Introduction to Consumer Credit

advertisement

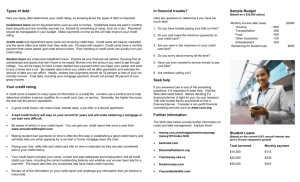

Chapter 6: Credit Use and Credit Cards Objectives • Compare and contrast installment and non-installment credit and discuss the costs of credit. • Discuss reasons for and against using credit. • Describe the types of charge accounts. Objectives • Describe the process of opening a credit account and the procedures lenders use to evaluate credit applicants. • Manage your credit card and charge accounts properly. What is Consumer Credit? Receiving products, services or cash now, and paying for them in the future. Before you use credit, think about... • Could I pay cash or make a down payment? • Do I want to use savings for this purchase? • Does purchase fit with my goals and budget? 6-2 What is Consumer Credit?(continued) • • • • Does purchase fit with my goals and budget? Could I use the credit I’ll need another way? Can I wait to buy it? What are the opportunity costs of postponing the purchase? • What are the economic & psychological costs of using credit for the purchase? 6-3 Credit Use and Credit Cards A RECENT SURVEY OF U.S. HOUSEHOLDS: •1:3 fear credit over-extension •1:2 are concerned about payments Credit Use and Credit Cards •Credit is any situation in which goods, services or money are received in exchange for a promise to pay a definite sum of money at a future date. Credit Use and Credit Cards • Consumer • Installment • Non-installment • Open-ended Closed vs. Open-End Credit Advantages of Credit • • • • • Current use of goods and services Demonstrates financial stability Use for financial emergencies Convenience when shopping Safer than cash Reasons For Using Credit • Convenience • Emergencies • Identification • Reservations Reasons For Using Credit • Consume expensive products earlier • Enjoy the good life • Take advantage of free credit • Consolidate debts • Protection against ripoffs and frauds Volume of Consumer Credit Charting the Economy Consumer Credit – Student Loans Total Consumer Credit Disadvantages of Consumer Credit • • • • Purchases are more expensive Temptation to overspend Possible financial difficulties Possible loss of merchandise due to late or non-payment • Ties up future income Credit Card Circulation • 176.8 million credit cardholders in 2008. • 159 million credit cardholders in the U.S. in 2000 • 173 million credit cardholders in the U.S. in 2006 • Average credit cardholder has 3.5 credit cards. • Only 2% of undergraduates have no credit history. • 50% of college undergraduates have 4 or more credit cards. • 76% of undergraduates have credit cards. • Average undergrad has $2,200 in credit card debt. • Average undergrad will amass about $20,000 student debt. http://www.creditcards.com/credit-card-news/credit-card-industry-facts-personal-debt-statistics-1276.php Helpful Tips About Credit •Always budget your credit spending carefully. •Shop around for the lowest credit rates. •Use credit only when doing so is to your advantage. •Buy items on credit that will last at least until the last payment is due. •Pay your bills on time •Understand the credit contract before signing it. •Notify the creditor if, for any reason, you can not make your payment. •Keep an eye on your credit card when you give it to a salesperson. •Tear up any carbons after you sign the receipt. •Never give your credit card to anyone over the phone unless you initiated the call. •Keep your receipt after you make charges. Compare them with your monthly statement. •Keep a list of your credit card numbers and the issuers’ phone number in a safe place. •Report stolen cards at once. •After reporting a stolen card via telephone, follow up with a telegram or registered letter. Reasons Against Using Credit • Interest is costly • Additional fees • High-priced add-ons • Liability for lost credit cards Reasons Against Using Credit • Tempting to overspend • Privacy is a concern • Reduces financial flexibility How to Calculate Debt Paymentsto-Income Ratio Fair Credit Reporting Act • • • • Is your credit report accurate? If you are denied credit based on your report, you can get a copy of your credit report free within 60 days of your request Obsolete information must be deleted Only authorized persons have access to your report Adverse data can be reported for seven years or bankruptcy for ten Sample Dispute Letter Open-Ended Charge Accounts PROCESS FOR OPENING: • Application • Investigation • Credit ratings and risk scoring Build and Maintain Your Credit Rating • Establish a steady work record • Pay all bills promptly • Opening a checking account and don’t bounce checks • Get a cosigner on a loan and pay back the loan as agreed • Open a savings account and make regular deposits • Check to see what is in your file Avoiding and Correcting Credit Mistakes Fair Credit Billing Act • • • • Notify creditor of error in writing in 60 days Send it to the correct address They must respond within 30 days Credit card company has 90 days to resolve the problem • Won’t affect your credit rating while in dispute • You can withhold payment on shoddy goods Managing a Charge Account CREDIT STATEMENTS: • • • • Billing date/Due date Transaction/Posting dates Grace period/Minimum payments Credit for merchandise returns/Errors/ Correcting errors Managing a Charge Account COMPUTATION OF FINANCE CHARGES: • Annual Percentage Rate (APR) • Periodic Rate • Average Daily Balance What Should You Do If You are Denied Credit? • You have the right to know the specific reason why • Ask yourself if you can afford the item • Check your credit report • You are entitled to have errors in your credit report corrected • You have the right to provide a 100 word explanation What If You Are Denied Credit? Protecting Against Credit/Debit Card Fraud • Sign new cards as soon as they arrive • Treat the cards like money • Shred anything with your account number on it • Don’t give your number over the phone unless you make the call • Get a receipt after every transaction • Check your statements for errors Measuring Your Credit Capacity • Ask yourself..... • can you afford the loan? • what do you plan to give up in order to make the payment? • Cosigning a loan • if the person doesn’t pay, you will have to • co-signers often have to pay • it can affect your credit report Criteria Used to Grant Credit 5 C’s of Credit • Character • Capital • Capacity • Collateral • Conditions What Creditors Look For • Character - do you pay bills on time? • Capacity - can you repay the loan? • Capital - what are your assets and net worth? • Collateral - what if you don’t repay? • Conditions - what economic conditions would affect your repayment of the loan? Minimum Payments Equals Permanent Debt •Credit card issuers often require a minimum monthly repayment as low as 1/36 or 1/48 of the outstanding balance. Such a payment is mathematically guaranteed to keep the user in “perma-debt.” Bank Card Competition • Fixed or variable interest rates • Introductory/teaser rate • Co-branded card • Rebates www.e-wizdom.com/cc/index.html www.bestcreditoffers.com www.bankrate.com/brm/rate/cc_home.asp Establish a Credit History • Establish both checking and savings accounts • Install telephone and bill to home address • Request, acquire, and use an oil-company card • Apply for bank credit card • Ask bank for small short-term cash loan • Pay off student loans Five Primary Areas of Interest in Calculating FICO Score What Your FICO Score Looks At Payment History (35%) Do you pay your bills on time. Amount Owed (30%) Debt ratio Length of Credit History (15%) How long have your accounts been established? Types of Credit (10%) Credit cards, retail accounts, installment loans, mortgage loans, etc. New Credit (10%) It’s OK to request and check your own credit report. Credit Score Breakdown Credit Score 499 and Below 500-549 550-599 600-649 650-699 700-749 750-799 800+ Percentage 2% 5% 8% 12% 15% 18% 27% 13%