Bruck Textiles - Victorian Competition and Efficiency Commission

advertisement

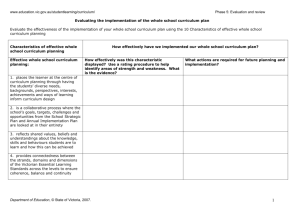

BRUCK TEXTILES PTY LTD SUBMISSION TO Victorian Competition and Efficiency Commission INQUIRY INTO A MORE COMPETITIVE VICTORIAN MANUFACTURING INDUSTRY July 2011 Bruck Textiles Pty Limited 791 Botany Road Rosebery NSW 2018 Page 1 of 12 INTRODUCTION This submission has been prepared by Bruck Textiles Pty Ltd, in response to the Draft Report, Victorian Manufacturing – Meeting the Challenges, issued by the Victorian Competition and Efficiency Commission in relation to its Inquiry into a More Competitive Victorian Manufacturing Industry. Bruck is the largest textile manufacturer, producing fabrics, in Australia. It is privately owned and its manufacturing plant is located in regional Victoria at Wangaratta. As at 30 June 2011, Bruck (excluding a related wholesale business, Wilson) employed a total of 246 staff plus 20 contractors. BACKGROUND TO BRUCK Bruck was established in Wangaratta in 1946 as a supplier of apparel and furnishing fabrics. Following a rapid reduction in import tariffs and quotas for textiles, in the I980’s and 1990’s, the supply chain for traditional apparel and furnishings products began relocating to low cost countries and Bruck began to transform from a vertically integrated synthetic fabric manufacturer to a technical fabrics specialist. Today Bruck is the major manufacturer and distributor of value added, high performance and protective uniform fabrics for Defence, firefighting, aluminum smelters, steel manufacturing and anti-ballistics. It also produces automotive and other technical fabrics, coated blind fabrics for home furnishings and is the major Australian manufacturer and supplier of woven fabric for industrial and corporate wear. Considerable expertise has been developed in technical fabrics such as liquid coatings, laminated membranes, woven fabrics with properties such as waterproofing, breathability, flame retardant and photo luminescence qualities. Bruck has forged a reputation as a high quality supplier and service provider, capable of a strong degree of flexibility and willingness to meet customer requirements. Page 2 of 12 The business has been transformed successfully a number of times to adapt to changing trends. For example, to combat a strong trend away from traditional window treatments, in the 1990’s, it invested in fabric coating equipment to supplement its furnishing fabric ranges with high quality foam coated window blind fabrics.. In the late 1990’s the acquisition of National Textiles, the granting of a Proban license by Rhodia International Inc (France) and the purchase of a Proban curing machine to produce technical fire retardant fabrics, enabled Bruck to enter the industrial workwear market. In 2003, the acquisition of the National Coating Company Limited (well known for its Bradsal brand) brought with it enhanced access to export markets in the EU, USA and Asia The acquisition of the business of Melba in May 2009 opened up the opportunity to enter the ballistics, metal splash and automotive markets and broadened Bruck’s range of protective fabrics. In June 2010, the Wilson Fabrics division was transferred to another company within the Group and is today managed out of the home fashions group of companies. Bruck however continues to manufacture drapery, linings, blinds and ready-made curtains for Wilson. It has an annual turnover currently around $60 million. MANUFACTURING IN REGIONAL VICTORIA The Report has recognised the importance of manufacturing to regional Victoria. Indeed, it makes special note of major regional centres such as Geelong, Ballarat and Bendigo. We were somewhat bemused to note that Wangaratta did not rate a special mention. However, manufacturing is a significant contributor to the economic well-being of Page 3 of 12 north-east Victoria and Bruck is a noteworthy member of the Wangaratta community which also includes two other suppliers, a textile chemical company Nuplex and Australian Country Spinners. Not only does Bruck create direct employment benefits for the local community, with much of this employment being in highly skilled areas, but our presence in the region also creates substantial demand for many other services and materials supplied from the immediate region. We estimate that for every job Bruck provides directly, a further 3 to 4 jobs are generated through the need to service our Wangaratta facility. However, it is not easy operating in a regional environment. There are many significant costs imposed on regionally based businesses that are either not incurred by, or are less severe for, our metropolitan based counterparts/competitors. Certainly, there are many of these that we consider constitute “unnecessary regulatory burdens on manufacturing activity”. These include: a. Trade Waste Costs in Regional Victoria b. EPA Licences, restrictions and autocracy c. Rural Fire Levies d. A highly restrictive, prescriptive and unnecessarily bureaucratic industrial relations regime (which seems to be more aggressively pursued by the unions with regionally based businesses) e. Payroll compliance e.g. payroll taxes, workers compensation, holiday loading, long service leave, award rate , compulsory superannuation (while these are not unique to regionally based businesses, they do act as a disincentive to employ people – especially the payroll tax - and given the other imposts noted above this is just a further aggravation for operating regional businesses). GOVERNMENT PROCUREMENT The Draft Report highlights that, with regard to Government Procurement considerations, Value for Money is “the optimum combination of quality, quantity, Page 4 of 12 risk, timeliness and cost, [which] should be determined on a whole-of-contract and whole-of-asset-life basis”. However, in our experience, we have found that when Purchasing Officers are assessing “value for money”, they are rarely comparing like with like and generally just focus on price without fully understanding to what this really relates. Certainly there is no account taken of the add-on regulatory costs (highlighted above), which are imposed on local producers but are not necessarily incurred by offshore suppliers. All aspects, outside of mere price, must be taken into consideration – and ideally written into government policy - to ensure that Australian companies are being treated on a true “like-for-like” basis in government purchasing decisions. Long term, this would do more for the