Paycheck Options

advertisement

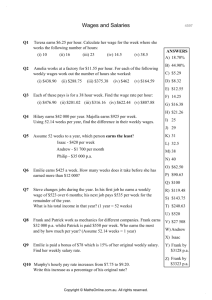

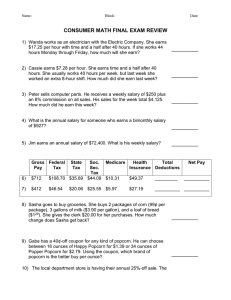

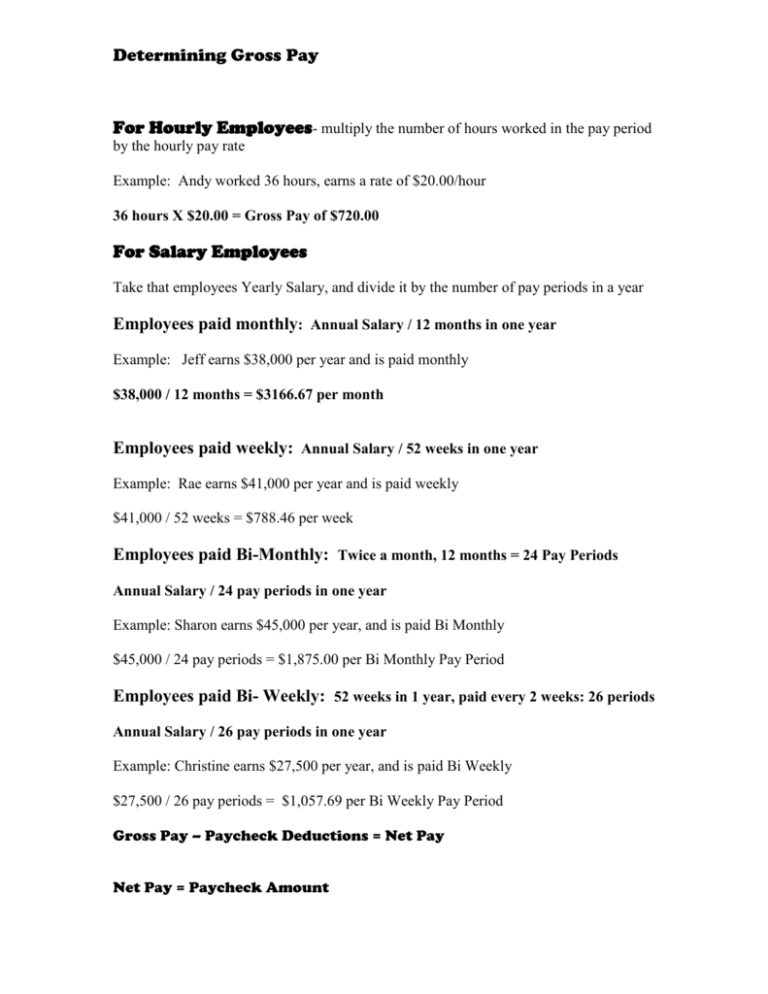

Determining Gross Pay For Hourly Employees- multiply the number of hours worked in the pay period by the hourly pay rate Example: Andy worked 36 hours, earns a rate of $20.00/hour 36 hours X $20.00 = Gross Pay of $720.00 For Salary Employees Take that employees Yearly Salary, and divide it by the number of pay periods in a year Employees paid monthly: Annual Salary / 12 months in one year Example: Jeff earns $38,000 per year and is paid monthly $38,000 / 12 months = $3166.67 per month Employees paid weekly: Annual Salary / 52 weeks in one year Example: Rae earns $41,000 per year and is paid weekly $41,000 / 52 weeks = $788.46 per week Employees paid Bi-Monthly: Twice a month, 12 months = 24 Pay Periods Annual Salary / 24 pay periods in one year Example: Sharon earns $45,000 per year, and is paid Bi Monthly $45,000 / 24 pay periods = $1,875.00 per Bi Monthly Pay Period Employees paid Bi- Weekly: 52 weeks in 1 year, paid every 2 weeks: 26 periods Annual Salary / 26 pay periods in one year Example: Christine earns $27,500 per year, and is paid Bi Weekly $27,500 / 26 pay periods = $1,057.69 per Bi Weekly Pay Period Gross Pay – Paycheck Deductions = Net Pay Net Pay = Paycheck Amount