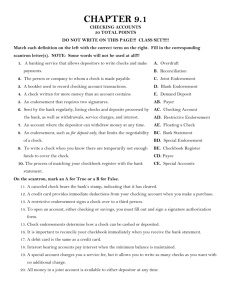

checking account - Beavercreek City School District

advertisement

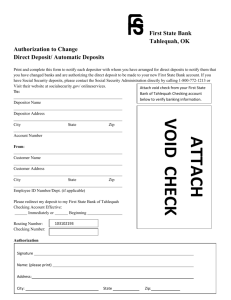

Business Math/Excel Unit Chapter 2 Bank Services Student Notes Note to Students: Most people think of cash when they think of money. Most people, however, often pay for things with checks. According to the Federal Reserve Bank of Atlanta, U.S. individuals and businesses write around 60 billion checks a year and households write an average of 25 checks a month, usually to acquire cash, pay bills, and make retail purchases. Using checks is a convenient form of payment that frees people from the risk and inconvenience of carrying around large sums of cash. In this chapter, you will be introduced to one very important bank service – the checking account. Because almost all business and personal financial transactions involve manual and electronic checking, it is important that you have a good understanding of the terminology and procedures associated with checking accounts. 2.1 THE CHECKING ACCOUNT Objective 1: Identify terms used with checking accounts A check is a written order used to tell the bank to pay money or to transfer funds from an account to the check holder. A checking account is an account opened at an institution that provides a method for payment of funds on deposit in that bank. If you are the owner of a small business, you may use a personal checking account for your individual needs. Some institutions do not charge customers for activities related to their personal checking accounts. However, if you do not keep a minimum monthly balance in the checking account, you may be charged a service fee. Institutions commonly pay interest on checking account balances. The amount depends on the institution and the monthly balance in the personal checking account. For using a business checking account, some institutions may offer additional services, such as a high interest rate on the checking account if a specific minimum balances is maintained. A checkbook includes checks along with a record of checks written on the account and deposits made into the account. A bank statement is a listing of paid checks, deposits, charges against the account, and a final balance. Reconciliation is the process of adjusting the balance in a checkbook to the bank statement balance so both balances agree. Objective 2: Identify checking account services Most banks provide a wide range of financial service related to checking accounts. For example: Employee’s paychecks or earnings can be transferred from the company and deposited directly into their checking accounts. This process is called electronic funds transfer (EFT). Loan payments can be made automatically from a checking account. Direct deposit of monthly payments, such as social security checks or payroll checks, is available. 1 Business Math/Excel Unit Chapter 2 Bank Services Student Notes The Federal Deposit Insurance Corporation (FDIC) insures the depositor’s account up to $250,000. Overdraft check protection assures that should you write a check over the amount in your account; the bank will automatically deposit funds to your account to cover the overdraft amount. Service charges may be waived when minimum amounts are kept in checking accounts. The bank will stop payment on a check and charge a service fee. One of the most popular services provided by most banks today is use of an Automated Teller Machine (ATM) card. ATM machines are located outside of banks and in many establishments such as supermarkets, convenience stores, and shopping malls. ATMs allow you 24-hour access to your account. The institution issues a plastic card, called a debit card, which contains a code number (called a PIN, or personal identification number. The bank assigns the PIN number, or you can choose your own. The number is NOT written on the card, nor should it be. The absence of the number is for your security to keep unauthorized people from using the card. Online banking can take different forms. Some online or virtual banking systems are softwarebased - meaning you need software such as Quicken or Microsoft Money in order to access your account. Other systems are Internet-based – meaning you can access your bank account from any computer that is connected to the Web. Why online banking? Visiting a branch or an ATM, paying bills by paper check (and mailing them), and reconciling or balancing a checkbook can be time-consuming. Banking online, but its nature, can automate many of these processes, saving you time and in many cases money. You can access your account and do your banking when (and where) it is convenient for you. Objective 3: Distinguish among the types of checking accounts The demand deposit account is the most common checking account. The money in the account is available to the account holder “on demand” – by writing a check, making a withdrawal, or transferring funds. Interest-bearing checking accounts, such as a money market deposit account (MMDA) earns a higher interest rate than other checking accounts but usually has a specified minimum balance and limits the number of checks that may be written per month. Money market mutual fund accounts, which pay market interest rates. Although most of these accounts allow the account holder to write an unlimited number of check, there may also be a per check minimum amount. Fees associated with checking accounts very widely among different institutions. Examples of charges include those for books of blank checks, for checks written, and for returned checks and overdrafts. Some account may carry a general service charge or may incur a fee if the minimum balance falls below a certain level. 