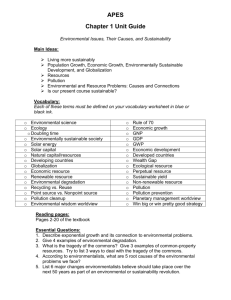

Chapter 24

advertisement

Chapter 24 Economics, Environment, and Sustainability Chapter Overview Questions What are economic systems and how do they work? How do economists differ in their views of economic systems, pollution control, and resource management? How can we monitor economic environmental progress? What economic tools can we use to improve environmental quality? Chapter Overview Questions (cont’d) How does poverty reduce environmental quality, and how can we reduce poverty? How can we shift to more environmentally sustainable economies over the next few decades? Updates Online The latest references for topics covered in this section can be found at the book companion website. Log in to the book’s e-resources page at www.thomsonedu.com to access InfoTrac articles. InfoTrac: Is buying local always best? The Christian Science Monitor, July 24, 2006 p13. InfoTrac: A corporate solution to global poverty. George C. Lodge; Craig Wilson. The Chronicle of Higher Education, May 12, 2006 v52 i36 pB14(1). InfoTrac: No bar code: the next revolution in food is just around the corner. Michael Pollan. Mother Jones, May-June 2006 v31 i3 p36(10). The Environmental Magazine: Sharing the Wealth. Global Policy Forum: Meet the Losers of Globalization The Brookings Institution: Waging a Living Video: The Working Poor This video clip is available in CNN Today Videos for Environmental Science, 2004, Volume VII. Instructors, contact your local sales representative to order this volume, while supplies last. Core Case Study: A New Economic and Environmental Vision Some components of more environmentally sustainable economic development. Figure 24-1 Production of energyefficient fuel-cell cars Forest Underground CO2 storage conservation using abandoned oil wells No-till cultivation High-speed trains Deep-sea CO2 storage Solar-cell fields Bicycling Wind farms Communities of passive solar homes Recycling plant Water conservation Landfill Cluster housing development Recycling, reuse, & composting Fig. 24-1, p. 569 ECONOMIC SYSTEMS AND SUSTAINABILITY An economic system produces and distributes goods and services by using natural, human, and manufactured resources. In a pure free-market system, buyers and sellers interact without any government or other interference. Actual capitalist market systems deviate from this model. Economic Resources: The Big Three Three types of resources are used to produce goods and services. Figure 24-2 Natural Resources Manufactured Resources + Human Resources + Goods and Services = Fig. 24-2, p. 570 Market Economic Systems: Pure Free Market and Capitalistic Models Supply, demand, and market equilibrium for a good or service in a pure market system. Figure 24-3 OIL Price (low to high) Quantity demanded Quantity supplied Surplus If the price is too high, more of a good is available than buyers are willing to buy. At this market equilibrium price, the quantity of a good suppliers are willing to sell is the same as the quantity buyers are willing to buy. If the price is too low, buyers want to buy more than suppliers are willing to sell. 0 Quantity supplied Shortage Quantity demanded Quantity Fig. 24-3, p. 571 Government Intervention in Market Economic Systems: Correcting Market Failures Governments intervene in market systems to help provide economic stability, national security, and public services such as education, crime protection, and environmental protection. Environmentally Sustainable Economic Development: Copying Nature Models of ecological economists are built on the following assumptions: Resources are limited. Encourage environmentally beneficial and sustainable forms of development. The harmful environmental and health effects of producing goods and services should be included in market prices. Sun Natural Capital Air, water, land, soil, biodiversity, minerals, raw materials, energy resources; dilution, decomposition, & recycling services EARTH Economic Systems Heat Production Depletion of nonrenewable resources Degradation & depletion of renewable resources used faster than replenished Consumption Pollution, waste from overloading nature’s waste disposal & recycling systems Recycling and reuse Fig. 24-4, p. 573 Economic Development Comparison of unsustainable economic development and environmentally sustainable economic development. Figure 24-5 Characteristic Unsustainable Economic Growth Environmentally Sustainable Economic Development Production emphasis Quantity Quality Natural resources Not very important Very important Resource productivity Inefficient (high waste) Efficient (low waste) Resource throughput High Low Resource type emphasized Nonrenewable Renewable Resource fate Matter discarded Matter recycled, reused, or composted Pollution control Cleanup (output reduction) Prevention (input reduction) Guiding principles Risk–benefit analysis Prevention and precaution Fig. 24-5, p. 573 ESTIMATING THE VALUE OF ECOLOGICAL SERVICES AND MONITORING ENVIRONMENTAL PROGRESS Economists have developed several ways to estimate nonmarket values of the earth’s ecological services based using: Mitigation cost: how much it takes to offset any environmental damage. Willingness to pay: determine how much people are willing to pay to keep the environment in tact (e.g. protect an endangered species). ESTIMATING THE VALUE OF ECOLOGICAL SERVICES AND MONITORING ENVIRONMENTAL PROGRESS Economists use discount rates (estimate resource’s future value compared to current) to estimate the future value of a resource. The market price you pay for something does not include most of the environmental, health, and other harmful costs associated with its production and use. Estimating the Optimum Levels of Pollution Control and Resource Use Environmental