GIK Best Practices

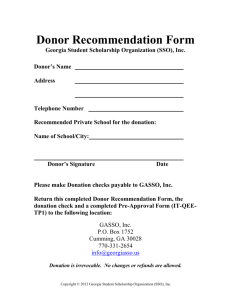

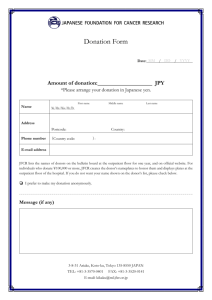

advertisement

Cameron Calabrese, Food for the Hungry Benjamin, Menenberg, World Vision Susan Talbot, World Concern John Van Drunen, ECFA Gary Wybenga, Medical Teams International Why Pursue Best Practices? We have a higher purpose than others…shouldn’t we have a higher standard? Being above reproach Setting the tone Collaborating with one another Gift Acceptance Policy Purpose Protect the interest of donor, charity, and the cause. Ensure gifts provide maximum benefits Encourage donors to make gifts without encumbering their own or the organizations resources Optimize opportunities to secure gifts from individuals to causes without compromising or endangering the reputation of the charity General Guidelines Not inconsistent with exempt purpose Irrevocable gifts – donor financial jeopardy? Any gift presented without approval is not received until determined to be in the donor’s best interest Key staff are notified of any potential gift Donor legal counsel? Donor privacy Through review Professional advice General Guidelines Donor capacity? IRS conforming acknowledgement Investment considerations evaluated separately No finder’s fees Any written instruments properly reviewed Deal with specific guidelines for different kinds of property Valuation Issues Scope of presentation Highlights of FAS 157 How to value a GIK donation Recommended sources for further research Valuation Issues Highlights of FAS 157 Definition of fair value “the price that would be received to sell an asset…in an orderly transaction between market participants at the measurement date” (ASC 820-10-35-2) Exit market concept Market participants, principal market Reciprocal versus non-reciprocal transactions (FAS 116) Input levels – majority of GIK donations will use level 2 inputs (i.e., “like-kind” values) Valuation Issues How to Value a GIK Donation Wholesale versus retail – most NPOs will typically use wholesale values due to quantities of GIK goods received “Like-kind” valuation How to determine a “like-kind” value? Average of 5-7 published prices* If published prices are retail values, may need to adjust to wholesale NPOs have a responsibility to independently ascertain a donation’s value; cannot rely solely on donor-provided value * This number of sources is a guideline only and is not a prescription from AERDO Valuation Issues Recommended sources for further research Primary Source FAS 157 (now included within Topic 820 in FASB Codification) Secondary Sources FAS 116 (now included within Topic 958-605 in FASB Codification) AERDO Standards Unofficial FASB response to NPO Letter – October 2008 AICPA NPO Guide End Use Reporting Do we discuss both our final reports and the fields’ final reports (macro and micro)? Techniques to obtain the reports donors desperately want – no magic bullet Media reporting Time constraints Personal stories The dangers of scale GIK Disclosures Financial statements should disclose information about the valuation, source, and use of GIK. The basis and method for valuing donated GIK should be disclosed in an organization's financial statements. Appendix C – sample. Make a spreadsheet using categories as columns. Preparing this helped in completing the 990. Excel Spreadsheet to Track GIK SHIP DATE INVOICE DATE INV CONSIGNEE TYPE OF COMMODITY TYPE OF DONOR 10/2/2009 10/2/2009 62679 Africa/Kenya WC Food WFP FMV 10/25/2009 10/28/2009 62680 Africa/Somalia WC Medical Supplies Nonprofit FMV 11/5/2009 11/7/2009 62681 Africa/Sudan WR School Supplies Individual FMV 11/16/2009 11/19/2009 62682 Africa/Sudan WC Clothing For Profit FMV 11/20/2009 11/25/2009 62683 Africa/Kenya WC Pharmaceuticals For Profit FMV QTY Value Each Total AWP Value 990 REGION COUNTRY Method # BENEF # of gifts 0.00 0 Inventory Scope of presentation AERDO recommendations for inventory Assigning value to inventory on-hand Inventory AERDO recommendations for inventory Organizations should proactively establish systems to track and report inventory Option 1 – GIK recognized on date of donation as Revenue and Inventory. When GIK is expended in programs, record expense and reduction of inventory. Option 2 – GIK revenue and expense recognized on date of donation. Make a year-end adjustment to recognize NPO’s inventory by reducing expenses and increasing inventory. Inventory Assigning value to inventory on-hand Example: NPO receives 10 donations of 10 pallets each of t-shirts during the year; at year-end, 20 pallets of t-shirts remain in inventory – how to value these 20 pallets? Alternative A – tie directly to donation value Very accurate, but NPOs may lack ability to track GIK by each donation from revenue to inventory Alternative B – calculate average pallet (or other inventory metric) values based on all donations received during the year, and assign average pallet values to remaining inventory Reasonably accurate, uses fewer resources; consider materiality Records Retention AERDO standard 4.9 requires the retention of GIK documents Documentation of product value A specific donation inventory Verification of donation provided from the donor Documentation of the end-use or transfer of donation Generally 7 years Conditions/restrictions – 7 years after expended Processing Fees AERDO Standard 6 Service fees related to GIK transactions must not be based upon the value of those gifts but should reflect the expenses incurred to administrate, process, warehouse, manage, and handle the GIK provided Donor Intent Establish systems to adequately track donorrestricted gifts and related expenses Apply overhead charges to restricted gifts based on cost analyses only Stewardship Philosophy Maintain systems to provide project reports, including financial data and measurable results Regularly determine if donor-restricted net assets have been used for operational purposes Provide adequate due diligence for funds (cash & noncash). Fraud prevention efforts Compare solicitations and philosophy Pass-Through Note revenue recognition aspects of AERDO standard five Expend all donor-restricted gifts under the discretion and control of the organization, avoiding all earmarked gifts, and clearly communicate these policies to donors. Deputized Fund-Raising Terminology Clearly communicate to donors Clearly communicate to workers Discretion and control Keep clear which property belongs to the organization Donor Privacy How is donor information used? Who is it shared with? Removal process Communicate a policy Cameron Calabrese, Food for the Hungry Benjamin, Menenberg, World Vision Susan Talbot, World Concern John Van Drunen, ECFA Gary Wybenga, Medical Teams International