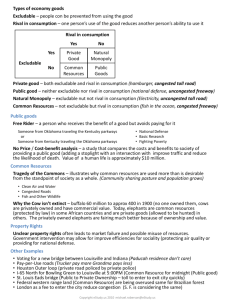

Chapter 11 Public Goods and Common Resources MULTIPLE CHOICE 1. In the market for a good like ice-cream cones, a. an inefficient number of ice-cream cones will be produced. b. the sum of producer surplus and consumer surplus is minimized. c. price adjusts to balance supply and demand. d. the price established in the market will not reflect the value of ice cream cones to consumers. ANSWER: c. price adjusts to balance supply and demand. TYPE: M SECTION: 1 DIFFICULTY: 2 2. When goods are available in an economy free of charge a. market forces cannot be used to allocate resources. b. too many of these goods will be produced since there is no cost of production. c. the product will have no value for the majority of the population. d. goods are not available in market economies free of charge. ANSWER: a. market forces cannot be used to allocate resources. TYPE: M SECTION: 1 DIFFICULTY: 2 3. Each of the following are provided by nature EXCEPT a. mountains. b. beaches. c. oceans. d. parks. ANSWER: d. parks. TYPE: M SECTION: 1 DIFFICULTY: 1 4. Each of the following are provided by government EXCEPT a. playgrounds. b. parks. c. beaches. d. parades. ANSWER: c. beaches. TYPE: M SECTION: 1 DIFFICULTY: 1 5. For most goods in an economy, the signal that guides the decisions of buyers and sellers is a. greed. b. the self-interest of both buyers and sellers. c. prices. d. profits. ANSWER: c. prices. TYPE: M SECTION: 1 DIFFICULTY: 1 6. In an economy, when goods do not have a price, what/who primarily ensures that the good is produced? a. entrepreneurs b. the government c. charities d. nature ANSWER: b. the government TYPE: M SECTION: 1 DIFFICULTY: 1 311 312 Chapter 11/Public Goods and Common Resources 7. When a good is excludable it means that a. one person’s use of the good diminishes another person’s ability to use it. b. people can be prevented from using the good. c. no more than one person can use the good at the same time. d. everyone will be excluded from obtaining the good. ANSWER: b. people can be prevented from using the good. TYPE: M SECTION: 1 DIFFICULTY: 2 8. A good is excludable if a. one person's use of the good diminishes another person's enjoyment of it. b. the government can regulate its availability. c. it is not a normal good. d. people can be prevented from using it. ANSWER: d. people can be prevented from using it. TYPE: M SECTION: 1 DIFFICULTY: 1 9. When a good is rival it means that a. one person’s use of the good diminishes another person’s ability to use it. b. people can be prevented from using the good. c. no more than one person can use the good at the same time. d. everyone will be excluded from obtaining the good. ANSWER: a. one person’s use of the good diminishes another person’s ability to use it. TYPE: M SECTION: 1 DIFFICULTY: 2 10. If one person’s use of a good diminishes another person’s enjoyment of it, the good is a. rival. b. excludable. c. normal. d. exhaustible. ANSWER: a. rival. TYPE: M SECTION: 1 DIFFICULTY: 1 11. Goods that are excludable include both a. natural monopolies and public goods. b. public goods and common resources. c. common resources and private goods. d. private goods and natural monopolies. ANSWER: d. private goods and natural monopolies. TYPE: M SECTION: 1 DIFFICULTY: 2 12. Goods that are rival include both a. natural monopolies and public goods. b. public goods and common resources. c. common resources and private goods. d. private goods and natural monopolies. ANSWER: c. common resources and private goods. TYPE: M SECTION: 1 DIFFICULTY: 2 13. Goods that are NOT excludable include both a. private goods and public goods. b. natural monopolies and common resources. c. common resources and public goods. d. private goods and natural monopolies. ANSWER: c. common resources and public goods. TYPE: M SECTION: 1DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 313 14. Goods that are both excludable and rival would be considered a. natural monopolies. b. common resources. c. public goods. d. private goods. ANSWER: d. private goods. TYPE: M SECTION: 1 DIFFICULTY: 1 15. Which of the following would NOT be considered a private good? a. tennis shoes b. pizza c. french fries d. cable TV ANSWER: d. cable TV TYPE: M SECTION: 1 DIFFICULTY: 1 16. Private goods are both a. excludable and nonrival. b. nonexcludable and rival. c. excludable and rival. d. nonexcludable and nonrival. ANSWER: c. excludable and rival. TYPE: M SECTION: 1 DIFFICULTY: 2 17. Which of the following would be considered a private good? a. national defense b. a public beach c. local cable television service d. a bottle of natural mineral water ANSWER: d. a bottle of natural mineral water TYPE: M SECTION: 1 DIFFICULTY: 1 18. A cheeseburger is a. excludable and rival. b. excludable and nonrival. c. nonexcludable and rival. d. nonexcludable and nonrival ANSWER: a. excludable and rival. TYPE: M SECTION: 1 DIFFICULTY: 2 19. If the local government in Richmond, Missouri decides to put on a public fireworks display, the display would be a. excludable. b. rival. c. a public good. d. All of the above are correct. ANSWER: c. a public good. TYPE: M SECTION: 1 DIFFICULTY: 1 20. Goods that are nonexcludable and nonrival are a. public goods. b. private goods. c. natural monopolies. d. common resources. ANSWER: a. public goods. TYPE: M SECTION: 1 DIFFICULTY: 2 314 Chapter 11/Public Goods and Common Resources 21. Goods that are not rival include both a. natural monopolies and public goods. b. public goods and common resources. c. common resources and private goods. d. private goods and natural monopolies. ANSWER: a. natural monopolies and public goods. TYPE: M SECTION: 1DIFFICULTY: 2 22. Most goods in the economy are a. natural monopolies. b. common resources. c. public goods. d. private goods. ANSWER: d. private goods. TYPE: M SECTION: 1 DIFFICULTY: 1 23. An example of a private good would be a. cable TV. b. tornado sirens. c. clothing. d. the environment. ANSWER: c. clothing. TYPE: M SECTION: 1 DIFFICULTY: 1 24. Public goods are a. excludable but not rival. b. rival but not excludable. c. both excludable and rival. d. neither excludable nor rival. ANSWER: d. neither excludable nor rival. TYPE: M SECTION: 1 DIFFICULTY: 2 25. Goods that are not excludable are usually a. higher priced than excludable goods. b. higher priced than rival goods. c. in short supply. d. free of charge. ANSWER: d. free of charge. TYPE: M SECTION: 1 DIFFICULTY: 2 26. When something of value has no price attached to it such as a public good a. externalities will be present. b. the good will be completely used up. c. only those who are better off have to pay. d. private companies will eventually produce the product and the good will no longer be free. ANSWER: a. externalities will be present. TYPE: M SECTION: 1DIFFICULTY: 2 27. The market does not provide national defense because a. it is impossible to prevent any single person from enjoying the benefit of national defense. b. the fixed cost of national defense is too high. c. the necessary resources for national defense are not available in the private sector. d. All of the above are correct. ANSWER: a. it is impossible to prevent any single