1.5 Theory of the firm and market structures (HL only) Production

advertisement

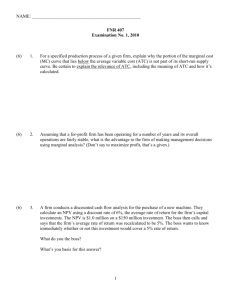

SECTION 1.5A THEORY OF THE FIRM AND MARKET STRUCTURES (HL ONLY) PRODUCTION AND COSTS 1. Distinguish between the short run and long run in the context of production. Short run is a period of time when at least one of the factors of production is fixed. Usually labor is the easiest factor to change. Thus in short run a firm can increase production only by employing more labor because no more land or capital is available. Thus, labor is the variable factor in the short run. The planning period over which a firm can consider all factors of production as variable is called the long run. In the long run, firm may contemplate alternatives such as modifying the building or building a new facility. 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. Marginal product (MP) is the change in total output when one more input is employed. MP = Change in total product / Change in number of inputs Average product (AP) is the total product divided by the number of inputs producing it. AP = Total product / Number of workers Total product (TP) is the total quantity of output produced by a firm for a given quantity of inputs. TP = Total Output 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. Production function It is the equation that expresses the relationship between the quantities of productive factors (such as labor and capital) used and the amount of product obtained. It states the amount of product that can be obtained from every combination of factors, assuming that the most efficient available methods of production are used. 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. A production function shows the relationship between the quantity of inputs used to produce a good, and the quantity of output of that good. It can be represented by a table, equation, or graph. Example: Farmer Jack grows wheat. He has 5 acres of land. He can hire as many workers as he wants. Example: Farmer Jack’s Production Function Q (no. of (bushels workers) of wheat) 3,000 Quantity of output L 2,500 0 0 1 1000 2 1800 3 2400 500 4 2800 0 5 3000 2,000 1,500 1,000 0 1 2 3 4 No. of workers 5 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. The marginal product of any input is the increase in output arising from an additional unit of that input, holding all other inputs constant. Example: if Farmer Jack hires one more worker, his output rises by the marginal product of labor. Notation: ∆ (delta) = “change in…” Examples: ∆Q = change in output, ∆L = change in labor ∆Q Marginal product of labor (MPL) = ∆L EXAMPLE : Total & Marginal Product L Q (no. of (bushels workers) of wheat) ∆L = 1 0 1 ∆L = 1 ∆L = 1 ∆L = 1 ∆L = 1 2 3 4 5 0 MPL ∆Q = 1000 1000 ∆Q = 800 800 ∆Q = 600 600 ∆Q = 400 400 ∆Q = 200 200 1000 1800 2400 2800 3000 EXAMPLE: MPL = Slope of The Total Product Curve Q (no. of (bushels MPL workers) of wheat) 0 0 1000 1 1000 800 2 1800 600 3 4 5 2400 2800 3000 400 200 MPL 3,000 Quantity of output L equals the slope of the 2,500 production function. 2,000 Notice that MPL diminishes 1,500 as L increases. 1,000 This explains why 500 production the function gets flatter 0 as L0 increases. 1 2 3 4 No. of workers 5 Why MPL Is Important? Recall one of the Ten Principles: Rational people think at the margin. When Farmer Jack hires an extra worker, his costs rise by the wage he pays the worker his output rises by MPL Comparing them helps Jack decide whether he would benefit from hiring the worker. 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. Product curves It can be observed that, at first, the marginal product curve increases and then decreases. The marginal product curve cuts the average product curve when average product are at their peak. 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. 2. Define total product, average product and marginal product, and construct diagrams to show their relationship. How is this pattern explained? With a small number of workers, output is low and a division of labor cannot be employed, and workers cannot specialize or develop new skills. However, marginal returns increase quickly as specialization occurs and efficiency increases. This creates the opportunity for labor to develop skills and become more productive. Eventually, marginal returns diminish as the effects of specialization and new skills wear off. This pattern has a considerable impact on the firm’s short-run cost curves. 