Corporate and Conduit Taxation: December 18, 2015

advertisement

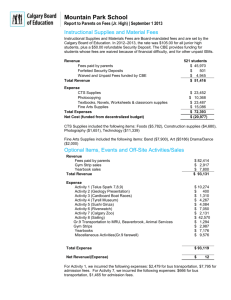

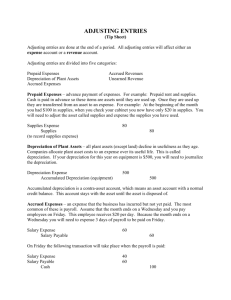

ACCT 5315 – Comprehensive Case #2 Due: December 18, 2015 Security Monitoring Services Attached to this case are the comparative balance sheets for Security Monitoring Services for calendar years 2014 and 2015. In addition, the profit and loss statement for 2015 is provided. Based on the financial statements and the information provided below, prepare answers for the following requirements. Security monitoring services reports its tax information on the accrual basis of accounting. Facts and Other Information Employee morale expense consists of various on site meals and entertainment to keep the employees morale up and in a positive momentum. Included in the owners salary account and accrued payroll account is an accrued bonus of $250,000. At this juncture, no accrual for FICA taxes on the bonus has been made. Due to cash constraints, the officer’s were told that the bonus payments would not be paid until the June 1, 2016 paycheck. There was no accrued officer payroll in 2014. Included in vehicle expenses category in the general and administrative section are lease payments from 6 leased vehicles. All are BMA SUVs weighing less than 6,000 pounds. The vehicles were all leased in January 2015 and had a market value of $52,500 at the time of acquisition. The leases are operating in nature. As such, they are not included in the balance sheet of the company. Included in the fringe benefits are life insurance premiums on officer’s (or partner’s in the case of an LLC) lives where the company is the beneficiary. The amount of these premiums is $24,000 for calendar year 2015. The company has a charitable contributions carryover from 2014 of $165,420. Also included in COGS fringe benefits is an accrual for other post employment benefits (See SFAS 106) for which no actual contribution to fund the accrual is necessary nor is made. The amount is $28,450. Prior to 2015, the company chose to have book and tax depreciation be equal. However, now that the company is making a profit, they have decided to maximize depreciation for tax, but use straight-line depreciation over the tax useful life along with the proper convention (i.e., half year, mid quarter or mid month) for book. The following asset acquisitions were all made on 6/30/2015 (assume Bonus and Section 179 are being extended at 2014 levels for the current year): 3 Vehicles each costing Machinery and Equipment: Office Equipment: Computer and Network System: Leasehold Improvements: $32,750 $83,900 $492,600 $361,050 $72,600 In year 2012, the company acquired many smaller companies giving rise to substantial goodwill as shown on the balance sheet. No amortization has been taken for book purposes in 2013 or 2014 in accordance with GAAP that require no adjustment if no impairment of goodwill has occurred. Included in the revenue figure is $1,500,000 of proceeds received by the company on the death of its former director (a non-owner) who was covered by a life insurance policy paid for by the company. The company bills in advance. As such, it records advanced payments in deferred revenue for book purposes. It also properly accounts for any advance payments using the proper method for tax since Revenue Procedure 2004-34 does not apply to them. In 2013, the company applied for and was granted by the Internal Revenue Service a change in accounting method from the cash basis to the accrual basis. The change resulted in a total Section 481(a) positive adjustment to income of $1,500,000. Sec. 481(a) allows this adjustment to be spread over 4 years (the year of the change and 3 subsequent years). The company is not a member of a controlled group and is not entitled to any tax credits. 1 The entity does not own more than 2% of the stock of any other company. This is a closely held business owned equally by 3 American citizens: Ross Geller, Frasier Crane, and Daphne Craine. Upon creation of the business in 2012, each owner contributed 1/3 of the total $500,000 used to form the entity. Each owner received an equal share of the total cash distributions on 12/31/2015 of $500,000 all of which is paid out of earnings and profits. The entity does not own any interest in other partnerships or LLCs This entity neither qualifies as a tax shelter nor does it have any interests whatsoever in foreign countries. Make up any and all social security numbers and addresses as needed. Assume the entities employer identification number is 11-3425647 No accrual for current Federal Income Taxes payable by the entity has been made on the financial statements. Please make the adjustment to the profit and loss statement and balance sheet where appropriate. No recording of any deferred tax asset or liability is required for this assignment despite the fact that one would exist for this company. 1. 2. 3. 4. 5. 