Energize CT Follow Up Survey Results

advertisement

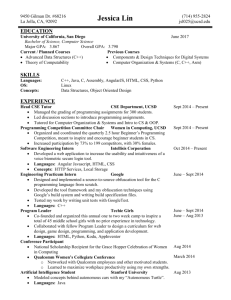

AWARENESS OF ENERGIZE CONNECTICUT AND OTHER ENERGY EFFICIENCY RESOURCES AND BRANDS Tami Buhr, Director of Survey Research January 2014 About the Surveys The purpose of the surveys was to measure change in awareness of and interest in the various energy efficiency brands following the launch of Energize Connecticut. Survey Field Dates Completes (Landline/Cell) Baseline August 6-21, 2012 400 (284/116) Follow Up September 9-29, 2013 400 (263/137) The data were weighted by phone type to account for overlap of landline and cell phone samples, and to match the sample phone type to that of the population. Both surveys have a margin of error of plus or minus 5%, with a 95% confidence interval. Awareness of Programs and Brands Presentation Name 3 Are you aware of any programs in Connecticut that help people (save energy by making their homes more energy efficient/make use of renewable energy sources to meet their home energy needs)? 50% Energy Efficiency Programs 56% 24% Renewables Sept 2013 20% Aug 2012 0% 20% 40% 60% 80% 100% Q1A & Q5A (Ask if aware of programs) How familiar are you with these programs? Not at all familiar Not too familiar Somewhat familiar Renewables Energy Efficiency Programs 100% 21% 20% Very familiar 9% 24% * 80% 48% 60% 48% 54% 46% 40% 29% 20% 0% 25% 26% 22% 7% 4% Aug 2012 (n=224) Sept 2013 (n=201) * Statistically different from 2012 at .05 level 14% Aug 2012 (n=79) 4% Sept 2013 (n=95) Q1B & Q5B Compared to three months ago, are you more aware today about resources to save energy or use renewable energy, or not? (If more aware) Would you say you are much more aware or somewhat more aware? Not more Somewhat more Sept 2013 76% Aug 2012 77% 0% 20% 40% Much more 14% 15% 60% 80% 6% 6% 100% Q12A & Q12B How familiar are you with Energize Connecticut? Not at all familiar Not too familiar Somewhat familiar Very familiar 23% Familiar Sept 2013 78% 15% 2% 6% 17% Familiar Aug 2012 83% 0% 20% 40% 13% 4% 60% 80% 0% 100% Q17A Awareness of Energy Connecticut Efficiency Brands % Familiar with Brand Connecticut Clean Energy Communities 40% Connecticut Clean Energy Fund 34% Connecticut Energy Efficiency Fund 32% Energize Connecticut 23% Connecticut Neighbor to Neighbor Challenge 15% Clean Energy Finance and Investment Authority 14% 0% 10% 20% 30% 40% Presentation Name 50% 8 Awareness of Energy Efficiency Brands Across the Country ENERGY Star (92-12) 87% Energy Trust of Oregon (02 - 12) 61% Flex Your Power CA (01 - 07) 50% MassSave (1980s-12) 36% Energize Connecticut (12-13) 23% Energy Upgrade CA (10-12) 17% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Presentation Name 100% 9 Depth of Knowledge Presentation Name 10 (Ask if aware of programs) Can you describe the type of help these programs offer to people who want to save energy by making their homes more energy efficient? (Multiple responses accepted) Energy Audits/ Home Inspections 30% * Insulation/weatherization/windows Rebates General Rebates/incentives/financial assistance for solar or alt. energy measures Programs (general) Programs for balanced billing/reduced rates/low income assistance Rebates/incentives/financial assistance for efficient HVAC Tax benefits Home energy kits (i.e. aerators, pipe wrap, etc) Appliance recycling programs Programs for load control/off peak usage Rebates/incentives/financial assistance for efficient hot water heaters (No – cannot describe) (Other) 49% 17% 20% Light bulbs discounts/CFLs More efficient appliances 42% * 26% 2% 7% 5% 5% 5% 7% 4% 4% 4% 6% 2% 4% 2% 8% 1% 5% 0% 1% 0% 1% 0% 1% 1% 1% 8% 5% (Don’t know/Refused) Sept 2013 (n=201) Aug 2012 (n=224) 11% 0% * Statistically different from 2012 at .05 level 16% 20% 40% 60% Q2 (Ask if aware of programs) Can you describe the type of help these programs offer to people who want to make use of renewable energy sources? (Multiple responses accepted) Rebates 17% Financing 9% Solar power/panels (general) 8% Saving energy and money (general) 7% Information/Advice/Evaluation Renewable energy programs (general) 13% 9% 8% 2% 0% 15% 15% 7% Tax incentives Sept 2013 (n=91) 3% Opportunity to purchase electricity generated by renewable sources 5% Recycling programs 1% 2% Other 2% 22% Aug 2012 (n=78) 8% 7% 23% Don't know 0% 10% 20% 36% 30% 40% Q6 (Ask if aware of programs) Can you name organizations that might offer programs to help people (save energy by making their homes more energy efficient/make use of renewable energy sources)? 