Chapter 6.1

advertisement

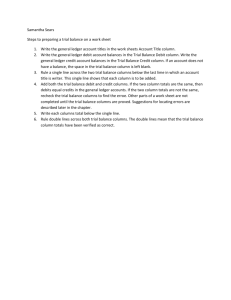

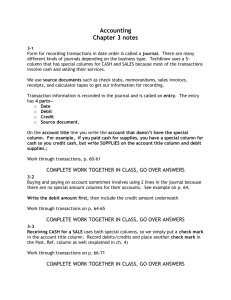

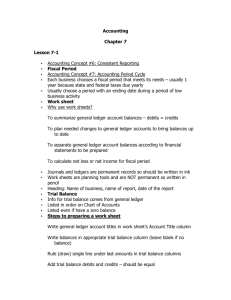

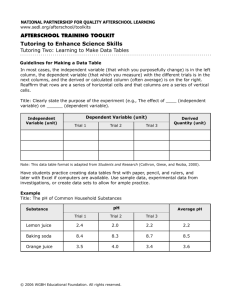

Chapter 6.1 Worksheet for a Service Business WARM UP In your Textbook, check out page 151 and read the accounting in the Real World section and answer the two Critical Thinking Questions that follow. Once finished, do the Internet Activity Exercise on the same page and follow the instructions given. These will be turned in at the end of class. Objectives for Chapter 6 •Chapter 6 Introduces the 8Column work sheet. •In order to complete a work sheet, adjustments must be made. Chapter 6 describes two simple adjustments for a proprietorship-supplies and prepaid insurance. • Agenda Monday November 28, 2011 Objectives for Chapter 6.1 •Define Accounting terms related to a work sheet for a services business organization organized as a proprietorship. •Identify accounting concepts and practices related to a work sheet for a service business organized as a proprietorship. •Prepare a heading and a trial balance on a work sheet Consistent Reporting Very Important! Without consistent reporting, it would be very difficult to compare results from year to year. Question for YOU! Can you think of any way to test to see if debit equal credits after all posting is complete? -If Debits equal Credits for each transaction, total debits should equal total credits. This leads to a listing of each account and its balance-a trial balance. Terminology fiscal period-the length of time for which a business summarizes and reports financial information. (p. 152) work sheet-a columnar accounting form used to summarize the general ledger information needed to prepare financial statements. (p. 153) trial balance-a proof of the equality of debits and credits in a general ledger. (p. 154) Explanation Reporting accounting information for a fiscal period is very important…Why ???????? A fiscal period can begin on any date. However, most businesses begin their fiscal periods on the first day of a month. LESSON 6-1 Creating a Worksheet PREPARING THE HEADING OF page 153 A WORK SHEET 1 2 Name of Company Name of Report 3 Date of Report A WORK SHEET IS A PLANNING DOCUMENT PREPARING THE HEADING OF page 153 A WORK SHEET ALL FINANCIAL STATEMENT HEADINGS ANSWER THE QUESTIONS: WHO? WHAT? AND WHEN? A WORK SHEET IS A PLANNING DOCUMENT 12 PREPARING A TRIAL BALANCE ON A WORK SHEET •ALL ACCOUNTS ARE LISTED IN CHART OF ACCOUNTS ORDER ON A WORK SHEET WHETHER THEY HAVE A BALANCE OR NOT. •ACCOUNT TITLES ARE WRITTEN IN FULL UNLESS THERE IS NOT ENOUGH ROOM. IF THERE IS NOT ENOUGH ROOM, ABBREVIATIONS CAN BE USED •ACCURACY IS IMPORTANT WHEN COPYING ACCOUNT BALANCES TO THE WORK SHEET COLUMNS PREPARING A TRIAL BALANCE ON A WORK SHEET page 154 2 1 3 5 14 1. Write the general ledger account titles. 2. Write the general ledger debit account balances. Write the general ledger credit account balances. 3. Rule a single line across the two Trial Balance columns. 4 4. Add both the Trial Balance Debit and Credit columns. 5. Write each column’s total below the single line. 6. Rule double lines across both Trial Balance columns. 6 TERMS REVIEW fiscal period-the length of timepage for 155 which a business summarizes and reports financial information. (p. 152) work sheet-a columnar accounting form used to summarize the general ledger information needed to prepare financial statements. (p. 153) trial balance-a proof of the equality of debits and credits in a general ledger. (p. 154) 15 APLIA 6.1 Work Together and On Your Own Application Problem Character Counts Page 153 EXIT TICKET WHAT IS WRITTEN ON THE THREE-LINE HEADING ON A WORK SHEET? WHAT GENERAL LEDGER ACCOUNTS ARE LISTED IN THE TRIAL BALANCE COLUMNS ON A WORK SHEET? LESSON 6-2 Planning Adjusting Entries on a Work Sheet Objectives •Define Accounting terms related to a work sheet for a services business organization organized as a proprietorship. •Identify accounting concepts and practices related to a work sheet for a service business organized as a proprietorship. • Plan Adjustments for supplies and prepaid insurance. Question for YOU! How have we accounted for supplies up to this point? Answer: We have increased the asset account, Supplies, when we purchase supplies. We have NOT recorded the use of supplies. Today we will stress that if this continues, the balance in the supplies account will get larger and larger, even though supplies are being used each period. New VOCAB TERM ADJUSTMENTS: changes recorded on a work sheet to update general ledger accounts at the end of a fiscal period. (p. 157) Today’s lesson will discuss how to