person from enjoying the benefit of national defense. TYPE: M SECTION: 1 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 315 28. A natural monopoly is a. excludable but not rival. b. rival but not excludable. c. both excludable and rival. d. neither excludable nor rival. ANSWER: a. excludable but not rival. TYPE: M SECTION: 1 DIFFICULTY: 2 29. An example of a natural monopoly would be a. cable TV. b. tornado sirens. c. clothing. d. the environment. ANSWER: a. cable TV. TYPE: M SECTION: 1 DIFFICULTY: 1 30. Both public goods and common resources are a. rival. b. nonrival. c. excludable. d. nonexcludable. ANSWER: d. nonexcludable. TYPE: M SECTION: 1 DIFFICULTY: 3 31. Common resources are both a. rival and nonexcludable. b. rival and excludable. c. nonrival and excludable. d. nonrival and nonexcludable. ANSWER: a. rival and nonexcludable. TYPE: M SECTION: 1 DIFFICULTY: 2 32. Common resource goods are a. excludable but not rival. b. rival but not excludable. c. both excludable and rival. d. neither excludable nor rival. ANSWER: b. rival but not excludable. TYPE: M SECTION: 1 DIFFICULTY: 2 33. A good that is rival but not excludable would be a a. public good. b. private good. c. natural monopoly. d. common resource. ANSWER: d. common resource. TYPE: M SECTION: 1 DIFFICULTY: 2 34. Which of the following would be considered a common resource good? a. cable television b. bottled natural mineral water c. uncongested toll roads d. fish in the ocean ANSWER: d. fish in the ocean TYPE: M SECTION: 1 DIFFICULTY: 2 316 Chapter 11/Public Goods and Common Resources 35. The fish in the ocean are an example of a a. common resource. b. public good. c. private good. d. natural monopoly. ANSWER: a. common resource. TYPE: M SECTION: 1 DIFFICULTY: 1 36. When one person uses a common resource, which will NOT occur? a. An externality will arise. b. Other people are worse off. c. It is difficult to charge him or her for usage of it. d. No one else will be able to use the common resource. ANSWER: d. No one else will be able to use the common resource. TYPE: M SECTION: 1 DIFFICULTY: 2 37. Goods that are not excludable may be socially desirable a. but not privately profitable. b. and therefore will be provided by both the government and as a private good. c. and have a lower price so more consumers will be able to afford them. d. but are still generally taxed by the government. ANSWER: a. but not privately profitable. TYPE: M SECTION: 1DIFFICULTY: 2 38. When goods are not excludable a. the good will be produced as a private good but not as a public good. b. the good will not be produced since no one values it. c. the free-rider problem prevents the private market from supplying them. d. everyone can have all they want and the good will have a zero price. ANSWER: c. the free-rider problem prevents the private market from supplying them. TYPE: M SECTION: 1DIFFICULTY: 2 39. A free-rider problem exists for any good that is NOT a. rival. b. a private good. c. free. d. excludable. ANSWER: d. excludable. TYPE: M SECTION: 1DIFFICULTY: 1 40. A free-rider is a person who a. will only purchase a product on sale. b. receives the benefit of a good but avoids paying for it. c. can produce a good at no cost . d. takes advantage of tax loop-holes to lower his taxes. ANSWER: b. receives the benefit of a good but avoids paying for it. TYPE: M SECTION: 2 DIFFICULTY: 1 41. When a good is excludable but not rival, it is an example of a a. natural monopoly. b. private good. c. public good. d. common resource. ANSWER: a. natural monopoly. TYPE: M SECTION: 1 DIFFICULTY: 1 Chapter 11/Public Goods and Common Resources 317 42. Which of the following goods would satisfy attributes of a natural monopoly? a. a congested public freeway b. an airline flight that has been overbooked c. local cable television d. public parking ANSWER: c. local cable television TYPE: M SECTION: 1 DIFFICULTY: 1 43. What characteristics do public goods and common resources have in common? a. both goods are nonexcludable b. both goods are excludable c. both goods are rival d. both goods are nonrival ANSWER: a. both goods are nonexcludable TYPE: M SECTION: 1 DIFFICULTY: 2 44. For both public goods and common resources, an externality arises because a. something of value has no price attached to it. b. the goods are undervalued by society. c. the social optimum level of output is lower than the market equilibrium’s. d. All of the above are correct. ANSWER: a. something of value has no price attached to it. TYPE: M SECTION: 1 DIFFICULTY: 2 45. Which of the following is NOT considered a public good? a. national defense b. basic research c. fire protection d. fighting poverty ANSWER: c. fire protection TYPE: M SECTION: 1DIFFICULTY: 1 46. National defense is provided by the government because a. it is impossible for private markets to produce public goods. b. products provided by the government can be produced more efficiently. c. free-riders make it difficult for private markets to supply the socially optimal quantity. d. if the good were produced in private markets, most likely too much of the product would be produced. ANSWER: c. free-riders make it difficult for private markets to supply the socially optimal quantity. TYPE: M SECTION: 2 DIFFICULTY: 2 47. For the government to provide a product with tax revenue a. the total cost must exceed the total benefit. b. it must be able to produce the product cheaper than the private market could. c. the total benefit must exceed the total cost. d. the government does not provide products with tax revenue. ANSWER: c. the total benefit must exceed the total cost. TYPE: M SECTION: 2 DIFFICULTY: 2 48. National defense is a classic example of a public good because a. private security services are very difficult to find. b. it is difficult to exclude people from receiving the benefits from national defense once it is provided. c. everyone agrees that some level of national defense is important, but only the government knows the optimal amount. d. if individuals were required to purchase their own armored tank, there wouldn’t be enough to go around. ANSWER: b. it is difficult to exclude people from receiving the benefits from national defense once it is provided. TYPE: M SECTION: 1 DIFFICULTY: 2 318 Chapter 11/Public Goods and Common Resources 49. In 2002, per person expenditures on national defense amounted to a. $800. b. $1,200. c. $1,500. d. $2,000. ANSWER: b. $1,200. TYPE: M SECTION: 1 DIFFICULTY: 1 50. When one person uses a common resource, such as fish in the ocean, which would NOT be true? a. Other people are likely to be worse off. b. Other people are not likely to be compensated for their loss. c. He or she neglects to account for external effects. d. There will still be enough left, since one person cannot make a major impact. ANSWER: d. There will still be enough left, since one person cannot make a major impact. TYPE: M SECTION: 1 DIFFICULTY: 3 51. Due to the externalities associated with public goods and common resources, a. private markets will lead to an efficient allocation of resources. b. government intervention can potentially raise economic well-being. c. private markets will correct for the gain or loss to consumer