3. Explain the law of diminishing returns. Law of increasing returns: This states that as more units of variable factor are added to a fixed factor, output will first rise more than proportionately. Thus, the firm experiences increasing returns. (Usually due to specialization) Law of diminishing returns: The law states that as more units of a variable factor are added to a fixed factor, there will come a point when output will rise less than proportionately. The firm experiences diminishing returns. (Usually due to sharing the fixed resources) 3. Explain the law of diminishing returns. This graph shows firm's total product curve with the ranges of increasing marginal returns, diminishing marginal returns, and negative marginal returns marked. This firm experiences increasing marginal returns between 0 and 3 units of labor per day, diminishing marginal returns between 3 and 7 units of labor per day, and negative marginal returns beyond the 7th unit of labor. 3. Explain the law of diminishing returns. Diminishing marginal product: the marginal product of an input declines as the quantity of the input increases (other things equal) Example: Farmer Jack’s output rises by a smaller and smaller amount for each additional worker. Why? If Jack increases workers (variable input) but not land, (fixed input) the average worker has less land to work with, so will be less productive. In general, MPL diminishes as variable inputs rises whether the fixed input is land or capital (equipment, machines, etc.). 4. Calculate total, average and marginal product from a set of data and/or diagrams. HOW TO: Total product is the output of workers as the number of workers increases. Average product is the “output per worker” = Total Product/ number of workers Marginal product is the “output of the last worker” = Change in total product / change in the number of workers. 4. Calculate total, average and marginal product from a set of data and/or diagrams. Consider the following example: Returns to labor Assuming one factor is fixed, the addition of extra workers will result in increasing returns followed eventually by diminishing returns. WORKERS 1 2 3 4 5 6 7 8 9 TOTAL PRODUCT 6 16 28 42 56 66 69 70 69 AVERAGE PRODUCT MARGINAL PRODUCT 5. Explain the meaning of economic costs as the opportunity cost of all resources employed by the firm (including entrepreneurship). Accounting costs are the costs most often associated with the costs of producing. Economic costs are not only the costs of producing a good, it also includes the opportunities forgone by producing this product. Example: If a firm is producing Computers then the accounting costs are the costs incurred for producing the computers. Economic costs include the cost of producing the computers as well as opportunity cost. Suppose, If this firm could lease its office and the plant for say $100,000 then that is the opportunity cost. 6. Distinguish between explicit costs and implicit costs as the two components of economic costs. Explicit costs – require an outlay of money, e.g. paying wages to workers Implicit costs – do not require a cash outlay, e.g. the opportunity cost of the owner’s time Depreciation is considered a explicit cost. Depreciation is the decrease in value due to wear and tear, decay, decline in price, etc. 6. Distinguish between explicit costs and implicit costs as the two components of economic costs. Explicit vs. Implicit Costs: An Example You need $100,000 to start your business. The interest rate is 5%. Case 1: borrow $100,000 explicit cost = $5000 interest on loan Case 2: use $40,000 of your savings, borrow the other $60,000 explicit cost = $3000 (5%) interest on the loan implicit cost = $2000 (5%) foregone interest you could have earned on your $40,000. In both cases, total (exp + imp) costs are $5000. 6. Distinguish between explicit costs and implicit costs as the two components of economic costs. Accounting profit = total revenue minus total explicit costs Economic profit = total revenue minus total costs (including explicit and implicit costs) Accounting profit ignores implicit costs, so it’s higher than economic profit. 6. Distinguish between explicit costs and implicit costs as the two components of economic costs. Economic Profit versus Accounting Profit When total revenue exceeds both explicit and implicit costs, the firm earns economic profit. Economic profit is smaller than accounting profit. Sometimes referred to as: Super Normal Profit Monopoly Profit Producer Surplus Above Normal profit Abnormal profit Normal Profit is when total revenue just equals explicit and implicit cost. (Break even or Zero Economic Profit) Figure 1 Economic versus Accountants How an Economist Views a Firm How an Accountant Views a Firm Economic profit Accounting profit Revenue Implicit costs Revenue Total opportunity costs Explicit costs Explicit costs CHAPTER 13 THE COSTS OF PRODUCTION Copyright © 2004 South-Western 7. Explain the distinction between the short run and the long run, with reference to fixed factors and variable factors. In the short run, because at least one factor of production is fixed, output can be increased only by adding more variable factors. Hence we consider both fixed and variable costs. Fixed costs Fixed costs are business expenses that do not vary directly with the level of output i.e. they are treated as independent of the level of production. Examples of fixed costs include the rental costs of buildings; the costs of leasing or purchasing capital equipment such as plant and machinery. 