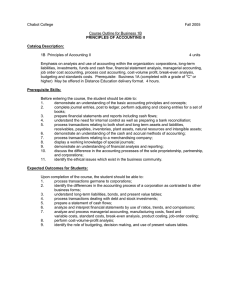

Chabot College Fall, 2001 Course Outline for Business 1B

advertisement

Chabot College Fall, 2001 Course Outline for Business 1B PRINCIPLES OF ACCOUNTING II Catalog Description: 1B Principles of Accounting II 4 units Emphasis on analysis and use of accounting within the organization: corporations, long-term liabilities, investments, funds and cash flow, financial statement analysis, managerial accounting, job order cost accounting, process cost accounting, cost-volume profit, break-even analysis, budgeting and standards costs. Prerequisite: Business 1A (completed with a grade of "C" or higher) 4 hours. Prerequisite Skills: Before entering the course, the student should be able to demonstrate: 1. an understanding of the basic accounting principles and concepts; 2. the ability to complete journal entries, post to ledger, perform adjusting and closing entries for a set of books; 3. the ability to prepare financial statements and reports; 4. an understanding for the need for internal control as well as preparing a bank reconciliation; 5. the ability to process transactions relating to receivables, payables, inventories, plant assets, natural resources and intangible assets; 6. an understanding of the cash and accrual methods of accounting; 7. the ability to process transactions relating to a merchandising company; 8. a working knowledge of special journals; 9. an understanding of financial analysis and reporting; 10. an understanding of the difference in the accounting processes of the sole proprietorship and partnership; 11. an awareness of the ethical issues which exist in the business community. Expected Outcomes for Students: Upon completion of the course, the student should be able to demonstrate: 1. an understanding of transactions germane to corporations; 2. an understanding between the difference in the accounting processes of the corporation as contrasted to other business forms; 3. an understanding of long-term liabilities, bonds, present value tables; 4. the ability to process transactions dealing with debt and stock investments; 5. an understanding of statement of cash flows; 6. the ability to analyze and interpret financial statements by use of ratios, trends, and comparisons; 7. an understanding of managerial accounting, manufacturing costs, fixed and variable costs, standard costs, break-even analysis, product costing, job-order costing systems; 8. an understanding of cost-volume-profit analysis; 9. an understanding of role of budgeting, decision making, and use of present values tables. Course Outline for Business 1B, Page 2 Course Content: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Corporations a. nature and formation b. accounting for common stock, treasury stock, preferred stock c. cash and stock dividends, retained earnings, income reporting Long-term liabilities a. accounting for the issuing of and retiring of bonds b. leases and long-term notes payable Statement of cash flows a. indirect method b. direct method Financial statement analysis Managerial accounting a. manufacturing costs b. product versus period costs Job order cost accounting Process cost accounting Cost-Volume-Profit relationships Budgetary planning Budgetary control and responsibility accounting Performance evaluation through standard costs Incremental business analysis and capital budgeting Methods of Presentation: 1. 2. 3. Lecture Discussion Problem solving Assignments and Methods of Evaluating Student Progress: 1. 2. Typical Assignments a. Assigned problems dealing with controlling and planning decisions that managers must make Evaluation Methods a. Chapter Examinations b. Final Examination Textbook(s) Typical: Accounting Principles, Weygandt, Kiesco, Kimmel, Wiley & Sons, Inc., 1999 Special Student Materials: Calculator mc 10/2/99 REVISEBUS1B