Community Advantage (CA)

advertisement

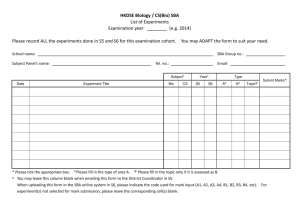

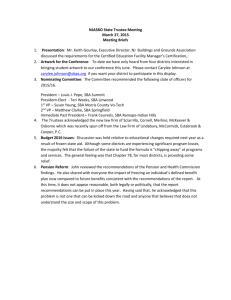

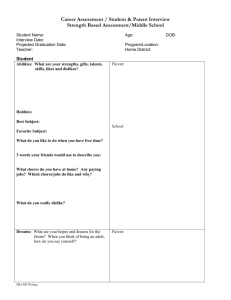

Pilot Loan Program U.S. Small Business Administration September 2014 Program Agenda 1.SBA Community Advantage Overview 2.Program Sustainability 3.Best Use of the Program 4.Associate Program 5.Questions and Contacts Panelists Chuck Evans, Prudent Lenders, President and CEO Kitty Barbee, Eastern Maine Development Corporation, Deputy Director – Business and Economic Development Lisa Holmes, South Eastern Economic Development (SEED) Corporation, Sr. Vice President and Lending Team Leader What is the Community Advantage (CA) Program? A Pilot Loan Program introduced by US SBA to meet the credit, management and technical assistance needs of small businesses in underserved markets. CA is designed to provide mission-oriented lenders, primarily nonprofit financial intermediaries focused on economic development, to access to 7(a) loan guarantees for loans of $250,000 or less. CA will operate through March 15, 2017 and may be extended or made permanent at SBA’s discretion. Is my organization eligible to participate as a CA Lender? Certain organizations making loans in underserved markets are eligible to participate in CA: SBA Authorized Certified Development Companies (CDC’s) SBA Authorized Microloan Intermediaries Non-Federally Regulated Community Development Financial Institutions (CDFI’s) What are the SBA’s goals for CA? Increase access to credit for small businesses located in underserved areas; Expand points of access to the SBA 7(a) loan program by allowing non-traditional, missionoriented lenders to participate; Provide Management and Technical Assistance (M&TA), as needed; and Manage portfolio risk at acceptable levels. Example 1: Example 2: Infancy, minorityowned retail pharmacy Enhanced cash flow of a growing business by paying off short term payable Collateral was limited Wanted to support good 9-month results! Pre-existing, ML client that was in operation five years, but was overcoming a hurdle in last FY Relying on in-house figures after a difficult year Limited collateral Support an excellent previous client during recovery time! SBA Program CA - Expanding Access Eligible Businesses For profit Eligible Use of Proceeds Purchase of land & building Construction & renovation Machinery & equipment Business acquisitions (incl. goodwill) Leasehold improvements Existing debt refinance (incl. seller notes) Furniture & fixtures Working capital (incl. franchise fees, liquor license) Maximum Loan Amount $250,000 Loan Guarantee 85% / Maximum of $150,000 75% / Maximum of $250,000 Interest Rates Set by lender according to SBA max. Base Rate + 6% Equity 10% standard for fixed asset purchases Typically higher for start-up or change in ownership Fees Up to $150,000 = 2% of guaranteed portion Lender may retain 25% of fee for loans $150,000 and below Above $150,000 = 3% of guaranteed portion Available Loan Term Up to 25 years. Set by lender according to SBA maximum Term must also agree with Lenders CA Loan Policy Eligibility Criteria Sales And Employee Limits By Industry or Tangible net worth < $15 million; NIAT < $5 million Pre-Payment Penalty 5%, 3%, 1% on loans > 15 years Non-Penalized Pre-Payment For 15 year terms or greater, 25% or less of principal in any one year during the first three (3) years of the loan term SBA Program Overview – Interest Rates Interest Rates – Loans can be fixed or variable. SBA establishes maximum rates based on term of the loan Two sets of maximum rates: < 7 years and > 7 years. The maximum rate is Prime plus 6% or 9.25%, Lender pays SBA servicing fee (52 bps) annually on guaranteed amount resulting in reduced rate margin. SBA Program Overview - Eligibility Eligibility – Organized for Profit Small Business Concern -SBA Size Standards for the industry or the Alternate Size Standard ($15MM Tangible Net Worth and $5MM Average Net Income After Tax - 2 years) Affiliates as well as