Great Depression

advertisement

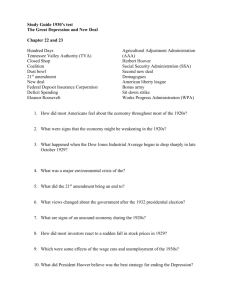

The Causes of the Great Depression * The Bull Market and the “Strong Economy” of the 1920s * * The Great Crash and Black Tuesday * * The Roots and Long-Term Causes of the Depression * Great Depression Fun Facts * At its highest point during the Great Depression, unemployment reached 25% (1933) * The Great Depression began in 1929 and ended in 1941 as the U.S. prepared to enter WWII * Social Security, a program that continues to this day, was introduced by FDR during the Great Depression (The New Deal) * The “Roaring Twenties” weren’t roaring for everyone. By 1929, 1% of Americans controlled 40% of the wealth in this country (this would become a HUGE problem!) * The Federal Deposit Insurance Corporation (FDIC) was formed in 1934 to insure deposits in banks and restore customers’ faith in the American banking system (security and relief) * The Dust Bowl years spanned 1930-1936, when a million acres of farmland across the Plains became worthless due to severe drought and over-farming * After the stock market crash in 1929, it took 27 years to reach pre-crash levels * In 1939, the unemployment rate in America had dropped from a high of 25% to 15% * Tuesday, October 29, 1929 is known as “Black Tuesday” because of the plunge the stock market took, and it largely symbolizes the start of the Great Depression * By 1933, more than 11,000 of the nation’s 25,000 American banks had shuttered, victims of the Great Depression * “Hoovervilles” were the catchphrase for the shantytowns that cropped up across the United States, as homeless Americans improvised with scraps, abandoned cars, and packing crates The Presidential Election of 1928 * Herbert Hoover (R) * Al Smith (D) The Bull Market and the “Strong Economy” of the 1920s * Prolonged bull market encouraged people to invest in stock! – STRONG economy! * Peak of stock market is in August 1929 The Bull Market and the “Strong Economy” of the 1920s * What is the Dow Jones Industrial Average? (the average value of 30 large, industrial stocks) – indicator of the stock market! * If the DJIA is going up, then the stock market is doing well; if the DJIA is going down, then the stock market is not doing well * The Bull Market and the “Strong Economy” of the 1920s * Speculation and buying stocks “on margin” (buying stocks on margin – 10% necessary – plus speculation led to falsely high stocks) * Example: with $1,000 an individual could buy $10,000 worth of stock – the other $9,000 became a loan to the stockbroker… BUT, no worries! (yeah, right) * IF price of stock rose, investor made a profit (value of stock to $11,000 – investor made a $1,000 profit) * IF price of stock fell, the stock broker could make a margin call (call for repayment of loan all at once) What was the result of this? * sensitivity to price change in the stock market; as long as prices were rising, everything was good, if prices fells, the system fell apart * The Bull Market and the “Strong Economy” of the 1920s * False sense of prosperity in the “Roaring Twenties” (wide-gap between the rich and poor – 60% of population below poverty level; 1% owned 40% of nation’s wealth) * Over-production and under-consumption (wages for unskilled workers barely rose during the 1920s – so, the BUBBLE industries were being created – consumption could keep up with production only for a short period of time…) The Great Crash and Black Thursday *By early October, 1929, the NYSE stock market prices had begun to slowly fluctuate (August was the high point of the market) * Monday, Oct. 21, 1929 – Stockbrokers began to make large-scale margin calls (by that Thursday, Oct. 24, the NYSE had lost 11% of it’s market) * Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded! The Great Crash and Black Tuesday * Investment companies and leading bankers attempted to stabilize the market by buying up blocks of stock, producing a moderate rally on Friday (on Monday, the market went into free fall) * Black Tuesday (October 29), stock prices collapsed completely and 16,410,030 shares were traded on the NYSE in a single day! ($10-$15 billion lost) *By mid-November, $30 billion had been lost! (wiped out thousands of investors, companies – more money lost than all wages earned in 1929) Banks Begin to Close and Bank Runs * The History Channel and Bank Runs * Banks throughout the country had loaned money to potential investors – when stock market crashed thousands of people lost ability to pay debts (not THAT bad, but…) *Banks also began to invest depositor's money into the stock market (uh-oh) What was the result of this? * When stock values collapsed, banks lost money on investments and speculators defaulted on their loans – banks stopped lending money, making less credit available, send economy into recession and banks begin to close due to their inability to absorb loses * Banks Begin to Close and Bank Runs The Roots and Long-Term Causes of the Great Depression 1.) Uneven distribution of wealth (failing DEMAND)… BUBBLE industries! 2.) Over- production and underconsumption 3.) Low Interest Rates (Federal Reserve) 4.) High Tariffs (Hawley-Smoot Tariff)… meant a loss of export sales! The Great Depression 5.) Stock Market speculation