10 Income and Spending

advertisement

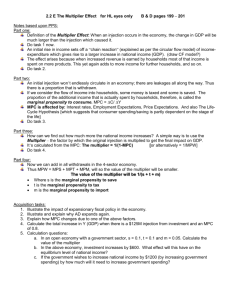

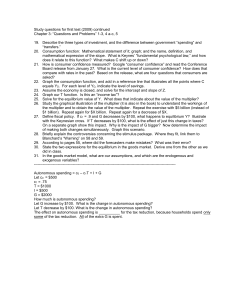

10 INCOME AND SPENDING FOCUS OF THE CHAPTER • This chapter takes a closer look at the way that changes in the goods market affect aggregate demand by examining the link between income and spendingi.e., we use the fundamental national income identity (Y = C + I + G + NX) to analyze the way that changes in consumption affect output. We treat both income and consumption as endogenous variables. • A basic result is that an increase in autonomous spending will increase output by an amount greater than that of the spending increase. SECTION SUMMARIES 1. Aggregate Demand and Equilibrium Output The fundamental national income accounting identity, Y = C + I + G, states that the actual level of output must always equal the sum of all the different sources of aggregate demand. (Notice that we’re ignoring net exports for the moment; we’ll talk about how to incorporate these into our analysis in Chapter 13.) It is easy, however, to imagine a situation in which planned levels of output differ from planned levels of consumption, investment, and government spending. When this happens, the goods market is not in equilibriumthe quantity of output produced does not equal the quantity demanded. Unintended changes in inventories occur. These unplanned inventory changes cause firms to increase or decrease their production. The level of output rises or falls accordingly, and brings the goods market back into equilibrium. 97 98 CHAPTER 10 2. The Consumption Function and Aggregate Demand Increased income causes increased consumption. This relationship is captured by the consumption function: C = C + cY, where c is a number between zero and one, and C is positive. The fraction of each additional dollar of income that is consumed is represented by the variable c in the equation above and called the marginal propensity to consume (mpc). The fraction that is saved is equal to (1 – c), and is called the marginal propensity to save (mps). Neither the mpc nor the mps can be greater than 1; that would mean that people were consuming or saving an amount greater than their income. The amount that people choose to consume when their income is zerothe variable income. C is positive because people consume out of wealth as well as Since saving (Y – C) is just the difference between income and consumption, saving and consumption cannot be looked at independently. A specific consumption function implies a specific savings function. If we add a government sector to this model, force individuals to pay taxes (TA), and allow them to receive transfers (TR) the consumption function changes slightly: C = C + c (Y – TA + TR ) so that consumption now depends on disposable, or after-tax, income (YD). If we assume that investment and government spending are exogenously determined, we can write aggregate demand as: AD = C + I + G = C + c (Y – TA + TR ) + I + G or, defining a new variable A = C + I + G – c ( TA – TR ) as: AD A cY . We can find the level of output for which the goods market is in equilibrium (Y0) by imposing the requirement Y = AD. This can be accomplished graphically, as in Figure 10–1, by finding the point at which the lines Y = AD and AD A cY intersect. It can also be accomplished algebraically, by solving the equation Y0 AD A cY0 . (It turns out that Y0 = (1/1– c) A0.) 99 INCOME AND SPENDING AD Y = AD The goods market is in equilibrium AD = A + cY when the quantity of output produced is equal to the quantity A 450 demanded, or when Y = AD. 0 Y0 Y Figure 101 A GRAPH OF THE GOODS MARKET EQUILIBRIUM We can also get this result by setting total saving (government + personal) in our economy equal to planned investment (T A - T R - G ) S I , where S = (Y – C). 3. The Multiplier A $1 increase in autonomous spending (the term increases GDP by much more than $1. A introduced in the previous section), in general, Let’s follow this $1 of spending through the economy. The first thing it does is to create one additional dollar of income for those people who helped to produce and sell the goods and services it purchased. Once in their pockets, a fraction c of it is spent and a fraction (1 – c) is saved, so that an amount (c x $1), or $c, goes on to become income for others. They, in turn, spend a fraction c and save a fraction (1 – c); an amount (c x c x $1), or $c2, moves on to become income for still others. As this process continues, the original $1 spending increase generates an increase in income (and output) of (1 + c + c2 + c3 + ... ) x $1, or (1/(1 – c)) x $1, as the infinite geometric series (1 + c + c2 + c3 + ... ) can be written as 1/(1 – c) when c < 1. (This chapter’s “Review of Technique” shows why this is the case.) We call the number 1/(1 – c) the multiplier, as it describes the amount by which that initial $1 is multiplied as it changes hands, and is spent again and again. Note that an increase in the mpc (the variable c) makes this multiplier larger. 