Things you should consider when looking for an insurance plan

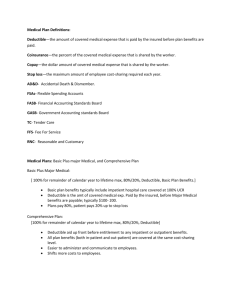

advertisement

Things you should consider when looking for an insurance plan Compiled by Victoria Lam, GSU Health Care Committee Chair, February 2012 [Disclaimer: ND and the GSU do not endorse/support or ensure the validity of these statements and are not responsible/affiliated with any of these companies/organizations. This list is only to be used as a resource at the user's discretion.] 1. 2. 3. VOCABULARY GENERAL CONSIDERATIONS QUESTIONS YOU SHOULD ASK 1. VOCABULARY: Allowed amount The dollar amount that a health plan determines is an appropriate charge for a medical service it covers. Why it matters: Depending on your plan and whether you visit an in- or out-of-network provider, you may be responsible for a provider’s charges above this amount. Claim Information from a health care provider or member that says health care services were provided. Why it matters: Blue Cross network providers submit claims for members, so you don’t have to. When you visit out-ofnetwork providers, you may need to submit a paper claim to your health plan. Coinsurance The percentage of the bill that you pay (or your health plan pays) when you file a claim. This percentage is usually in addition to the deductible. Example: 80%/20%, where the plan pays 80% and you pay 20%. Why it matters: Generally, your monthly rate can be lower for a plan in which you pay some coinsurance. Deductible The amount you pay for health care services each year before the health plan begins to pay for covered medical services. In other words: generally is an annual amount that is not covered by your health plan. It must be paid before your health plan starts to pay for your care. Why it matters: Generally, the higher your plan’s deductible is, the lower your monthly rate will be. When considering deductibles, think about how much you could pay for health care if you need it. Formulary The list of generic and brand-name drugs covered by your health plan. Why it matters: Generally, you’ll pay much less for your prescription drugs if they’re on your health plan’s formulary. You can usually check a plan’s formulary to see if your drugs are covered before you choose the plan. Health savings account (HSA) Money you set aside in a tax-advantaged savings account to help you pay for health care services; like a savings or checking account from a bank. Why it matters: Choosing a health plan that works with a health savings account is a way you can save money for health care expenses and even save to use for health care expenses after you’re retired. Rate The amount you pay for your health plan. Also known as “premium.” Why it matters: Generally, your rate is related to your health plan’s coverage and your age – the higher the rate, the more complete the coverage. It’s generally shown as a monthly amount. Pay attention to coverage specifics as you compare plans. It’s possible that a very low rate may mean you’re not getting the coverage you may need. 1 Network The hospitals, doctors and other medical professionals who sign a contract with a health plan to provide care for its members. Also referred to as participating or in-network providers. Why it matters: You can check a health plan’s network to see if your desired doctors, clinics and hospitals are included. Many plans offer large provider networks. Seeing providers that are in the network will cost you less than seeing those that are not; in some instances, you may not have any coverage for out-of-network providers. Out-of-pocket maximum The most you will pay in deductible and coinsurance (and copays, if any) for covered services in a year. Why it matters: You can think of this as your “worst-case scenario” for the year. This is the most you’ll have to pay out of your pocket for covered services if you or your family has high health care expenses. Preventive care Wellness visits including physicals, some immunizations and cancer screenings, well-child care and prenatal care. Why it matters: Preventive care is an important way to keep yourself healthy and lower your health care costs, since it can cost much less to treat a condition when it’s caught early. As of September 23, 2010, most plans cover preventive care at 100 percent. Provider A doctor, clinic or hospital. It can also mean other care facilities or professionals, such as physician’s assistants, chiropractors, psychologists and many others. Why it matters: You’ll often see this term used to refer to health care professionals and facilities in general, for example, in an online “provider search” tool. Retail health clinics Clinics often located in major retail stores and pharmacies that offer convenient and affordable treatment for many common illnesses. Why it matters: Some health plans include coverage for visits to these clinics. Sometimes you may have a small, or even no, copay. These clinics can help you save time and money when you or your family needs routine care or tests. http://www.bluecrossmn.com/bc/wcs/groups/bcbsmn/@m bc_bluecrossmn/documents/public/mbc1_hp_how_terms. hcsp 2. GENERAL CONSIDERATIONS: Plans vary in how much you’ll pay before your insurance covers you. These are called out-of-pocket costs and they usually are in the form of deductibles or co-insurance. Many of the common health insurance plans today offer several choices for coverage, based on factors including cost, flexibility and how much of a role you want to play in managing and paying for your own health care. These include the following NETWORK types: General