Australian TCF industry that any budgetary support scheme as it would provide positive reinforcement for the need for Australian companies to become internationally competitive IN ALL ASPECTS NOT JUST PRICE. For example the multiplier effect on employment is far higher in rural Australia than in the Cities. The Government should be held accountable for ensuring that they are practicing what they preach by promoting through their own policy (whole of government) framework for all industries (not just textiles) to truly add value within Australia in terms of full compliance of a wages system, conditions of employment, regulatory compliance requirements i.e. OH&S and workers compensation, and environmental policy. Government purchasing should reflect this policy, and favour businesses (whether Australian or overseas) that comply with all these policy requirements. Australian industry is making huge in-roads on environmental savings and sustainable development. This should be a factor taken into account in government procurement decisions. That is, Government Buyers should have an ethical purchasing policy – i.e. everyone that Government purchases from, should comply with similar conditions to what is expected of Australian industry. Page 5 of 12 Yet Bruck’s experience is that the demands placed upon local manufacturers submitting tenders are much more onerous than what is expected of offshore suppliers and decisions tend to be made without any regard to past practice or local capability. For example local manufacturers must register with and abide by the requirements of Ethical Clothing Australia whereas the same conditions are not imposed on offshore manufacturers which give them a cost advantage. For example, Bruck has been supplying the fabric for VIC Police shirts from 1996 to 2011. Currently, VIC Police is working on new Police uniforms with the relevant clothing industry body, the Council of Textile and Fashion Industries of Australia (TFIA) - and indeed, the TFIA has engaged Bruck to do confidential development work, which is now understood to be for VIC Police Uniforms. Based on the samples supplied through TFIA, VIC Police intend to finalise the specifications and issue a tender document soon. However, while this development work is going on, Yakka (the garment manufacturer) has been advised by VIC Police that they will not place any further shirt orders. Instead, interim orders have been placed with Trade Imports (ie100% imported garment), even though the shirts can be made up competitively in Australia, from fabric made in Australia, and there is a proven track record for this. We suspect that this is due to pattern making and garment specifications related issues ex Yakka that VIC Police has decided to buy the interim garments ex importer rather than manufactured in Victoria. But this is at Bruck’s cost, who have not even been given the opportunity to supply the fabric, or help find an alternative local garment producer, to overcome any perceived problems with Yakka. There would have been significant merit (and mutual value) if VIC Police had engaged with the local industry to explore all available avenues to resolve what appears to be a shortterm supply issue. Compare this to the situation we find with the Country Fire Authority (CFA), who have engaged with the local industry to get the best possible service/product. Before Page 6 of 12 finalising a recent tender, the CFA undertook due diligence on the total supply chain, not just the garment maker or total apparel management company. This included a tour of all key manufacturing sites, including Bruck at Wangaratta. The CFA’s intent was to fully understand the importance and extent of the capability and capacity of the various suppliers through the value chain, many of which would obviously need to be sub-contractors to the garment maker or TAM company. CFA placed great importance on the supply chain being local (especially regional as it fitted in with their company profile), but first and foremost it needed to be clearly reliable, quality conscious and viable. The result has been that, in their last two tenders for personal protective apparel, they specified the use of Bruck fabrics and that the fabric must be Australian made, simply because they realised that this improved the overall value of the offering due to the reliability of supply and consistency in product quality. While VIC Police have engaged the Australian industry body to undertake development work, before they release their new uniform tender, they have not undertaken the same type of due diligence of the Victorian Manufacturing Industry as the CFA has done. Turning specifically to the Information Requests on Procurement in the Draft Report, we would make the following responses: Compared with the VIPP and the role played by ICNV, are there better ways to address gaps in information about local suppliers? In its current form, the VIPP is an excellent method of providing information to government procurement agencies on local suppliers. The question, is how well do those agencies read the VIPP submitted with tenders? Is there evidence, from Victorian Government procurement, that selecting providers based on local content is an effective way to increase local manufacturing output, improve the viability or profitability of local production, or reduce unemployment? Page 7 of 12 If the local content is attributed from manufacturing activity and not from repackaging or warehousing of imported products, then yes it is very effective. Is the VIPP an appropriate instrument for increasing innovation? It is possible that it could be used to drive innovation in industry, but only if industry could have confidence that Government will stand by firms that engage in real R&D to try to develop new, improved product features. Sadly, there are many and varied examples from the past where companies have developed new products and government agencies have then freely passed around the specifications developed for anyone to replicate without having to recoup the development costs. In any event, true innovation comes from the culture/strategy of the manufacturing companies. This seems to be ably stimulated by government incentive to innovate via grants and tax incentives. Who should own the IP that is created as a result of government procurement contracts? Obviously the IP must be owned by whoever created it, ie invested in the development. Surely it cannot be suggested that Government should own the IP simply