analyze adjustments for supplies and prepaid insurance. Don’t look too excited! Lesson 6.2 The concept Matching Expenses with Revenue means that amounts that helped earn revenue for a period must be reported as expenses in the same period. Again, Today we are going to look how adjustments are made for supplies and insurance. These adjustments will be planned on the work sheet. Example (Supplies) A Company starts the accounting with two boxes of If the period company uses four boxes of envelopes, the envelopes matching concept requires that the cost of the four boxes to be included with expenses for the period. The cost of the one remaining box must be listed as an asset, Supplies. Three additional boxes are purchased during the period. Good Habits You should establish the habit of asking the four questions to analyze each adjustment. 1.What is the balance of Supplies? 2.What should the balance be for this account? 3.What must be done to connect the account balance? 4.What adjustment is made? Good Habits The amount of the adjustment is the amount of supplies used. This amount will also be the balance of Supplies Expense after the adjusting entry. After the adjusting entry, the balance in the asset account, Supplies, is the cost of the supplies still on hand. There are Three Steps for a Supplies Adjustment on a work sheet SUPPLIES ADJUSTMENT ON A WORK SHEET page 158 2 3 1 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment. 26 SUPPLIES ADJUSTMENT ON A WORK SHEET Supplies Account Balance – Supplies on Hand= Supplies Used $1025.00 - $310.00 = $715.00 PREPAID INSURANCE ADJUSTMENT ON A WORK SHEET page 159 2 3 1 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment. 28 PREPAID INSURANCE ADJUSTMENT ON A WORK SHEET Prepaid Insurance Balance – Insurance Coverage Remaining (Unused) = Insurance Coverage Used $1200.00 - $1100.00 = $100.00 PROVING THE ADJUSTMENTS COLUMNS OF A WORK SHEET •Reminder: If Debits equal Credits for each adjustment, the total debits and total credits in the Adjustments columns must also equal. •There are three steps for proving the Adjustments columns of a work sheet…. PROVING THE ADJUSTMENTS COLUMNS OF A WORK SHEET page 160 1 2 1. Rule a single line. 2. Add both the Adjustments Debit and Credit columns. Write each column’s total. 3. Rule double lines. 31 3 PREPARING A WORK SHEET 1. Write the heading. 2. Record the trial balance. 3. Record the supplies adjustment. 4. Record the prepaid insurance adjustment. 5. Prove the Adjustments columns. 6. Extend all balance sheet account balances. 7. Extend all income statement account balances. 8. Calculate and record the net income (or net loss). 9. Total and rule the Income Statement and Balance Sheet columns. 32 page 160 C 33 1 34 1 2 496400 10000 15000 10000 102500 120000 (a) (b) 6 71500 10000 20000 5000 500000 62500 4 356500 356500 21300 (b) 10000 (a) 71500 2800 30000 11000 881500 881500 8 81500 21300 10000 7 2800 30000 71500 5 11000 81500 146600 356500 734900 525000 209900 209900 356500 356500 734900 734900 9 35 20000 5000 500000 3 62500 Net Income 10000 31000 110000 TERM REVIEW Adjustments- changes recorded on a work sheet to page 161 update general ledger accounts at the end of a fiscal period. (p. 157) 36 Global Perspective Check out page 160 and answer the two critical thinking questions listed. You may use the internet to research your answers. EXIT TICKET Write a short paragraph on why adjustments are necessary. When done, share your answer with another student and turn it in. LESSON 6-3 Extending Financial Statement Information on a Work Sheet Objectives •Define Accounting terms related to a work sheet for a services business organization organized as a proprietorship. •Identify accounting concepts and practices related to a work sheet for a service business organized as a proprietorship. •Complete a Work Sheet for a service business organized as a proprietorship What kinds of accounts will be moved to the Balance Sheet columns and what kinds of accounts will be moved to the Income Statement Columns 41 New Terminology Balance sheet: a financial statement that reports assets, liabilities, and owner’s equity on a specific date Income Statement: a financial statement showing the revenue and expenses for a fiscal period Net Income: the difference between total revenue and total expenses when total revenue is greater Net Loss: the difference between total revenue and total expenses when total expenses are greater Here we go! When extending balances, assets, liabilities and owner’s equity, they always go in the Balance Sheet Reminder!!! The work sheet will be used to prepare the balance sheet. All accounts extended to the Balance Sheet columns