120610 WSJ Bearish ETF Drinks Up Bad News

advertisement

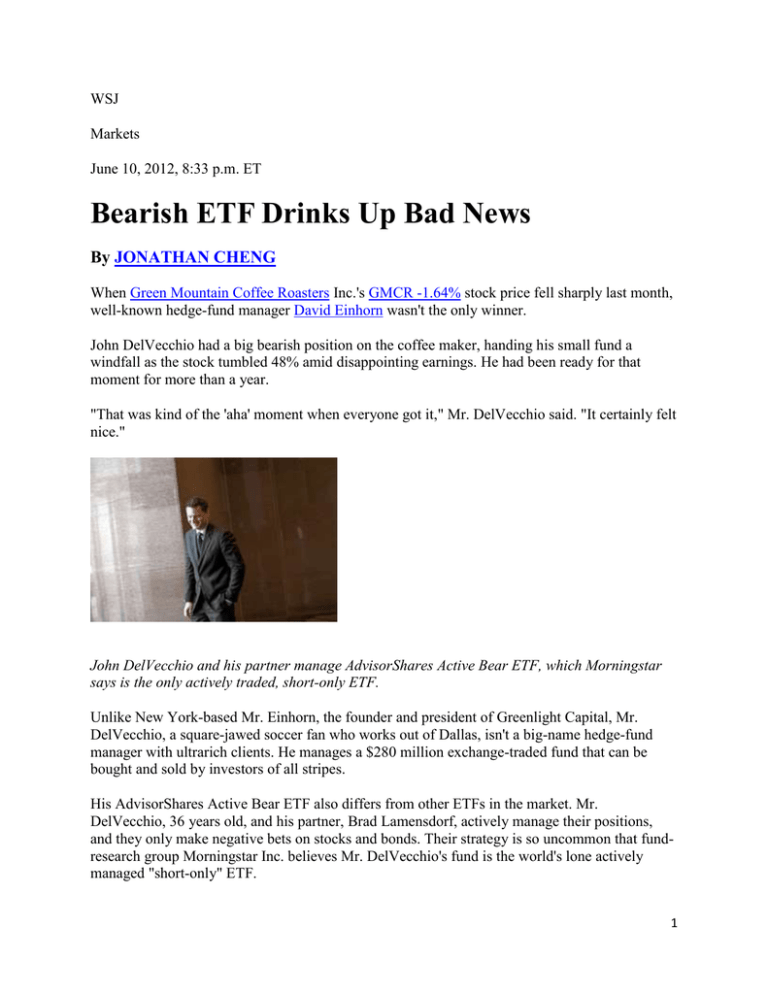

WSJ Markets June 10, 2012, 8:33 p.m. ET Bearish ETF Drinks Up Bad News By JONATHAN CHENG When Green Mountain Coffee Roasters Inc.'s GMCR -1.64% stock price fell sharply last month, well-known hedge-fund manager David Einhorn wasn't the only winner. John DelVecchio had a big bearish position on the coffee maker, handing his small fund a windfall as the stock tumbled 48% amid disappointing earnings. He had been ready for that moment for more than a year. "That was kind of the 'aha' moment when everyone got it," Mr. DelVecchio said. "It certainly felt nice." John DelVecchio and his partner manage AdvisorShares Active Bear ETF, which Morningstar says is the only actively traded, short-only ETF. Unlike New York-based Mr. Einhorn, the founder and president of Greenlight Capital, Mr. DelVecchio, a square-jawed soccer fan who works out of Dallas, isn't a big-name hedge-fund manager with ultrarich clients. He manages a $280 million exchange-traded fund that can be bought and sold by investors of all stripes. His AdvisorShares Active Bear ETF also differs from other ETFs in the market. Mr. DelVecchio, 36 years old, and his partner, Brad Lamensdorf, actively manage their positions, and they only make negative bets on stocks and bonds. Their strategy is so uncommon that fundresearch group Morningstar Inc. believes Mr. DelVecchio's fund is the world's lone actively managed "short-only" ETF. 1 The fund had a good two months in April and May. In those months, Mr. DelVecchio's fund soared 19% as the Standard & Poor's 500-stock index fell 7%. Over the past year, the fund has risen 3.9% compared with a 5.4% rise in the S&P 500. Mr. DelVecchio and Mr. Lamensdorf, 44, who works out of Connecticut, saw an opportunity for an actively managed fund that takes bearish bets on stocks. The fund doesn't use leverage, or borrowed money, to make bigger bets and doesn't buy derivatives, which can exacerbate losses. "People can vote with their dollars," said Mr. DelVecchio. Unlike a hedge fund, which only reports its holdings once a month and restricts when investors can pull their money, investors in Mr. DelVecchio's fund can track its holdings day by day and move their money in and out at will. "We're not like a hedge fund where they're secretly shorting a company and their clients are paying you for that personal stock selection," said Mr. Lamensdorf. Mr. DelVecchio began targeting Green Mountain at the beginning of 2011 after it emerged as No. 1 on his list when he searched 1,500 companies looking for those with strong revenue gains but little operating profit. He concluded that a series of acquisitions had left the company "overbloated" with items, such as goodwill, that didn't contribute to revenue. The fund started with a modest position in Green Mountain of 0.5% of its portfolio, but ramped that up to 3.5% after the stock began to weaken. "Green Mountain was already flashing warning signs" before Mr. Einhorn began publicly criticizing the company last October, said Mr. DelVecchio. 