surplus. d. the free-rider problem is eliminated. ANSWER: b. government intervention can potentially raise economic well-being. TYPE: M SECTION: 1 DIFFICULTY: 2 52. The privately-owned school system in Smalltown has a virtually unlimited capacity. It accepts all applicants and operates on both tuition and private donations. Although every resident places value on having an educated community, the school’s revenues have suffered lately due to a large decline in private donations from the elderly population. If the private market quantity of education is below the socially desirable quantity, Smalltown can remedy its problem by a. allowing the local government to compel local citizens to subsidize education by taxing them. b. increasing tuition to compensate for the decrease in donations. c. increasing teacher wages. d. All of the above are correct. ANSWER: a. allowing the local government to compel local citizens to subsidize education by taxing them. TYPE: M SECTION: 1 DIFFICULTY: 2 53. The privately-owned school system in Smalltown has a virtually unlimited capacity. It accepts all applicants and operates on both tuition and private donations. Although every resident places value on having an educated community, the school’s revenues have suffered lately due to a large decline in private donations from the elderly population. Since the benefit each citizen receives from having an educated community is a public good, which would NOT be true? a The free-rider problem causes the private market to undersupply education to the community. b. The government can potentially help the market reach a socially optimal level of education. c. A tax increase to pay for education could potentially make the community better off. d. The private market is the best way to supply education. ANSWER: d. The private market is the best way to supply education. TYPE: M SECTION: 2 DIFFICULTY: 3 54. Market failure associated with the free-rider problem is a result of a. a problem associated with pollution. b. benefits that accrue to those who don’t pay. c. losses that accrue to providers of the product. d. a project in which costs exceed benefits. ANSWER: b. benefits that accrue to those who don’t pay. TYPE: M SECTION: 2 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 319 55. The government provides public goods because a. private markets are incapable of producing public goods. b. free-riders make it difficult for private markets to supply the socially optimal quantity. c. markets are always better off with some government oversight. d. external benefits will occur to private producers. ANSWER: b. free-riders make it difficult for private markets to supply the socially optimal quantity. TYPE: M SECTION: 2 DIFFICULTY: 2 56. Basic research is a public good because it a. is difficult to exclude those who might benefit from it. b. is used to develop public goods. c. always benefits developed countries at the expense of developing countries. d. is a rival good. ANSWER: a. is difficult to exclude those who might benefit from it. TYPE: M SECTION: 2 DIFFICULTY: 2 57. The free-rider problem exists with a. fire protection. b. knowledge. c. cable TV. d. congested toll roads. ANSWER: b. knowledge. TYPE: M SECTION: 2 DIFFICULTY: 1 58. When a free-rider problem exists a. too few resources are devoted to the good. b. the cost of the good will always be more than the benefit of the good. c. the good will not be produced. d. entrepreneurs will eventually find a way to make free-riders pay their share. ANSWER: a. too few resources are devoted to the good. TYPE: M SECTION: 2 DIFFICULTY: 2 59. Too few resources are devoted to the creation of knowledge because profit-seeking firms a. undervalue knowledge in their pursuit of revenues. b. abuse their patents. c. tend to free-ride on the knowledge that others have developed. d. tend to rely on existing employee knowledge. ANSWER: c. tend to free-ride on the knowledge that others have developed. TYPE: M SECTION: 2 DIFFICULTY: 2 60. Knowledge is an example of a a. public good. b. private good. c. common resource. d. natural monopoly good. ANSWER: a. public good. TYPE: M SECTION: 3 DIFFICULTY: 1 61. The U.S. patent system a. makes both general and technical knowledge excludable. b. makes only technical knowledge excludable. c. creates a disincentive to invent. d. All of the above are correct. ANSWER: b. makes only technical knowledge excludable. TYPE: M SECTION: 2 DIFFICULTY: 2 320 Chapter 11/Public Goods and Common Resources 62. The difference between technological knowledge and general knowledge is that a. general knowledge creation is usually more profitable for the creator. b. technological knowledge is excludable and general knowledge is not. c. general knowledge is excludable and technological knowledge is not. d. general knowledge is rival and technological knowledge is not. ANSWER: b. technological knowledge is excludable and general knowledge is not. TYPE: M SECTION: 2 DIFFICULTY: 2 63. Which of the following is NOT a reason why government agencies subsidize basic research? a. The private market devotes too few resources to basic research. b. The general knowledge developed through basic research can be used without charge. c. The social benefit of additional knowledge is perceived to be greater than the cost of subsidies. d. The government attempts to attract the best and the brightest researchers. ANSWER: d. The government attempts to attract the best and the brightest researchers. TYPE: M SECTION: 2 DIFFICULTY: 2 64. Because general knowledge is not excludable a. the government contributes to its production. b. the cost generally outweighs the benefit to society. c. private markets would choose to not supply any general knowledge to society. d. general knowledge cannot be “supplied” to the market by anyone since it is not a product. ANSWER: a. the government contributes to its production. TYPE: M SECTION: 2 DIFFICULTY: 2 65. As with many public goods, determining the appropriate level of government support for the production of general knowledge is difficult because a. benefits are hard to measure. b. patents correct for an unknown portion of the externality. c. members of Congress are often experts in the sciences. d. the costs always exceed the benefits. ANSWER: a. benefits are hard to measure. TYPE: M SECTION: 2 DIFFICULTY: 2 66. Determining the appropriate level of government support for expanding general knowledge a. is determined by demand and supply. b. is accurately determined by Congress. c. can be easily measured by determining the amount where benefits equal cost. d. is difficult since benefits are hard to measure. ANSWER: d. is difficult since benefits are hard to measure. TYPE: M SECTION: 2 DIFFICULTY: 2 67. Advocates of antipoverty programs claim that fighting poverty a. is most successfully done by charities. b. is a public good. c. can be done efficiently by the market system. d. should not be done with tax dollars. ANSWER: b. is a public good. TYPE: M SECTION: 2 DIFFICULTY: 2 68. Advocates of antipoverty programs believe that fighting poverty a. can make everyone better off. b. is most successfully done by charities. c. can be done efficiently by the