7. Explain the distinction between the short run and the long run, with reference to fixed factors and variable factors. Variable Costs Variable costs are costs that vary directly with output. Examples of variable costs include the costs of intermediate raw materials and other components, the wages of part-time staff or employees paid by the hour, the costs of electricity and gas and the depreciation of capital inputs due to wear and tear. The planning period over which a firm can consider all factors of production as variable is called the long run. In the long run, firm may contemplate alternatives such as modifying the building or building a new facility. 8. Distinguish between total costs, marginal costs and average costs. Total cost It is composed of all the fixed cost and variable cost put together. TC= VC+FC Marginal Cost It is the cost of production for adding one extra unit of output. Marginal costs are variable costs consisting of labor and material costs, plus an estimated portion of fixed costs (such as administration overheads and selling expenses). Change in total cost / Change in output Average Cost It is the Total cost of production divided by total output. AC=TC/output 8. Distinguish between total costs, marginal costs and average costs. Total fixed costs Given that total fixed costs (TFC) are constant as output increases, the curve is a horizontal line on the cost graph. Total variable costs The total variable cost (TVC) curve slopes up at an accelerating rate, reflecting the law of diminishing marginal returns. Total costs The total cost (TC) curve is found by adding total fixed and total variable costs. Its position reflects the amount of fixed costs, and its gradient reflects variable costs. 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Average fixed costs Average fixed costs are found by dividing total fixed costs by output. As fixed cost is divided by an increasing output, average fixed costs will continue to fall. The average fixed cost (AFC) curve will slope down continuously, from left to right. 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Average variable costs Average variable costs are found by dividing total fixed variable costs by output. The average variable cost (AVC) curve will at first slope down from left to right, then reach a minimum point, and rise again. AVC is ‘U’ shaped because of the principle of variable Proportions, which explains the three phases of the curve: Increasing returns to the variable factors, which cause average costs to fall, followed by: Constant returns, followed by: Diminishing returns, which cause costs to rise. 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Average total cost Average total cost (ATC) is also called average cost or unit cost. Average total costs are a key cost in the theory of the firm because they indicate how efficiently scarce resources are being used. Average variable costs are found by dividing total fixed variable costs by output. Average total cost (ATC) can be found by adding average fixed costs (AFC) and average variable costs (AVC). The ATC curve is also ‘U’ shaped because it takes its shape from the AVC curve, with the upturn reflecting the onset of diminishing returns to the variable factor 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Areas for total costs: Total Fixed costs and Total Variable costs are the respective areas under the Average Fixed and Average Variable cost curves. TC = ATC x Q VC = AVC x Q FC = (ATC – AVC) x Q 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Marginal costs Marginal cost is the cost of producing one extra unit of output. It can be found by calculating the change in total cost when output is increased by one unit. It is important to note that marginal cost is derived solely from variable costs, and not fixed costs. The marginal cost curve falls briefly at first, then rises. Marginal costs are derived from variable costs and are subject to the principle of variable proportions. 