note: An HMO requires that you use physicians within a specific network, giving you less flexibility but a more affordable cost. A PPO allows you to stay in-network or go out of network for a heftier fee; out-of-pocket costs are usually higher for PPO's than for HMO's. POS plans combine elements of HMO's and PPO's. They give you the option to pay more for venturing out of network, but usually require you to choose a primary care physician within the network and get a referral from that physician before seeing any specialist. (http://health.usnews.com/healthnews/managing-yourhealthcare/insurance/articles/2010/11/01/ how-to-choose-a-health-insurance-plan-12helpful-tips?PageNr=2) Preferred provider organizations (PPOs). These plans contract with doctors, hospitals, and other providers but typically do not manage your care. PPOs allow you to see providers outside the network, but you will pay more for your care if you do. These are the most common work-based health plans. Health maintenance organizations (HMOs). Many of these plans focus on preventing diseases and staying healthy. If you join an HMO, you typically must receive all your care from network providers, except in medical emergencies. When you join, you pick a primary care doctor to manage your care. HMOs usually have copayments rather than deductibles or co-insurance. 2 Point-of-service organizations (POS). These plans are a combination of a PPO and an HMO. POS plans have a primary care doctor who manages your care but allow you to seek care from doctors and hospitals that are not part of the plan. You pay more for seeking care out of network, however. Consumer-directed health plans. These newer health plans give you more control over your own health care, both in choosing the care you receive and paying for it. They often require you to pay a substantial deductible (often $2,000 or more) before coverage starts, and are combined with a personal health savings account or another similar product that allows you to pay for care with pre-tax money. To get the best plan at the right price to fit your needs, consider the following: Avoid basing your decision only on the premium. Lower premiums typically mean care comes with higher out-of-pocket costs through deductibles, coinsurance, or copayments. If you’re young and healthy, low premiums may be a good fit, but if you have a health condition or are older, it may not be. Review all potential costs before choosing your health plan. Basic FYI: Understand what a plan covers. Read the materials you Please note that premiums quoted by receive with the following questions in mind: What type of companies are usually subject to doctor visits, surgeries, and hospital care are covered? Is change/increase based on: there a drug benefit? If so, how much does it cover and *medical history (do you smoke, have what will it cost you? Are dental and eye care covered? Are pre-existing conditions? Etc.) there limits on what you pay or what the plan will pay for? Medically underwritten coverage Review last year’s coverage and care costs. Determine if it was a typical year, what your out-of-pocket costs were, requires a questionnaire, in which and if it was a good plan for you after all. case pre-existing conditions may Find out if your doctor, hospitals, and other providers not be covered; however, starting in are in your health plan’s network. Decide if you are 2014, the health reform legislation willing to see other providers, and if you aren’t how much it may prevent health plans from will cost you to go out of the plan’s network for care? denying coverage for a pre-existing Look for ways to save money under the plan. Check to condition. Pre-existing conditions see if you can get cheaper prescription drugs if you order them by mail. If you have diabetes or another chronic can vary between plans from being illness, find out if the plan lowers copayments on medicines excluded to being covered fully and to keep your condition in check. Some plans even offer sometimes somewhere in-between cash or incentives for you to get checkups or join disease like being covered after a specific management programs. http://www.ahrq.gov/consumer/cc/cc100609.htm 3. MAKE SURE YOU ASK (where applicable) What is necessary paper work for international students? Do I have to be a resident for 6 months first? What do I have to show for proof of residency? Do you cover Maternity (pre-natal care as well or during and after birth as well? Ex. For Blue Cross Anthem, ‘maternity’ in Indiana is after a 18 month waiting period, you have to pay the 1st $3,000 of pregnancy and meet your deductible, then anthem pays 100% after that) Dental coverage? Additional fees to sign-up? amount of time. Note the Health Insurance Portability and Accountability Act ensures coverage for pre-existing conditions if you are joining a new group plan from your employer and you were insured the previous twelve months. Guaranteed issue is like an "existing medical condition blind" policy. It may have less coverage, and cost more, because the insurer is taking a bigger chance on the individual applicant. *actual plan effective date (Do you need this to start immediately?) *age of applicant(s), (age of yourself, your spouse and your children) *geographic location (zip code) *and/or scheduled rate adjustments. Costs: Compare costs: What is your monthly premium? How much per office visit (may be different depending if you see a Specialist or PCP Primary Care Physician)? Be careful of limitations Ex. $35 copay for the first 3 visits…ask how much will each visit be after