2 On May 2, the company's disappointing earnings sent the stock tumbling, handing the fund a paper gain of about $4.5 million. Green Mountain "is well-positioned with a strong balance sheet that will support continued growth," a spokeswoman for the company said. Early last year, the fund bet against technology company Juniper Networks Inc. because of an accounting change that allowed the company to book some sales earlier than usual. It took awhile for analysts to notice the change, Mr. DelVecchio says, and when they did, the stock plunged. Juniper declined to comment. Mr. DelVecchio also bet against fashion company Fossil Inc. because its inventory was growing, suggesting it would have to slash prices to move its merchandise. "People were all lathered up over that stock, but it had a lot of issues," he said. The stock has tumbled 45% since it announced disappointing earnings on May 8, earning Mr. DelVecchio about $2.5 million on the first day alone. A Fossil spokeswoman declined to comment. The two men haven't gotten all their calls right. Bets against Under Armour Inc., UA +4.00% Amazon.com Inc. AMZN +1.82% and Hanesbrands Inc. HBI +1.82% haven't paid off, though they have stuck with Hanesbrands and believe they will be vindicated. And the stock market's gains in the first quarter also hurt, causing his portfolio to fall by about one-third. Still, some investors have embraced the chance to buy into a short-only fund. Jody Wilson, a 45-year-old planetary astronomer and amateur stock trader, said he had been waiting "for years" for such an ETF. Mr. Wilson has $17,000 invested with the fund, he said. "It's not that I'm a high-frequency trader, but corrections are relatively brief compared to rallies," Mr. Wilson said. "And I like that this ETF lets me buy and sell in a couple of weeks." These days, Mr. DelVecchio is pursuing Constant Contact Inc., CTCT +5.10% a provider of online marketing tools. Mr. DelVecchio saw that the company was offering gift cards to get customers to sign up, bolstering revenue growth. "That's all I needed to know," Mr. DelVecchio said. "The numbers weren't as good as they were telling everyone." The stock has fallen 30% since mid April. Constant Contact didn't make an executive available for comment. Write to Jonathan Cheng at jonathan.cheng@wsj.com 3 A version of this article appeared June 11, 2012, on page C1 in the U.S. edition of The Wall Street Journal, with the headline: Bearish ETF Drinks Up Bad News. 4