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. The significance of marginal cost The marginal cost curve is significant in the theory of the firm for two reasons: It is the leading cost curve, because changes in total and average costs are derived from changes in marginal cost. The lowest price a firm is prepared to supply at is the price that just covers marginal cost. ATC and MC Average total cost and marginal cost are connected because they are derived from the same basic numerical cost data. The general rules governing the relationship are: Marginal cost will always cut average total cost from below. When marginal cost is below average total cost, average total cost will be falling, and when marginal cost is above average total cost, average total cost will be rising. A firm is most productively efficient at the lowest average total cost, which is also where average total cost (ATC) = marginal cost (MC). EXAMPLE 2: Why ATC Is Usually U-Shaped $200 As Q rises: Eventually, rising AVC pulls ATC up. $150 Costs Initially, falling AFC pulls ATC down. $175 $125 $100 $75 $50 $25 $0 0 1 2 3 4 Q 5 6 7 EXAMPLE 2: ATC and MC ATC MC $200 Average Marginal Rule: $175 When MC < ATC, $125 Costs ATC is falling. $150 $100 When MC > ATC, $75 ATC is rising. $50 The MC curve crosses the ATC curve at the ATC curve’s minimum. $25 $0 0 1 2 3 4 Q 5 6 7 Efficient Scale The bottom of the U-shaped ATC curve occurs at the quantity that minimizes average total cost. This quantity is sometimes called the efficient scale of the firm. Efficient scale , MC = ATC Efficient scale is the quantity that minimizes average total cost. EXAMPLE 2: The Various Cost Curves Together $200 $175 ATC AVC AFC MC Costs $150 $125 $100 $75 $50 $25 $0 0 1 2 3 4 Q 5 6 7 9. Draw diagrams illustrating the relationship between marginal costs and average costs, and explain the connection with production in the short run. Total costs and marginal costs Marginal costs are derived exclusively from variable costs, and are unaffected by changes in fixed costs. The MC curve is the gradient of the TC curve, and the positive gradient of the total cost curve only exists because of a positive variable cost. Sunk costs Sunk costs are those that cannot be recovered if a firm goes out of business. Examples of sunk costs include spending on advertising and marketing, specialist machines that have no scrap value, and stocks which cannot be sold off. Sunk costs are a considerable barrier to entry and exit. 10. Explain the relationship between the product curves (average product and marginal product) and the cost curves (average variable cost and marginal cost), with reference to the law of diminishing returns. The check-shape of the marginal cost curve is closely related to the humpshape of the marginal product curve. Because variable cost is largely associated with the cost of employing a variable input in the short run, it is possible to identify a connection between the marginal cost curve and the marginal product curve. The quantity of output in which marginal cost is at a minimum is the same quantity of output produced by the variable input when the marginal product of the variable input is at a maximum. Over the range of production in which marginal product increases and the variable input experiences increasing marginal returns, the marginal cost curve declines. (Due to specialization) Over the range of production in which marginal product increases and the variable input experiences decreasing marginal returns brought on by the law of diminishing marginal returns, the marginal cost curve is rising. (Due to over use of fixed inputs) ` 10. Explain the relationship between the product curves (average product and marginal product) and the cost curves (average variable cost and marginal cost), with reference to the law of diminishing returns. 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. HOW TO: TFC is constant as output increases. It is the firm’s total cost when output = 0. TVC increases as output increase, at first at a decreasing rate (due to increasing returns), and then at an increasing rate (due to diminishing marginal returns). TC = TVC + TFC. If you know the firm’s fixed costs and its variable costs, TC can easily be calculated. EXAMPLE 2: Costs Q FC VC TC $800 FC $700 VC $0 $100 $600 1 100 70 170 $500 2 100 120 220 3 100 160 260 4 100 210 310 5 100 280 380 6 100 380 480 7 100 520 620 Costs 0 $100 TC $400 $300 $200 $100 $0 0 1 2 3 4 Q 5 6 7 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. AFC = TFC / Q of output. AFC falls as output increases as the firm “spreads its overhead”. Graphically, it is the distance between AVC and ATC. AVC = TVC / Quantity of output. AVC falls at first due to increasing returns and then increases due to diminishing returns. MC and AVC should intersect at the lowest point of AVC ATC = AFC + AVC, or TC / Quantity of output. ATC lies ABOVE the AVC curve (since it includes the average fixed costs), and will intersect MC at its lowest point. 