Entry in Balance Sheet

advertisement

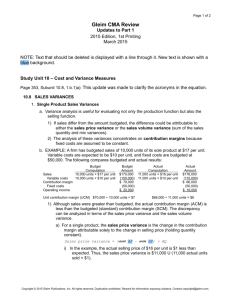

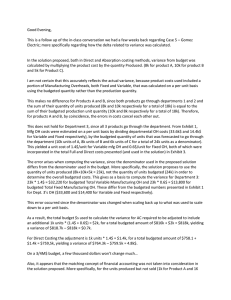

Cheat Sheet Chapter 1: ASSETS=OWNERS EQUITY + LIABILITIES ASSETS EQUITY Owners Equity Cash Plant & Equipment Raw Material Processed Inventory Labor for creation of product Finished Goods inventory - Depreciation to Plant & Equip Prepayments Debtors - Bad Debts - Administrative Wages +Profit -Depreciation -Cost of doing business - Expenses like maintenance LIABILITIES Creditors + Accruals Loans Deferred Revenue In P&L: Inventory & Labor that include in Cost of Sales is only that which applies to goods actually sold Balance Sheet: Inventory means the value of all inventory (raw & finished) Cash: Increase in inventory is total inventory Provision for bad debt: Year One Debtors Policy: bad debts provision set at 5% Entry in P&L Charge for bad debts provision Entry in balance sheet Debtors less provision 100,000 5000 95,000 Year Two Debtors Same policy 122,000 Specific bad debt arising in Year 2 to be written off Entry in P&L Bad debt written off 2,000 Top Up provision to 5% (5% of 120K – 5000, its 120K because 122k minus 2k bad debts) 1000 Entry in Balance Sheet Debtors Less Provision ($6000) 2,000 $120,000 $114,000 Chapter 2: Cost of goods sold = cost of opening stock + cost of purchases – cost of closing stock If using average cost method to calculate cost of closing stock, don’t forget to include the opening balance value in your calculations Reducing Balance Depreciation = 1 – nth Sq Root (Scrap cost/Cost), n = life of asset – but most of the time you are given a precentage which you apply to an ever diminishing book value. Bad debts are taken off debtors in the Balance Sheet Rent is a general expense in the P&L. The P&L only contains expenses that are for the time period in questions, prepayments are instead included in the Current Assets section of the Balance Sheet Accruals appear in the Current Liabilities section of the balance sheet, they are taken added to the Creditors figure. Cash Statement : ortcaelf O= Cash Flow from Operations (Profits after tax & interest (+depreciation + increase in bad debts provision), increase in inventory/creditors (+),decrease in creditors ) R = Returns on Investments & servicing finance (e.g. interest paid) T = Taxation (Taken from last year’s balance sheet) C = Capital Expenditure (cash from selling assets A = Acquisitions E= Equity Dividend (including increase in shares & Drawings on Cash) L = Management of liquid resources (govt securities etc.) F = Financing (increase or decrease in loans) Gearing = (Long term Debts/Owners Equity) Return on Owners Equity = (Profit after interest on loan/Equity) x 1000 Note: Equity includes any long term debts Chapter 3: Deferred Income: Example: One year subscription = $75, Three year = $ 210. In 1996 there were 3000 one year and 2000 three year subscriptions: Balance Sheets 1996 1997 1998 Cash 645000 Owners Equity $X $X $X Deferred Revenue 280,000 140,000 Profit and Loss Account Subscription Revenue: One Year Three Years Total 225,000 140,000 365,000 140,000 140,000 140,000 140,000 Only this years rightful income appears in the P&L, Deferred Revenue is used to offset the artificially high Cash figure The result of the cash flow statement should equal the increase (or decrease) of ‘Cash’ in the Current Assets part of the balance sheet from one year to the next. Note: When calculating cash flow its important to include any fixed assets disposed of. Look at the book value in the previous years balance sheet and the value at the end of this year’s. If they differ then there was a fixed asset disposal, you must calculate the actual value of the disposal (rather than the profit) and include that in the cash flow statement. Note: Do not include bank overdrafts in the cash flow statement – instead add their delta to the cash delta and compare to the cash flow statement result Chapter 6: Ratios are only good when comparing companies of a similar size and in the same type of business. Liquidity: Current Ratio Quick Ratio (Acid Test) Current Assets Current Liabilities Current Assets – Inventory Current Liabilities Profit: Gross Profit Margin Profit Margin Return on Total Assets Return on Specific Assets Return on Capital Employed Return on Owners Equity Gross Profit x 100% Sales Profit before Interest and Taxes x 100% Sales (Profit includes that from associated companies) Profit before Interest and Taxes x 100% Total Assets Profit before Interest and Taxes x 100% Inventory Profit before Interest and Taxes x 100% Capital Employed Profit Attributable to Shareholders x 100% Owners Equity (remove profit attributable to minority interests and dividends but after tax and interest) (Owners Equity = share capital + retained earnings + share