100 CHAPTER 10 4. The Government Sector In this section we develop a more complete government sector. We assume that the government collects a proportional income tax. Everyone pays the government a constant fraction t of their income, and keeps a fraction 1 – t. Disposable income is now equal to (Y + TR – tY). The consumption function becomes C = C + c TR + c (1 – t) Y, and the multiplier αG 1 . 1 c(1 t) Because it makes the multiplier smaller, so that shocks to autonomous spending have less of an impact on the output and unemployment, the income tax is considered an automatic stabilizer. Transfers, because they initially increase aggregate demand by only cT R (some of the transfer is saved), have a smaller multiplier: c aG . 5. The Budget The budget surplus (BS) is defined as the difference between the money that the government takes in and the money that the government spends: BS T A T R G . When a proportional income tax is assumed, as in the previous section, measures of the budget surplus change both because of changes in government policy (G, t, TR) and because the level of output changes. We should, therefore, not be surprised to see the budget surplus shrink (or become more negative) in recessions, when output falls. A negative budget surplus is called a budget deficit. 6. The Full-Employment Budget Surplus The full-employment budget surplus (BS*) is a measure of what the budget surplus would be if the economy were at full employment. It responds only to changes in government policy, and is not affected by changes in the output gap. For this reason it can be an indicator of fiscal policy. A full-employment budget deficit, for example, would suggest that fiscal policy is expansionary, or tending to increase output. INCOME AND SPENDING 101 KEY TERMS aggregate demand equilibrium level of output consumption function marginal propensity to consume budget constraint marginal propensity to save disposable income multiplier fiscal policy automatic stabilizer balanced budget multiplier budget surplus/deficit full-employment budget surplus GRAPH IT 10 This graph asks you to verify the following proposition: A rise in the marginal propensity to consume increases the multiplier, so that a given change in autonomous spending ( A ) produces a larger change in GDP. Chart 10–1 provides you with two AD functions with different mpc’s, and with the 45 o line that represents the goods market equilibrium (Y = AD). Your task is to shift each of these lines upward by a fixed amount (call it output. AD DA ), and to compare the effect of those shifts on the level of Y AD AD A c 2Y AD A c1Y A 45 o Y Chart 101 102 CHAPTER 10 The shift in the steeper curvethe one with the higher mpcshould cause a greater increase in the level of output than the shift in the flatter one. Remember to shift both lines upward by the same amount; your result will, otherwise, not be terribly informative. A big shift will make this result easier for you to see. THE LANGUAGE OF ECONOMICS 10 Autonomous Spending Autonomous spending is spending that is exogenously determinedthat is not affected by any of the other variables in our model. In this chapter, this means specifically that it must be independent of income. In the next, we will find that it must be independent of interest rates as well. Even when a variable itself is endogenously determinedconsumption, in this chapter’s model, is an exampleit may have an exogenous, or autonomous, component. REVIEW OF TECHNIQUE 10 Infinite Geometric Series This section shows you how to calculate the sum of an infinite geometric seriesa series of the form S = 1 + c + c2 + c3 + c4 + … that goes on forever (i.e., the exponents approach infinity). Suppose that c is a number between zero and one. When this is the case, there is a useful trick that we can use to find the value of S (the series’ sum): We multiply every term in our geometric series by c, creating a new series cS = c + c2 + c3 + c4 + c5 + … , and then subtract this new series from our original one S – cS = 1 + (c – c) + (c2 – c2) + (c3 – c3) + … This allows us to solve for S, the sum of the original series: INCOME AND SPENDING 103 S – cS = 1 + (c – c) + (c2 – c2) + (c3 – c3) + … S – cS = 1 + 0 + 0 + 0 + … = 1 S(1 – c) = 1 or, S = 1 / (1 – c). IN THE QUESTIONS BELOW, WE INCLUDE A GOVERNMENT SECTOR BUT NOT A FOREIGN SECTOR. FILL-IN QUESTIONS 1. When planned and actual spending are equal, the goods market is in ______________. 2. In this chapter’s model of aggregate demand, consumption is an ______________ variable. 3. A $1 increase in income will increase consumption by $1 times the _________________ . 4. Consumption, in this chapter, is assumed to be a function of _____________________. 5. When the goods market is out of equilibrium, there are unintended changes in _________________________. 