that? Ex.2. ‘subject to calendar-year deductible’ meaning that the cost will change What is the out-of-pocket maximum (the max amount you will be required to pay for your treatment)? Does this amount include the deductible? Find out what deductibles you will need to pay first before the health care dollars will kick in. You will also want to know if your deductible needs to be met before any services can be used. Also, find out what percent the 3 health care will pay after your deductible, as well what percent they will pay if you need to use a doctor, hospital, or specialist that is out of network if that is a concern to you. In addition, you will want to know what your co-payments are. Co-payments are the fees you need to pay when visiting your doctor, hospital, or emergency room. Finally, know your limits. Some plans have lifetime limits on how much the health care plan will pay and some have lifetime limits along with yearly limits. Emergency and Hospital Care: You will want to find out what emergency rooms and hospitals are covered on your plan. In addition, find out what constitutes an “emergency.” Sometimes your definition of an emergency may not be the same as the health care plan you are considering and it could possibly not be covered. Also, check to see if you need to contact your primary care physician first before getting emergency care. Regular Physicals and Health Screenings: If you like getting regular physicals and health screenings you will want to make sure they are covered. Most managed care plans cover these types of screenings yearly, but some independent insurance plans do not cover them at all. Also, if you have children find out if well-baby check-ups and immunizations are covered. Prescription Drug Coverage: What type of prescription drug coverage do they have (Brand name and Generic?) and are there additional upgrade costs or fees? If you currently use prescription drugs on a regular basis or think you may need to in the future, you will want to consider a plan that has a good prescription drug coverage. This coverage type can vary enormously from plan to plan. Variations can include no coverage at all to complete coverage and everywhere in-between like varying co-pays for different types of drugs. Also, if you cannot get your prescription in a generic form, find out first from the different plans what price you will pay for your prescription. Additional Services: Ask about additional covered services that important to you ex. Mental Health Care, Counseling, Home Health Care, Chiropractic Care etc. Here is helpful information from: http://www.ehealthinsurance.com/individual-health-insurance/resources/choosing-health-plan/ Choosing a health plan can be a confusing experience. Although there is no one "best" plan, there are some plans that will be better than others for you and your family's health needs. We will try to guide you in simple terms. However, rather than just giving you answers, the best thing we can do is to make sure you are equipped with the right questions. The following can help you make sense of all your health care choices and options: http://finder.healthcare.gov/ There are three major things to consider, each with their own unique set of questions. By considering the questions thoroughly, you will arrive at the right plan for you and your family. How affordable is the care (cost of care)? How much will it cost me on a monthly basis? Should I try to insure just major medical expenses or most of my medical expenses? Can I afford a policy that at least covers my children? Are there deductibles I must pay before the insurance begins to help cover my costs? After I have met the deductible, what part of my costs are paid by the plan? If I use doctors outside a plan's network, how much more will I pay to get care? How often do I visit the doctor and how much do I have to pay at each visit? Do the included services match my needs (access of care)? What doctors, hospitals, and other medical providers are part of the plan? Are there enough of the kinds of doctors I want to see? Where will I go for care? Are these places near where I work or live? Do I need to get permission before I see a medical specialist? Are there any limits to how much I must pay in case of a major illness? Is the prescription medication which I need covered by the plan? Does the plan cover the expenses of delivering a baby? Have people had good results when covered by a specific plan (quality of care)? How do independent government organizations rate the different plans? What do my friends say about their experience with a specific plan? What does my doctor say about their experience with a specific plan? 4 Your Guide to Choosing Quality Health Care (http://archive.ahrq.gov/consumer/qntool.htm) shows how you can use information about quality to improve the quality of health care services you and your family receive. It describes quality measures including consumer ratings, clinical performance measures, and accreditation-what they are, where to find them, and how to use them. The Guide has checklists, questions, charts, and other tools to help you make the health care decisions that are right for you. The major ways you can check for quality in health care are also summarized in: Quick Checks for Quality (http://www.ahrq.gov/consumer/quick.htm) The above documents are provided with permission from the Agency for Health Care Policy and Research. The above guides are for informational purposes only and should not be considered advise or counsel as to any particular individual or family's situation for health insurance needs. SOME TIPS FROM BLUE CROSS: There are many things to consider when choosing a plan. Ask yourself the following questions to guide your decision. Then take a quiz to see which Blue Cross plans fit you best. 1. Do I need long or short-term coverage? If you're between jobs or looking for a job, you may want to consider short-term coverage. But if you’re self-employed or your employer does not offer group health insurance coverage, you may need longer term coverage offered through an individual and family health insurance plan. If you’re not currently covered, consider short-term coverage while you wait for a longerterm plan to become effective. (Short-term plans do not cover preexisting conditions.) 