market system. d. should not be done with tax dollars. ANSWER: a. can make everyone better off. TYPE: M SECTION: 2 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 321 69. Assuming that everyone prefers to live in a society without poverty, people who do not donate to private charity a. receive no external benefit from private antipoverty programs. b. decrease the reliance of individuals on antipoverty programs. c. free ride on the generosity of others. d. are most likely to be in favor of government-sponsored programs. ANSWER: c. free ride on the generosity of others. TYPE: M SECTION: 2 DIFFICULTY: 2 70. If everyone benefits from helping the poor, a. taxing the wealthy to raise living standards of the poor can potentially make everyone better off. b. eliminating taxes aimed at redistributing income will necessarily make rich people better off. c. government intervention can only make things worse. d. private markets can adequately provide charity programs to help the poor despite free-rider problems. ANSWER: a. taxing the wealthy to raise living standards of the poor can potentially make everyone better off. TYPE: M SECTION: 2 DIFFICULTY: 2 71. Most lighthouses are operated by the government because a. of the free-rider problem. b. lighthouses are no longer valued by society. c. most lighthouses are only tourist attractions in state and national parks. d. shipping companies would not be able to afford lighthouse upkeep. ANSWER: a. of the free-rider problem. TYPE: M SECTION: 2 DIFFICULTY: 2 72. A lighthouse is typically considered a good example of a public good because a. the owner of the lighthouse is able to exclude beneficiaries from enjoying the lighthouse. b. there is rarely another lighthouse nearby to provide competition. c. a nearby port authority cannot avoid paying fees to the lighthouse owner. d. all passing ships are able to enjoy the benefits of the lighthouse without paying. ANSWER: d. all passing ships are able to enjoy the benefits of the lighthouse without paying. TYPE: M SECTION: 2 DIFFICULTY: 2 73. Private markets usually fail to provide lighthouses because a. lighthouses cost too much to build relative to their benefits. b. government intervention makes it hard for private lighthouse owners to compete in the market. c. ship captains have incentives to use lighthouses without paying. d. lighthouses are valued very little by ship captains these days. ANSWER: c. ship captains have incentives to use lighthouses without paying. TYPE: M SECTION: 2 DIFFICULTY: 2 74. A lighthouse might be considered a private good if a. there is a second lighthouse nearby, thus preventing a monopoly. b. the owner of the lighthouse is able to exclude beneficiaries from receiving the benefits of the lighthouse. c. ships are able to enjoy the benefits of the lighthouse without paying for the benefit. d. a nearby port authority is able to avoid paying any fees to the lighthouse owner. ANSWER: b. the owner of the lighthouse is able to exclude beneficiaries from receiving the benefits of the lighthouse. TYPE: M SECTION: 2 DIFFICULTY: 2 75. In deciding whether something is a public good, one must determine the a. number of beneficiaries. b. value of external benefits which accrue to resource owners. c. excludability of the beneficiaries. d. All of the above are correct. e. Both a and c are correct. ANSWER: e. Both a and c are correct. TYPE: M SECTION: 2 DIFFICULTY: 3 322 Chapter 11/Public Goods and Common Resources 76. The free-rider problem is worse if a. the government refuses to provide the product. b. the number of beneficiaries is large. c. private markets can provide the rival good. d. the number of provisions is small. ANSWER: b. the number of beneficiaries is large. TYPE: M SECTION: 2 DIFFICULTY: 2 77. A lighthouse that primarily benefits a single port owner is more like a a. public good. b. natural monopoly. c. private good. d. common resource. ANSWER: c. private good. TYPE: M SECTION: 2 DIFFICULTY: 2 78. Suppose that Martin owns a lighthouse and Lewis owns a nearby port. Martin’s lighthouse benefits only those ships that enter Lewis’s port. Which of the following statements is NOT true? a. Martin’s lighthouse may be considered a private good. b. Martin can combat the free-rider problem by charging Lewis a usage fee. c. Martin can exclude Lewis’s port from benefiting from the lighthouse by simply turning the power off. d. Martin’s lighthouse would be considered a common resource. ANSWER: d. Martin’s lighthouse would be considered a common resource. TYPE: M SECTION: 2 DIFFICULTY: 3 79. When the government decides to build a new highway, the first step would be to conduct a study to determine the value of the project. The study is called a a. fiscal analysis. b. monetary analysis. c. welfare analysis. d. cost-benefit analysis. ANSWER: d. cost-benefit analysis. TYPE: M SECTION: 2 DIFFICULTY: 1 80. A cost-benefit analysis of a highway is difficult to conduct because analysts a. cannot estimate the explicit cost of a project that has not been completed. b. are unlikely to have access to costs on similar projects. c. are not able to consider the opportunity cost of resources. d. do not have a price with which to judge the value of the highway. ANSWER: d. do not have a price with which to judge the value of the highway. TYPE: M SECTION: 2 DIFFICULTY: 2 81. The value and cost of goods provided in an economy are easier to determine when those goods are a. private goods. b. public goods. c. common resources. d. natural monopolies. ANSWER: a. private goods. TYPE: M SECTION: 2 DIFFICULTY: 1 82. Simply asking people how much they value a highway is not a reliable way of measuring the benefits and costs because a. those who stand to gain have an incentive to tell the truth. b. those who stand to lose have an incentive to exaggerate their true costs. c. answers to the survey questions will always be downwardly biased. d. not everyone asked will be using the highway. ANSWER: b. those who stand to lose have an incentive to exaggerate their true costs. TYPE: M SECTION: 2 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 323 83. The government provides public goods because a. private markets would not produce any of the good. b. private markets would not produce the efficient quantity of the good. c. private markets would charge too high a price for the good. d. the government produces public goods more efficiently than private markets can. ANSWER: b. private markets would not produce the efficient quantity of the good. TYPE: M SECTION: 2 DIFFICULTY: 2 84. Before considering any public project the government should a. compare the total cost and total benefits of the project. b. conduct a cost-benefit analysis. c. allow citizens to determine which projects are most valuable to them. d. All of the above are correct. e. Both a and b are correct. ANSWER: e. Both a and b are correct. TYPE: M SECTION: 2 DIFFICULTY: 2 85. The greatest difficulty with cost-benefit analysis of a public project is determining a. whether government revenue is sufficient to cover the cost of the project. b. who to award the project contract to. c. the cost of the project. d. the value or benefit of the project. ANSWER: d. the value