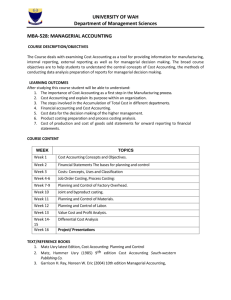

Basic Management Accounting and Control Concepts

advertisement

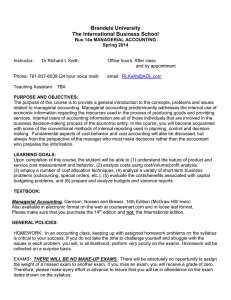

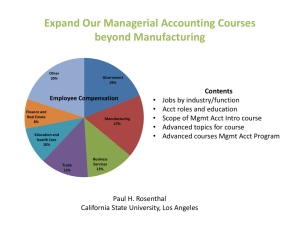

Basic Management Accounting and Control Concepts Managerial Accounting and Financial Accounting Managerial accounting provides information for managers inside an organization who direct and control operations Financial accounting provides information to stockholders, creditors and others who are outside the organization Differences Between Financial and Managerial Accounting Financial Accounting Managerial Accounting 1. Users External persons who make financial decisions Managers who plan for and control an organization Historical perspective Future emphasis 3. Verifiability versus relevance Emphasis on verifiability Emphasis on relevance for planning and control 4. Precision versus timeliness Emphasis on precision Emphasis on timeliness 5. Subject Primary focus is on the whole organization Focuses on segments of an organization 6. Requirements Must follow GAAP and prescribed formats Need not follow GAAP or any prescribed format 2. Time focus International Competition Meeting world-class competition demands a world-class management accounting system. Managers must make decisions to plan, direct, and control a world-class organization. Many U.S. companies derive more than 50% of their income from overseas operations Evolution and Adaptation in Managerial Accounting Theory of Constraints E-Commerce Computer-Integrated Mfg. Service Vs. Mfg. Firms Six Sigma Emergence of New Industries Global Competition Focus on the Customer Lean Manufacturing Continuous Improvement Change Information and Communication Technology Product Life Cycles Total Quality Management Time-Based Competition Just-in-Time Inventory © The McGraw-Hill Companies, Inc. Importance of Ethics in Accounting Ethical accounting practices build trust and promote loyal, productive relationships with users of accounting information. Many companies and professional organizations, such as the Institute of Management Accountants (IMA), have written codes of ethics which serve as guides for employees. Code of Conduct for Management Accountants IMA Code of Ethics for Management Accountants Four broad areas of responsibility: Maintain a high level of professional competence treat sensitive matters with confidentiality Maintain personal integrity Be objective in all disclosures Managerial Accounting Tools Failed dot.com and other businesses might have benefited from the application of managerial accounting tools: Cost concepts Cost-volume-profit Activity-based costing Budgeting Standard Costs Decision making Capital budgeting Transfer pricing Measuring Performance Cost concepts Period Costs Product Costs Elements of Cost Direct material Direct labor Manufacturing overhead Cost concepts (continued) Basic Cost Management Concepts Cost driver Variable and fixed costs Direct and indirect costs Controllable and uncontrollable costs Sunk Costs Differential Costs Relevant Costs Cost concepts (continued) Manufacturing overhead Estimated – budgeted Applied – allocated Incurred – actual Over- or Under-applied Overhead Cost-Volume-Profit Break-even point Cost structure Operating leverage Airlines Activity-based Costing Problems with a single factory-wide overhead rate Many different cost drivers CD versus DVD units Change in cost allocation under activitybased costing Budgeting (Profit Planning and Control) Budget – quantitative expression of management’s goals Budget function Planning Communicating and coordinating Allocating limited resources Control Performance evaluation Sales budget Behavioral impact of budgets Standard Costs Managing costs Setting standards Variance analysis and investigation Behavioral impact of standard costing Balanced scorecard Decision-making (Special Decision Situations) Special orders Add or drop a service, product or department Allocation of limited resources Capital Budgeting Discounted cash flow Discount rate Other methods Net present value method Internal rate of return Payback Project approval and Post Audit Transfer Pricing Market-based prices Negotiated prices Cost-based prices Goal congruence Measuring Performance Responsibility accounting Return on investment Residual income Economic value added Sustainability Sustainability Reporting Economic Environmental Social Triple Bottom Line Integrated Reporting Developments in Regulation Sarbanes – Oxley Corporate Governance Audit Committees Internal Control Evaluation Added Costs Dodd-Frank