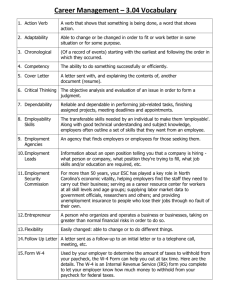

CHAPTER 9

advertisement

Income Tax Fundamentals 2009 Gerald E. Whittenburg Martha Altus-Buller Student’s Copy 2009 Cengage Learning Employer calculates income tax withholding from employees’ paychecks based on their Form W-4 • Pay includes salaries, bonuses, commissions • W-4 completed by employee, tells employer: Number of allowances claimed by employee Single, married, or married but withhold tax at higher single rate Exempt status – employee can only claim exempt if he/she had no income tax liability last year and expects none this year • If no W-4 filed, employer must withhold at highest rate 2009 Cengage Learning To compute amount to withhold from pay • Multiply number of allowances found on W-4 by allowance amounts [found on pp. 9-2, 9-5] • Subtract that amount from employee’s gross wages • Use IRS tables to calculate federal income tax based on wages after allowance amounts Found in textbook in Appendix C IRS also publishes Circular E each year “Employer’s Tax Guide” 2009 Cengage Learning Withholding is mandatory on pension and other deferred income payments • Rates used depend on nature of payment Rates on periodic payments based on taxpayer’s W-4 Withhold at either flat 10% [or 20% for certain distributions] 2009 Cengage Learning Self-employed taxpayers must make quarterly estimated tax payments if • Annual payment due for the year is ≥ $1000 (after withholding) Quarterly payments due April 15, June 15, September 15, and January 15 of next year Total annual estimated payments is lesser of • 90% of current year tax or • 100% of prior year tax or • 90% of current year TI, AMT & annualized SE income Exception: if AGI > $150,000 for prior year, then annual required payment = 110% of prior year tax 2009 Cengage Learning Federal Insurance Contributions Act (FICA) introduced to provide retirement and disability benefits for American workers and their families FICA comprised of two taxes • Social Security - 6.2% of first $102,000 of gross wages • Medicare - 1.45% of total gross earnings [no cap] 2009 Cengage Learning Employers withhold both income tax and FICA from paychecks Must deposit these taxes either monthly or semiweekly [as determined by lookback period] • Monthly depositors make deposit by 15th of following month All new employers are automatically monthly • Semiweekly depositors make deposit either Wednesday and/or Friday depending upon when payroll is run Very small employers with payroll tax liabilities of $1000 or less can file/pay annually by using a Form 944 2009 Cengage Learning To make deposit at commercial bank, fill out Form 8109 (coupon) and take to an authorized depository • Or, if mailed, must be postmarked second day before due date May be electronically deposited via Electronic Federal Tax Payment System [EFTPS] • Some employers must deposit using EFTPS Form 941 [Employer’s Quarterly Federal Tax Return] must include payroll taxes not yet deposited for quarter • Can use Form 941 e-file program 2009 Cengage Learning Self-employment [SE] tax is the same as FICA, except self-employed taxpayer pays both shares Therefore, rates are: • Social Security [OASDI] is 12.4% of first $102,000 of net self-employment income • Medicare is 2.9% on total net self-employment income If taxpayer has both W-2 wages and selfemployment income, the $102,000 limit applies to the combined earnings • FICA is not required if SE income is < $400 • May take a Deduction for AGI for 1/2 of SE tax paid 2009 Cengage Learning Federal Unemployment Tax Act [FUTA] requires employers to pay tax to administer state unemployment programs Employer pays 6.2% up to first $7,000 per employee per year • However credit of up to 5.4% for state unemployment tax is taken against the 6.2% Therefore, net FUTA rate = .8% [6.2% - 5.4%] • Must deposit quarterly if over $500 • Must file annual report 2009 Cengage Learning Form 940