Small Steps to Health and Wealth

advertisement

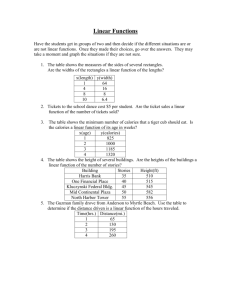

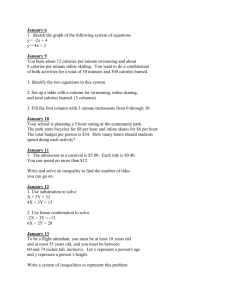

Small Steps to Health and Wealth Barbara O’Neill, Ph.D., CFP Karen Ensle, Ed.D., RD, FADA 1 How is Your Wellness & Quality of Life? 2 2 Class Content 1. Discuss relationships between health & wealth 2. Discuss common behavior change strategies 3. Encourage participants to: Set health and finance goals Identify small steps to reach goals Periodically monitor progress 3 Overall Class Goal: Empowerment • Set realistic goals • Identify small, do-able “action steps” • Identify obstacles and overcome them • “Put your mind to it” and take action 4 Health & Human Services (HHS) Press Release, March 2004 “Consumers don’t need to go to extremes-- such as joining a gym or taking part in the latest diet plan-- to make improvements in their health. But they do need to get active and eat healthier.” “America needs to get healthier one small step at a time. Each small step does make a difference, whether it’s taking the stairs instead of an elevator or snacking on fruits and vegetables. The more small steps we can take, the further down the road we will be toward better health for ourselves and our families.” Tommy G. Thompson, HHS Department Secretary 5 “Save For Your Future” National Campaign Booklet, May 2003 “You may not need a lot of money to accumulate meaningful savings. Thanks to compound interest, small regular savings can add up over time. Because, with compound interest, it’s not just your money that earns interest-- your interest earns interest as well-- creating a snowball effect. The longer you save, the more compound interest works for you.” 6 Health and Finance “Issues” Similarities 1. Problems develop gradually 2. Less stigma due to increasing frequency 3. Impacts job productivity, discrimination 4. Lots of technical jargon Medical terms and directions Financial terms and acronyms 7 More Similarities Health and Finance “Issues” 5. Need for programs in schools & at work sites 6. People fear drastic changes & large numbers 7. Need for more “point of purchase” info 8. Advice needs to be realistic 8 Still More Similarities Health and Finance “Issues” 9. Lack of limits causes problems 10. Restrictions help avoid problems 11. Drastic solutions have major drawbacks 12. Good health and wealth are related to: Higher productivity, fewer work absences Lower medical expenses to erode wealth Live long enough to collect Social Security benefit 9 Still More Similarities... 13. Longevity concerns: healthy people need more money 14. People want quick fixes; targets for fraud 15. Denial and disconnects 16. Need for routine check-ups 10 …And More Similarities 17. Many available resources 18. Poor risk perception 19. Personal Traits = Success 20. Government and employer intervention 11 Overeating: An “Issue” for Many 1. Many Americans overeat for their activity level 2. 3,500 calories = 1 pound 3. 100 extra calories a day = about 10 pounds per year 4. Walking a mile burns about 100 calories 5. Can lose about 10 pounds per year OR Eat 100 cals/day more without weight gain 10,000 steps/day (about 5 miles) recommended 12 Overspending: Another Common “Issue” • Increasing household debt balances • “Perma-debt” • The minimum payment trap • Punitive credit card fees • > 1 million bankruptcies filed annually 13 Save the Money Spent on Unhealthy Behaviors • Fewer alcoholic beverages • Fewer “empty calorie” foods • Smaller portion sizes; more leftovers • Give up smoking 14 Just One Example • $1.50 a day (junk food) saved from age 18 to 67 = $290,363 • $5.00 a day saved for 49 years = $ 1 million + Assumes an 8% average annual return Source: Getting Rich in America: 8 Simple Rules 15 Ten Small Steps to Health & Wealth 16 1. Convert Calories & Spending Into Labor • Health: How many hours of exercise are needed to burn off extra food? • Is eating a certain food “worth the calories?” Finances: How many hours of work are needed in order to buy something (use after-tax dollars)? Is buying something worth the time worked? 17 Case Example: French Fries 20 Years Ago 2.4 ounces 210 calories Today ??? Calories 590? 610? 650? 18 Today's 6.9-Ounce Portion of French Fries Has 610 Calories • This is 400 more calories than a 2.4 oz portion 20 years ago. • Now guess how long you will have to walk leisurely in order to burn those extra calories?* • 1 hour 10 minutes 2 hours 20 minutes 3 hours *Based on a 160-pound person 19 To Burn the French Fries, Walk 1 Hour & 10 Minutes • If you walk leisurely for 1 hour and 10 minutes you will burn approximately 400 calories.* *Based on a 160-pound person. 