are at the top of the work sheet, from Cash through the owner’s drawing account. EXTENDING BALANCE SHEET ACCOUNT BALANCES ON A page 162 WORK SHEET 2 1. Debit balances without adjustments 2. Debit balances with adjustments 3. Credit balances without adjustments 44 1 3 EXTENDING BALANCE SHEET ACCOUNT BALANCES ON A WORK SHEET FYI…A work sheet is prepared in manual accounting to adjust the accounts and sort amounts needed to prepare financial statements. However, in automated accounting, adjustments are prepared from the trial balance, and the software automatically generates the financial statements with no need for a work sheet. Extending Income Statement Account Balances When extending balances, revenue and expenses always go in the Income Statement columns. REMINDER: A worksheet will be used to prepare the income statement. There are three steps for extending income statement account balances on a work sheet. All accounts that are extended to the income statement columns are at the bottom of the work sheet, from Sales through the last Expense account. EXTENDING INCOME STATEMENT ACCOUNT BALANCES ON A WORK SHEET page 163 1 2 3 1. Sales balance 2. Expense balances without adjustments 3. Expense balances with adjustments 47 RECORDING NET INCOME, AND TOTALING AND RULING A WORK SHEET Remember Net Income? Net Income: the difference between total revenue and total expenses when total revenue is greater. There are SEVEN (7) Steps for calculating and recording net income on a work sheet and totaling and ruling a work sheet. RECORDING NET INCOME, AND TOTALING AND RULING A WORK page 164 SHEET 4 1. Single rule 2. Totals 3. Net income 49 3 4. Extend net income 5. Single rule 6 6. Totals 7. Double rule 1 7 2 5 CALCULATING AND RECORDING A NET LOSS ON A WORK SHEET Remember Net Loss? Net Loss: the difference between total revenue and total expenses when total expenses are greater There are FOUR (4) Steps for calculating and recording new loss on a work sheet. CALCULATING AND RECORDING A NET LOSS ON A page 165 WORK SHEET 1 3 1. 2. 3. 4. 51 Single rule Totals Net loss Extend net loss 4 2 TERMS REVIEW • balance sheet • income statement • net income • net loss 52 page 166 Explore Accounting! Check out Page 171 and make a written recommendation to the owner of the company regarding what kind of Fiscal Year should be used. Exit Ticket • Which Accounts are extended into the Balance Sheet columns of the work sheet? • Which Accounts are extended into the Income Statement columns of the work sheet? • In which Balance Sheet column do you record net income on the work sheet? • In which Balance Sheet column do you record net loss on the work sheet? EXIT TICKET Answers • Which Accounts are extended into the Balance Sheet columns of the work sheet? • Asset, Liability and Owner’s Equity accounts • Which Accounts are extended into the Income Statement columns of the work sheet? • Revenue and Expense accounts • In which Balance Sheet column do you record net income on the work sheet? • Balance Sheet Credit Column • In which Balance Sheet column do you record net loss on the work sheet? • Balance Sheet Debit Column. LESSON 6-4 Finding and Correcting Errors on the Work Sheet Objectives •Identify selected procedures for finding and correcting errors in accounting records. What If ? ? ? What might happen if the columns of a work sheet do not equal? Would you leave it and go on, or find the error before going on? Answer: Common errors may be discovered while preparing a worksheet. Preview •In this lesson, specific procedures will be discussed that will help find errors in the accounting records. Here we go! • If errors are found while preparing the work sheet, the errors must be corrected as shown in this lesson. • It is very important to work accurately and prevent errors whenever possible. • This lesson is designed to provide you with some quick and effective ways of finding, correcting, and preventing errors when preparing a work sheet. • Many of the suggestions provided today can be applied while performing other types of accounting and non accounting calculations. Checking for Typical Calculation Errors •When two column totals are not in balance; subtract the smaller total from the larger total to find the difference. Check the difference between the two amounts against the following four guides. Checking for Typical Calculation Errors There are four methods of finding errors described on page 167. 