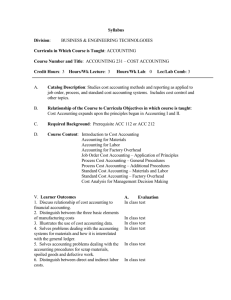

4361_HO1B_costclassificationsSP16

advertisement

ACG 4361 Handout #1B – Cost Classifications & Cost Flows Spring 2016 Problem 1. For each of the following costs incurred in a manufacturing company, indicate the proper classification by placing an X in the correct columns. Fixed Variable Product Period Prime Conversion Indirect 1. Salary of the CFO 2. Lettuce used on taco at Taco Bell 3. Wages of clerical staff in corporate office 4. DDB Depreciation of factory machines 5. Property taxes on the factory 6. Maintenance cost on delivery trucks 7. Factory janitor salary 8. Sales personnel commissions 9. Wages of assembly workers 10. Shipping cost to acquire production materials Problem 2. Answer each of the following: A. What are the three manufacturing costs? B. What are the four product cost accounts reported on financial statements? C. What are the three inventory accounts for manufacturers? In which section of the balance sheet are they reported? D. What are the three components of manufacturing overhead? E. How do direct and indirect costs differ? Updated December 26, 2015 Problem 3 Speedster Inc. manufactures custom all terrain vehicles (ATVs). March's beginning inventory consisted of the following components: Raw materials $ 45,000 Work in process 17,000 Finished goods 40,000 Speedster applies factory overhead based on direct labor cost using normal costing. Budgeted direct labor is $102,000 at an average labor rate of $15.00 based on direct labor cost. Budgeted factory overhead for March is $112,200. Speedster tracks both direct and indirect materials in its Raw Materials Inventory. Over or underapplied overhead is considered to be immaterial. The following descriptions summarize the various transactions that occurred during March: 1. Purchased $96,000 of raw materials on account. 2. Purchased $7,000 of raw materials for cash. 3. Used $137,000 of raw materials in the production process. $124,000 of this amount consisted of parts and other materials directly incorporated into ATVs. The remainder was indirect material for shop supplies and small dollar items that are not otherwise traceable to specific ATVs. 4. Paid $2,400 during the month for shipping costs for raw materials acquired. 5. Paid for materials purchased in transaction 1. 6. Total wages and salaries were $147,000 at an actual wage rate of $16.00 per hour. Of this amount, $99,000 was attributable to direct labor, $12,000 to indirect labor, and $36,000 to general and administrative activities. 7. Depreciation for the period totaled $29,000, with $21,000 related to the factory and factoryrelated equipment (included in the factory overhead rates). The other $8,000 is related to general and administrative activities. 8. Other general and administrative costs, excluding wages and depreciation, totaled $15,000. 9. Other factory overhead costs, excluding indirect materials, wages, and depreciation, totaled $61,200. 10. Applied manufacturing overhead for the period at the rate of $1.10 per direct labor dollar. 11. Sales for the month amounted to $525,000. All sales are on account. Cash received from customers totaled $522,000. 12. Ending work in process was $33,000. 13. Ending finished goods inventory totaled to $21,500. 14. Income taxes are 30%. Speedster treats under or overapplied overhead as immaterial in amount. A. B. C. D. Draw t-accounts for all product cost accounts and post all transactions to these accounts. Prepare a cost of goods manufactured statement for the month of March. Prepare a multiple-step full costing income statement for March, Show how the inventories would be reported on the company’s March 31 balance sheet. Be sure to indicate the specific balance sheet sections. E. Why is overhead applied? Updated December 26, 2015 Updated December 26, 2015 Problem 4 Randalson, Inc. applied $87,700 of manufacturing overhead during 2016. Budgeted factory overhead was $87,100 and budgeted machine hours were 10,575. Actual factory overhead was $88,250 and actual machine-hours were 10,900. Actual year end account balances before disposition of the under or over applied amount were as follows: Account Names Cost of goods sold Raw materials Work in process Finished goods Account Balances $363,350 27,500 33,800 25,350 Sales revenue for the period was $385,000. The company uses only one control account for factory overhead. The total amount of overhead cost included in each account is not readily determinable. A. If the company deems under or overapplied overhead to be immaterial, to which account(s) is it closed, and why is/are this/these account(s) selected? B. If the company deems under or overapplied overhead to be material in amount, to which account(s) is it closed, and why is/are this/these account(s) selected? C. Post all transactions and respective amounts to the two t-accounts below, including the effects of disposing of any over/underapplied overhead assuming the amount is material. Calculate and write the account balances n the proper account location. Label the amount of over or underapplied. Manufacturing Overhead Cost of Goods Sold D. How much gross profit will the company report on its income statement for 2016 (if under or overapplied MOH is assumed to be material)? Updated December 26, 2015 Problem 5 Fanna Fans produces several ceiling fan styles, employs a normal costing system, and considers under or overapplied overhead to be immaterial. It tracks all material costs in the materials storeroom. During July, its transactions and account balances included the following: Raw materials purchased on account Work in process inventory, beginning Work in process inventory, ending Finished goods, beginning Finished goods, ending Total manufacturing overhead applied A. B. C. D. E. F. $132,000 12,200 23,500 19,000 12,500 41,600 Raw materials inventory, beg. Raw materials inventory, ending Product delivery cost to customers Indirect materials used in production Total manufacturing overhead incurred Direct labor cost incurred $12,600 13,400 3,400 2,700 43,000 50,400 How much is the cost of direct materials transferred to production during July? How much is the cost of goods manufactured for July? How much is total manufacturing costs for July? What amount of conversion costs were added to production during July? What amount of prime costs were added to production during July? How much will Fanna Fans report as cost of goods sold for July? Updated December 26, 2015