CHAPTER 5

Relationship of Revenue, Expenses,

and Withdrawals to Owner’s Equity

SECTION 5.1

Relationship of Revenue, Expenses, and

Withdrawals to Owner’s Equity

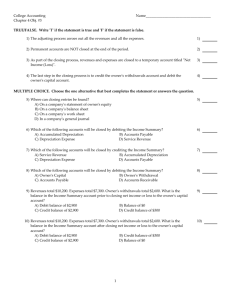

Temporary and Permanent Accounts

Revenues, expenses, and withdrawals could be

recorded as increases or decreases in the capital

account.

A better way to record these transactions is to set up

separate accounts for each type of revenue or

expense.

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

SECTION 5.1

Using Temporary Accounts

Use temporary accounts to temporarily record information for

revenues, expenses and withdrawals.

Temporary accounts

start the accounting period with a

zero balance,

accumulate amounts for

one accounting period, and

transfer the balance to the owner’s capital account at the end of

the period.

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

Using Permanent Accounts

In contrast to temporary accounts, permanent accounts

continue accumulating from one accounting period to the

next. The owner’s capital account and the asset and liability

accounts are permanent accounts.

Permanent accounts show

the balances on hand or amounts owed at any time, and

the day-to-day account changes.

SECTION 5.1

Rules for Revenue Accounts

These rules of debit and credit are used for revenue accounts:

A revenue account is increased on the credit side.

A revenue account is decreased on the debit side.

The normal balance for a revenue account is the increase or the credit

side. Revenue accounts normally have credit balances.

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

SECTION 5.1

Relationship of Revenue, Expenses, and Withdrawals to Owner’s

Equity

Rules for Expense Accounts

These rules of debit and credit are used for expense

accounts:

An expense account is increased on the

debit side.

An expense account is decreased on the

credit side.

The normal balance for an expense account is the

increase or the debit side. Expense accounts

normally have debit balances.

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

SECTION 5.1

Rules for Expense Accounts

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

SECTION 5.1

Rules for Withdrawals Accounts

These rules of debit and credit are used for withdrawals

accounts:

A withdrawals account is increased on the

debit side.

A withdrawals account is decreased on the

credit side.

The normal balance for a withdrawals account is the

increase or the debit side. Withdrawals accounts

normally have debit balances.

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

SECTION 5.1

Rules for Withdrawals Accounts

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.

Relationship of Revenue, Expenses, and Withdrawals to Owner’s Equity

Summary of the Rules of Debit and Credit for

Temporary Accounts

Glencoe Accounting Unit 2

Chapter 5 Copyright © by The

McGraw-Hill Companies, Inc. All

rights reserved.