100% Aug 2012 (n=224) Sept 2013 (n=201) Aug 2012 (n=79) Sept 2013 (n=95) 80% 60% 49% 53% 37% 40% 34% 20% 0% Energy Efficiency Programs Renewables Q3 (Results shown for those who can name organizations) Can you name organizations that might offer programs to help people save energy by making their homes more energy efficient? (Multiple responses accepted) 91% 93% Utilities 7% 5% Community renewal team 5% Other 19% 4% 7% State government CT Energy Efficiency Fund 3% 1% CT Clean Energy Fund 3% 2% 3% 4% Federal government Energize Connecticut 1% 0% Clean Energy Finance and Investment Authority - CEFIA 1% 0% 0% September 2013 (n=123) August 2012 (n=141) 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q3 (Results shown for those who can name organizations) Can you name organizations that might offer programs to help people make use of renewable energy sources? (Multiple responses accepted) 67% Utilities Federal government CT Clean Energy Fund 14% 6% 12% 0% 8% State government 89% 16% 7% 12% Private solar industry/retailers/installers 5% 3% CT Energy Efficiency Fund Clean Energy Finance and Investment Authority - CEFIA 3% 0% Other 2% 0% Sept 2013 (n=43) 9% Aug 2012 (n=39) 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q7 Interest in Energy Efficiency and Renewables Programs and Barriers Presentation Name 16 How interested are you in learning more about programs that could help you (save energy by making your home more energy efficient/make use of renewable energy sources)? Not at all interested Not too interested Somewhat interested Energy Efficiency Programs Very interested Renewables 100% 20% 19% 20% 17% 80% 60% 40% 36% 20% 32% 41% 22% 16% 38% 20% 20% 24% 27% Aug 2012 Sept 2013 21% 24% Aug 2012 Sept 2013 0% Q4A (Ask if very/somewhat interested) Why would you say YOU are interested in making your home more efficient? (Multiple responses accepted) 61% Save money/Reduce utility bills 66% 23% 25% Save money and help the environment 17% 14% Preserve/help the environment/be more efficient 5% 6% Make home more comfortable 2% 1% General interest/seems like a good idea 1% 3% Increase value of home 5% 3% Other Sept 2013 (n=200) Aug 2012 (n=224) 3% 2% Don’t know/Refused 0% 10% 20% 30% 40% 50% 60% 70% Q4B (Ask if not very/somewhat interested) Why would you say YOU are interested in using renewable energy? (Multiple responses accepted) Save money/Reduce utility bills 35% Preserve/help the environment/be more efficient 30% 23% Save money and help the environment Make home more comfortable 3% 38% 35% 27% 5% 3% 4% General interest/seems like a good idea 2% 2% Increase value of home 3% 2% Other 4% Don’t know/Refused 0% 5% Sept 2013 (n=218) Aug 2012 (n=244) 10% 10% 15% 20% 25% 30% 35% 40% Q8B (Ask if not very/not at all interested) Why would you say YOU are NOT interested in learning about programs that could help you save energy in your home? (Multiple responses accepted) 47% 48% No remaining EE opportunities/new home Rent home 20% 8% Simply not interested 5% Cost of improvements 6% 5% Utility bills aren't high enough 5% 4% Too difficult/hassle/not a priority 5% 12% 2% 4% Elderly 2% 1% Would not qualify Don't need help/DIY 25% 0% 3% Sept 2013 (n=189) 3% 4% Other Don’t know/Refused 1% 0% Aug 2012 (n=175) 4% 10% 20% 30% 40% 50% 60% Q4B (Ask if not very/not at all interested) Why would you say YOU are NOT interested in learning more about programs that could help you make use of renewable energy? (Multiple responses accepted) Rent home 21% 18% Simply not interested 20% 15% 19% 20% No remaining opporunities/new home 14% Cost of renewable systems Too difficult/hassle/not a priority 8% Elderly/Moving 4% Not possible given hometype 4% 2% Utility bills aren't high enough Would not qualify 1% 1% Too new of technology 1% Other 7% 3% Sept 2013 (n=174) 8% 6% 4% 0% 10% 10% 3% Don’t know/Refused 18% Aug 2012 (n=150) 5% 5% 10% 15% 20% 25% Q8B Exposure to Energy Efficiency Information and Information Seeking Presentation Name 22 Resources to help you save energy in your home and make use of renewable energy Have you ever attempted to find out what resources are available to help you save energy in your home or make use of renewable energy? 100% 80% 100% Aug 2012 Sept 2013 80% Aug 2012 (n=124) Sept 2013 (n=130) 60% 60% 40% (If yes) Have you looked for this type of information in the past month? 