ETF*s: The Problems with Mutual Funds

advertisement

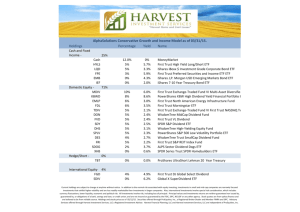

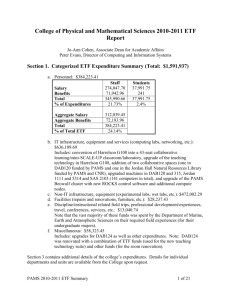

ETF’ S: T HE P ROBLEMS WITH M UTUAL F UNDS P ROBLEMS WITH M UTUAL F UNDS Sales Charges and Loads High Annual Fees Taxes Too Many Choices E XPENSE R ATIOS Expense Ratio: the percentage the mutual fund charges to run the fund on a daily basis. Some funds charge as high as 1% to manage the fund. E XPENSE R ATIO The American Developing World Growth and Income Fund (DWGAX) $14,216,000,000 in Assets 1.39% Annual Fee $197,602,400 in Annual Fees E XPENSE R ATIO If you invested $1,000,000 in DWGAX, every year you would pay $13,000 in management fees. 12B-1 F EE ’ S In addition to the expense ratio, some firms charge a 12B-1 fee. This fee is used to market the mutual fund. Ranges anywhere from .25%-1%. F UND C LOSING Some funds that close their doors to new investors, still charge a 12B-1 marketing fee. ETF’ S ETF stands for Exchange – Traded Funds Mutual Funds younger…sexier cousin! ETF’ S AND M UTUAL F UNDS Mutual Funds ETF’s Trade at one price Are bought and sold throughout the day. Must wait until 5 o’clock to see what the price is. Expense ratio is about 1% Actively Managed at anytime during regular trading hours Expense ratio is .09% Typically Run by Computers to track indexes. C OMMISSIONS Mutual Funds ETFs 5.75% Same cost as buying a If you buy $10,000 of Mutual Funds… $575 stock. E*Trade $10 Scottrade $7 ShareBuilder $4 Some companies charge no fees! A DVANTAGES OF ETF’ S Trades like a stock Extremely low expense ratios $1,000,000 invested would only cost $900 in fees, rather than $13,000 in mutual funds. Instant Diversification Tax Efficiency I NDEX ETF’ S Index Funds track the progress of major benchmarks S&P 500 (SPY) Spider Nasdaq 100 (QQQQ) Cube Dow Jones (DIA) Diamond M ARKET C AP ETF’ S Buys either: Small Mid, Large, Multi-cap B OND ETF’ S Buys Corporate Municipal Government Bonds ETF’ S Vanguard Total Stock Market Portfolio (VTI) Buys every stock that exists on every market S ECTOR ETF’ S Tracks the progress in a particular sector. Buys all the stocks in the same industry. Cell Phone Carriers Oil Banking Green Energy R EGIONAL ETF’ S Buys stocks in one region China Japan Europe Developing Countries (BRIC) ETF’ S ETF’s can be any combination of the above mentioned Small Cap Europe Chinese Banking Mid Cap Bond Funds C ONCLUSION Instant diversification Extremely low costs Tax Efficiency Trades like a stock Better alternative to mutual funds