6. Required Assuming this entity is a C corporation, compute the firms total effective corporate tax liability and average tax rate (total taxes / book profit before taxes). Total corporate tax liability is calculated as the sum of: 1) the corporate taxes calculated on the Form 1120 add to: 2) the dividend taxes paid by each of the owners on the corporate dividend received in 2012 added to 3) the taxes paid by each owner on their cash salary received in 2015. Assume each owner is a single taxpayer and had total 2015 AGI of $333,333 comprised only of their firm salary. Further assume none of the owners have any itemized deductions. Also, prepare in good form, Federal Form 1120 pages 1-5 for the above entity. As part of your answer be sure to fully explain your computation of schedule M-1: Group 2 presents Assume instead this entity is a Limited Liability Company that qualifies for taxation as a partnership under Subchapter K. Please prepare pages 1-5 of Form 1065 (EXCLUDING SCHEDULE M-1) and the form k-1s for each owner. Prepare an analysis that 1) reconciles and explains the differences between corporate taxable income from page 1 of Form 1120 and ordinary income from page 1 of Form 1065. For example, if a revenue item is included in corporate taxable income on Form 1120, but is not included on page 1 of Form 1065 because it is separately stated on Schedule K, you will want to show that as an adjustment in your analysis and explain why. Again assume that this entity is an LLC. Calculate the total tax liability (income and self employment tax) each LLC member will be required to pay because of including their share of firm profits and separately stated items. To do this, assume that each partner is a single and cannot itemize their deductions. Please note that entities taxed as partnerships do not pay salaries to their owners. Instead, any salary like payment to an owner is called a guaranteed payment which is deducted in the computation of ordinary income on page 1 of form 1065 and is reported to each owner on their respective K-1 for the year. The guaranteed payments (also self employment taxable) are added to the other K-1 items and included in each owner’s tax return. Thus, assume that the only taxable income items each owner will have for 2015 are those reported to them on the K-1 for this entity. Presenter: Group 4 Prepare a memorandum briefly explaining the definition and rationale of the following key state income tax concepts: 1) Nexus, 2) Allocation versus apportionment (be sure to explain 3 v. 4 factors) and 3) Throwback rules. Presenter Group 6 Prepare a memorandum explaining the distinction between ordinary dividends and qualifying dividends and the implications this have for Income Tax Purposes. Presenter: Group 6 Prepare a memorandum summarizing the key depreciation and individual tax provisions included in the 2015 extenders package. Presenter: Group 6 2 Security Monitoring Services Income Statement For fiscal year ending 12/31/2015 2015 Revenue $18,249,836 Cost of Goods Sold COGS – Payroll COGS - Payroll Tax Expense COGS - Fringe Benefits - Health Ins Total Cost of Labor $ 8,401,249 $ 239,474 $ 191,934 $ 8,832,658 Other Costs Recruitment Expenses Vehicle Expenses Equipment Operating Leases Licenses and Permits Pager Expense Advertising Expense Report Administration Expense Printing Expense Office Expense Computer Support and Maintenance Network Maintenance Freight In Mobile/Land Telephone Employee Morale Expenses Travel Business Meals (50%) ded Dues and Subscriptions Depreciation Expense Radio Monitoring Expense Education Expenses Total Cost of Sales $ 25,931 $ 60,949 $ 23,496 $ 19,373 $ 61,773 $ 111,973 $ 13,516 $ 12,855 $ 22,909 $ 58,365 $ 30,039 $ 276 $ 1,228,390 $ 51,825 $ 51,202 $ 5,888 $ 1,514 $ 228,081 $ 135,699 $ 10,477 $10,987,191 Gross Profit $ 7,262,645 3 Gross Profit $ 7,262,645 Payroll Owners Salary (split evenly among owners) Recruitment Expense Payroll tax expense Health Insuracne Vehicle Expense and auto repairs Depreciation Trade shows Postage and Freight Professional Fees Insurance Rent Expense Office expense Network Maintenance Expense Dues and Subscriptions Employee Morale Expense (50%) Mobile Phone Legal Expenses and Consulting fees Credit Card Fees Travel net of meals Business Meals (50%) Payroll Processing New York State Taxes 401(K) Expense Training Office Equipment leases and expense Total Other Expenses $ 749,117 $ 1,250,000 $ 581 $ 36,123 $ 42,941 $ 93,261 $ 25,221 $ 220,167 $ 64,923 $ 5,695 $ 127,377 $ 204,208 $ 62,713 $ 11,627 $ 14,373 $ 56,796 $ 26,198 $ 226,165 $ 22,109 $ 108,612 $ 26,263 $ 8,081 $ 887 $ 13,951 $ 528 $ 42,140 $ 3,440,057 Amortization Bad Debt expense Interest expense Net capital loss State of Texas Municipal Interest Dividend Income $ $ $ $ $ $ Net Income per books before taxes $ 3,779,837 24,825 26,847 122,450 (15,921) (115,449) 4 Security Monitoring Services Balance Sheet as of 12/31/2015 and 12/31/2014 2015 2014 Cash A/R Less: Allowance for D/A Security Deposits Office Equipment (f & f) Accum Depreciation (f& f) Machinery and Equpiment Accum Depreciation Leasehold Improvements Accum Deprec Computers and Networks Accum Depreciation Vehicles Accumulated Depreciation Goodwill Accum Amort Investment Account $ 91,964 $ 997,007 $ (17,450) $ 16,202 $ 622,900 $ (162,269) $ 378,297 $ (238,146) $ 103,280 $ (33,089) $ 428,524 $ (149,951) $ 130,628 $ (15,620) $ 1,250,000 $ (62,500) $ 5,697,531 $ 74,602 $ 751,264 $ (4,477) $ 16,202 $ 130,300 $ (101,847) $ 294,397 $ (197,662) $ 30,680 $ (29,695) $ 67,474 $ (13,495) $ 32,378 $ (3,060) $ 1,250,000 $ (62,500) $ 887,409 Total Assets $ 9,037,308 $ 3,121,971 Liabilities Accounts payable Accrued Payroll Current Portion Debt OPEB Liability (deducted in fringe bene) Accrued Expenses Deferred Revenue Total Current Liabilities Long Term - Notes Payable Total Liabilities $ 445,098 $ 392,334 $ 76,276 $ 68,450 $ 105,236 $ 528,334 $ 1,615,728 $ 3,116,345 $ 4,732,073 $ 297,022 $ 91,597 $ 6,240 $ 40,000 $ 7,507 $ 336,690 $ 779,055 $ 1,317,518 $ 2,096,573 Equity Common Stock Retained earnings C/Y Profit Loss Paid In Capital Distributions to Owners (split evenly) Total Equity $ 5,000 $ 525,398 $ 3,779,837 $ 495,000 $ (500,000) $ 4,305,235 $ 5,000 $(1,172,285) $ 1,697,683 $ 495,000 $ $ 1,025,398 Total Liabilities and Equity $ 9,037,308 $ 3,121,971 5