2. Do I want basic or more comprehensive coverage? Some insurance plans offer basic coverage that protects your finances in case of a major illness or injury. These plans typically have a lower monthly premium, but you’ll be responsible for more of your health care costs each year. (Some basic plans, like Simply Blue, cover preventive care and generic drugs.) Other plans offer more comprehensive coverage that may include chemical dependency or behavioral health care, maternity, prescription drug benefits, vision and eye care, and regular doctor office visits. These plans typically have a higher monthly premium and may be appropriate for people who intend to use their insurance on a regular basis. 3. Is my doctor or hospital covered by the plan? Check the plan’s provider directory to verify that your doctors and hospitals are included in the plan’s network. You receive the highest level of benefits if you use doctors in the plan’s network. 4. Does the plan’s network require a referral? Under some health insurance plans, you need a referral from a primary care doctor to see a specialist. With Blue Cross and Blue Shield of Minnesota plans, you don’t need a referral to see a network specialist. 5. Does the health plan cover me while traveling? Some plans have provider networks that are based on where you live. If you travel outside that area, you are not covered by your health plan. Blue Cross plans include access to the BlueCard® and BlueCard Worldwide® networks, so you’re covered almost anywhere in the United States or the world. 6. Does the plan cover services that are important to me? How important is coverage for and delivery? For example, Simply Blue does not cover labor and delivery. If you are planning a family, you may want to consider plans that include coverage for maternity labor and delivery, like Personal Blue. You may also wish to pay attention to a plan’s coverage for things like mental health and substance abuse care. With some plans, for example, you can opt out of substance abuse coverage. 5 7. Does the plan cover my family? If you need coverage for your family, now or in the future, be sure that you are purchasing family coverage, and not singleonly coverage just for you. Personal Blue and Options Blue are plans for families. 8. Does the plan cover preexisting medical conditions? Most individual health plans do not cover the cost of care for a preexisting condition — a condition you have had during a period prior to your enrollment date in the plan. Generally, those conditions are not covered until you have been a member of the new plan for a certain number of months. As of September 23, 2010, you can include a dependent under age 19 on your plan without exclusions for preexisting conditions, and Blue Cross will pay for claims for those conditions without a waiting period. 9. Does the plan work with a health savings account? Some plans such as Options Blue work with health savings accounts that can be used to pay for care. See more benefits of a plan with a health savings account. 10. Are prescription drugs covered? Prescription drug coverage varies by plan. For example, some Blue Cross plans require that you pay a copay, depending on the type of drug purchased. Blue Cross pays the balance. On other plans, such as Options Blue, you must first meet your deductible before anything is paid. With Simply Blue and most Personal Blue plans, generic drugs are covered by the plan at 100 percent after you pay a $5 copay. Most plans have a formulary, or list of drugs, that the plan covers. Check if your drug is covered with a Blue Cross individual plan. 11. Does the plan have tools & resources to support decision making and my health? Does the plan offer a wide range of tools and resources to help you stay healthy – so you pay less in medical costs? Does it offer services like a nurse line – a 24-hour line you can call to find out the best course of action when you or your child gets sick after hours? Does it offer resources to help you compare costs and quality of doctors and hospitals, so you can choose the right one? Blue Cross has health support like its health club discounts, Stop-Smoking Support, Weight Watchers discounts and more to help you and your family be your healthiest and keep medical costs down. 12. What is the health insurance company’s reputation? Find out about the company offering the health plan. How long have they been in business? Have they been rated by independent agencies with regard to their financial strength? How do their ratings compare to the ratings of companies offering other plans you are considering? Blue Cross has an A.M. Best rating of “A-” (Excellent). What about customer service? Are they known for quick and hassle-free claims payments http://www.bluecrossmn.com/bc/wcs/groups/bcbsmn/@mbc_bluecrossmn/documents/public/mb c1_hp_choose_consider.hcsp 6