32% 31% 40% 20% 20% 0% 0% Yes 17% 14% Yes Q9A & Q9B (Ask if looked for information in the past month) Where did you go for information? (Multiple responses accepted) General on-line search/Google/The internet 39% Utilities 24% 28% 14% 12% Educational/non-profit institutions 4% 5% Local government 4% State government generally CTEnergyInfo.com 42% 0% 7% 5% Sept 2013 (n=20) 17% Other 0% 5% 10% 15% 20% Aug 2012 (n=18) 25% 25% 30% 35% 40% 45% Q9C If you wanted to learn what resources are available to help you save energy in your home or make use of renewable energy, where would you go for TRUSTWORTHY information? (Multiple responses accepted) 42% 40% General online search/Google/The Internet 17% 14% Utilities 6% 5% 6% Friend/neighbor/coworker State government website/generally Local government/agency website Call/contact a contractor, supplier, or other trade professional Newspaper/magazines/other print media Call 211/info line Non-profit/educational or community organization Home shows/other community events The library Review site/Consumer Reports/other independent resource Federal/national government, agency, website Would not look for that information/don’t care Clean Energy Finance and Investment Authority - CEFIA Go to a retail location (i.e. Home Depot)/talk to a salesman Other Don’t know/Refused 9% 3% 2% 3% 3% 2% 1% 2% 2% 2% 5% 1% 1% 1% 1% 1% 2% 1% 3% 0% 1% 0% 1% 0% 1% 0% 2% 0% 0% 10% Sept 2013 Aug 2012 21% 20% 30% 40% 50% Q10 Have you ever… (Based on all respondents, including those who are unaware) Aug 2012 Sept 2013 Aug 2012 Sept 2013) Aug 2012 Sept 2013 40% 20% 1% 3% 4% 6% 0% Visited the website Energize Connecticut.com Visited the website CTEnergyInfo.com 2% 1% Called the toll-free number 877WISE-USE Q17B, Q21B & Q22B In the past month, have you read or heard anything about the resources that are available to help you save energy in your home or make use of renewable energy? Aug 2012 Sept 2013 100% 80% 60% 40% 20% 16% 16% 0% Yes Q11A Program Participation Presentation Name 28 Have you ever participated in a program to save energy at your home or one that helps you make use of renewable energy? 20% Yes 21% Sept 2013 Aug 2012 0% 20% 40% QD1 (Ask if participated in a program) In which program did you participate? 16% The “Home Energy Solutions” program Other/general renewable energy program 15% 4% Other/general home audit/energy kit program 12% Incentives and rebates for high efficiency furnaces and boilers, air conditioners, hot water heaters, appliances and insulation 7% 8% 4% 4% Done independently/not sponsored by a program 1% Photovoltaic system purchase or lease program 3% 1% Done through other state A program for limited-income homeowners or renters 9% 6% Retail products available through stores and online Balanced billing/reduced rate/other discounted billing 15% 15% 16% Program through utility (unspecific) Recycling 23% 5% 0% 3% 0% 3% Sept 2013 (n=81) 0% 1% Aug 2012 (n=84) Other 7% 9% Don’t know/Refused 19% 12% 0% 5% 10% 15% 20% 25% QD2 Where Does Connecticut Go from Here? Presentation Name 31 The Challenges Moderate to low awareness of programs in general Depth of knowledge is low Awareness of EE brands is low Barriers to program participation include: Belief that have already done all that can be done to save Split incentive problem Lack of interest Lack of efficacy Cost of improvements/ROI Presentation Name 32 Strengths and Opportunities Desire and political will to make CT #1 in energy efficiency CT already has award-winning HES program. Future program focus includes: Low-cost financing partnerships Deeper savings Improved program marketing through segmentation and microtargeting Presentation Name 33 Customer Segmentation and Microtargeting What it is and what can be achieved Presentation Name 34 Three-Layer Approach to Microtargeting and Segmentation Consider three layers of engagement for each customer Likely Adoption (function of attitudes/beliefs, trust in utility, perceived opportunity, perceived ability to act) Energy Opportunities (function of home, equipment, load shapes) Propensity to Act Energy Savings Potential Relevant Messaging (function of barriers, motivations, attitudes/beliefs; related to sociodemographics) Customer Segmentation Propensity models based on past participation incorporate adoption decision (explicit) and