Lecture 1

advertisement

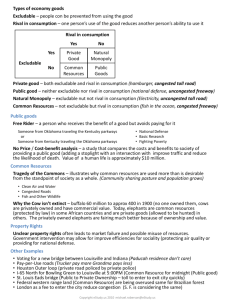

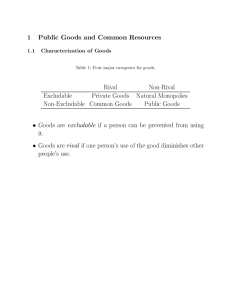

Principles of Micro by Tanya Molodtsova, Fall 2005 Chapter 11: Public Goods and Common Resources We Will Learn: the defining characteristics of public goods and common resources. why private markets fail to provide public goods. some of the important public goods in our economy. why the cost–benefit analysis of public goods is both necessary and difficult. why people tend to use common resources too much. some of the important common resources in our economy. Introduction Free goods provide a special challenge for economic analysis. Most goods in our economy are allocated in markets… When goods are available free of charge, - the market forces that normally allocate resources in our economy are absent. - private markets cannot ensure that the good is produced and consumed in the proper amounts. Introduction In such cases, government policy can potentially remedy the market failure that results, and raise economic well-being. The Different Kinds of Goods When thinking about the various goods in the economy, it is useful to group them according to two characteristics: Is the good excludable? Is the good rival? Excludability: the property of a good that a person can be prevented from using it. Rivalry: the property of a good that one person’s use diminishes other people’s use. The Different Kinds of Goods Four Types of Goods 1. 2. 3. 4. Private Goods: goods that are both excludable and rival. Public Goods: goods that are neither excludable nor rival. Common Resources: : goods that are rival but not excludable. Natural Monopolies: goods that are excludable but not rival. The Different Kinds of Goods Rival? Yes Yes No Private Goods Natural Monopolies • Ice-cream cones • Fire protection • Clothing • Cable TV • Congested toll roads • Uncongested toll roads Common Resources Public Goods • Fish in the ocean • Tornado siren • The environment • National defense Excludable? No • Congested nontoll roads • Uncongested nontoll roads The Different Kinds of Goods Public goods and common resources each create externalities because they have value but no price because they are not sold in the marketplace. These external effects imply that market outcomes will be inefficient in the absence of government involvement or private resolutions to correct the externality. Public Goods Example: a fireworks display. The Free-Rider Problem A free-rider is a person who receives the benefit of a good but avoids paying for it. Since people cannot be excluded from enjoying the benefits of a public good, individuals may withhold paying for the good hoping that others will pay for it. The free-rider problem prevents private markets from supplying public goods. The Free-Rider Problem Solving the Free-Rider Problem The government can decide to provide the public good if the total benefits exceed the costs. The government can make everyone better off by providing the public good and paying for it with tax revenue. Some Important Public Goods National Defense Basic Research Fighting Poverty Case Study: Are Lighthouses Public Goods? Lighthouses are used so that ships can mark specific locations and avoid treacherous waters. Use of a lighthouse is both nonexcludable and nonrival. Thus, most lighthouses are provided by the government. In 19th century England, lighthouses were operated more like private goods. The owners of local ports were charged with the service and if they did not pay, the owner of the lighthouse simply turned off the light and ships avoided stopping in that port. The Difficult Job of Cost–Benefit Analysis Cost benefit analysis: a study that compares the costs and benefits to society of providing a public good. In order to decide whether to provide a public good or not, the total benefits of all those who use the good must be compared to the costs of providing and maintaining the public good. The Difficult Job of Cost–Benefit Analysis A cost-benefit analysis would be used to estimate the total costs and benefits of the project to society as a whole. It is difficult to do because of the absence of prices needed to estimate social benefits and resource costs. The value of life, the consumer’s time, and aesthetics are difficult to assess. Common Resources Common resources, like public goods, are not excludable. They are available free of charge to anyone who wishes to use them. Common resources are rival goods because one person’s use of the common resource reduces other people’s use. The Tragedy of the Commons The Tragedy of the Commons is a parable that illustrates why common resources get used more than is desirable from the standpoint of society as a whole. Common resources tend to be used excessively when individuals are not charged for their usage. This is similar to a negative externality. Some Important Common Resources Clean air and water Congested roads Fish, whales, and other wildlife Case Study: Why the Cow is Not Extinct Elephants in Africa are common resources because no one owns them. they are becoming extinct Solution: governments could allow people to kill the elephants on their own property (thus making the elephants a private good). This is different from a cow, which is usually owned by a ranch. The rancher has an incentive to ensure that the cattle population on his ranch is maintained so that he can continue to earn a profit. Conclusion: The Importance of Property Rights The market fails to allocate resources efficiently when property rights are not wellestablished (i.e. some item of value does not have an owner with the legal authority to control it). When the absence of property rights causes a market failure, the government can potentially solve the problem. Summary Goods differ in whether they are excludable and whether they are rival. A good is excludable if it is possible to prevent someone from using it. A good is rival if one person’s enjoyment of the good prevents other people from enjoying the same unit of the good. Summary Public goods are neither rival nor excludable. Because people are not charged for their use of public goods, they have an incentive to free ride when the good is provided privately. Governments provide public goods, making quantity decisions based upon cost-benefit analysis. Summary Common resources are rival but not excludable. Because people are not charged for their use of common resources, they tend to use them excessively. Governments tend to try to limit the use of common resources. Summary When private parties cannot adequately deal with externalities, then the government steps in. The government can either regulate behavior or internalize the externality by using Pigouvian taxes or by issuing pollution permits.