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. OUTPUT TOTAL FIXED COST 1 2 3 4 5 6 7 8 100 100 100 100 100 100 100 100 AVERAGE FIXED COST 100 50 33.3 25 20 16.6 14.3 12.5 EXAMPLE 2: Average Fixed Cost FC 0 $100 1 2 100 100 AFC n.a. $100 50 3 100 33.33 4 100 25 5 100 20 6 100 16.67 7 100 14.29 $200 Average fixed cost (AFC) is$175 fixed cost divided by the quantity of output: $150 Costs Q AFC $125 = FC/Q $100 Notice $75 that AFC falls as Q rises: The firm is spreading its fixed $50 costs over a larger and larger $25 number of units. $0 0 1 2 3 4 Q 5 6 7 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. OUTPUT TOTAL VARIABLE COST 1 2 3 4 5 6 7 8 50 80 100 110 150 220 350 640 AVERAGE VARIABLE COST 50 40 33.3 27.5 30 36.7 50 80 EXAMPLE 2: Average Variable Cost VC AVC 0 $0 n.a. 1 70 $70 2 120 60 3 160 53.33 4 210 52.50 5 280 56.00 6 380 63.33 7 520 74.29 $200 Average variable cost (AVC) is$175 variable cost divided by the quantity of output: $150 Costs Q AVC $125 = VC/Q $100 As$75 Q rises, AVC may fall initially. In most cases, AVC will $50 eventually rise as output rises. $25 $0 0 1 2 3 4 Q 5 6 7 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. OUTPUT 1 2 3 4 5 6 7 8 AVERAGE FIXED COST 100 50 33.3 25 20 16.6 14.3 12.5 AVERAGE VARIABLE COST 50 40 33.3 27.5 30 36.7 50 80 AVERAGE TOTAL COSTS 150 90 67 52.5 50 53.3 64.3 92.5 EXAMPLE 2: Average Total Cost Q TC 0 $100 1 170 ATC $200 Usually, as in this example, $175 the ATC curve is U-shaped. n.a. $150 $170 2 220 3 260 86.67 4 310 77.50 5 380 76 $25 6 480 80 $0 7 620 88.57 Costs 110 $125 $100 $75 $50 0 1 2 3 4 Q 5 6 7 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. MC = the change in TC / the change in output. It is the cost of the last unit produced. MC sloped down when a firm’s workers experience increasing returns and upwards once the firm experiences diminishing marginal returns. 11. Calculate total fixed costs, total variable costs, total costs, average fixed costs, average variable costs, average total costs and marginal costs from a set of data and/or diagrams. OUTPUT 1 2 3 4 5 6 7 8 TOTAL COST 150 180 200 210 250 320 450 740 MARGINAL COST 30 20 10 40 70 130 290 EXAMPLE 1: The Marginal Cost Curve 0 TC MC $1,000 $2.00 1000 $3,000 $2.50 1800 $5,000 $3.33 2400 $7,000 2800 $9,000 3000 $11,000 $10 Marginal Cost ($) Q (bushels of wheat) $12 $8 MC usually rises as Q rises, as in this example. $6 $4 $2 $5.00 $10.00 $0 0 1,000 2,000 Q 3,000 12. Costs in the Short Run & Long Run Short run: Some inputs are fixed (e.g., factories, land). The costs of these inputs are FC. Long run: All inputs are variable (e.g., firms can build more factories, or sell existing ones) In the long run, ATC at any Q is cost per unit using the most efficient mix of inputs for that Q (e.g., the factory size with the lowest ATC). 12. Distinguish between increasing returns to scale, decreasing returns to scale and constant returns to scale. Increasing return to scale: A given proportional change in all resources in the long run results in a proportional greater change in production. Decreasing returns to scale: A given proportionate increase in all resources in the long run results in a proportionately smaller increase in production. Constant returns to scale: The property whereby long-run average total cost stays the same as the quantity of output changes. 13. Explain the relationship between short-run average costs and long-run average costs. Long run costs The firm’s long run average cost shows what is happening to average cost when the firm expands, and is at a tangent to the series of short run average cost curves. Each short run average cost curve relates to a separate stage or phase of expansion. 