perceived opportunity (implicit). E.g., “Mass customization” of building energy savings models frame specific opportunities for customers. Energy-specific segmentation informs positioning and messaging 35 Segmentation and microtargeting go hand-in-hand Segmentation Propensity to Act Segmentation defines and divides a large population into identifiable groups based on similar characteristics Customers within each segment share similar barriers and drivers, and may be interested in similar types of offerings Medium Complacent Consumers Lowest Not Motivated Impact Seekers Rebate Opportunists Very Motivated Renters Resigned Retirees Low Ability High score: Best target for program Simple Savers Use segment insights for positioning Demand Response Home Energy Audit Segment 20010203 2 99 B 11212322 66 41 A 29215134 20 16 A 44321278 31 50 C Account High Ability Past Participation Highest Microtargeting scores individual customers on their likelihood to take a specific action The best “targets” from microtargeting may belong to different segments Microtargeting ≠ Targeting: Traditional “targeting” may identify one segment (e.g., homeowners, “leaning green”), and market to all of them. Within the target segment, individual customers may be more or less likely to participate because of unique barriers or traits. 36 Microtargeting Scores can be used “vertically” and “horizontally” Score for each customer, for each product/offering Portfolio management: Prioritize what to market to each customer based on relative scores Ready-made target list for each product/offering: Go “as far down” as goals and budget require High score; best target for offering Customer segment informs positioning Low score; poor target for offering Account Home Energy Audit Solar PV Lease Demand Response “Barriers” Segment 200102030 99 1 86 A 112123221 41 89 66 C 292151312 82 94 44 A 37 Case Study: Arizona Public Service Assigned propensity scores to all 990,000 residential customers of a US utility Propensity to adopt existing EE and DR programs, and pricing products Propensity to adopt new programs/products (e.g., planning phase) Developed customer segmentation around ability & motivation to save energy Solar PV / Solar H2O DR and Critical Peak Pricing Audits / Diagnostics Electric Vehicles Envelope Measures Low-income and “equal payment” rate plans 38 Increased response rates with “microtargeting” propensity scores and tailored messaging 1% Typical response rate before propensity scores This is without customized energy opportunities – Can we improve further? 4% New typical response rate using propensity scores (typically 80+) 5.7% Response rate using propensity scores and tailored messaging 39 Profile High-Propensity Customers Home Energy Audit (HPwES) APS Engagement Registered HP 93% Opted In Others 42% HP 52% Spanish Preference Others 21% HP 0% Others 3% Years as a Customer Last Payment Method 41% 40% 41% 34% 27% 32% 18% 26% 25% 21% 12% 15% 3% Surepay APS.com 7% Auto 5% Mail 0% Online ■ HP ■ Others 10% Phone Equalizer 0% 28% 24% 23% 12% 7% 10% New 1-4 years 5-9 years customers 10-19 years 20 years or more ■ HP ■ Others 40 Home Energy Audit (HPwES) Demographics and Psychographics Age 7% 7% Under 24 11% 25-34 Top Barriers Segments 1 2 3 4 5 Top PRIZM Codes 22% 17% 11% 8% 8% Impact Seekers Thoughtful Spenders Recession-Hit Resigned Retirees Simple Savers 1 2 3 4 5 Big Fish, Small Pond Country Squires Upper Crust Upward Bound Movers & Shakers Married Single Unknown 9.4% 8.1% 6.4% 5.7% 5.4% Children under 18 Others 49% 9% 42% 13% 12% 65-74 8% 9% 16% 14% 14% 11% 12% 13% 12% 7% 5% 4% 3% 0% 0% 15k and 15k to 25k to 35k to 50k to 75k to 100k to 150k to 200k Unknown under 24,999 34,999 49,999 74,999 99,999 149,999 199,000 and up ■ HP ■ Others 0% 0% ■ HP ■ Others Less than HS degree High school graduate or equiv. Some college, no degree College graduate Graduate or professional degree Unknown 19% 4% 17% Highest level of Education 24% 3% 20% 55-64 HP Others 34% 24% 21% 9% 22% 21% 45-54 Unknown Annual Income 10% 19% 20% 35-44 75+ Marital Status HP 60% 2% 38% 14% Professional Sales Farm Blue collar Retired Unknown Occupation HP 50% 22% 0% 5% 18% 1% HP 3% 15% 26% 35% 20% 1% Others 17% 21% 36% 16% 8% 2% Others 25% 33% 1% 16% 18% 2% Multiple stages from awareness to participation, and different characteristics/factors may affect conversion at each stage Metrics