Document

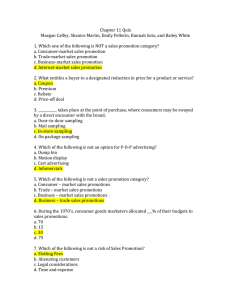

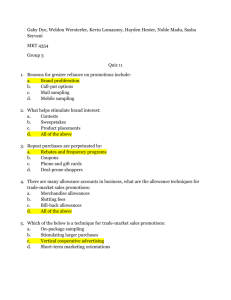

advertisement

Sales Promotions Chapter 12 Chapter Overview • Consumer promotions Directed to individuals/ businesses that use product • Trade promotions Directed to channel members • Can differentiate a brand • Use varies – product life cycle Push/Pull Promotions Manufacturer Wholesaler/ distributors Retailers Pull: aimed at consumers – consumer promotions Consumers Push: aimed at channel members – trade promotions Consumer Promotions • • • • • • • Coupons Premiums Contests and sweepstakes Refunds and rebates Sampling Bonus packs Price-offs Coupons • • • • Over 188 billion distributed Less than 1% redeemed Average value ~ $1.50 Savings of $2.25 billion Coupon Usage • Coupon usage 80% of households use 67% willing to switch brands • • • • Always ~ 21% Sometimes ~ 37% Rarely ~ 17% Never ~ 25% Influencing Brand Purchases On a scale of 1 to 10, the following are the top five influences on the brand purchased by a consumer. • • • • • Sampling Word-of-mouth Coupons Advertising Contests 7.8 7.2 5.9 5.6 1.2 Source: The Second Annual Survey of Consumer Preferences for Product Sampling, Santella & Associates (Http://www.santella.com/marketing.htm). Types of Coupons • Instant redemption Lead to trial purchase • Bounce back Encourage repeat purchase • Scanner-delivered Encourage brand switching Cross-ruffing Coupon Distribution • Manufacturers issue about 80% • Freestanding inserts – 88% • Freestanding and print most popular Create brand awareness Encourage next trip purchase • Digital coupons growing Users more affluent, better educated Coupon Distribution • Print media (90%) FSI (88%) • Direct mail • On- or in-package • In-store Scanner-delivered • Digital • Employee/Sales staff Percentage of Sales with a Coupon Product category Disposable diapers Detergents Meal starters Dough products (refrigerated) Cereal Wrapping materials, bags Oral hygiene products Household cleaners % of sales using manufacturer’s coupon ~17% ~15% ~14% ~14% ~13% ~13% ~12% ~12% Coupon Redemption Rates Type of coupon • • • • • • • • Percent Redeemed Instant redeemable Bounce-back, In-Pack Electronic shelf Instant redeemable – cross ruff On-pack Direct mail Handout Free-standing inserts Source: Santella & Associates ~39% ~23% ~18% ~17% ~5% ~4% ~3% ~1% Problems with Coupons • Reduced revenues • Used by brand preference consumers (80%) • “Necessary evil” Premiums • • • • Free-in-the-mail In- or on-package Store or manufacturer Self-liquidating • Don’t expect premiums to increase short-term profits Contests and Sweepstakes • Contests Require activity, skill Can require purchase • Sweepstakes Random chance Must publish odds Cannot require purchase Enter as many times as desired Refunds and Rebates • • • • • Refunds – soft goods Rebates – hard goods Hassle to redeem Now expected by consumers Redemption rates 30% overall 65% for rebates over $50 Sampling • • • • • In-store distribution Direct sampling Response sampling Cross-ruff sampling Professional sampling • 33% who tried a sample made a purchase during same shopping trip • 58% would buy product again • 25% bought product instead of intended brand Benefits of Sampling Target specific markets/audience! • • • • • Introduce new products Encourage trial Generate leads Collect information Boost sales Bonus Packs • • • • • • Increase usage of product Match or preempt competition May lead to stockpiling Develop customer loyalty Attract new users Encourage brand switching Typical bonus packs are special multi-packs or packages with extra 20- 100 % of product. Price-Offs Temporary price reduction Benefits: • • • • Stimulate sales Entice trial Reduces customer financial risk Encourages brand switching, stockpiling Problems: • Negative impact on profit • Encourages price-sensitivity • Potential impact on brand image Planning Consumer Promotions (Pull) Advertising vs. Sales Promotion • Advertising more profitable, high growth, and premium priced brands. • Sales Promotion significant in less popular, low growth, mid to lower priced brands. Planning Consumer Promotions (Pull) Retailers’ incentive to participate: • • • • Increase store traffic Increase store sales Attract new customers Increase basket size Trade Promotions (Push) • Types of trade promotions • • • • Trade allowances Trade contests Trade incentives Trade shows For manufacturers, trade promotions • • • Accounts for 70% of marketing budget Often 2nd largest expense Accounts for 17.4% of gross sales Trade Allowances Trade allowances: financial incentives to channel members – may be passed on to other members of channel Types: • Off-invoice allowance Price discount 35% of all trade dollars • Slotting fees • Exit fees Slotting & Exit Fees • Retailer justification Cost to add new products to inventory Requires shelf space Simplifies decision about new products Adds to bottom line • Manufacturer objections Form of extortion Divert money from advertising and marketing Detrimental to small manufacturers 4% of retailers use exit fees, 82% use slotting fees Trade Allowance Complications • Failure to pass allowances on to retail customers Only occurs 52% of the time Retailers like only one brand on-deal at a time • Forward buying Pass savings on or pocket higher margin Additional carrying costs • Diversion Segmentation strategy nullified Additional shipping costs Trade Contests • • • • Used to achieve specific sales targets. Funds known as “spiff money.” Rewards can be prizes or cash. Can be designed for various channel members. • Some channel members do not allow trade contests because of possible conflict of interests. Trade Incentives Trade Incentives • Cooperative merchandising agreement • Premium or bonus pack • Co-op advertising programs 12-28 Cooperative Merchandising Agreement • Formal agreement • Popular with manufacturers Retailer must perform marketing functions Manufacturer maintains control Longer-term commitments • Benefit retailers Schedule calendar promotions Cooperative Advertising • Manufacturer pays part of retailer’s costs • Retailer must follow specific guidelines No competing brands • Retailers accrue monies Amount is based on sales • Allows retailers to expand advertising • Manufacturers gain exposure in local markets Trade Shows • Business to Business venue Consumer & BtB goods • Few deals finalized • Increase in international shows • National shows being replaced by regional and niche shows • Niche shows better prospects, Lower costs Trade Shows - Attendees • • • • • • Education seekers Reinforcement seekers Solution seekers Buying teams Power buyers Competitive interests