because it is purchasing a particular product? This would suggest that IP can be created from a purchase order. But even if a particular tender might call for something that is not yet developed and the tender has advised industry of a new concept that it wants to buy, industry still needs to develop that concept into a commercial item. This requires resources, including industry experience and knowledge, and money to be expended, and the party that undertakes that effort should rightfully own the IP. Who should commercialise the IP? Firstly whoever owns it and then who is the best placed to do so. Page 8 of 12 How effective has the VIPP been in achieving skills-related objectives? Surely it is the projects/orders/requirements of the buyer that influences skill development rather than a program that is designed to measure the amount of local content that is being offered as part of a supply agreement? In that context, it is questionable that the VIPP as such, is responsible for developing skills in the industry. However, it could be used proactively to generate upskilling by supporting tenders were such commitments can be made by local manufacturers. Should the Victorian Government publish a 'pipeline' of procurement opportunities? Yes. What is an appropriate time horizon for the pipeline? For textiles and apparel value chains, it should ideally be one year in advance or at least 6 months. Are there other ways to better inform firms about procurement opportunities? The current arrangements/mechanisms appear reasonable, although they could be complemented with a public forum for each industry sector to discuss individual projects/prospects in more detail. This would provide scope for the Purchasing agencies to also get a better understanding of what is realistic and reasonable. Is there evidence of the effectiveness of the Regional Industry Link program in linking Victorian firms to new commercial opportunities? We are not certain about this, which would suggest that the effectiveness is not overly apparent. Page 9 of 12 Are Victorian Government procurement projects of an appropriate scale? From our experience, with textile and apparel tenders, the scale appears appropriate. The VIPP Guidelines state that 'project design specifications need to be performance oriented rather than design specific. Technical specifications should not be an obstacle to the local supply of required goods or services.' (p. 14). How effective has the VIPP been in this regard? We do not know how effective the VIPP has been in this regard but we certainly agree with, and fully support, this principle. Are other steps needed to ensure procuring agencies adopt outcome-based specifications where appropriate? Bruck does not have enough experience to comment on this, however the specification guidelines should be standardised across all agencies. Are the standards used in Victorian procurement inconsistent or unnecessarily onerous? This varies between agencies/ departments with some much better than others. For example, as highlighted above, CFA is much better than VIC Police in this regard, with the latter retaining an outdated and poorly written fabric performance specification (whereas CFA is more up to date and relevant). If so, is this a barrier to the involvement of local firms? It definitely can be, especially if a specification refers to a product type that is only made offshore, and there is no allowance for other tenderers to suggest alternative specifications, provided they can demonstrate an improved or Page 10 of 12 similar performance with the alternate. Is it an obstacle to achieving value for money? Obviously this is an obstacle to achieving value for money, especially if there is a better way to make a product, or a better product can be made, but this is precluded by the existing performance specification. How might procurement standards be better aligned? This is really up to the different agencies to coordinate. Do procuring agencies in Victoria adopt overly restrictive and burdensome prequalification and tendering rules? Not from Bruck’s experience. Are tender fees excessive or onerous? Not from Bruck’s experience. Do procuring agencies in Victoria impose inconsistent and excessive contractual conditions? Not from Bruck’s experience. Do they make onerous information requests? Not from Bruck’s experience. Are there important inconsistencies in how procuring agencies in Victoria develop and apply evaluative criteria? Yes - some agencies, like the CFA, are very comprehensive in their Page 11 of 12 assessment, including consideration not just of local content but more importantly, local capability. Other agencies, like VIC Police, are less interested in the inherent value of local content in terms of the reliability of supply and consistency of product from order to order. Do the agencies require better guidance, for example, regarding how they consider whole-of-life costs? Yes, most definitely. Most agencies do not understand what this means and do not truly account for the hidden costs in relying on offshore manufacturing (in terms of the lead-times involved, inability to quickly replace sub-standard product, inconsistency of delivered product with initial sample, inconsistency of product from order to order, post delivery service/advice/support, etc. If VIPP plans were to be prepared only on tenders where competition between local and foreign suppliers is important, how should this be determined? We do not see how this could be determined. Surely the same rules should apply to all tenders, i.e. it is best to apply a VIPP requirement on all tenders. How significant are the compliance costs associated with the VIPP, for example, the cost of preparing a VIPP plan? The compliance cost is not onerous. Finally, we would make one further comment, relating to the summary report – i.e. on the table on page 19 relating to the VIPP. It recommends that training skills, innovation and knowledge should not be included in a VIPP submission and should only be used as a tiebreaker between equivalently rated tender submissions. The problem with this is that in many cases, imported tender submissions will be rated higher than local submissions because of a price differential and so as there will not be a tiebreaker situation, these key areas will not be considered. Surely Training, skills, innovation and knowledge should be key evaluation criteria in the initial evaluation stage of a tender, not just when two tenders need to be separated? Page 12 of 12