Credit card

advertisement

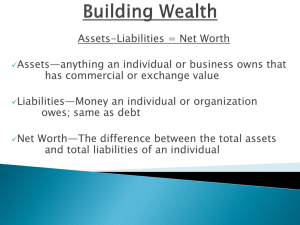

Sources of Loans and Credit I. Types of financial institutions A. Commercial Banks (example: Bank of America) – 1. accept deposits, 2. lend $$ 3. transfer funds among banks, individuals and businesses B. Savings and Loan Associations (S&L… also known as a ‘thrift’) = building societies C. Savings Banks 1. savings accounts 2. Home loans D. Credit Unions 1. Owned and operated by its members to provide savings accounts and low-interest loans to its members 2. Not for profit E. Finance Companies 1. take over contracts for installment debts from stores and adds a fee for collecting the debt F. Consumer Finance Company 1. Makes loans directly to consumers at HIGH RATES OF INTEREST II. Charge Accounts – allows customers to buy goods and services from a particular company and pay for them later A. Regular charge account = 30 day charge; 1. entire amount must be paid 2. no interest 3. credit limit B. Revolving Charge account – allowed to make additional purchases from a store even if previous bill not PIF C. Installment Charge account = equal payments over time III. Credit and Debit Cards A. Credit card = purchases without cash 1. used in many stores 2. usually high interest 3. first credit cards in the 1950s – Diners Club and American Express B. Debit card – NOT CREDIT = cashless purchase directly from bank account IV. Finance Charges and Annual Percentage Rates (APR) A. Finance charges = cost of credit expressed in dollars and cents 1. includes membership fees B. Annual Percentage Rates = cost of credit expressed as a yearly percentage; includes membership fees V. Determining Credit Worthiness A. Credit History 1. Credit Bureau – private business that runs credit checks 2. Credit Check – investigation of a person’s income, current debts, details about personal life, how well debts have been repaid 3. Credit Rating – rating of the risk involved in lending $$ to a person or business B. Three other credit check factors 1. Capacity to pay 2. Character 3. Collateral C. Loans 1. Secured Loans – loan backed by collateral 2. Unsecured loans – loan without collateral 3. Cosigner – person who signs a loan contract with the borrower and promises to repay the loan if the borrower does not VI. Responsibilities as a borrower A. Pay on time B. Keep accurate records Credit Cards •Americans charged more than $886 billion on their bank credit cards in 2010. Record high = $975 billion in Sept. 2008. By the end of 2011 expected to reach $1.177 trillion! •The average credit card holder has more than four credit cards. •One third of Americans do not own a credit card •The average American credit card debt in 1990 = $2,966 •The average American had about $10,679 in credit card debt at the end of 2008, with a typical average interest rate of 19% in March of 2007. •Anchorage, Alaska has the highest credit card debt and Lincoln, Nebraska has the lowest Costs of Credit Cards •Costs more if unpaid balance is not paid monthly •Ties up future income •Tempts one to overspend… impulse buying •Reduces comparison shopping if you only shop in stores extending credit •Decreases future buying power •Poor credit use can harm credit ratings and make future credit more expensive Benefits of Credit Cards •Earlier consumption; use of goods while paying for them •Convenience •Use for emergencies •Establishment of a good credit history •Consolidation of debts Opportunity Cost = value of whatever is given up when credit card is used • Future income and $$ spent on interest payment Collective Cost = if balance is unpaid each month then finance charges on total unpaid balance begin to add up – thus increasing the original cost Purchasing consumable and durable goods with credit = * Consumable – not wise UNLESS paid off each month * Durable – better off with loans versus credit card on these purchases due to lower interest rate and installment pay off rates with loans The Four C’s of Credit Capacity: * Ability to pay Collateral: * Assets used as a guide to determine your ability to repay debt Character: * Reputation as a reliable and trustworthy person Credit History: * Previous financial record… are you a good risk?? Methods of Calculating Credit Card Interest Assume an APR of 18.9% and a daily interest rate of .05476% (.0005476) For these examples the number of days in the cycle is 30, and only payments have been included. An actual active account with purchases or cash advances