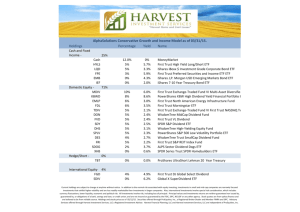

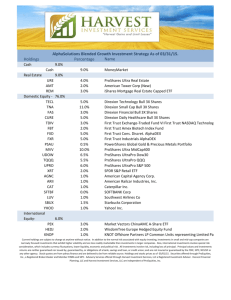

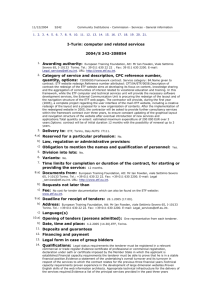

Company Name (Ticker) Total Entry Cost Current Value ($) 2/24

advertisement

Company Name (Ticker) CVS Caremark Corp. (CVS) Corning Inc (GLW) Fifth Third Bancorp (FITB) Applied Materials Inc. (AMAT) Sonic Corporation (SONC) Utilities Select Sector SPDR ETF (XLU) Steris Corp. (STE) Valero Energy Corporation (VLO) Comcast Corporation (CMCSA) Omega Healthcare Investors Inc. (OHI) H&R Block, Inc. (HRB) The Interpublic Group of Companies, Inc. (IPG) Boise Cascade Co (BCC) ProShares Short S&P 500 ETF (SH) Bank of America Corp (BAC) L Brands Inc (LB) Market Vectors Gold Miners ETF (GDX) WalMart Stores (WMT) Apple Inc. (AAPL) Sunoco LP (SUN) Covered Call Options: # of Current Quote ($) Initial Purchase Most Recent Shares/ Avg. Cost Per as of Date Trade Date Contracts ($) Share Total Entry Cost 3/4/2016 $99.28 02/10/14 12/26/14 374 $66.80 $24,983.20 $18.96 02/26/14 08/01/14 1,551 $19.41 $30,109.17 $17.13 06/06/14 01/22/15 2,906 $20.65 $60,006.62 $19.39 08/29/14 11/11/14 3,566 $22.42 $79,961.58 $30.30 11/18/14 07/15/15 841 $26.73 $22,477.85 $47.11 12/05/14 12/05/14 437 $45.77 $20,000.66 $66.98 12/12/14 01/22/15 756 $65.96 $49,862.86 $63.89 01/14/15 01/14/15 557 $44.81 $24,958.49 $59.74 01/22/15 01/22/15 617 $56.64 $34,948.66 $33.29 02/06/15 02/06/15 980 $40.79 $39,972.45 $27.76 02/27/15 02/27/15 1,043 $33.54 $34,981.01 $21.48 02/27/15 02/27/15 1,120 $22.32 $24,995.04 $17.16 07/30/15 07/30/15 912 $32.88 $29,982.00 $21.09 09/03/15 09/03/15 1,345 $22.22 $29,881.87 $13.54 10/15/15 10/15/15 3,726 $16.10 $59,974.44 $87.50 11/20/15 11/20/15 638 $93.92 $59,917.77 $19.71 12/22/15 12/22/15 3,610 $13.79 $49,781.54 $66.78 12/30/15 12/30/15 1,053 $61.67 $64,938.40 $103.01 01/07/16 01/07/16 507 $98.47 $49,922.16 $32.76 01/28/16 01/28/16 1,595 $34.22 $54,572.93 Sell to Open: Apple May-16 110 Calls (AAPL160520C00110000) $2.17 03/02/16 03/02/16 -5 $1.39 ($695.00) Sell to Open: Market Vectors Gold Miners Apr-16 21 Calls (GDX160415C00021000) $0.86 03/02/16 03/02/16 -36 $0.61 ($2,196.00) Sell to Open: Walmart May-16 70 Calls (WMT160520C00070000) $0.70 03/04/16 03/04/16 -10 $0.65 ($650.00) Cash Balance $ Position Performance Total Value of Portfolio Month-to-Date Total Return (%) Year-to-Date Total Return (%) Inception-to-Date Total Return (%) $1,076,255.02 Million Dollar Weiss Ratings Portfolio 2.44 (1.53) 37.49 *Entries are estimated and that they will be finalized upon receipt of the brokerage trade confirmations. New balance of $1 million reflects the withdrawal of $298,626.82 in cash 2,842.63 $842,687.70 ( T i c k e r Current Value ($) Total Return (%) ) 3/4/2016 $37,130.72 48.62 CVS Caremark Corp. (CVS) $29,406.96 (2.33) Corning Inc (GLW) $49,779.78 (17.04) Fifth Third Bancorp (FITB) $69,144.74 (13.53) Applied Materials Inc. (AMAT) $25,482.30 13.37 Sonic Corporation (SONC) $20,587.07 2.93 Utilities Select Sector SPDR ETF (XLU) $50,636.88 1.55 Steris Corp. (STE) $35,586.73 42.58 Valero Energy Corporation (VLO) $36,859.58 5.47 Comcast Corporation (CMCSA) $32,624.20 (18.38) Omega Healthcare Investors Inc. (OHI) $28,953.68 (17.23) H&R Block, Inc. (HRB) $24,057.60 (3.75) The Interpublic Group of Companies, Inc. (IPG) $15,649.92 (47.80) Boise Cascade Co (BCC) $28,366.05 (5.07) ProShares Short S&P 500 ETF (SH) $50,450.04 (15.88) Bank of America Corp (BAC) $55,825.00 (6.83) L Brands Inc (LB) $71,153.10 42.93 Market Vectors Gold Miners ETF (GDX) $70,319.34 8.29 WalMart Stores (WMT) $52,226.07 4.62 Apple Inc. (AAPL) $52,252.20 (4.25) Sunoco LP (SUN) Short Position Use Equity in Account ($1,085.00) Short Position Use Equity in ($3,096.00) Account Short Position Use Equity in Account ($700.00) $244,644.06 $831,610.96 --> -