Required - John J. Masselli, Ph.D

ACCT 5315 – Comprehensive Case #2

Due: December 18, 2014

Security Monitoring Services

Attached to this case are the comparative balance sheets for Security Monitoring Services for calendar years 2014 and 2013. In addition, the profit and loss statement for 2013 is provided. Based on the financial statements and the information provided below, prepare answers for the following requirements.

Security monitoring services reports its tax information on the accrual basis of accounting.

Facts and Other Information

Employee morale expense consists of various meals and entertainment to keep the employees morale up and in a positive momentum. Please limit the deductions to 50% for tax.

Included in the owners salary account and accrued payroll account is an accrued bonus of

$300,000. At this juncture, no accrual for FICA taxes on the bonus has been made. Due to cash constraints, the officer’s were told that the bonus payments would not be paid until the June 1,

2015 paycheck. There was no accrued officer payroll in 2013.

Included in vehicle expenses category in the general and administrative section are lease payments from 6 leased vehicles. All are BMA SUVs weighing less than 6,000 pounds. The vehicles were all leased in January 2012 and had a market value of $75,500 at the time of acquisition. The leases are operating in nature. As such, they are not included in the balance sheet of the company.

Included in the fringe benefits are life insurance premiums on officer’s (or partner’s in the case of an LLC) lives where the company is the beneficiary. The amount of these premiums is $12,000 for calendar year 2014.

The company has a charitable contributions carryover from 2013 of $125,420.

Also included in COGS fringe benefits is an accrual for other post employment benefits (See

SFAS 106) for which no actual contribution to fund the accrual is necessary nor is made. The amount is $48,450.

Prior to 2014, the company chose to have book and tax depreciation be equal. However, now that the company is making a profit, they have decided to maximize depreciation for tax, but use straight-line depreciation over the tax useful life along with the proper convention (i.e., half year, mid quarter or mid month) for book. The following asset acquisitions were all made on

6/30/2011.

3 Vehicles each costing

Machinery and Equipment:

Office Equipment:

Computer and Network System:

$32,750

$83,900

$492,600

$361,050

Leasehold Improvements: $72,600

In year 2011, the company acquired many smaller companies giving rise to substantial goodwill as shown on the balance sheet. No amortization has been taken for book purposes in 2014 or 2013 in accordance with GAAP that require no adjustment if no impairment of goodwill has occurred.

Included in the revenue figure is $3,000,000 of proceeds received by the company on the death of its former director (a non-owner) who was covered by a life insurance policy paid for by the company.

The company bills in advance. As such, it records advanced payments in deferred revenue for book purposes. It also properly accounts for any advance payments using the proper method for tax since Revenue Procedure 2004-34 does not apply to them.

In 2012, the company applied for and was granted by the Internal Revenue Service a change in accounting method from the cash basis to the accrual basis. The change resulted in a total Section

481(a) positive adjustment to income of $1,000,000. Sec. 481(a) allows this adjustment to be spread over 4 years (the year of the change and 3 subsequent years).

The company is not a member of a controlled group and is not entitled to any tax credits.

1

The entity does not own more than 2% of the stock of any other company.

This is a closely held business owned equally by 3 American citizens: Walter White, Mike Biggs, and, Claire Dunphy. Upon creation of the business in 2010, each owner contributed 1/3 of the total

$900,000 used to form the entity.

Each owner received an equal share of the total cash distributions on 12/31/ 2014 of $900,000 all of which is paid out of earnings and profits.

The entity does not own any interest in other partnerships or LLCs

This entity neither qualifies as a tax shelter nor does it have any interests whatsoever in foreign countries.

Make up any and all social security numbers and addresses as needed. Assume the entities employer identification number is 11-3425647

No accrual for current Federal Income Taxes payable by the entity has been made on the financial statements. Please make the adjustment to the profit and loss statement and balance sheet where appropriate. No recording of any deferred tax asset or liability is required for this assignment despite the fact that one would exist for this company.