would be more involved. April 1 Opening Balance = $1,000 April 15 Payment = 400 April 30 Closing Balance = 600 Average Daily Balance, Adjusted Balance, Previous Balance are the three most common methods of calculating credit card interest. Average Daily Balance: You pay interest on the average balance owed during the billing cycle. The creditor Figures the balance in your account each day of the billing cycle, then adds together these amounts and divides by the number of days in the billing cycle. Average balance = $1,000 x 15 days x .0005476 = $8.21 $ 600 x 15 days x .0005476 = 4.93 $13.14 Adjusted Balance: You pay interest on the opening balance after subtracting the payment or returns made during the month. Opening Balance = $1,000 Payment = 400 Interest calculated on 600 x 30 x .0005476 = $9.86 Previous Balance: You pay interest on the opening balance, regardless of payments made during the month. Opening Balance = $1,000 x 30 x .0005476 = $16.43 Interest Rates on Loans and Savings Accounts Interest rate is the percentage amount of payment by borrowers to the lender. An annual interest rate of 5% on a $100 loan would translate differently depending upon how the interest was calculated. With a SIMPLE interest rate, interest is determined annually with the original loan amount. 5% = .05 5% ($100)=(.05)(100)=$5.00 + $100 = $105.00 In the second year, interest would again be $5, so a person would Owe $105 + $5 = $110. With a SIMPLE interest rate, interest is determined annually with the original loan amount. 5% = .05 5% ($100)=(.05)(100)=$5.00 + $100 = $105.00 In the second year, interest would again be $5, so a person would Owe $105 + $5 = $110. With COMPOUND interest, future interest is determined with the existing amount owed. In the second year of a compound debt, interest would be: . 5%($105) = (.05)(105) = $5.25 $105 + $5.25 = $110.25 Bottom line…. Compound interest rates are greater than simple interest rates. In this example, the current difference is only $.25, but compound interest over time can build up. This is: •good for savings accounts, but •bad for those whose interest on debt is calculated by compounding. Budget Bombs… ways to break your budget 1. Cut out all the fun stuff – *Allow for about 5% of budget to go toward entertainment 2. Be hit or miss with savings – *MAKE deposits consistent; pay yourself first 3. Overuse debit card – *Use cash only instead 4. Pay only the minimum on credit card debt – *Only charge what you can pay off each month 5. Live without emergency savings – *Should have between three and six months of savings in a liquid interest bearing account; the self-employed should have a years worth of savings 6. Spend more than you earn *Live within your means Schwartz, Shelly K. Schwartz (2007). Six Budget Bombs. Retrieved October 2008, from http://www.bankrate.com Savings Accounts and Investing Accounts Savings Accounts – offer easy availability of funds, money may be withdrawn w/o a penalty, and there is no minimum balance. •Trade-off = interest paid on these accounts is LOW •Passbook (regular) savings account – customer must present passbook to make transactions •Statement savings account – same as passbook, but depositor receives monthly statement •Called “share accounts” at credit unions Money Market Deposit Account (MMDA) – relatively high rates of interest and immediate access to money •Trade-off = minimum balance of $1,000 to $2,500 required •May withdraw in person at any time •Can only write a few checks a month against the account Time Deposits – saver is required to leave funds in the account for a specific period of time, called maturity •Offer higher interest rates than savings accounts… the longer the maturity the higher the rate •Certificates of Deposit (CDs) – usually require minimum deposit $250 to $100,000 – interest rates and maturity dates vary •Called “share certificates” at credit unions Stocks and Bonds Stocks (also called equities) represent ownership shares in a corporation. •Ownership by stock can be risky… there is no guarantee of a return on the investment Bonds – a formal contract to repay borrowed $$ and interest on the borrowed $$ at regular future intervals •Corporate Bonds = can be risky… “junk” bonds •Municipal Bonds (munis) = issued by state and local governments. Generally safe and tax exempt (gov. does not tax the interest paid) •Government Savings Bonds = low denomination, nontransferable from $50 to $10,000; have virtually no risk.