14. Explain, using a diagram, the reason for the shape of the long-run average total cost curve. The long run cost curve for most firms is assumed to be ‘U’ shaped, because of the impact of internal economies and diseconomies of scale. However, economic theory suggests that average costs will eventually rise because of diseconomies of scale. EXAMPLE 3: LRATC with 3 factory Sizes Firm can choose from 3 factory sizes: S, M, L. Each size has its own SRATC curve. The firm can change to a different factory size in the long run, but not in the short run. Avg Total Cost ATCS ATCM ATCL Q EXAMPLE 3: LRATC with 3 factory Sizes To produce less than QA, firm will choose size S in the long run. To produce between QA and QB, firm will choose size M in the long run. To produce more than QB, firm will choose size L in the long run. Avg Total Cost ATCS ATCM ATCL LRATC QA QB Q A Typical LRATC Curve ATC In the real world, factories come in many sizes, each with its own SRATC curve. So a typical LRATC curve looks like this: LRATC Q How ATC Changes As the Scale of Production Changes Economies of scale: ATC falls as Q increases. ATC LRATC Constant returns to scale: ATC stays the same as Q increases. Diseconomies of scale: ATC rises as Q increases. Q Long Run Average Cost Curve The long run average cost curve shows the least-cost method of production of any given level of output. It is often drawn U-shaped (though in practice will vary) to show that initially there may be economies of scale which reduce the cost per unit. Subsequently there may be constant returns to scale where the cost per unit remains the same and eventually the cost per unit may begin to rise as diseconomies of scale set in. Long Run Average Cost Curve Long Run Average Total Cost (LRATC) LRATC of producing a given level of output when all input can vary. LRATC curve is constructed as the least cost of all possible short run cost curves. (NOTE) No AFC in the long-run. In the long run all inputs are variable, so no fixed costs. LRATC is equal to long run AVC (since all costs are variable). 15. Explain factors giving rise to economies of scale, including specialization, efficiency, marketing and indivisibilities. Economies of scale are any decrease in long-run average costs that come about when a firm alters all of its factors of production in order to increase its scale of output. More common when Quantity is low. Examples: Specialization Division of labor Bulk buying Financial economies Transportation economies Large machines Promotional economies 15. Explain factors giving rise to economies of scale, including specialization, efficiency, marketing and indivisibilities. Types of economy of scale: Technical economies are the cost savings a firm makes as it grows larger, and arise from the increased use of large scale mechanical processes and machinery. For example, a mass producer of motor vehicles can benefit from technical economies because it can employ mass production techniques and benefit from specialization and a division of labor. Purchasing economies are gained when larger firms buy in bulk and achieve purchasing discounts. For example, a large supermarket chain can buy its fresh fruit in much greater quantities than a small fruit and vegetable supplier. Administrative savings can arise when large firms spread their administrative and management costs across all their plants, departments, divisions, or subsidiaries. For example, a large multinational can employ one set of financial accountants for all its separate businesses. 15. Explain factors giving rise to economies of scale, including specialization, efficiency, marketing and indivisibilities. Types of economy of scale: Large firms can gain financial savings because they can usually borrow money more cheaply than small firms. This is because they usually have more valuable assets which can be used as security (collateral), and are seen to be a lower risk, especially in comparison with new businesses Risk bearing economies are often derived by large firms who can bear business risks more effectively than smaller firms. For example, a large record company can more easily bear the risk of a ‘flop’ than a smaller record label. 16. Explain factors giving rise to diseconomies of scale, including problems of coordination and communication. Diseconomies of scale are any increase in long-run average costs that comes about when a firm alters all of its factors of production in order to increase its scale of output. More common when Quantity is high. Dis-economies of scale can occur for the following reasons: Poor communication in a large firm Alienation: Working in a highly specialized assembly line can be very boring, if workers become de motivated. In a large firm there is an increased gap between top and bottom e.g. call centers Lack of control: when there is a large number of workers it is easier to escape with not working very hard because it is more difficult for managers to notice shirking. 