Exchange Rates

advertisement

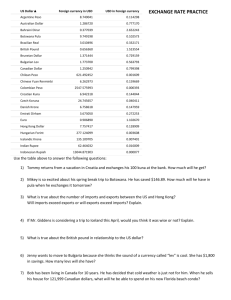

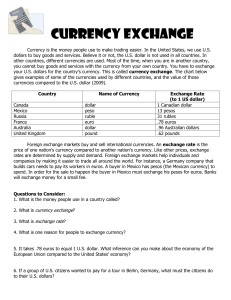

Exchange Rates What is an exchange rate? What types of rates exist, and how are they different? How would you graph supply and demand for a currency? Why would exchange rates change? Current Exchange Rates Appreciation of the dollar –an increase in the value of the dollar relative to the currency of another nation dollar buys more foreign stuff Depreciation of the dollar – a decrease in the value of the dollar relative to another currency dollar buys a smaller amount of foreign currency and thus foreign goods Floating Exchange Rates Market Exchange Rates determined by Supply and Demand Items requiring foreign exchange: Services Tourism Business trips Currency speculators Set-up a manufacturing company An Overview Suppose: Canadian Dollars Mexican Pesos IF Mexican importers demand Canadian goods they must pay for the goods in Canadian dollars, therefore, an increase in demand for Canadian dollars. Peso Price of C$ D1 D2 for C$ Q of C$ Downward Sloping Demand The lower the price of the C$ the more will be demanded The cheaper the C$ is to Mexican traders the cheaper are Canadian goods, services and assets. Therefore the demand curve for the dollar will slope downward. Canadian Dollar Exchange Rate Peso Price of C$ D by Mexico Q of C$ Upward Sloping Supply Supply of C$ into foreign Exchange Rate for Canadian $ exchange markets comes from Canadians wishing to buy Peso Mexican goods, services and Price S by Canada assets of C$ The higher the C$/peso exchange rate the more pesos will be bought and the more dollars will be supplied. This is because the price of Mexican goods, services and assets are cheaper in Canadian dollars the higher is the price of the C$. Q of C$ Equilibrium Exchange Rates A= Equilibrium exchange rate, Exchange Rate for Canadian $ DC$ = S C$ If exchange rate is below Peso S of C$ equilibrium, at C$1 =90 pesos Price by Canada then D>S, shown as B-C. of C$ Dealers wanting to earn commission by exchanging A money will have to raise the 100 offer price for the C$ to B C 90 encourage greater supply and reduce the excess demand. 80 This would continue until equilibrium was reached. D of C$ by Mexico In practice the process is very rapid, they adjust to small gaps in rates minute by Q of C$ minute. Floating Exchange Rates Suppose there is an increase in demand for British goods. This means that foreigners need pounds and the need for pounds drives up the exchange rate. The reverse is true as well. Exchange rates for British Sterling (Pounds) Currency Terms Appreciate = A rise in the exchange rate is called appreciation. Depreciation = A fall in the exchange rate is called depreciation. Peso price Of C$ S1 of C$ A S2 of C$ B C Quantity of C$ D1 of C$ D2 of C$ A fall in demand of C$ is shown As a shift in the demand curve From D1 to D2. An increase in Supply is shown as a movement From S1 to S2. In both cases the exchange rate Of the C$ will fall, or depreciate (Conversely, the peso has Appreciated). Fixed Exchange Rates Suppose there is an increase in demand for British Sterling= D1 to D2, thus increasing exchange rate. British authorities will then tap into their currency reserves and sell more sterling, thus increasing supply from S1 to S2, and maintaining fixed exchange rate. Determinants of Foreign Exchange Rates Taste and Preferences Relative Interest Rates If GDP increases then increased M, increase supply of their currency, therefore their currency depreciates Prices levels, relative Price Levels Canada offers high interest rates = increased demand for C$ therefore C$ appreciates Income, real Income Increase taste for German cars = increase demand for Euro, therefore euro appreciates If a country has high inflation, consumers in that country will increase M because M is relatively cheaper, increase supply currency to buy Mcurrency depreciates Speculation – If speculators think the currency will do well then buy low and sell high. If speculators think $ is overvalued and is due for a fall, people holding $ will rush to sell and the supply of $ will increase - $ depreciates China, A Currency Manipulator?