economists try to determine optimum levels of pollution control and resource use. Figure 24-6 Cost High Marginal cost of resource use Marginal cost of resource production Optimum level of resource use Low Coal removed (%) Fig. 24-6, p. 575 Optimum Pollution Control The marginal cost of cleaning up pollution rises with each additional unit removed. Figure 24-7 High Cost Marginal cost of pollution Marginal cost of pollution control Optimum pollution clean-up level Low Pollution removed (%) Fig. 24-7, p. 576 Cost-Benefit Analysis: a Useful but Crude Tool Comparing likely costs and benefits of an environmental action is useful but involves many uncertainties. Cost–benefit analyses involves determining: • Who or what might be affected by a particular regulation or project. • Projecting potential outcomes. • Evaluating alternative actions. • Establishing who benefits and who is harmed. Environmental and Economic Indicators: Environmental Radar We need indicators that reflect changing levels of environmental quality and human health. Gross domestic product (GDP): measures the annual economic value of all goods and services produced in a country without taking harmful effects into consideration. Genuine progress indicator (GPI): Subtracts from the GDP costs that lead to a lower quality of life or deplete / degrade natural resources. Environmental and Economic Indicators: Environmental Radar Comparison of the per capita GDP and the GPI in the U.S. between 1950 and 2002. Figure 24-8 1996 Dollars per person Per capita genuine progress indicator (GPI) Year Fig. 24-8, p. 577 How Would You Vote? To conduct an instant in-class survey using a classroom response system, access “JoinIn Clicker Content” from the PowerLecture main menu for Living in the Environment. Should full-cost pricing be used in setting market prices for goods and services? a. No. Low-income people will not be able to afford some essential goods and services. b. Yes. Full-cost pricing will improve environmental protection. ECONOMIC TOOLS FOR IMPROVING ENVIRONMENTAL QUALITY Including external costs in market prices informs consumers about the harmful impact of their purchases the earth’s life-support systems and on human health. Eco-Labeling: Informing Consumers So They can Vote with Their Wallets Certifying and labeling environmentally beneficial goods and resources extracted by more sustainable methods can help consumers decide what goods and services to buy. Figure 24-9 Germany: Blue Angel (1978) European Union: Eco-label (1992) United States: Green Seal (1989) Canada: Environmental Choice (1988) Nordic Council: White Swan (1989) China: Environmental label (1993) Fig. 24-9, p. 579 Subsidy Shifting Taxes on pollution and resource use can move us closer to full-costing pricing. Shifting taxes from wages and profits to pollution and waste (green taxes) helps make this feasible. We can improve environmental quality and human health by replacing environmentally harmful government subsidies with environmentally beneficial ones. Trade-Offs Environmental Taxes and Fees Advantages Helps bring about full-cost pricing Provides incentive for businesses to do better to save money Can change behavior of polluters and consumers if taxes & fees are set at a high enough level Easily administered by existing tax agencies Disadvantages Penalizes low income groups unless safety nets are provided Hard to determine optimal level for taxes and fees Need to frequently readjust levels, which is technically and politically difficult Gov’ts may see this as a way of increasing general revenue instead of using funds to improve environmental quality and reduce taxes on income, payroll, & profits Fairly easy to detect cheaters Fig. 24-10, p. 580 How Would You Vote? To conduct an instant in-class survey using a classroom response system, access “JoinIn Clicker Content” from the PowerLecture main menu for Living in the Environment. Do the advantages of green taxes and fees outweigh the disadvantages? a. No. Low-income people, farmers, ranchers, and small businesses would suffer from environmental taxes and fees. b. Yes. They would reduce waste and protect the environment. Green Taxes Advantages of taxing wages and profits less and pollution and waste more. Figure 24-11 • Decreases depletion and degradation of natural resources • Improves environmental quality by full-cost pricing • Encourages pollution prevention & waste reduction • Stimulates creativity in solving environmental problems to avoid paying pollution taxes and thereby increases profits • Rewards recycling and reuse • Relies more on marketplace rather than regulation for environmental protection • Provides jobs • Can stimulate sustainable economic development • Allows cuts in income, payroll, and sales taxes Fig. 24-11, p. 581 How Would You Vote? To conduct an instant in-class survey using a classroom response system, access “JoinIn Clicker Content” from the PowerLecture main menu for Living in the Environment. Do you favor shifting taxes on wages and profits to pollution and waste? a. No. This tax system would penalize many farmers, ranchers, and businesses that cannot avoid generating waste. b. Yes. But, only if we offer subsidies to assist lower income people in meeting their basic needs. c. Yes. It would promote a cleaner environment. ECONOMIC TOOLS FOR IMPROVING ENVIRONMENTAL QUALITY Environmental laws and regulations work best if they motivate companies to find innovative ways to control and prevent pollution and reduce resource waste. Governments can set a limit on pollution emissions or use of a resource, give permits to users, and allow them to trade their permits on the marketplace. Trade-Offs Tradable Environmental Permits Advantages Disadvantages Flexible Big polluters and resource wasters can buy