Required

1.

Assuming this entity is a C corporation, compute the firms total effective corporate tax liability and average tax rate (total taxes / book profit before taxes). Total corporate tax liability is calculated as the sum of: 1) the corporate taxes calculated on the Form 1120 add to:

2) the dividend taxes paid by each of the owners on the corporate dividend received in 2014 added to 3) the taxes paid by each owner on their cash salary received in 2014. Assume each owner is a single taxpayer and had total 2014 AGI of $300,000 comprised only of their firm salary. Further assume none of the owners have any itemized deductions. Also, prepare in good form, Federal Form 1120 pages 1-5 for the above entity. As part of your answer be sure to fully explain your computation of schedule M-1:

2.

Assume instead this entity is a Limited Liability Company that qualifies for taxation as a partnership under Subchapter K. Please prepare pages 1-5 of Form 1065 (EXCLUDING

SCHEDULE M-1). Prepare an analysis that 1) reconciles and explains the differences between corporate taxable income from page 1 of Form 1120 and ordinary income from page

1 of Form 1065. For example, if a revenue item is included in corporate taxable income on

Form 1120, but is not included on page 1 of Form 1065 because it is separately stated on

Schedule K, you will want to show that as an adjustment in your analysis and explain why.

Group 2 presents parts 1 and 2

3.

Again assume that this entity is an LLC. Calculate the total tax liability (income and self employment tax) each LLC member will be required to pay because of including their share of firm profits and separately stated items. To do this, assume that each partner is a single and cannot itemize their deductions. Please note that entities taxed as partnerships do not pay salaries to their owners. Instead, any salary like payment to an owner is called a guaranteed payment which is deducted in the computation of ordinary income on page 1 of form 1065 and is reported to each owner on their respective K-1 for the year. The guaranteed payments

(also self employment taxable) are added to the other K-1 items and included in each owner’s tax return. Thus, assume that the only taxable income items each owner will have for 2010 are those reported to them on the K-1 for this entity. Presenter: Group 4

4.

Prepare a memorandum briefly explaining the definition and rationale of the following key state income tax concepts: 1) Nexus, 2) Allocation versus apportionment (be sure to explain 3 v. 4 factors) and 3) Throwback rules. Also prepare a research memorandum that summarizes the rules related to the Deceased spouse unused exclusion amount for estate taxation.

Presenting: Group 6

5.

Prepare a memorandum explaining the distinction between ordinary dividends and qualifying dividends and the implications of this for Income Tax Purposes. Also explain how the 0% preferential gain works for taxpayers in the 10 & 15% marginal tax rate categories. Finally, prepare a memorandum discussing how the claim to right doctrine impact revenue recognition and the tests that must be met for accruing expenses for tax purposes. Presenting: Group 8.