2 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Objective 4: Maintain a checkbook and check register A check authorizes a bank to pay a certain sum from the checking account to an individual or a business knows as a payee. The person who writes the check is the drawer. The drawer’s bank is the drawee. The check below has been completed by Phillip Rochelle, the drawer. It includes the following parts: a. b. c. d. Drawer’s name and address Check number Date of check Name of party to whom the check is written (payee) e. Amount of check written in numbers and words f. Imprinted numbers to identify the bank, the account number, and the check number g. Drawer’s signature h. Bank’s name and address i. ABA (American Bankers Association) transit number The handwritten information on the check can also be completed on a check writer or a computer. The signature, however, must be written by hand. A facsimile signature can also be affixed with a signature machine or when printing checks using a computer. Check Writing Tips A check is a form of money and should be protected. Fill in all information clearly so it cannot be altered. Use a pen when filling out a check. Black ink is best. Do not use a pencil, felt-tip marker, or pen with colored ink (such as red). Ink from a pen cannot be easily erased or smeared. Use the current date on a check. To avoid alteration, write out the date instead of using numerical abbreviations. Be sure to write clearly. 3 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Make sure the written amount is exactly the same as the numerical amount. If the two amounts differ, the written amount is considered legally binding. Sign your name neatly. Your signature should match the one on file. Illegible handwriting is easy to forge. Deposit Slip A deposit slip is completed when cash (currency or coin) and/or checks are deposited to a checking account. The depositor fills in the form. The depositor, Phillip Rochelle, has prepared the deposit slip shown below. The deposit slip contains the following information: a. Depositor’s name and address, which are usually preprinted b. Date of deposit c. Depositor’s signature for any cash received d. Bank’s name and address e. Bank’s identification number and depositor’s account number ABA (American Bankers Association) transit number f. Amount of currency and coin g. Subtotal amount deposited h. Amount of cash depositor receives i. Net deposit, which is the actual amount being deposited into account To help identify each deposited check, Mr. Rochelle listed each check’s ABA transit number on the deposit slip. The ABA number is usually located in the upper right corner of the check somewhere below the check number it may appear as a fraction, such as 14-88/650. The top numbers identify city or state in which the bank is located and the specific bank on which the check is drawn. The bottom number identifies the Federal Reserve District where the check will be cleared and is the routing number used by the Federal Reserve Bank. These numbers allow the check to be traced more easily should it become lost. 4 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Endorsements Checks must be signed on the back before the bank will cash or deposit it. The signature is known as an endorsement. Blank endorsement – just a signature. This endorsement would allow anyone to cash a check if it were lost or stolen. For this reason, be cautious when you use a blank endorsement. Restrictive endorsement – To ensure protection should the checks be lost or stolen before being deposited, the words for deposit only are written on the checks above the signature. It allows the payee only to deposit a check into his or her account. If a check is endorsed “For deposit only”, cash cannot be received from the bank, the check can only be deposited. Full Endorsement is used when the payee wants to transfer a check to another party. For example, a check may be passed on to someone else to pay a bill. The endorsement would be written as “pay to the order of” and is restricted in a special way. Check Register or Check Stub A check register or check stub is used to help the depositor keep track of checks written. The check register or check stub provides a record of each check number and date, the amount of each check, the deposits made, and the balance in the checking account. Examples of a check register and a check stub are show below. The forms provide the following information: a. b. c. d. e. f. Check number Date Individual or business to whom the check is written and a description of the transaction. Amount of check Amount of any deposit made since the last check Balance brought forward, which is the balance in the account after the last check was written 5 Business Math/Excel Unit Chapter 2 Bank Services Student Notes g. Running balance, which is determined after each check has been subtracted from a deposit has been added to the account Check Register Check Stub Personal Financial Software and Personal Check Writer You can purchase personal financial software for check writing or a personal check writer to manage your check records. The check writer is a little larger than a personal checkbook and hold supply of blank checks. When you want to write a check, you retrieve a check, insert it in the bottom of the check writer, and key the necessary information (date, payee, and so on). The check writer then keys the check for you. The check writer also writes payments from memory for repeating monthly payments, such as an automobile loan or a utility bill. The check writer automatically keeps a check register and shows the running balance of the checking account at all times. It can also complete the reconciliation form as well. The Future of Checks Can you imagine a “checkless society” in the future? Many bankers believed that once people began using ATM cards and electronic transfers, paper checks would become obsolete. Although there has been an increase in the use of ATM’s and electronic payment methods, the Federal Resource Bank of Atlanta reports that check volume has not declined, but has actually increased slightly. As sophisticated electronic technology becomes more familiar and acceptable to customers, the use of checks may decrease and help everyone move to a more “checkless society.” Objective 5: Use Excel to complete a deposit slip and a check register A deposit slip wouldn’t necessarily be created in a worksheet. However, one has been created for you in Excel to give you additional practice using the worksheet. To calculate the net deposit requires basic math skills – addition and subtraction – and Excel’s basic formulas. 