Measurement Opportunities Awareness / Knowledge General population and non-part surveys Intention Inquiries, leads, incomplete applications that link to customer database by account # Qualification Ex ante: Filter database by qualifying criteria Ex post: Program qualification rates Participation Program participation rates Portfolio-level participation: What % of all segment members have participated in any EE? Engagement Online/device tracking; equipment monitoring Participant surveys Impacts Realization rates by segment Savings “depth” by segment (% savings) Measure mix by segment 42 Community Targeting An alternative approach for hard-toreach communities Case Study: Massachusetts Efficient Neighborhoods+ Initiative Increase participation in Mass Save® Home Energy Services (HES) program among lower to moderate income customers Design a program that effectively targets these customers and addresses their unique barriers to participation Staying on Target 44 Barriers to Participation No point of contact 41% of Massachusetts housing stock is multi-unit structures Higher Job Costs Income verification screening Split Incentives Pre-Weatherization Barriers Staying on Target 45 Initiative Design Based on existing HES program To address barriers, provided increased incentives and other support (landlord, pre-weatherization, etc.) Target communities/neighborhoods based on population: High concentration of target customers 60% - 120% of state median income 1-4 unit buildings No income pre-qualification -- open to nearly all members of the community Low-income customers and customers in 5+ unit structures do not qualify and are referred to other programs Staying on Target 46 Step 1: Initial Analysis to Narrow Target Communities Qualifying communities: • 30% of households or more have incomes between 61% and 100% of the state median income • No more than 30% of households are in 5+ unit structures Qualifying communities: 311 census block groups • • 112 towns with at least one qualifying census block group • 43,253 households Staying on Target 47 Step 2: In-Depth Community Analysis Staying on Target 48 Step 3: Development Customer Targeting Lists Staying on Target 49 Achieving Deep Savings Looking Beyond Equipment Staying on Target 50 Case Study: Commonwealth Edison Energy Usage and Waste Analysis Study commissioned to address two primary research objectives Provide data to inform program planning - identify gaps in current program offerings and opportunities to achieve deeper savings Provide updated end use baseline data to support a potential study and quantification of behavioral “waste” Research objectives require detailed electricity usage profiles by segment and end-use 51 Study Theory End Use Profile Percentage of Total Annual GWh Lighting Current Usage: How much electricity actually goes to each end use? Waste Profile Percentage of Annual Lighting GWh Waste: How much of the remaining usage is due to inefficient equipment vs. wasteful behavior? Efficient Usage: How little lighting energy could be used if all customers installed efficient lamps and turned lights off when not needed? 52 Residential Usage and Waste Summary Energy Use Classified in Baseline Study Technology Waste: 28-37% 28% Efficient Usage 51% 9% Shared Waste* 12% Behavioral Waste: 12-21% * Either technology or behavioral waste, depending on which is addressed first 53 Residential Cooling : Usage and Waste Results Penetration: 97% Technology Waste: 26-34% Current Usage: 15% (4,268 GWh) Upgrade to new Energy Star units (58%) Add duct sealing (16%) Add insulation (27%) 26% 15% Efficient Usage 36% 8% Shared Waste 31% Behavioral Waste: 31-39% Increase temperature setpoints (93%) Perform annual system maintenance (7%) 54 Key Take Away and Use of Findings Behavioral waste comprises a substantial share of savings potential in residential and commercial sectors ~24 – 42% Residential ~ 31 – 46 % Commercial Behavioral waste on par with or greater than savings from increased equipment efficiency for key end uses Analysis allows us characterize waste and savings opportunities and select strategies to achieve deeper savings Combine usage and waste analysis with load shape, billing and demographic data for enhanced customer targeting 55 Additional Results Presentation Name 56 Key Findings Awareness of and interest in energy efficiency and renewable programs has changed little