2

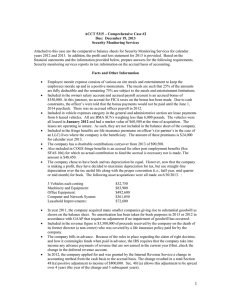

Security Monitoring Services

Income Statement

For fiscal year ending 12/31/2014

Revenue

Cost of Goods Sold

COGS – Payroll

COGS - Payroll Tax Expense

COGS - Fringe Benefits - Health Ins

Total Cost of Labor

Other Costs

Recruitment Expenses

Vehicle Expenses

Equipment Operating Leases

Licenses and Permits

Pager Expense

Advertising Expense

Report Administration Expense

Printing Expense

Office Expense

Computer Support and Maintenance

Network Maintenance

Freight In

Mobile/Land Telephone

Employee Morale Expenses

Travel

Business Meals

Dues and Subscriptions

Depreciation Expense

Radio Monitoring Expense

Education Expenses

Total Cost of Sales

Gross Profit

2014

$18,249,836

$ 8,401,249

$ 239,474

$ 191,934

$ 8,832,658

$ 25,931

$ 60,949

$ 23,496

$ 19,373

$ 61,773

$ 111,973

$ 13,516

$ 12,855

$ 22,909

$ 58,365

$ 30,039

$ 276

$ 1,228,390

$ 51,825

$ 51,202

$ 5,888

$ 1,514

$ 228,095

$ 135,685

$ 10,477

$10,987,191

$ 7,262,647

3

Gross Profit $ 7,262,647

Payroll $ 749,117

Owners Salary (split evenly among owners) $ 1,200,000

Recruitment Expense $ 50,581

Payroll tax expense

Health Insuracne

Vehicle Expense and auto repairs

Depreciation

Trade shows

$ 36,123

$ 42,941

$ 93,261

$ 25,221

$ 220,167

Postage and Freight

Professional Fees

Insurance

Rent Expense

Office expense

Network Maintenance Expense

Dues and Subscriptions

Employee Morale Expense

Mobile Phone

Legal Expenses and Consulting fees

Credit Card Fees

$ 64,923

$ 5,695

$ 127,377

$ 204,208

$ 62,713

$ 11,627

$ 14,373

$ 56,796

$ 26,198

$ 226,165

$ 22,109

Travel net of meals

Business Meals

Payroll Processing

New York State Taxes

401(K) Expense

Training

Office Equipment leases and expense

Total Other Expenses

Amortization

Bad Debt expense

Interest expense

Net capital loss

State of Texas Municipal Interest

Dividend Income

Net Income per books before taxes

$ 108,612

$ 26,263

$ 8,081

$ 887

$ 13,951

$ 528

$ 42,140

$ 3,440,057

$ -

$ 24,825

$ 26,847

$ 122,450

$ (15,921)

$ (115,449)

$ 3,779,838

4

Security Monitoring Services

Balance Sheet as of 12/31/2014 and 12/31/2013

Cash

A/R

Less: Allowance for D/A

Security Deposits

Office Equipment (f & f)

Accum Depreciation (f& f)

Machinery and Equpiment

Accum Depreciation

Leasehold Improvements

Accum Deprec

Computers and Networks

Accum Depreciation

Vehicles

Accumulated Depreciation

Goodwill

Accum Amort

Investment Account

Total Assets

Liabilities

Accounts payable

Accrued Payroll

$ 645,098

$ 392,334

Current Portion Debt $ 76,276

OPEB Liability (deducted in fringe bene) $ 88,450

Accrued Expenses

Deferred Revenue

Total Current Liabilities

$ 85,236

$ 328,334

$ 1,615,728

Long Term - Notes Payable

Total Liabilities

Equity

Common Stock

Retained earnings

C/Y Profit Loss

Paid In Capital

Distributions to Owners (split evenly)

Total Equity

$ 3,116,345

$ 4,732,073

$ 5,000

$ 525,398

$ 3,779,837

$ 895,000

$ (900,000)

$ 4,305,235

Total Liabilities and Equity $ 9,037,308

2014

$ 91,964

$ 997,007

$ (7,450)

$ 6,202

$ 622,900

$ (162,269)

$ 378,297

$ (238,146)

$ 103,280

$ (33,089)

$ 428,524

$ (149,951)

$ 130,628

$ (15,620)

$ 1,250,000

$ (62,500)

$ 5,697,531

$ 9,037,308

2013

$ 74,602

$ 751,264

$ (4,477)

$ 16,202

$ 130,300

$ (101,847)

$ 294,397

$ (197,662)

$ 30,680

$ (29,695)

$ 67,474

$ (13,495)

$ 32,378

$ (3,060)

$ 1,250,000

$ (62,500)

$ 887,409

$ 3,121,971

$ 297,022

$ 91,597

$ 6,240

$ 40,000

$ 7,507

$ 336,690

$ 779,055

$ 1,317,518

$ 2,096,573

$ 5,000

$(1,172,285)

$ 1,297,683

$ 895,000

$ -

$ 1,025,398

$ 3,121,971

5