EventStudies

advertisement

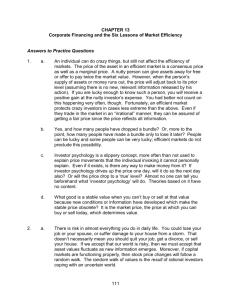

1 An event study is designed to examine market reactions to, and abnormal returns around specific information-imparting events. These events can be market-wide or firmspecific The event can occur at the same point in time for all stocks (9/11) or at different points in time for each stock (M&A Announcement) 2 The day or time of the event is day (or time) 0. You are looking to see if there is unusual movement either on day 0, before day 0, or after day 0. You want to find out if you can show that there is a 95% chance that the event caused the unusual movement. Knowing that an event caused or didn’t cause an abnormal return can help us predict stock reactions to similar events in the future. 3 1. Clearly identify the event and the date on which the event announcement occurred Note that the announcement date is preferred to the date that the event took place if you expect prices to react to the announcement 2. Find returns around the event date Usually daily, but can be more frequent (CNBC Reports) or less frequent 3. Determine your sample size and collect all the pertinent data in your sample 4 4. Determine the event window Days –n to +n 5. Control for the Market Determine how much of each stock’s movement was due to market movement separate from the event. This will give us the excess returns we are looking for. 6. Average the excess returns across all stocks in the sample for each day in the event window Equally-weighted or value-weighted 5 7. Calculate the standard errors of the excess returns Sample standard deviation divided by the square root of the sample size 7. Calculate t statistics to test for statistical significance Divide the average abnormal return for the day by the standard error and compare with hurdle rate of t=1.96 8. Plot cumulative abnormal returns on a graph to give a clear visual description of what you found. 6 9. If desired, calculate a long-short portfolio Determine the results of a portfolio where you go long the top decile (or 20%) and short the bottom decile (or 20%). This works best if the top decile has positive abnormal returns and the bottom decile has negative abnormal returns 7 No Risk Adjustment ◦ Actual Rit – Actual Rm,t ◦ Often close enough for short-term movements Risk Adjustment using Beta ◦ Actual Rit – [ai + Bi[Actual Rm,t] ◦ ai and Bi must be determined outside event window Risk Adjustment using Matched Firms ◦ Actual Rit – [Actual Rmatch,t] ◦ Find matches in same industry with closest possible market cap 8 M & A Announcements ◦ How do stocks react before, at, and after an announcement that there is a bid to acquire them? IPO Long-Run Returns ◦ How do stocks do over the three years following their IPO? Do those with higher initial returns do better than those with lower initial returns? Reaction to CNBC Reports ◦ If a stock is mentioned favorably or unfavorably on CNBC, does it affect its price? Is so, how quickly? 9 Momentum in Weekly Returns ◦ If we go long the stocks with the top decile of weekly returns and short the bottom decile, how will our portfolio perform over the next 52 weeks? Stocks Within Mutual Funds ◦ Ranking mutual funds based on their inflow of new money, we can form a portfolio where we go long the stocks that the top 20% hold and short the stocks that the bottom 20% hold. How well do these stocks do over the next 40 months? 10 Name Changes ◦ Was there an abnormal return when companies changed their name to include “dot com” between January 1998 and March 1999? 11 12 Adjusted Median Return to Date 10.0 Median Percentage Return to Date 5.0 0.0 -5.0 -10.0 -15.0 -20.0 -25.0 -30.0 -35.0 1 4 7 10 13 16 Init Ret >= 13.75% 19 Month 22 25 28 31 34 Init Ret < 13.75% 13 14 15 16 17 Do your own Event Study Find out if being added to the S&P 500 has an impact on a stock’s return Randomly select 100 stocks that were added to the S&P 500 between 1/2000 and 10/2009 Stocks and dates are provided Get price data on Yahoo Finance Use market model to find abnormal returns Graph CARs from Event Day-10 to Event Day+11 Details on class website 18