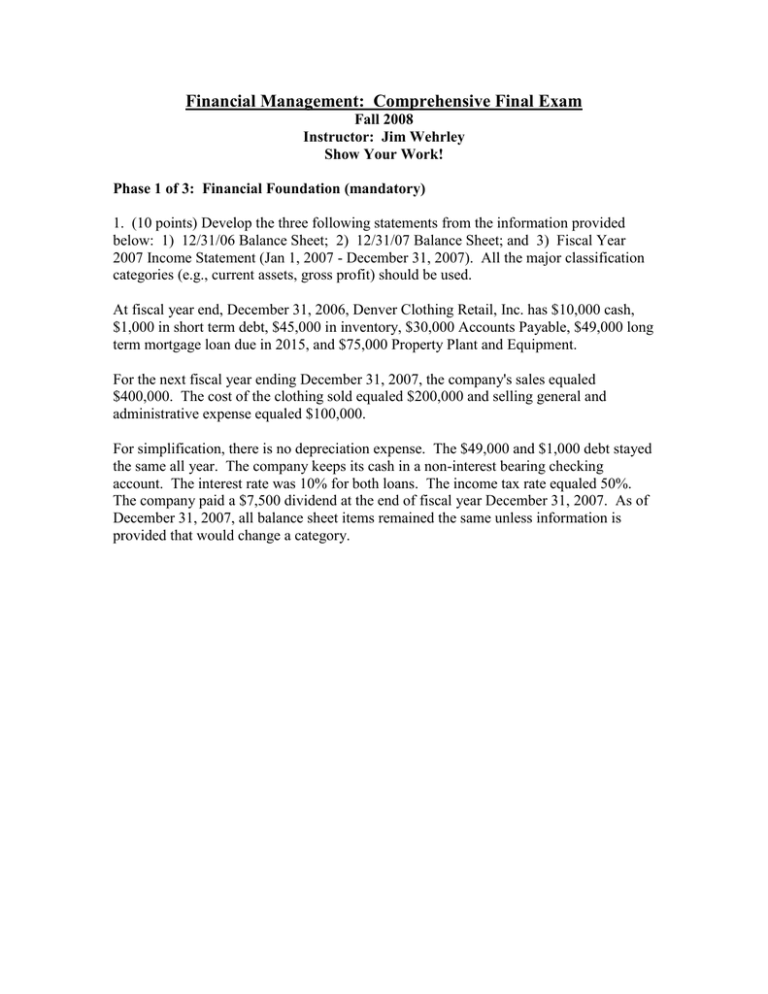

Financial Management: Comprehensive Final Exam Fall 2008 Instructor: Jim Wehrley Show Your Work! Phase 1 of 3: Financial Foundation (mandatory) 1. (10 points) Develop the three following statements from the information provided below: 1) 12/31/06 Balance Sheet; 2) 12/31/07 Balance Sheet; and 3) Fiscal Year 2007 Income Statement (Jan 1, 2007 - December 31, 2007). All the major classification categories (e.g., current assets, gross profit) should be used. At fiscal year end, December 31, 2006, Denver Clothing Retail, Inc. has $10,000 cash, $1,000 in short term debt, $45,000 in inventory, $30,000 Accounts Payable, $49,000 long term mortgage loan due in 2015, and $75,000 Property Plant and Equipment. For the next fiscal year ending December 31, 2007, the company's sales equaled $400,000. The cost of the clothing sold equaled $200,000 and selling general and administrative expense equaled $100,000. For simplification, there is no depreciation expense. The $49,000 and $1,000 debt stayed the same all year. The company keeps its cash in a non-interest bearing checking account. The interest rate was 10% for both loans. The income tax rate equaled 50%. The company paid a $7,500 dividend at the end of fiscal year December 31, 2007. As of December 31, 2007, all balance sheet items remained the same unless information is provided that would change a category. Phase 2 of 3: Financial Management: Comprehensive Final Exam Fall 2008 Show Your Work! Problems (2 points each)—Answer 15 of 23. Please cross out the questions you do not want graded. 1. You deposit $100 in a bank on January 1, 2000 and you want to find the value of that deposit January 1, 2006. If the interest rate is 5% annually, what is the future value of the deposit on January 1, 2006? 2. You deposit $100 in a bank on January 1, 2000. If the interest rate is 5% nominal annual rate, compounded quarterly, what is the future value of the deposit on January 1, 2006? 3. You have $15,000 in cash. You expect inflation to equal 12 percent for the next 15 years. How much cash will you need in 15 years to equal the buying power of the current $15,000? 4. You notice that all your neighbors seem to need various items (e.g., tree limbs, construction debris) hauled away. You are thinking of buying a dump truck for $35,000. You estimate you could generate $10,000 a year cash flow (end of year) after paying for all expenses including hiring someone to drive the truck. The estimated life of the truck is 7 years with no salvage value. You would like an annual return of 12%. Should you buy the dump truck? Explain. 5. Cemex, a large cement provider, issued a 10 percent coupon interest rate, 10-year bond with a $1,000 par value. The market rate for a bond like this (risk level of company and maturity rate) is 11 percent. How much should these bonds sell for in the marketplace? 6. Alligators R Us is contemplating expansion through the issuance of debt/bonds. Your broker calls you and suggests that you buy 10 bonds—price $1,150 for each bond, 11 percent coupon rate, $1,000 par value, interest paid annually. The bonds mature in 12 years. Calculate the Yield-to-Maturity (YTM) of these bonds. For question 7 and 8, assume the company has a cost of capital of 10 percent, cost of debt of 7 percent, and cost of equity of 12 percent. Year Initial Investment (Year 0) Year 1 Year 2 Year 3 Year 4 Year 5 Project A Cash Flows ($840,000) $280,000 $280,000 $280,000 $280,000 $280,000 7. What is the NPV of project A? Is the project acceptable? Why? 8. What is the IRR of Project A? Is the project acceptable? Why? 9. Project the company’s 2009 sales, gross profit, and earnings per share (EPS). 2007 sales = $1,000 and sales are expected to grow 20% annually. Going forward, you expect the gross profit margin to equal 40% and the net profit margin to equal 5%. The company has 100 shares outstanding. 