their way out Easy to administer May not reduce pollution at dirtiest plants Encourages pollution prevention and waste reduction Can promote achievement of caps Can exclude small companies from buying permits Caps can be too low Caps must be gradually reduced to encourage innovation Determining caps is difficult Permit prices determined by market transactions Confronts ethical problem of how much pollution or resource waste is acceptable Confronts problem of how permits should be fairly distributed Must decide who gets permits and why Administrative costs high with many participants Emissions and resource wastes must be monitored Self-monitoring can promote cheating Sets bad example by selling legal rights to pollute or waste resources Fig. 24-12, p. 582 How Would You Vote? To conduct an instant in-class survey using a classroom response system, access “JoinIn Clicker Content” from the PowerLecture main menu for Living in the Environment. Do the advantages of using tradable pollution and resource-use permits to reduce pollution and resource waste outweigh the disadvantages? a. No. The policies would allow old and dirty plants to continue polluting local air and water. b. Yes. The policies are effective ways of capping and then reducing air and water pollution and resource use. Green Economics: Selling Services Instead of Things Some businesses can greatly decrease their resource use, pollution, and waste by shifting from selling goods and services to selling the services the goods provide. Carrier has begun shifting selling heating and air conditioning equipment to providing the service itself. • It makes higher profits by having the most energyefficient units. REDUCING POVERTY TO IMPROVE ENVIRONMENTAL QUALITY AND HUMAN WELL-BEING We can sharply cut poverty by forgiving the international debts of the poorest countries, greatly increasing international aid and small individual loans to help the poor help themselves. Distribution of the World’s Wealth: a Widening Gap The global distribution of income shows that most of the world’s income flows up. Each horizontal band is 1/5th of the world’s population Figure 24-13 Richest fifth 85% Poorest fifth 1.3% Fig. 24-13, p. 584 Solutions: Achieving the Millennium Development Goals In 2000, the world’s nations set goals for sharply reducing hunger and poverty, improving health care and moving toward environmental sustainability by 2015. In 1980 and 2002, developed countries agreed to devote 0.7% of their annual national income towards achieving such goals. • The average amount donated was 0.25%. • The U.S. gives 0.16%. Fig. 24-14, p. 586 Expenditures per year (2005) $1 trillion World military $492 billion (including Iraq) U.S. military $29 billion U.S. highways U.S. potato chips & snacks $22 billion $19 billion U.S. pet foods U.S. EPA U.S. foreign aid U.S. cosmetics $8 billion $8 billion $8 billion Fig. 24-14a, p. 586 Expenditures per year needed to Eliminate hunger & malnutrition $48 billion Provide clean drinking water and sewage treatment for all $37 billion $33 billion Provide basic health care for all $31 billion Protect biodiversity $24 billion Protect topsoil on cropland Provide universal primary education and end illiteracy Restore fisheries $16 billion $13 billion Deal with global HIV/AIDS $10 billion Stabilize water tables $10 billion Restore rangelands $9 billion Protect tropical forests $8 billion Reforest the earth $6 billion Total Earth Restoration and Social Budget = $245 billion Fig. 24-14b, p. 586 MAKING THE TRANSITION TO MORE ENVIRONMENTALLY SUSTAINABLE ECONOMIES Nature's four principles of sustainability and a number of environmental and economic strategies can be used to develop more environmentally sustainable economies. The Netherlands has dedicated itself to making its economy more environmentally sustainable. Eco-Economies Principles for shifting to more environmentally sustainable economies during this century. Figure 24-15 Economics Reward (subsidize) earth sustaining behavior Penalize (tax and do not subsidize) earth degrading behavior Shift taxes from wages and profits to pollution and waste Use full-cost pricing Sell more services instead of more things Do not deplete or degrade natural capital Live off income from natural capital Reduce poverty Use environmental indicators to measure progress Certify sustainable practices and products Use eco-labels on products Environmentally Sustainable Economy (EcoEconomy) Resource Use & Pollution Reduce resource use and waste by refusing, reducing, reusing, and recycling Improve energy efficiency Rely more on renewable solar and geothermal energy Shift from a carbonbased (fossil fuel) economy to a renewable fuel–based economy Ecology & Population Mimic nature Preserve biodiversity Repair ecological damage Stabilize population by reducing fertility Fig. 24-15, p. 587 Jobs, Profits, and the Environment: New Industries and New Jobs Shifting to more environmentally sustainable economies will create immense profits and huge numbers of jobs. Figure 24-16 Environmentally Sustainable Businesses and Careers Aquaculture Biodiversity protection Environmental law Environmental nanotechnology Fuel cell technology Biofuels Geographic information systems (GIS) Climate change research Geothermal geologist Conservation biology Hydrogen energy Eco-industrial design Marine science Pollution prevention Ecotourism management Reconciliation ecology Energy efficient product design Selling services in place of products Environmental chemistry Solar cell technology Environmental design Sustainable agriculture Environmental economics Sustainable forestry Waste reduction Environmental education Watershed hydrologist Environmental engineering Water conservation Environmental health Wind energy Fig. 24-16, p. 589