or benefit of the project. TYPE: M SECTION: 2 DIFFICULTY: 2 86. Externalities are present in a market whenever a. a shortage exists. b. the price is higher than equilibrium price. c. private costs differ from social costs. d. the seller is not making a profit. ANSWER: c. private costs differ from social costs. TYPE: M SECTION: 3 DIFFICULTY: 2 87. Because of the free-rider problem, respondents to cost-benefit surveys a. are unable to evaluate the effect of the project on their personal satisfaction. b. are typically not benefited directly by government projects. c. have a difficult time identifying explicit costs. d. have little incentive to tell the truth. ANSWER: d. have little incentive to tell the truth. TYPE: M SECTION: 2 DIFFICULTY: 2 88. Each of the following explain why cost-benefit analysis is difficult EXCEPT a. there is no price with which to judge the value of a public good. b. surveys are often biased and unreliable. c. it is difficult to identify all factors that influence costs and benefits of public goods. d. government projects rarely have sufficient funding to complete projects on time. ANSWER: d. government projects rarely have sufficient funding to complete projects on time. TYPE: M SECTION: 2 DIFFICULTY: 2 89. To increase safety at a bad intersection, you must decide whether to install a traffic light in your hometown at a cost of $10,000. If the traffic light reduces the risk of fatality by 0.5 percent and the value of a human life is about $10 million, you should a. install the light because the expected benefit of $50,000 is greater than the cost. b. install the light because the expected benefit of $20,000 is greater than the cost. c. not install the light because the expected benefit of $10,000 is only equal to the cost. d. not install the light because the expected benefit of $5,000 is less than the cost. ANSWER: a. install the light because the expected benefit of $50,000 is greater than the cost. TYPE: M SECTION: 2 DIFFICULTY: 3 324 Chapter 11/Public Goods and Common Resources 90. A town engineer comes to the town council with a proposal to build a traffic light at a certain intersection that currently has a stop sign. The benefit of the traffic light is increased safety and will reduce the incidence of fatal traffic accidents by 50 percent per year. Which of the following statements is true? a. The project should definitely be accepted. b. The decision to install the light is likely to require a complex evaluation of the trade-off between the worth of human life and the lost time waiting for the light to change signals. c. The full cost of the traffic light will be relatively small since it only includes the purchase and installation costs. d. The cost will invariably outweigh the benefit. ANSWER: b. The decision to install the light is likely to require a complex evaluation of the trade-off between the worth of human life and the lost time waiting for the light to change signals. TYPE: M SECTION: 2 DIFFICULTY: 3 91. Suppose that installing an overhead pedestrian walkway would cost a college town $100,000. If the walkway is expected to reduce the risk of fatality by 2 percent and the cost of a human life was estimated at $10 million, the town would a. install the walkway because the estimated benefit is twice the cost. b. install the walkway because the estimated benefit equals the cost. c. not install the walkway, since the cost is twice the estimated benefit. d. install the walkway, since the cost of even a single life is too great. ANSWER: a. install the walkway because the estimated benefit is twice the cost. TYPE: M SECTION: 2 DIFFICULTY: 3 92. Suppose that the cost of installing an overhead pedestrian walkway in a college town is $100,000. If the walkway is expected to reduce the risk of fatality by 0.5 percent and the cost of a human life is estimated at $10 million the town would a. install the walkway because the estimated benefit is twice the cost. b. install the walkway because the estimated benefit equals the cost. c. not install the walkway, since the cost is twice the estimated benefit. d. install the walkway, since the cost of even a single life is too great. ANSWER: c. not install the walkway, since the cost is twice the estimated benefit. TYPE: M SECTION: 2 DIFFICULTY: 3 93. Suppose that policymakers are doing cost-benefit analysis on a proposal to add traffic barriers to divide the flow of traffic in an effort to increase safety on a given highway. Which of the following statements is true? a. The costs and benefits need not be measured in the same units to compare them meaningfully. b. It is hard to measure the cost of installing the traffic barriers. c. Quantification of the benefit received from saving a human life is a straightforward process. d. Policymakers must put a dollar value on human life. ANSWER: d. Policymakers must put a dollar value on human life. TYPE: M SECTION: 2 DIFFICULTY: 2 94. Studies show that the value of a human life is about a. $1 million. b. $5 million. c. $10 million. d. $20 million. ANSWER: c. $10 million. TYPE: M SECTION: 2 DIFFICULTY: 1 95. When an infinite value is placed on human life, policymakers who rely on cost-benefit analysis a. are forced to pursue any project in which a single human life is saved. b. are likely to make decisions that optimally allocate society’s scarce resources. c. would not pursue any public project that would not save human life. d. would be forced to rely on private markets to provide the project. ANSWER: a. are forced to pursue any project in which a single human life is saved. TYPE: M SECTION: 2 DIFFICULTY: 3 Chapter 11/Public Goods and Common Resources 325 96. For use in cost-benefit analysis, the value of a human life is sometimes calculated on the basis of a. the risks that a person voluntarily exposes herself to in her job and/or recreational choices. b. the value of each individual’s assets. c. an infinite value for each life. d. the amount of resources required to adequately sustain life. ANSWER: a. the risks that a person voluntarily exposes herself to in her job and/or recreational choices. TYPE: M SECTION: 2 DIFFICULTY: 2 97. Fire protection is a good example of a natural monopoly because a. it is nonexcludable b. it is rival. c. protecting an extra house is unlikely to reduce the protection available to others. d. All of the above are correct. ANSWER: c. protecting an extra house is unlikely to reduce the protection available to others. TYPE: M SECTION: 1 DIFFICULTY: 2 98. Suppose that you want to put on a fireworks display in your hometown of 1,000 people this July. The cost of the display is $6,000 and each person values the display at $5. After a month, you have only sold 50 tickets at $5 each. The result is a. the local government will put on the display but you will not. b. you will still put on the display but the local government would not. c. neither you nor the local government would put on the display. d. This question cannot be answered without knowing the amount of tax the local government would charge for the display. ANSWER: c. neither you nor the local government would put on the display. TYPE: M SECTION: 2 DIFFICULTY: 3 99. Cost-benefit analysis is