16. Explain factors giving rise to diseconomies of scale, including problems of coordination and communication. Economic theory also predicts that a single firm may become less efficient if it becomes too large. The additional costs of becoming too large are called diseconomies of scale. Examples of diseconomies include: Larger firms often suffer poor communication because they find it difficult to maintain an effective flow of information between departments, divisions or between head office and subsidiaries. Time lags in the flow of information can also create problems in terms of the speed of response to changing market conditions. For example, a large supermarket chain may be less responsive to changing tastes and fashions than a much smaller, ‘local’ retailer. Co-ordination problems also affect large firms with many departments and divisions, and may find it much harder to co-ordinate its operations than a smaller firm. For example, a small manufacturer can more easily co-ordinate the activities of its small number of staff than a large manufacturer employing tens of thousands. 16. Explain factors giving rise to diseconomies of scale, including problems of coordination and communication. Internal diseconomies of scale ‘X’ inefficiency is the loss of management efficiency that occurs when firms become large and operate in uncompetitive markets. Such loses of efficiency include over paying for resources, such as paying managers salaries higher than needed to secure their services, and excessive waste of resources. ‘X’ inefficiency means that average costs are higher than would be experienced by firms in more competitive markets. Low motivation of workers in large firms is a potential diseconomy of scale that results in lower productivity, as measured by output per worker. Large firms may experience inefficiencies related to the principal-agent problem. This problem is caused because the size and complexity of most large firms means that their owners often have to delegate decision making to appointed managers, which can lead to inefficiencies. For example, the owners of a large chain of clothes retailers will have to employ managers for each store, and delegate some of the jobs to managers but they may not necessarily make decisions in the best interest of the owners Diminishing Returns versus Economies of Scale: The shape of short-run costs (MC, ATC and AVC) are determined by the law of diminishing returns. Since short-run costs are determined by the productivity of the variable resource in the short-run (labor), diminishing returns assures that at first, since a firm can expect to get MORE output for additional units of labor (as fixed capital is used more efficiently) ATC declines as output increases. But beyond a certain point, diminishing returns sets in and the additional output attributable to more units of the variable resource declines. Inevitably, a firm will experience higher and higher average costs as its output continues to grow, since it's only able to vary the amount of labor used, not capital. The shape of long run ATC is determined by economies of scale (and diseconomies of scale). All resources are variable in the long-run, but lower costs cannot be guaranteed the larger a firm gets. At first, efficiency is improved as the firm grows, but at some point it becomes ‘too big for its own good’ and costs start to rise as productivity of resources (land, labor and capital) is inhibited due to the firm's massive size. What is the difference between Diminishing Returns and Diseconomies of Scale? Diseconomies of scale and diminishing returns show how a company can suffer losses in terms of production output/higher cost when inputs are increased. Despite their similarities, the two concepts are quite different to one another. Diminishing returns to scale looks at how production output decreases as one input is increased, while other inputs are left constant (fixed). Diseconomies of scale occurs when the per unit cost rises as output is increased. Another major difference between diminishing returns and diseconomies of scale is that diminishing returns to scale occur in the short run, whereas diseconomies of scale is a problem that a company can be faced with over the long run. Diminishing Returns vs Diseconomies of Scale • Diseconomies of scale and diminishing returns are both concepts that represent how the company can end up making losses as inputs are increased in the production process. • Diminishing returns to scale looks at how production output decreases as one input is increased, while other inputs are left constant. • Diseconomies of scale refers to a point at which the company no longer enjoys economies of scale, and at which the cost per unit rises as more units are produced. • A major difference between diminishing returns and diseconomies of scale is that diminishing returns to scale occur in the short run, whereas a company faces diseconomies of scale over a longer period of time.