1.The difference is 1 2.The difference can be divided evenly by 2 3.The difference can be divided evenly by 9 4.The difference is an omitted account. The Difference Is 1 • For example, if the totals of the two columns are debit $14,657 and Credit $14658, the difference between the two columns is $1.00. The error is most likely in addition. • Add the columns again. The Difference Can Be Divided Evenly By 2 • For example, the difference between two column totals is $48, which can be divided by 2 with no remainder. Look for $24 amount in the Trial Balance columns of the work sheet. If the amount is found, check to make sure it has been recorded in the correct Debit or Credit column. The Difference Can Be Divided Evenly By 2 • A $24 debit amount recorded in a credit column results in a difference between column totals of $48. • If the error is not found on the work sheet, check the general ledger accounts and journal entries. An entry for $24 may have been recorded in an incorrect column in the journal or in an account. The Difference Can Be Divided Evenly by 9 • For example, the difference between two columns is $45. which can be divided by 9 with no remainder. When the difference can be divided equally by 9, look for transposed numbers such as 54 or 19 written as 91. • Also, check for a “Slide”. A “Slide” occurs when numbers are moved to the right or left in an amount column. For example, $12 is recorded as $120 or $350 is recorded as $35. The Difference Is An Omitted Account. Look for an amount equal to the difference. If the difference is $50, look for an account balance of $50 that has not been extended. Look for any $50 amount on the work sheet and determine if it has been handled correctly. Look in the accounts and journals for a $50 amount and check if that amount has been handled correctly. Failure to record a $50 account balance will make a work sheet’s column totals differ by $50. Checking For Errors in the Work Sheet. 1.Check for Errors in the Trial Balance Column 2.Check for Errors in the Adjustment Columns 3.Check for Errors in the Income Statement and Balance Sheet Columns. Check for Errors in the Trial Balance Column 1.Have all general ledger account balances been copied in the trial balance column correctly? 2.Have all general ledger account balances been recorded in the correct Trial Balance Columns? Check for Errors in the Adjustment Columns Do the Debits equal the Credits for each adjustment? Use the small letters that label each part of an adjustment to help check accuracy and equality of debits and credits. Is the amount for each adjustment correct? Check for Errors in the Income Statement and Balance Sheet Columns. Has each amount been copied correctly when extended to the Income Statement or Balance Sheet column? Has each account balance been extended to the correct Income Statement or Balance Sheet columns? Has the net income or net loss been recorded in the correct Income Statement or Balance Sheet columns? Has the net income or net loss been recorded in the correct Income Statement or Balance Sheet Columns. POSTING TO THE WRONG ACCOUNT 2 page 168 Correct entry 1 Incorrect entry 1. Draw a line through the entire incorrect entry. Recalculate the account balance and correct the work sheet. 2. Record the posting in the correct account. Recalculate the account balance, and correct the work sheet. 72 CORRECTING AN INCORRECT AMOUNT page 169 2 1 3 1. Draw a line through the incorrect amount. 2. Write the correct amount just above the correction in the same space. 3. Recalculate the account balance, and correct the account balance on the work sheet. 3 Steps for correcting an incorrect amount in the account. 73 CORRECTING AN AMOUNT POSTED TO THE WRONG COLUMN 2 1 3 5 4 6 4. Draw a line through the incorrect item in the account. 5. Record the posting in the correct amount column. 6. Recalculate the account balance, and correct the work sheet. 74 page 169 Check Your Understanding • What is the first step in checking for arithmetic errors when two column totals are not in balance? • What is the one way to check for an error caused by transposed numbers? • What term is used to describe an error that occurs when numbers are moved to the right or left in an Amount Column. Check Your Understanding • What is the first step in checking for arithmetic errors when two column totals are not in balance? • Subtract the smaller total from the larger total to find the difference. Check for Understanding. What is the one way to check for an error caused by transposed numbers? Answer- The difference between the two column totals can be divided evenly by 9. Check for Understanding •What term is used to describe an error that occurs when numbers are moved to the right or left in an Amount Column. Answer: A slide Aplia • Work Together 6-4 •On Your own 6-4 •Application 6-4 •Chapter 6 Study Guide •Century21accounting.com Tutorial Test for Chapter 6 Exit Ticket •