2009 (not 2008) Projection Sales Gross Profit EPS 10. You have a job offer from two firms. A) $20,000.00 per year (paid at the end of year) with a $3,000 signing bonus. B) $22,000 per year (paid at the end of year) with no signing bonus. If you anticipate staying at your first job for three years, which firm would you go with? (Use an 8% discount rate) 11. Your great grandpa paid $100 a year (end of year) for 30 years for his life insurance policy. He died the last day he made his payment. The day he died, the life insurance company paid out the $6,000.00 value of the policy. If the life insurance company earned a 10% annual return on the $100 annual payments, how much did the life insurance company make off of your grandpa's life insurance policy? (Hint: compare the annuity with the $6,000 at time period 30) 12. Your philosophy is to double your money every three years. If you accomplish this, what is your annual rate of return? 13. Your uncle would like you to invest in a start-up company. He claims your portion of the investment would be worth $2,000,000 in ten years. If you would like a 15 percent annual return, how much would you be willing to invest today? 14. Your uncle would like you to invest in a start-up company. He claims your portion of the investment would be worth $2,000,000 in ten years. If you invest $700,000, what is your expected annual return? 15. If the inflation rate is 8 percent per year for 5 years, how much money do you need in 5 years to equal $1 today? 16. A major business publication reported a 24% annual rate of inflation based on a recent 2% monthly increase in the CPI (consumer price index). What is the correct or effective annual rate of increase? 17. Calculate the value (i.e., stock price) of a stock given the following information: Current dividend (time period 0) = $3 per share, growth rate of dividend = 5% per year, PE ratio = 10, EPS = $4, and required return equals 8%. Solve using the Gordon Growth Model Fiscal Year End 2006— 12/31/06 at 11:58 p.m. Transaction: 12/31/06 11:59 p.m. Obtain a $400 long term loan and buy back $400 of stock (i.e., buy back or reduce stock) Total Assets $2,000 Total Liabilities $800 Equity Sales $2,000 Net Income $100 Shares 400 Note: Above boxes will not be part of the grade; however, filling in the boxes may help you develop your answers. Use the table above to answer questions 18 and 19. 18. Using the current ratio as a measure of liquidity, will the transaction improve liquidity? Explain. 19. Using the Return on Equity (ROE) ratio as a measure of performance, will the transaction improve the company’s performance? Explain. 20. The goal is for your company to earn net income of $400,000. You expect your net profit margin to equal 5 percent. Revenue must equal how much to reach your goal? 21. The goal is for your company’s annual EPS (Earnings Per Share) to equal $5.00. There are 1,000 shares outstanding. Sales are expected to reach $200,000 per year. What does your net profit margin have to equal to reach your goal? 22. The gross profit margin for ABC Co. equals _________. If the industry average gross profit margin equals 50%, does ABC Co. have a strong gross profit margin? ABC Co Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses SGA Operating Income Other Inc (Expense) EBIT Interest Expense Earnings Before Tax Income Tax (benefit) Net Income Average Shares Outstanding YE 2007 $2,000,000 100.00% $900,000 45.00% $1,100,000 $400,000 $700,000 $0 $700,000 $20,000 $680,000 $136,000 $544,000 10,000 23. Calculate the value (i.e., stock price) of a stock given the following information: Current dividend (time period 0) = $3 per share, growth rate of dividend = 5% per year, PE ratio = 10, EPS = $4, and required return equals 8%. Solve using the PE ratio Phase 3 of 3: Financial Management: Comprehensive Final Exam (3 points each): Answer 20 of the 25 questions in this section. Please cross out the questions you do not want me to grade. 1. List three decisions a company could make to increase its financial leverage? 2. A company retires $100 of long-term debt and issues $100 of stock. How does the current ratio change? Explain. 3. A company buys a building for $1 million. In order to buy the building, the company uses $500,000 of cash and sells another building for $500,000. How does the debt ratio change? Explain. 4. A company has a debt ratio of .1 and times interest earned ratio of 1.0. The financial manager goes to the bank and takes out a loan. The debt ratio is now .9. Do you think the company’s cost of debt (%) will increase? Explain. 5. How might a financial manager use the yield curve to help him/her determine what financing alternatives to use? 6. What is the importance of a company’s stock price if a company is considering a secondary offering (issuing stock)? Explain your answer. 