since August 2012 when a baseline survey was conducted Approximately half of Connecticut residents are aware of energy efficiency programs and one-fifth to one-quarter are aware of renewables programs (changes between 2012 and 2013 are small and not statistically significant) Of those who are aware of renewables program, more are “very familiar” compared to 2012 As in 2012, more Connecticut residents are aware of programs that target improved energy efficiency of their homes than of renewable programs Residents are equally interested in learning more about both types of programs When asked to describe the help provided by energy efficiency programs, more residents mention energy audits in 2013 than in 2012 and fewer mentioned home weatherization. Key Findings (2) Compared to 2012, more residents mentioned rebates, financing and tax incentives in 2013 when asked to describe the help provided for people wanting to make use of renewable energy sources. Rebates were mentioned more frequently than either financing or tax credits. (Due to small sample sizes, these differences were not statistically significant). Those who are aware of the programs have difficulty naming the organizations offering the programs – only half can do so. Among those who can, most say it is their utility. Self-reported participation in energy efficiency and renewables programs remains the same in 2013. Approximately one in five report participating in these programs both years. Slightly over half of Connecticut residents are “somewhat” or “very” interested in learning more about energy efficiency or renewables programs. This is unchanged from 2012. Reasons for being interested in these programs are also unchanged from 2012. Saving money is a leading reason for both programs though helping the environment is mentioned more frequently when talking about renewables. Presentation Name 58 Key Findings (3) Information seeking behavior has not changed since 2012. Approximately one-third of residents in both years have ever attempted to find information on how to save energy or renewables. General internet searches remain the leading source of information both in terms of where people have gone for energy efficiency information and where they would go for trustworthy information in the future. 5% of respondents mentioned they had gone to CTEnergyinfo.com in 2013. None mentioned the website in 2012. Connecticut residents are no more likely to have read or heard about energy efficiency or renewables in 2013 than they were in 2012 in the past month 16% in both years Connecticut residents are not more aware of how to save energy or renewable energy today than they were three months ago. Three quarters say they are not more aware This is the same result as 2012 Presentation Name 59 Key Findings (4) Familiarity with the different organizations and agencies that provide energy efficiency assistance is low. Likewise, few have visited the websites associated with these groups or called the Wise Use number. Awareness of “Energize Connecticut” remains low but is significantly higher than in 2012. In 2013, 8% report being “very” or “somewhat” familiar compared to 4% in 2012. There are few group differences in awareness of and interest in energy efficiency and renewable programs. Those that exist are as we might expect: Better educated residents, middle aged to older adults, home owners, and past participants are more aware of programs Previous participants and middle aged adults are most interested in programs Better educated and middle aged Connecticut residents are more likely to have participated in programs and sought out information on energy efficiency How familiar are you with: Connecticut Clean Energy Fund 100% 2% 17% 80% 13% 4% 16% 14% Connecticut Energy Efficiency Fund 2% 3% 15% 16% 12% Clean Energy Finance and Investment Authority (CEFIA) 9% 3% 2% 9% 3% 88% 86% 13% 60% 40% 69% 66% 71% 68% 20% 0% Aug 2012 Sept 2013 Not at all familiar Aug 2012 Sept 2013 Somewhat familiar Not too familiar Aug 2012 Sept 2013 Very familiar Q18 How familiar are you with: Community based programs such as Connecticut Clean Energy Communities 100% 2% 22% 80% 12% 3% 26% Connecticut Neighbor to Neighbor Energy Challenge 1% 8% 4% 2% 10% 3% 11% 60% 40% 64% 61% Aug 2012 Sept 2013 86% 84% Aug 2012 Sept 2013 20% 0% Not at all familiar Somewhat familiar Not too familiar Very familiar Q13 & Q14