important to determine the role of government in our economy because a. the government should provide all goods in which benefits exceed costs. b. cost-benefit analysis identifies the possible gains to society from government provision of a particular good. c. markets for private goods are not able to effectively assign costs and benefits. d. cost-benefit analysis identifies market failure. ANSWER: b. cost-benefit analysis identifies the possible gains to society from government provision of a particular good. TYPE: M SECTION: 2 DIFFICULTY: 2 100. When the value of a human life is calculated according to the economic contribution a person makes to society (as reflected in their income-earning potential) it is likely to lead to the bizarre implication that a. it is possible for a retired or disabled person to have no value to society. b. economists are more valuable than entrepreneurs. c. retired people who volunteer in their communities are more valuable than physicians. d. all workers have equal value. ANSWER: a. it is possible for a retired or disabled person to have no value to society. TYPE: M SECTION: 2 DIFFICULTY: 2 101. Examples of careers that lend substance to the approach of valuing human life by evaluating the risks that people are voluntarily willing to take and the compensation they require for that risk include a. Certified Public Accounts at tax time. b. construction workers on high-rise buildings. c. neonatologists. d. nurses. ANSWER: b. construction workers on high-rise buildings. TYPE: M SECTION: 2 DIFFICULTY: 1 326 Chapter 11/Public Goods and Common Resources 102. The Occupational Safety and Health Administration (OSHA) has determined that the probability of a worker dying from exposure to a hazardous chemical used in the production of diet soft drinks is 0.0005. The cost of imposing a regulation that would ban this chemical is $18 million. If each person saved has a value equal to $10 million, how many people must the policy affect for benefits to exceed costs? a. 301 b. 601 c. 1801 d. 3601 ANSWER: d. 3601 TYPE: M SECTION: 2 DIFFICULTY: 3 103. The Occupational Safety and Health Administration (OSHA) has determined that 100 workers are exposed to a hazardous chemical used in the production of diet soft drinks. The cost of imposing a regulation that would ban this chemical is $10 million. OSHA has calculated that each person saved by this regulation has a value equal to $10 million. If benefits are exactly equal to costs, what probability is OSHA using to assess the likelihood of a fatality from exposure to this chemical? a. 0.001 b. 0.01 c. 0.1 d. 1.0 ANSWER: b. 0.01. TYPE: M SECTION: 2 DIFFICULTY: 3 104. Some goods can be either common resources or public goods depending on a. whether the good is rival. b. how policymakers deal with the good. c. the marginal cost of the good. d. None of the above are correct. ANSWER: a. whether the good is rival. TYPE: M SECTION: 3 DIFFICULTY: 2 105. Once a common resource is available for consumption, policymakers need to be concerned with a. making sure everyone gets a fair chance to consume. b. how much is consumed. c. creating laws that will completely forbid consumption, because the environment is priceless. d. None of the above are correct because common resources are optimally provided in private markets. ANSWER: b. how much is consumed. TYPE: M SECTION: 3 DIFFICULTY: 2 106. One way to eliminate the Tragedy of the Commons is to a. increase law enforcement in public areas. b. limit access to the commons. c. increase access to the commons. d. provide more public land for recreation. ANSWER: b. limit access to the commons. TYPE: M SECTION: 3 DIFFICULTY: 2 107. Once it becomes obvious that a common resource is being overused, a. market forces cause the use of the resource to shift to a sustainable level. b. society voluntarily limits its use of the good. c. it continues to be overused because individuals have no incentive to reduce their use of the good. d. the good becomes a natural monopoly. ANSWER: c. it continues to be overused because individuals have no incentive to reduce their use of the good. TYPE: M SECTION: 3 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 327 108. The Tragedy of the Commons results when a good is a. rival and not excludable. b. excludable and not rival. c. both rival and excludable. d. neither rival nor excludable. ANSWER: a. rival and not excludable. TYPE: M SECTION: 3 DIFFICULTY: 2 109. The Tragedy of the Commons occurs because a. a common resource is rival in consumption. b. a common resource is underutilized. c. crimes are committed in public places. d. common resources are subject to exclusionary rules. ANSWER: a. a common resource is rival in consumption. TYPE: M SECTION: 3 DIFFICULTY: 2 110. The Tragedy of the Commons occurs because a. government property is most heavily used by the wealthy. b. everyone deserves an equal share of government property. c. social and private incentives differ. d. established property rights create competition. ANSWER: c. social and private incentives differ. TYPE: M SECTION: 3 DIFFICULTY: 2 111. The Tragedy of the Commons for sheep grazing on common land can be eliminated by the government doing each of the following EXCEPT a. assigning land property rights. b. auctioning off sheep-grazing permits. c. taxation of sheep. d. subsidizing sheep flocks. ANSWER: d. subsidizing sheep flocks. TYPE: M SECTION: 3 DIFFICULTY: 2 112. When private costs differ from social costs, which of the following must be present? a. excludable resources b. a negative externality c. a natural monopoly d. poor profit incentive to capitalize on the resource ANSWER: b. a negative externality TYPE: M SECTION: 3 DIFFICULTY: 2 113. When one person uses a common resource and he diminishes other people’s enjoyment of it, it is an example of a. a market force. b. an externality. c. the invisible hand. d. excludability. ANSWER: b. an externality. TYPE: M SECTION: 3 DIFFICULTY: 2 114. The Tragedy of the Commons will be evident when a growing number of sheep grazing on the town commons leads to a destruction of the grazing resource. To correct for this problem, the a. town could allow individual shepherds to chose their own flock sizes. b. externality could be internalized by subsidizing the production of sheep’s wool. c. town could auction off a limited number of sheep-grazing permits. d. All of the above are correct. ANSWER: c. the town could auction off a limited number of sheep-grazing permits. TYPE: M SECTION: 3 DIFFICULTY: 2 328 Chapter 11/Public Goods and Common Resources 115. The pollution of water and air a. can be solved by addressing the positive externalities. b. can be viewed as an example of a common resource problem. c. are viewed as a bastion of efficient market processes. d. can be solved by taxes on swine, called Pigovian taxes. ANSWER: b. can be viewed as an example of a common resource problem. TYPE: M SECTION: 3 DIFFICULTY: 2 116. Government may be able to solve the problem of overuse of a common resource by doing each of the following EXCEPT a. regulating the use or consumption of the common resource. b. taxing the use or consumption of the common resource. c. selling the common