20 2. Meet Yourself Halfway… Or You Will Feel Deprived • • Health: Decrease portion sizes of favorite foods by 1/3 to 1/2 and/or increase exercise Eat half as much as you do now…gradually Take leftovers from restaurant meals home Finances: Reduce discretionary spending by 1/3 to 1/2 and/or increase income Spend less than you do now Look for less expensive options 21 “The Latte Factor” (David Bach) It’s not just about giving up pricey coffee • It’s about “finding” money to save by reducing everyday expenses • What are your “lattes”? _______________ _______________ _______________ _______________ • 22 3. Downsize and Substitute Health: “Just eat less” (than you do now) Buy less food Eating out? Try lunch portions and appetizers Buy low-calorie versions of foods Control your condiments • Finances: “Just spend less” (than you do now) Buy fewer items Track spending to understand habits Shop smart to buy things for less Buy lower-cost brands • 23 4. Just Say “No” to Super-Sizing • Health: Steer clear of “meal deals” in restaurants and order smaller portions People often eat all the food they are given • Finances: Avoid “buy three and save” offers when you only need one item Scrutinize offers to trade-up to a costlier item (bait and switch?) or buy more items 24 Is Bigger Better? • 1957: 1 oz. fast food burger 210 calories • 2002: 6 oz fast food burger at 618 calories Source: U.S News & World Report, August 19, 2002, Vol.133, No. 7. 25 Change in Soft Drink Consumption • In 1994 a 6.5 oz Coca Cola was 79 calories • In 2002 a 20 oz. Coca Cola is 250 calories Source: U.S News & World Report, August 19, 2002, Vol.133, No. 7. 26 5. Track Your Current Habits (Exercise, Eating, & Spending) • Use a pedometer: To determine current number of steps- then build up gradually • Track foods eaten & calories consumed: • “Use your feet more and you can eat more” Use a “Calorie Counter” book for unlabeled foods Track monthly income, expenses, & cash flow Is spending or eating related to emotions? 27 6. Compare Yourself With Experts’ Recommendations • Health: Body Mass Index (BMI) “Five a day” (fruits and vegetables) Total cholesterol < 200 mg/dl • Finances: Consumer debt-to-income ratio < 20% Age x gross income divided by 10 (Stanley & Danko net worth formula in The Millionaire Next Door) Suggested asset allocations by age 28 What is BMI? (Body Mass Index ) A formula based on height & weight used to determine a healthy person’s body fat A simple index to determine whether a person is at risk for weight-related diseases 29 7. Learn the Standards For Health and Financial Advice • Health: Compare portion sizes to objects 3 oz of meat or fish = size of deck of cards 1 cup of rice or pasta = size of a tennis ball Weekly fitness guidelines: • 30 minutes of daily exercise for adults; 60 minutes daily for youth Finances: Follow guidelines for saving Emergency fund of 3 to 6 months expenses Retirement income of at least 70% to 80% of pre-retirement amount 30 8. Put Good Habits On “Automatic Pilot” • Health: Routine health screenings, nutritional shakes and “points” programs for weight loss, short programmed workouts (e.g., Curves) • Finances: Dollar-cost averaging investment deposits, employer retirement savings plan, Save More Tomorrow concept, direct deposit 31 9. Control Intake and Outgo • • Health: “Budget” your daily calories Reduce the amount of food consumed Increase exercise to burn off more calories Do both Finances: Develop a written spending plan Reduce household expenses Increase income or benefits in lieu of income Do both 32 10. Small Remedies Make a Difference • Many people believe they must make major lifestyle changes to be healthy and wealthy • “Gloom and doom” messages don’t work • Start small with a specific goal in mind 33 Examples of Small Remedies • Health: Use less butter or salad dressing, drink less soda, cut portion sizes, share an entrée, get two meals from one, make time to exercise Finances: • Save $1/day + pocket change, • Add $1/day to the minimum payment due on a credit card, • Save an extra 1% of pay in a 401(k) plan, • Buy an EE bond monthly for $25 Track Your Progress: Success = Motivation 34 Make Progress Everyday Any small step to improve your health or increase your wealth is better than doing nothing! 35 Key Health and Wealth Factors • • • • • • • Attitude Automation Awareness/knowledge Control Environment Goals Time 36 Comments? Questions? Experiences? Be healthy, wealthy, and happy…always. 37 For More Information • www.smallstep.gov • • www.YourDiseaseRisk. Harvard.edu • • www.Medlineplus.gov • www.eatright.org • www.healthypeople.gov • • • www.rce.rutgers.edu/money2000 www.investing.rutgers.edu www.nefe.org/latesavers/ index.html www.asec.org www.pueblo.gsa.gov 38