Management Accounting:

advertisement

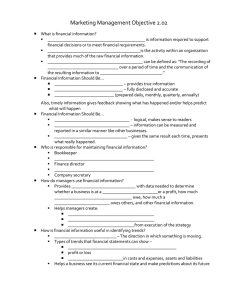

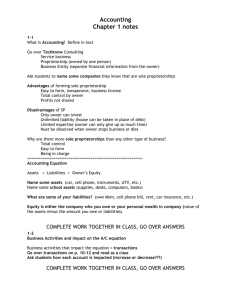

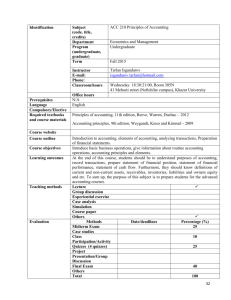

Management Accounting: A Road of Discovery Management Accounting: A Road of Discovery James T. Mackey Michael F. Thomas Presentations by: Roderick S. Barclay Texas A&M University - Commerce James T. Mackey California State University - Sacramento © 2000 South-Western College Publishing Chapter 2 How do companies create value? Why we can’t use financial accounting to manage the firm Key Learning Objectives • Define economic value and explain the factors that influence it.. • Demonstrate how value chains, product differentiation, and cost management are used to create value.. • Explain why financial accounting does not report economic value. • Give examples of the three manufacturing inventories. • Describe the three traditional manufacturing resources and prepare a cost of goods manufactured schedule. • List the six steps in strategic planning and discuss the role of management accounting in this process. How Do Companies Create Value? The objective of good management is to maintain and create value!! Street Talk: Know your business! Why we can’t use financial accounting alone to manage the firm. What is Economic Value? Making money now and in the future Financial Accounting Data = past cash transactions + current cash transactions Economic Value = current cash transactions + future cashflows Factors That Influence Value Value is influenced by Which Means Risk Effort Time Opportunities The likelihood of receiving cash How easy or hard it is to collect the cash How long it takes to collect the cash Other investments we can make instead of this one Businesses are Money-Making Machines Dollars-to-Dollars Cycle: Buy resources Make products Collect cash Sell products How do We Create Value? Manage Activities Buy something then do something with it and sell it for more than it costs! Value chains — see Exhibit 2-3 A series of value adding activities The activities spanned define a company Activities from cradle to grave define an industry We must position ourselves on the industry value chain The Home Building Industry’s Value Chain Cultivate forests Buy land Harvest trees Saw lumber Zone and subdivide land Install underground utilities Clear and grade land Build roads, curbs, sidewalks, etc. Purchase and deliver other materials and equipment Build houses Sell houses Deliver lumber Contract labor Provide customer and warranty service Creating Value through Product Differentiation and Image Brand Name Image Band Aid Xerox Ben & Jerry’s Ice Cream Coca-Cola Customer Service Federal Express Sears Roebuck & Co. State Farm Insurance Hilton Hotels Product Features Cadillac Burger King Canon Boeing Technological leadership IBM Hewlett Packard Maytag Intel Multree Homes Value Chain 1. 2. 3. Customer order-taking 1.1 Sales 1.2 Credit check Materials acquisition (inbound logistics) 2.1 Scheduling 2.2 Purchasing 2.3 Receiving, inspecting, and storage 2.4 Deliver to factory Manufacturing 3.1 Lumber sawing 3.2 Wall assembly 3.3 Rough wiring 3.4 Rough plumbing Continued 3. 4. Manufacturing (Continued) 3.5 Wall finishing 3.6 Roof construction 3.7 Finish carpentry 3.8 Top-off plumbing 3.9 Finish electric 3.10 Carpeting 3.11 Inspection Shipping (outbound logistics) 4.1 Packing 4.2 Shipping 4.3 Set up at retail dealer, customer lot Continued 5. 6. Close sales 5.1 Customer walk-through and inspection 5.2 Bill customer 5.3 Collect and deposit cash After customer services 6.1 Provide warranty work 6.2 Survey customer satisfaction 6.3 New product and service advertising We increase value by increasing value to the customer by more than it costs us! Creating Value Through Cost Management of Processes Another way to increase value is by reducing costs. Processes are sets of activities needed to provide goods or services. The objective is to minimize the cost of each process Economic Value and the Service Sector Will All Companies Become Service Companies? Financial Accounting Does Not Measure Economic Value Historical Costs: Look Backwards They do not measure all the things that determine economic value, I.e. future cashflows. Financial accounting measures the past not future value. Financial accounting requires arm’s length transactions. Financial reports must be audited to have wide acceptance. Hard (verifiable, countable) data is necessary. What does financial accounting information tell us about value? Unless we can exactly predict the future, nothing. Past accounting (statistical) information does not predict the future. It can only be used to estimate trends and likelihood. Balance Sheet Information Assets = Liabilities + Assets Assets — Resources we Have Current Assets Cash Promises for Cash (Accounts Receivable) The cost of merchandise we own (Inventory) Long Term Assets The cost of resources we own that will provide economic benefits in the future Balance Sheet Information (Continued) Liabilities — How much we owe outsiders Current Liabilities Long-Term Liabilities How much we owe in the future (after this year) Equity — How much we owe investors Contributed Capital How much we owe now (accounts payable) How much the owners invested in the business Retained Earnings How much we have left from previous earnings Income Statement Information Revenue — Sales of products or services Cost of Sales — Cost of products or services sold to generate revenue Gross Profit — Profit from basic activity Expenses Net profit from operations Sales function costs General and administrative costs Financing costs Income taxes Net Profit — Profit from operating the business Different Businesses Function Differently Service Businesses Merchandise Businesses Have no inventories. Value is added from services provided. Hold inventories for sale. The add value by purchasing products and reselling them to customers. Manufacturing Businesses Hold inventories of raw materials, work in process, and finished goods. They add value by converting raw materials (or purchased parts and materials) into products desired by customers (or other businesses). Manufacturing Cost of Goods Sold Traditional Resource Categories Direct Materials Direct Labor Manufacturing Overhead (Indirect) Indirect Materials Indirect Labor Manufacturing Overhead The Relationship Between Accounting and Economic Value The accounting system measures the results of past transactions. Economic value measures the economic value of the company now and in the future. Information is the key to understanding economic value. Financial measures relate to economic value. Managers must understand what causes economic value to increase and how the financial accounting measures help provide the necessary information. Strategic Planning to Create Value Create a vision or mission statement. Identify relevant objectives. Translate our objectives into measurable goals. Analyze our environments to facilitate accomplishing our goals. Determine how to accomplish our goals. Develop appropriate and relevant performance measures. Management Accounting’s Role in Strategic Planning The management accountant needs to be a ‘process controller’. The management accounting system should provide information for the strategic planning process. The management accountant needs to be ‘the copy on the block’ to develop and enforce performance measures.