6 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Completing a Deposit Slip Let’s practice together: Open the file ch02pr01 from the P:drive. Wait for teacher directions and complete the exercises as a class. See pages 175-for teacher led directions. Also delete the answers from the practice file. Filling in a Check Register Let’s practice together: Open the file ch02pr02 from the P:drive. Wait for teacher directions and complete the exercises as a class. See pages 176 for teacher led directions. Also delete the answers from the practice file. Copy pages 177-180 for Student Work 7 Business Math/Excel Unit Chapter 2 Bank Services Student Notes 2.2 BANK STATEMENT RECONCILIATION Objective 1: Understand why a checking account must be reconciled The first rule to managing a checking account is to keep good records. If you know the amount of money remaining in your account, you will be less likely to overdraw your account. Balancing your checkbook with your bank statement allows you to keep track of your money and the activity in your account. By making a habit of balancing your checkbook every month, you will always know how much money is really in your account. This will help you avoid overdrawn funds, for which there is a charge, not to mention a potential credit issue. Balancing your account will help you become aware of any unauthorized use of your ATM card or checkbook. Objective 2: Interpret a bank statement Each month the bank sends to each of its checking account customers a statement of his or her account. Although the statement covers a month’s transactions, it may begin and end on any day. For example, a statement may cover September 15 through October 16. A bank statement is a list of all the account activity processed through the bank to date. The information on this statement helps the customer verify the check register or check stubs. Study the statement sent to Mr. Rochelle that is illustrated below. I shows the following: a. b. c. d. e. Customer’s account number. Total number of checks transacted and total amount of these checks during the month. Total number of deposits made (credits) and total amount of deposited during the month. New balance. Each check number, date paid by the bank, and the amount of the check written. (Some statements do not show check numbers when canceled checks are returned.) f. Debits, such as bank charges, deducted from the account. (Specific bank charges will be explained later in this chapter.) g. Date and amount of deposits made to the checking account. h. Previous bank balance. i. Enclosures include the total number of checks transacted that are being returned to the depositor. Canceled checks (also known as returned checks) have been deducted from the depositor’s checking account. However, there is a trend for banks not to return canceled check to a depositor when the checks are listed on the statement. The statement balance may not agree with the depositor’s checkbook balance for the following reasons: 1. Outstanding checks: Checks that have been written and deducted by the depositor from the check register or check stubs but have not been received by the bank in time to be included on this month’s bank statement. 2. Outstanding deposits: Deposits that have been made by the depositor but have not been received by the bank in time to be included on this month’s bank statement. 8 Business Math/Excel Unit Chapter 2 Bank Services 3. Debits to the depositor’s account: 4. Credits to the depositor’s account: Student Notes These charges may include service charges (SC), sometimes called bank charges, which are monthly fees charged to the depositor by the bank. These charges include fees for providing a checking account, for printing checks, and for collecting notes. Items may include earned interest added to the depositor’s checking account balance when a minimum balance is maintained or an amount collected by the bank and added to the customer’s account. Although the bank deposited these items, the depositor did not record them in the check register or on the check stubs. 5. Errors made by either the depositor or the bank: A common error made by the depositor occurs when a check is written but not recorded or subtracted on the check register or on the check stub. Another typical error occurs when numbers are transposed (reversed), such as $21.45 for $12.45. Another common error occurs when a deposit is made but the depositor forgets to record it in the check register or on the check stub. For these reasons, it is important that you compare the check register or check stub balance with the bank statement. If you are still unable to clear up the discrepancy, you may want to contact a customer service representative at your bank for additional help. A fee may be involved with this service, but it is important that you keep your account up to date. 9 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Objective 3: Reconcile a bank statement with a check register When the check register or check stub balance and the statement balance do not agree, the depositor must reconcile the balances. To reconcile the balances is to adjust each balance so they agree. This procedure is usually completed on a reconciliation form. After the adjustments have been made, the balances should agree. Pay close attention to the examples on the next two pages. Mr. Rankin’s Bank Statement 10 Business Math/Excel Unit Chapter 2 Bank Services Student Notes 11 Business Math/Excel Unit Chapter 2 Bank Services Student Notes Objective 4: Use Excel to reconcile a bank statement To reconcile her checkbook with her monthly bank statement. Mandy created a form in Excel, as shown below. She created the Excel form by entering the titles and subtitles for the categories needed on a reconciliation form. She also entered the formulas needed to calculate the balances automatically to reconcile the bank statement and checkbook. Each month, Mandy enters her outstanding checks, deposits, and bank charges, and the balances are automatically calculated for her. If a discrepancy shows between the bank statement and her checkbook, she reviews all the records to determine the difference. Let’s practice together: Open the file ch02pr03 from the P:drive. Wait for teacher directions and complete the exercises as a class. See pages 187-for teacher led directions. Also delete the answers from the practice file. Copy pages 188 – 190 for student work 12