premium) Capital Fixed to Current Asset Debt Ratio (Gearing %) Fixed Assets Current Assets Total debt Total Assets (debt includes creditors +loans – debt attributable to minority interests) Time Interest Earned Profit before Tax +Interest Charges Interest Charges Efficiency: Inventory Turnover Sales Inventory Closing Inventory Average Collection Period Debtors Sales per day Fixed Asset Turnover Sales Fixed Assets Dupont Chart: Return on Total Assets Profit x Sales Sales Total Assets Stock Market Earnings Per Share Net Profit for the financial year Number of Ordinary Share in issue Price/Earnings Ratio (after tax + Interest but before dividends) Market Price Earning Per Share Dividend Yield Dividend per Share x 100 Market Value per Share Dividend Cover Net Profit of the year Dividend Payout Chapter 7 In an acquisition, if the holding does not own all the subsidiary, there will be a minority interest figure in the holding companies balance sheet under the Owners Equity. It will be equal the % of the subsidiary’s net worth that the subsidiary still owns Chapter 9 – Variable Costs are those that vary with the volume produced Fixed Costs do not vary with production output Direct Costs are those that are incurred simply because the item is manufactured (= Traceable costs) Indirect Costs are those that are incurred in the support of the fundamental activities of manufacturing and selling (= Common costs) Direct Cost usually = Variable costs (except for examples like buying a piece of machinery for a particular product) Product costs are costs which can be attached to the cost items without too much difficulty Period costs are costs which, although incurred ultimately in support of the product, are best controlled in time periods Neither are used in management accounting P/V ratio = Contribution Margin Ratio = Contribution Margin per unit Sales Price per unit BEP (units) = Fixed Cost Contribution Margin per unit BEP ($) = Fixed Costs Contribution Margin Ratio Profits = Sales Revenue - Fixed Costs - Variable Costs When calculating the BEP for multiple product companies, use the weighted average of their contribution margins – weighted by their sales revenue figures. When calculating the BEP for multiple product companies when there is a limiting production factor, use the weighted average of their contribution margins and then get the weighted contribution margin per limiting factor. Remember – an fixed overhead which is allocated on a per unit basis must first be de-unitized – ie. You should never have an equation like S x fixed overhead!!! Chapter 10 Plantwide rate means using one cost driver for whole plant rather than the more realistic of using a different driver for each department Direct Method of overhead allocation – use cost driver for each dept Step method – allocate one depts overheads to all others, including production and non production depts. – always ignore a depts. consumption of its own resources (don’t include it in the allocation denominator) – close down dept once allocated – when finished, use predetermined allocation for the production depts. Joint products should be products that management cannot prevent from resulting from the production process - Equal shares of cost - Cost sharing according to their physical characterisitics - Sales value at split off - Ultimate net sales : allocate on basis of sales value after all costs are deducted from joint products Process costing - Equivalent units Assuming FIFO is used, calculate equivalent units based on the % work that is required to complete them this period, starting with opening balance EX: if there is 2000 units of opening stock, 75% finished in terms of material then its 25% of 2000 or 500 equivalent units of material that are counted towards equivalent units of production To get closing stock value 1. Get equivalent units for opening + units completed + closing stock = equivalent units of production 2. Divide this by the cost incurred in this period for Materials and Labor – this gives you the two costs for equivalent units of production 3. Multiple the equiv units for closing inv x these two costs and sum them to get cost of closing inv. In the Weighted average, it’s the same, just include the work done on opening inv in the above three steps Chapter 11: Denominator Volume Variance is caused when actual production is not equal to planned production Bottom line profit difference arises when actual sales is not equal to actual production With a variable costing computation of inventory costs, only the variable costs of manufacturing are used to calculate the per unit cost of inventory Contribution Margin is defined as the selling price minus the total variable cost (including both manufacturing and non manufacturing variable costs). When looking at