6. The complement of the marginal propensity to consume is the _________________________. 7. The difference between government expenditure and taxes is called the _________________. 8. A(n) __________________________ is a program, such as unemployment insurance, that reduces the impact of shocks on the economy without any direct government intervention. 9. The difference between the taxes that would be taken in, if the economy were at fullemployment, and government expenditure is called the ________________________. 10. The balanced budget multiplier is always equal to _____________________. 104 CHAPTER 10 CROSSWORD 1 ACROSS 1 income after taxes, transfers 2 3 4 2 these change when AD Y 5 policy, taxes and spending are tools 6 increase in GDP resulting from a $1 increase 5 in autonomous spending 7 type of tax, an automatic stabilizer 6 8 goods market equilibrium condition: AD = ___ 7 DOWN 8 1 negative budget surplus 3 value of balanced budget multiplier 4 type of variable; I, G, and NX in this chapter are examples 6 slope of consumption function TRUE-FALSE QUESTIONS T F 1. Raising the income tax rate should increase GDP. T F 2. An increase in the marginal propensity to consume (mpc) should decrease GDP. T F 3. An increase in the mpc should decrease savings. T F 4. An increase in the mpc should increase the equilibrium level of investment. T F 5. The mpc is an endogenous variable. T F 6. An increase in disposable income will increase consumption. T F 7. An increase in disposable income will increase the mpc. T F 8. An increase in autonomous spending will have no effect on the equilibrium level of output. T F 9. An increase in the mpc will increase autonomous spending. T F 10. Output should fluctuate less when automatic stabilizers are present than when they aren’t. INCOME AND SPENDING 105 MULTIPLE-CHOICE QUESTIONS 1. When we say that investment and government spending are autonomous, we mean they are a. exogenous variables b. endogenous variables c. automatic stabilizers d. none of the above 2. When aggregate demand is greater than output, there is unplanned a. inventory accumulation b. inventory reduction c. saving d. consumption 3. An increase in the mpc will _____________ the multiplier. a. increase b. decrease c. not affect d. who knows? 4. An increase in the mpc will _____________ the mps (marginal propensity to save). a. increase b. decrease c. not affect d. who knows? 5. Income taxes _____________ the multiplier. a. increase b. decrease c. do not affect d. who knows? 6. Government purchases will have ____________ effect on output in an economy without income taxes than it will be in an economy with them. a. a greater b. less of an c. it depends on the tax rate d. it depends on the mpc 7. If the mpc = 0.8 and there are no income taxes, the multiplier will be a. 1 b. 2 c. 5 d. 10 8. If the mpc = 0.8 and there are no income taxes, the multiplier relating changes in transfer payments to changes in national income will be a. 4 b. 5 c. 6 d. 8 9. If the mpc = 0.8 and there is a $0.375 tax levied on each dollar of income, the multiplier will be a. 1 b. 2 c. 5 d. 10 106 CHAPTER 10 10. If the mpc = 0.8 and there is a $0.375 tax levied on each dollar of income, a $40 increase in government purchases will cause tax revenues to _____ , and the budget surplus to _____. a. increase by $30; rise b. increase by $30; fall c. increase by $80; rise d. increase by $80; fall CONCEPTUAL PROBLEMS 1. Which will increase output more: a $1 million increase in government spending, or a $1 million increase in government transfers? Why? 2. Which of the following variables are endogenously determined in this chapter’s model of aggregate demand? Which are exogenously determined? (See “The Language of Economics 2” for a review of endogenous and exogenous variables.) a) income d) consumption b) output e) investment c) disposable income f) autonomous spending 3. Why might the budget deficit be a bad measure of the direction of fiscal policy? 4. In what way is the full-employment budget surplus a better measure of the direction of fiscal policy? TECHNICAL PROBLEMS 1. Find the savings function that is implied by the following consumption function: (Hint: Remember that S = Y – C.) C = C + cY. 2. Consider an economy with no income taxes, where the mpc = 0.9. (a) What is the value of the multiplier associated with autonomous spending (G)? (b) How much will output in this economy increase if government expenditures are increased by $100? (c) How much will output in this economy increase if government transfers are increased by $100? INCOME AND SPENDING 107 3. Now suppose that this economy imposes a proportional income tax, t = 1/3. (a) What is the value of the multiplier (G) now? (b) How much will output in this economy increase if government spending rises by $100? (c) How will this affect the budget surplus/deficit? (d) How will it affect the full-employment budget surplus?