Chapter 5 Vocabulary

advertisement

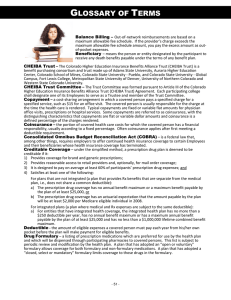

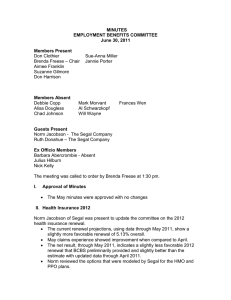

Naked Economics: Chapter 5 Vocabulary 1) Adverse Selection: The tendency of those in dangerous jobs or high risk lifestyles to get life insurance or health insurance. Or a situation where sellers have information that buyers don't (or vice versa) about some aspect of product quality. For example, if my family has a history of cancer and I purchase a cancer insurance policy. 2) HMO’s – Health Maintenance Organizations: In short, an HMO severely restricts the doctors you can visit. You can only those doctors in their plan, but the fees you pay per visit are much lower than a standard health insurance plan. 3) Branding: A distinguishing symbol, mark, logo, name, word, sentence or a combination of these items that companies use to distinguish their product from others in the market. Once a brand has created positive sentiment among its target audience, the firm is said to have built brand equity. Some examples of firms with brand equity - possessing very recognizable brands of products - are Microsoft, Coca-Cola, Ferrari, Sony, The Gap and Nokia. Legal protection given to a brand name is called a trademark. 4) Asymmetry of Information: A situation in which one party in a transaction has more or superior information compared to another. This often happens in transactions where the seller knows more than the buyer, although the reverse can happen as well. Potentially, this could be a harmful situation because one party can take advantage of the other party's lack of knowledge. For example, if I know my used car is going to fall apart soon but don’t tell a prospective buyer about all the issues the car has. 5) Deductible: The amount you have to pay out-of-pocket for expenses before the insurance company will cover the remaining costs. For example, if you get into an accident and your medical expenses are $2,000 and your deductible is $300, then you would have to pay the $300 out-of-pocket first before the insurance company paid the remaining $1,700. However, if your accident only resulted in $300 in medical expenses, then you would pay the $300 deductible and the insurance company would pay nothing. 6) Personal mandate for health insurance: A health insurance mandate is either an employer or individual mandate to obtain private health insurance instead of (or in addition to) a national health insurance plan. Under Obamacare, every American citizen is required to have some form of health insurance, either provided by their employer (most typical) or purchase an individual plan for themselves. Anyone who does not have health insurance must pay a yearly fine.