resource to a private entity. d. allowing individuals to voluntarily reduce their use of the resource. ANSWER: d. allowing individuals to voluntarily reduce their use of the resource. TYPE: M SECTION: 3 DIFFICULTY: 2 117. The Tragedy of the Commons a. occurs most often with public goods. b. is only applicable to shared grazing rights among sheep herders. c. is eliminated when property rights are assigned to individuals. d. occurs when social incentives are in line with private incentives. ANSWER: c. is eliminated when property rights are assigned to individuals. TYPE: M SECTION: 3 DIFFICULTY: 2 118. The Tragedy of the Commons can be corrected by a. providing more of the resource for public use. b. assigning property rights to individuals. c. providing government subsidies for the resource. d. making certain everyone in the economy has access to the resource. ANSWER: b. assigning property rights to individuals. TYPE: M SECTION: 3 DIFFICULTY: 2 119. If the use of a common resource is not regulated, a. it cannot be used by anyone. b. the economy will end up with too much of a good thing. c. it becomes a private good. d. it will be overused. ANSWER: d. it will be overused. TYPE: M SECTION: 3 DIFFICULTY: 2 120. The statement “What is common to many is taken least care of, for all men have greater regard for what is their own than for what they possess in common with others” is attributed to a. Karl Marx. b. Aristotle. c. Plato. d. Adam Smith. ANSWER: b. Aristotle. TYPE: M SECTION: 3 DIFFICULTY: 1 121. Each of the following would be considered a common resource EXCEPT a. clean air. b. congested roads. c. national defense. d. open grazing land. ANSWER: c. national defense. TYPE: M SECTION: 3 DIFFICULTY: 1 Chapter 11/Public Goods and Common Resources 329 122. In almost all cases, the problem with overuse of common resources is that a. the allocation of private property rights leads to overuse of the common resource. b. private decisionmakers use the common resource too much. c. government policy allows unequal division of the common resource. d. All of the above are correct. ANSWER: b. private decisionmakers use the common resource too much. TYPE: M SECTION: 3 DIFFICULTY: 2 123. To remedy the presence of a negative externality such as pollution in a market, the government may choose to impose a a. Pigovian tax. b. subsidy. c. price floor. d. Coase theorem solution. ANSWER: a. Pigovian tax. TYPE: M SECTION: 3 DIFFICULTY: 2 124. Environmental degradation is NOT a. a common resource problem. b. remedied through Pigovian taxes. c. a form of market failure. d. always best resolved by direct regulation. ANSWER: d. always best resolved by direct regulation. TYPE: M SECTION: 3 DIFFICULTY: 2 125. Market failure with common resources occurs because a. the government imposes a negative externality on everyone’s consumption of the resource. b. society is unable to value the social loss that results from individual consumption. c. consumption can be privately profitable even when it is socially undesirable. d. All of the above are correct. ANSWER: c. consumption can be privately profitable even when it is socially undesirable. TYPE: M SECTION: 3 DIFFICULTY: 2 126. Uncongested roads are a good example of a a. public good. b. private good. c. common resource. d. a good produced by a natural monopoly. ANSWER: a. public good. TYPE: M SECTION: 3 DIFFICULTY: 1 127. If a road is congested, then use of that road by an additional person would lead to a a. negative externality. b. positive externality. c. natural monopoly problem. d. free-rider problem with rush hour drivers stuck in traffic. ANSWER: a. negative externality. TYPE: M SECTION: 3 DIFFICULTY: 2 128. Using a toll to reduce traffic when congestion is greatest is an example of a a. regulation solution. b. command-and-control policy. c. Pigovian tax. d. Coase theorem solution. ANSWER: c. Pigovian tax. TYPE: M SECTION: 3 DIFFICULTY: 2 330 Chapter 11/Public Goods and Common Resources 129. A toll on congested roads is in essence a/an a. interstate highway tax. b. Department of Motor Vehicles tax. c. gasoline tax. d. Pigovian tax. ANSWER: d. Pigovian tax. TYPE: M SECTION: 3 DIFFICULTY: 1 130. Which of the following statements is true of the tax on gasoline? a. It does not reduce traffic volume. b. It is the best solution to road congestion because it gives private individuals an incentive to internalize the congestion externality. c. It discourages driving on noncongested roads, even though there is no congestion externality for these roads. d. It has little effect on driving behavior. ANSWER: c. It discourages driving on noncongested roads, even though there is no congestion externality for these roads. TYPE: M SECTION: 3 DIFFICULTY: 2 131. A tax on gasoline often reduces road congestion because gasoline a. and driving are complementary goods. b. and driving are substitute goods. c. and driving are normal goods. d. is considered an inferior good. ANSWER: a. and driving are complementary goods. TYPE: M SECTION: 3 DIFFICULTY: 2 132. According to economist Lester Thurow, no city has ever been able to solve its congestion problems by a. imposing tolls. b. building more roads. c. increasing gasoline taxes. d. enforcing traffic laws. ANSWER: b. building more roads. TYPE: M SECTION: 3 DIFFICULTY: 2 133. Road tolls used to reduce traffic can be desirable because of each of the following EXCEPT a. they charge people based on consumption. b. they can help bring usage closer to its optimal level. c. rates can differ according to the time of day. d. the administrative costs are virtually nonexistent. ANSWER: d. the administrative costs are virtually nonexistent. TYPE: M SECTION: 3 DIFFICULTY: 3 134. Singapore is the only city in the world to reduce road congestion by a. government-imposed road pricing. b. building 10 miles of new highways each week. c. using boats as the primary source of transportation. d. allowing each family to own only one car. ANSWER: a. government-imposed road pricing. TYPE: M SECTION: 3 DIFFICULTY: 2 135. Road pricing is used in Singapore to a. raise revenue for new roads. b. sell the rights to 50 mile stretches of roads to individuals. c. reduce congestion and pollution problems. d. allow contractors to bid on the specific sections of new roads they want to build. ANSWER: c. reduce congestion and pollution problems. TYPE: M SECTION: 3 DIFFICULTY: 1 Chapter 11/Public Goods and Common Resources 331 136. In Singapore, the road tolls are charged to drivers based on each of the following EXCEPT the a. time of day when driving occurs. b. pollution problem for the day. c. particular roads used. d. distance drivers travel on the roads. ANSWER: d. distance drivers travel on the roads. TYPE: M SECTION: 3 DIFFICULTY: 2 137. To ameliorate the pollution problem outside the central city of Singapore, the Singapore government a. charges a premium tax on gasoline. b. auctions off the right to license new cars. c. does not allow taxis to travel outside the central city. d. allows only motorcycle and bicycle transportation. ANSWER: b. auctions off the right to license new cars. TYPE: M SECTION: 3 DIFFICULTY: 2 138. Proposals to use road tolls in an effort to reduce