costing figures, remember they are based on the planned production. The variable costs must be adjusted for the actual production. Variable Costing: Sales Variable costs (Manufacturing+Sales) Contribution Margin Fixed Costs (Manu+Sales) Net Profit Here the variable costs/unit are adjusted for the actual number of units sold Full (Absorption) Costing: Sales Full cost of sales (Fixed +Var manufacturing costs) Gross Profit Expenses (Fixed + Var + Denominator Variance) Net Profit Here the full cost of sales per unit is not altered. To calculate the denominator variance, use the Fixed manufacturing overhead/units produced (planned and actual) Variable Cost of sales = 500/10000 + 125/10000 = Var Costing: Sales Variable cost of sales @$62.5 Contribution Margin Fixed Costs Manu 600 Fixed costs Sell 350 1875000 468750 1406250 950 456250 = d Absorption costing: Full Manufacturing Cost per unit = 1,100,000/10000 = $110/unit Fixed Overheads Allocation rate = 600, Should have been 1100000/9000 = $122.22 Underabsorbed by $12.22/ unit, total = $ Total Cost of sale = $110/unit Sales Total Cost of sales (7500 x$110) 1875 825,00 Chapter 12 Reasons to budget: Planning Control Motivation Co-ordination Benchmarking Chapter 13 – Standard Costing Flexed budget is one which the budgeted costs are adjusted to match the actual output Material Efficiency variance = [SQ-AQ]SP Note: SQ = actual number of units x material per unit Material Price Variance = [SP-AP]AQ AQ = number of actual units produced x actual material per unit Labor Efficiency variance = [ST-AT]SR ST= AQ x time per unit Labor rate variance = [SR-AR]AT Variable Overhead Efficiency variance = Standard cost of flexible budgeted time – standard costs of actual time taken for units produced = (standard o/h rate x standard time/unit x actual units produced) x (actual time x standard rate of time/unit) Compares the difference in the cost of the units produced to what that cost should have been given the time spent on them Variable O/H Spending Variance = Standard cost of actual time taken – actual costs incurred = (actual time spent x standard time/unit) – Actual cost of time Fixed Overhead Spending Variance = Budgeted - Actual Fixed Overhead denominator Variance = Budgeted Amount less Amount applied to units produced since it’s the denominator variance it deals in ’units’ produced – also a negative denominator variance is favorable, since it shows that more overhead has been allocated to production than budgeted for Sales Contribution Variance = [Difference between actual and budgeted contribution margin per unit] – [Actual sales in units] Sales Volume Variance = [Actual Sales less Budgeted sales] x [Budgeted Contribution Margin per unit] Sales Quantity = [Actual Sales less budgeted sales] x [Budgeted weighted average contribution margin per unit] weighted based on the relative volumes sold of all products Sales Mix Variance = [Actual sales less budgeted sales] x [Budgeted contribution margin per unit less budgeted weighted contribution margin per unit] Its Actual –Budgeted not the opposite way around Each one of there should be applied to all products and then results summed Chapter 14: ROI = Controllable Profit / Investment (%) RI = Controllable Profit – Imputed Interest on Assets ($) When assessing the effect on the companies overall financial performance, compare the ROI of the investment to the company’s cost of capital. If the ROI > imputed interest it’s a go! With Transfer pricing, the selling depts price becomes part of the buying depts variable cost. So the maximum a buying dept will pay is when its contribution margin = 0. In considering an investment’s ROI, its profit not contribution that is used. Profit is contribution –fixed costs. In considering an investments RI, calculate the RI before and then after the investment. The division which would gain the most is the division that should receive the investment. Chapter 15 – Investment Decisions PV = equivalent cost of future money now NPV = finding the current values of all cash flows & summing them to find if its >0 Discounted Cash Flow = finding the % cost of capital at which NPV = 0 Use interpolation to find this – try one low % (X) and then one high % (Y), giving you a below zero NPV (L) and one above zero NPV (H) DCF = Y + [ L L-H * (X - Y) ] When evaluating investments, check to see if their NPV > 0 when using the company’s cost of capital Payoff is usually done on cash flows rather than NPV’s unless opportunity costs should be taken into account Chapter 16 Return per factory hour = Sales price – Material Cost Time spent at the factory bottleneck per product Cost per factory hour = Total Factory Cost Total time available at factory bottleneck Throughput accounting ratio = Return per factory hour Cost per factory hour