Exchange Rates and Purchasing Power Parity

advertisement

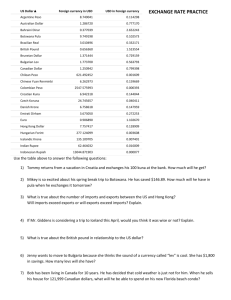

Exchange Rates and Purchasing Power Parity CHAPTER 13 Reinert/Windows on the World Economy, 2005 Introduction Exchange rates matter in many different ways to many different constituencies in the world economy Much of this section on international finance will be directly or indirectly concerned with exchange rates Reinert/Windows on the World Economy, 2005 2 The Nominal Exchange Rate Relative price of two currencies Often expressed as number of units of local or home currency required to buy a unit of foreign currency We will usually view Mexico (peso) as our home country and United States (dollar) as our foreign country Nominal or currency exchange rate (e) is local currency pesos e foreign currency dollar If e increases the value of the peso (home currency) falls If e decreases the value of the peso (home currency) rises e and the value of the peso are inversely related • e is often graphed as its inverse which is equal to the value of the peso Reinert/Windows on the World Economy, 2005 3 Table 13.1. Nominal Exchange Rates, October 9, 2002 (per US dollar) Reinert/Windows on the World Economy, 2005 4 Figure 13.1. The Value of the Peso Scale Reinert/Windows on the World Economy, 2005 5 The Real Exchange Rate Measures the rate at which two countries’ goods trade against each other Makes use of the price levels in the two countries under consideration PM—overall price level in Mexico (the home country) PUS—overall price level in the United States (the foreign country) P US re e M P Reinert/Windows on the World Economy, 2005 6 Table 13.2. Changes in the Real Exchange Rate Reinert/Windows on the World Economy, 2005 7 The Real Exchange Rate Suppose that the price level in the United States rises Takes more Mexican goods to purchase US goods Represents a fall in the real value of the peso Suppose that the price level in Mexico rises Takes fewer Mexican goods to purchase US goods Represents a rise in the real value of the peso Suppose that the nominal exchange rate increases Takes more Mexican pesos to buy a US dollar and, therefore, more Mexican goods to buy US goods Represents a fall in the real value of the peso Real exchange rates affected by both nominal exchange rates and price levels Reinert/Windows on the World Economy, 2005 8 Exchange Rates and Trade Flows Changes in e have an impact on trade flows Consider the case of Mexico’s imports and exports World prices (PW) are typically in US dollar terms Mexican prices (PM) are in peso terms • Relationship between the peso and world prices of Mexico’s import (Z) goods can be expressed as PZM e PZW • PZW is in dollar terms M Multiplying it by e gives us PZ in peso terms Reinert/Windows on the World Economy, 2005 9 Exchange Rates and Trade Flows Suppose e were to increase (the value of the peso falls) Movement down the scale in Figure 13.1 increases the peso price of the imported good in Mexico Import demand consequently decreases Suppose e were to decrease (the value of the peso rises) Movement up the scale in Figure 13.1 decreases the peso price of the imported good in Mexico Import demand consequently increases Reinert/Windows on the World Economy, 2005 10 Figure 13.2. The Value of the Peso and Mexico’s Imports Reinert/Windows on the World Economy, 2005 11 Figure 13.3. The Value of the Peso and Mexico’s Exports Reinert/Windows on the World Economy, 2005 12 Exchange Rates and Trade Flows Relationship between the peso and dollar prices of Mexico’s exported (E) goods can be expressed as PEM e PEW Suppose e were to increase (the value of the peso falls) Movement down the scale in Figure 13.1 increases the peso price of the export good in Mexico Export supply in Mexico consequently increases • Mexican firms now have more of an incentive in peso terms to export Reinert/Windows on the World Economy, 2005 13 Exchange Rates and Trade Flows Suppose e were to decrease (the value of the peso rises) Movement up the inverse scale in Figure 13.1 decreases the peso price of exports in Mexico Export supply consequently decreases Can put the relationships of Figures 13.2 and 13.3 together Figure 13.4 represents the positive relationship between value of peso and trade deficit, or Z – E Reinert/Windows on the World Economy, 2005 14 Figure 13.4. The Value of the Peso and Mexico’s Trade Deficit Reinert/Windows on the World Economy, 2005 15 The Purchasing Power Parity Model Begins with the hypothesis that the nominal exchange rate will adjust so that the purchasing power of a currency will be the same in every country Implications of hypothesis Purchasing power of a currency in a given country is inversely related to price level in that country • For example, purchasing power of the peso in Mexico can be expressed as 1 M P The higher the price level in Mexico the lower the purchasing power of the peso Purchasing power of peso in United States is more complicated • Need rate at which a peso can be exchanged into dollars, or 1/e • Need purchasing power of a dollar in United States, or 1/PUS • Purchasing power of a peso in United States is 1e 1P US Reinert/Windows on the World Economy, 2005 16 PPP Equation PPP hypothesis is 1 1 1 P M e P US Invert the equation M US P eP Divide both sides of the above equation by PUS to obtain PPP equation PM e US P Reinert/Windows on the World Economy, 2005 17 Meaning of PPP Equation Suppose PM were to increase According to the PPP model, e would increase • Value of the peso would move down the scale in Figure 13.1 Suppose PUS were to increase According to the PPP model e would decrease • Value of the peso would move up the scale in Figure 13.1 Nominal value of the peso adjusts to changes in its real purchasing power in the two countries Reinert/Windows on the World Economy, 2005 18 Meaning of PPP Equation Restrictiveness of PPP model can be seen when we re-express it in a third equation Multiplying both sides of the PPP equation by P US M P Obtain modified PPP equation P US e M 1 P Compare this equation with real exchange rate P US e M re P Reinert/Windows on the World Economy, 2005 19 PPP Model as Special Case PPP model is a special case of the real exchange rate Implies that real exchange rate is fixed at unity • No change in real exchange rate However real exchange rates do change therefore there must be important elements of the real world that the PPP theory ignores PPP assumes all goods entering into the price levels of both countries are internationally traded Phenomenon of product differentiation Allows for separate markets (and therefore prices) for import and domestic varieties of a good Reinert/Windows on the World Economy, 2005 20 PPP Model as Special Case Real exchange rate equation captures reality at any point in time PPP relationship never holds exactly PPP equation gives a sense of a long-term tendency towards which nominal exchange rates move absent other changes Reinert/Windows on the World Economy, 2005 21 Exchange Rate Exposure If sales from either exporting or foreign direct investment are not denominated in the currencies of the firms’ home countries Exchange rate exposure issues arise Suppose that the €/US$ exchange rate is currently at a value of 1.00 Suppose also that a US firm is expecting euro revenues of €1.0 million Current exchange rate (spot rate) suggests US firm might be expecting dollar revenues of US$1.0 million Suppose, however, that the spot rate moves to e = 1.25 (a dollar value of the euro of $0.80) • Now takes more euros to purchase a dollar—dollar revenues shrink to $800,000 Reinert/Windows on the World Economy, 2005 22 Forward Markets For some currencies forward rates also exist Rates of current contracts for “forward” transactions in currencies • Usually for one, three, or six months in the future If the forward rate of the euro (€/US$) is exactly the same as the spot rate Euro is “flat” If the forward rate of the euro is above the spot rate Euro is at a “forward discount” If the forward rate of the euro is below the spot rate Euro is at a “forward premium” Hedging exchange rate exposure requires that firms have expectations or forecasts of future spot rates that they can compare to forward rates Reinert/Windows on the World Economy, 2005 23