franchise, dealer, jobber and license arrangements come under scrutiny in determining size standard. The business must need the loan as determined by the "credit elsewhere test". SBA Program Overview - Collateral Collateral – SBA will not decline a loan request solely on the basis of inadequate collateral. SBA does not permit its guaranty to be used as a substitute for collateral. “All Available Collateral” - SBA requires that the Lender collateralize the loan to the maximum extent possible up to the loan amount. If the business assets do not fully secure the loan, the Lender must take available personal assets of the principals as collateral. First security interest in assets purchased by SBA loan proceeds is required. SBA Program Overview – Loan Terms Fixed asset acquisition (RE, Equipment, or Machinery), refinancing, furniture and fixtures, Line of Credit term-outs, working capital, and business acquisition are all eligible. Loan terms are based on the use of proceeds: Working Capital: 7-10 years Equipment: 10-25 years (depends on useful life) Building: 25 years Goodwill: 10 years No balloons SBA Program Overview – Best Use The most common way to utilize the 7a program is in expanding the conventional credit box by: Reducing the collateral requirement of lender; Providing longer terms than would be required conventionally; Reduced Equity injection in the project versus what would be required conventionally. Start-ups 504 Companion Loans Who Are We? Private non profit, established in 1967 (EDD & CDC) Located in Bangor Me and serve the four Eastern Counties of Maine: Hancock, Penobscot, Piscataquis Counties as well as portions of Waldo County Our service area covers almost 11,000 square miles with a population of 257,334 and is the largest economic development district in Maine Our professional staff members are divided into three service areas - business, community and workforce development EMDC – CA Lender First loan approved January 26, 2012, in the amount of $225,000 Since then, a total of 42 loans have been approved Average amount $121,000 Industries include: manufacturing, hospitality, medical office, transportation and others YTD 2014: 14 approved 6 in process Community Advantage Performance as of August 05, 2014 Lender / CDC lender state # loans approved $ loans approved CDC SMALL BUS. FINAN CORP. CA 130 16,817,500 EMPIRE ST. CERT. DEVEL CORP OBDC SMALL BUSINESS FINANCE NY 121 15,869,900 CA 89 11,599,600 VALLEY ECONOMIC DEVEL CORP. CA 77 11,087,000 EASTERN MAINE DEVEL CORP ME 42 6,522,000 PEOPLEFUND TX 55 3,992,800 TRENTON BUS. ASSISTANCE CORP NJ 26 3,390,000 ACCION TEXAS, INC. TX 26 3,281,600 NORTHERN ECONOMIC INITIATIVE C MI 18 3,227,800 GROWTH CAPITAL CORP. OH 25 3,214,700 MONTANA COMMUN DEVEL CORP. MT 25 2,945,000 SHOREBANK ENTER. GROUP PACIFIC WA 13 2,549,500 #5 How the Process Works Business Visitation/ Client counseling Assistance with necessary paperwork and application Underwriting by staff Review by loan review committee and board Submission to Small Business Administration Loan funded by EMDC Loan servicing Examples Two Rivers Realty Refinance to remove balloon payment $150,000 Print Central Leased building Purchase of existing business, equipment $250,000 Dog Not Gone 2nd 7(a) loan expansion of business, inventory & working capital $125,000 Advantages Streamlined process ETran system, simple to utilize Dedicated support Quick turnaround time Affiliate Program: Not a Lender? Be a CA Associate Allows for additional leverage of capital Expands reach and impact of program No application or paperwork required by SBA Form 159(7a) must be completed MOU between organization outlining agreement Sub notes between organizations Questions? Michelle Genovese Amy Bassett Financial Analyst Office of Economic Opportunity US Small Business Admin. 409 3rd St, SW Washington, DC 20416 202-401-8282 Michelle.genovese@sba.gov Deputy District Director New Hampshire District Office US Small Business Admin. 55 Pleasant St, Suite 3101 Concord, NH 03301 202-481-0190 Amy.bassett@sba.gov