7. The stock price of Starbucks increased from $40 per share to $45 per share? How does the company’s capital structure change? Explain. 8. How does a commercial lender at a bank or other financial institution determine whether a company should be approved for a commercial (i.e., business) loan? Hint: The seven 7 C’s of lending may help you answer this questions-- Credit, Capacity, Capital, Character, Conditions, Collateral, and Commitment. 9. A company’s ROE and ROA are the same. What does this tell you about the company’s capital structure? 10. A company’s average age of inventory is increasing and gross profit margin is decreasing. Why or how might this happen? 11. Define covenant. What could happen if a company violates its covenants? 12. If a company does not have strong liquidity, is it a good candidate for retiring or buying back stock? Explain. 13. If a company is raising funds and adjusting its capital structure by issuing more stock, what is the importance of the stock price? 14. A company would like to finance inventory. What type of debt or loan would you recommend? 15. Provide an example of each of the types of risk listed below: a. Business b. Liquidity c. Default d. Market e. Interest rate f. Purchasing power. 16. You own 100% (1,000 shares) of XYZ, Inc.. You purchased all the shares for $100 per share when the company went public. The company needs more capital ($100,000) and is going to have a secondary offering. If the stock price is $40 per share for the secondary offering and you don’t buy any of the new shares, what percentage ownership will you have in the company after the secondary offering is complete? 17. Complete one column in the table below. Answer either increase, decrease, or no change. Return on Equity (ROE) Earnings Per Share (EPS) Debt Ratio (TL/TA) Liquidity Dividend Payment A= C= E= G= Buyback Stock B= D= F= H= Explain your EPS answer to either C or D. 18. If a company has too much debt, how would it affect a) cost of debt, b) cost of equity, and c) the overall cost of capital? Explain 19. If a company has too little debt, how would it affect a) cost of debt, b) cost of equity, and c) the overall cost of capital? 20. Which is a riskier investment from an investor perspective, bond or stock? Explain. 21. Which type of financing is more expensive for a company, debt/bond financing or stock financing? Explain. 22. Current Total Assets Total Liabilities Equity Net Income Shares Outstanding EPS ($x.xx) ROE (x.xx%) You own 100 shares, what % of the company do you own? Scenario 1 Scenario 2 Buy back 200 shares at a stock price of $50.00 Buy back 500 shares at a stock price of $20.00 Scenario 3 Issue 200 Shares (secondary offering) at a stock price of $50.00 Scenario 4 Issue 500 shares at a stock price of $20.00 $50,000 $20,000 $30,000 $3,000 1,000 23. What are the lessons from the prior question? 24. Why don’t companies simply buy back as many shares as possible when their stock price is low? 25. a. List three reasons why companies may complete a cash budget. b. Analyze the cash budget on the following page. Note: you must complete the cash budget before analyzing the budget. Cash Budgeting assumptions 1. Sales: March $40,000; April $40,000; May $60,000; June $80,000; July $200,000 2. Sales: 25% for cash, 50% collected in one month, 25% in 2 months 3. Other cash receipts: $0 per month 4. No Accounts Payable: cash purchases: May $50,000, June $50,000, July $50,000 5. Rent: $5,000 per month 6. Wages and Salaries: May, $10,000; June, $10,000; July, $10,000 7. Tax Payment: June, $10,000 8. Purchase Equipment: July, $10,000 9. No interest due during the 3 month period 10. Principal payment: July, $10,000 11. Beginning cash balance in May: $10,000 12. Minimum cash balance: $20,000 MAR APR MAY JUN JUL MAR APR MAY JUN JUL MAY JUN JUL Sales Collections Cash Lagged 1 month Lagged 2 months Other cash receipts Total cash receipts Purchases Cash Purchases Payments of A/P Lagged 1 month Lagged 2 months Rent payments Wages and Salaries Tax payments Fixed-asset outlays Interest payments Cash dividend payments Principal payments Total cash disbursements Total cash receipts Less: Total cash disbursements Net cash flow Add: Beginning cash Ending cash Less: Minimum cash balance Excess cash balance OR (Required total financing)