traffic congestion are often rejected by the public because a. there is no longer sufficient government intervention. b. they allow the rich to drive more than the poor. c. they tax only those who chose to drive on the toll roads. d. All of the above are correct. ANSWER: b. they allow the rich to drive more than the poor. TYPE: M SECTION: 3 DIFFICULTY: 2 139. Suppose all citizens in a certain city are given identical debit cards used to pay for toll roads. Which of the following statements would NOT be true, assuming that the debit cards could be sold privately from person to person? a. This would be a very egalitarian policy. b. This system would end up being a redistribution of income from those that drive more to those that drive less. c. This system could potentially be a redistribution of income from the rich to the poor if the poor drive less. d. The cost to the government of such a program would greatly outweigh the benefit to society. ANSWER: d. The cost to the government of such a program would greatly outweigh the benefit to society. TYPE: M SECTION: 3 DIFFICULTY: 3 140. Excessive fishing occurs because a. each individual fisherman has little incentive to maintain the species for the next year. b. fishermen rely on government managers to worry about fish populations. c. fishermen are concerned about the population dynamics of fish biomass, not current harvest rates. d. fishermen have other marketable skills and do not fear exploitation of fish reserves. ANSWER: a. each individual fisherman has little incentive to maintain the species for the next year. TYPE: M SECTION: 3 DIFFICULTY: 2 141. One of the least regulated common resources today is a. U.S. national parks. b. the ocean. c. U.S. government land in the West. d. the Great Lakes. ANSWER: b. the ocean. TYPE: M SECTION: 3 DIFFICULTY: 1 142. The ocean remains one of the largest unregulated resources for each of the following reasons EXCEPT a. many countries have access to the ocean. b. it is difficult to get international cooperation among countries that hold different values. c. the oceans are so vast that enforcing any agreements would be difficult. d. the international organization formed to patrol the oceans is totally ineffective. ANSWER: d. the international organization formed to patrol the oceans is totally ineffective. TYPE: M SECTION: 3 DIFFICULTY: 2 332 Chapter 11/Public Goods and Common Resources 143. The U.S. government protects fish by a. subsidizing the fishing industry. b. heavily taxing competing industries. c. selling fishing licenses and regulating fish lengths. d. All of the above are correct. ANSWER: c. selling fishing licenses and regulating fish lengths. TYPE: M SECTION: 3 DIFFICULTY: 1 144. Why do elephants face the threat of extinction while cows do not? a. Cattle are a valuable source of income for many people and elephants have no market value. b. There is a high demand for products that come only from the cow. c. There are still lots of cattle that roam free, while most elephants are in zoos. d. Cattle are owned by ranchers, while elephants are owned by no one. ANSWER: d. Cattle are owned by ranchers, while elephants are owned by no one. TYPE: M SECTION: 3 DIFFICULTY: 2 145. Elephants are endangered and cows are not because a. cows are not as valuable as elephants. b. elephants are a common resource and cows are a private good. c. cows are a common resource and elephants are a private good. d. it is legal to kill cows, but not elephants. ANSWER: b. elephants are a common resource and cows are a private good. TYPE: M SECTION: 3 DIFFICULTY: 2 146. Why is the commercial value of ivory a threat to the elephant, while the commercial value of beef is the cow’s guardian? a. No other animal has ivory tusks. b. Elephants are a common resource. c. Cows are a common resource. d. Cows are a public good. ANSWER: b. Elephants are a common resource. TYPE: M SECTION: 3 DIFFICULTY: 2 147. Because in many countries in Africa elephants roam freely, each individual African elephant poacher has a. a strong incentive to kill as many elephants as he can find. b. a strong incentive to protect the elephants. c. the ability to save the elephants. d. All of the above are correct. ANSWER: a. a strong incentive to kill as many elephants as he can find. TYPE: M SECTION: 3 DIFFICULTY: 2 148. Many species of animals are common resources, and many must be protected by law to keep them from extinction. Why is the cow not one of these endangered species even though there is such a high demand for beef? a. Cows reproduce at a high rate and have adapted well to their environment. b. Public policies have been implemented to protect cows from predators and diseases. c. Cows are privately owned and many endangered species are owned by no one. d. There is a natural ecological balance between the birth rate of cows and human consumption. ANSWER: c. Cows are privately owned and many endangered species are owned by no one. TYPE: M SECTION: 3 DIFFICULTY: 2 149. Elephant populations in some African countries have started to rise because a. poachers are working together to save the elephants. b. it is now illegal to kill elephants and sell their ivory. c. elephants have been made a private good and people are allowed to kill elephants on their own property. d. high ivory taxes make it hard to earn a decent return on elephant tusks. ANSWER: c. elephants have been made a private good and people are allowed to kill elephants on their own property. TYPE: M SECTION: 3 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 333 150. A good solution to saving the tiger from extinction would be a. to outlaw the sale of tiger liver. b. to tax the sale of tiger hides. c. to give the tigers’ habitat to someone. d. to regulate the traditional use of Asian medicines that use tiger liver. ANSWER: c. to give the tigers’ habitat to someone. TYPE: M SECTION: 3 DIFFICULTY: 2 151. It is common knowledge that many U.S. national parks have become overused. One possible solution to this problem is to a. increase entrance fees. b. conduct a study to determine the daily attendance capacity of the individual parks. c. reduce the national park service budget. d. All of the above are possible solutions. ANSWER: a. increase entrance fees. TYPE: M SECTION: 3 DIFFICULTY: 2 152. One proposed solution to overused, deteriorating national parks would be to a. have Congress increase the entrance fees. b. increase the number of bears. c. decrease management and maintenance of facilities. d. reduce the number of improved camping facilities. ANSWER: a. have Congress increase the entrance fees. TYPE: M SECTION: 3 DIFFICULTY: 2 153. To most economists, the best solution to the overcrowding problem at Yellowstone National park is to a. increase entrance fees to the park. b. place daily quotas on the number of vehicles that enter the park. c. increase financial aid from the government. d. temporarily close down damaged sections of the park. ANSWER: a. increase entrance fees to the park. TYPE: M SECTION: 3 DIFFICULTY: 2 154. Which of the following statements concerning Yellowstone National Park is NOT true? a. Entrance fees have not kept pace with inflation over the last century. b. When the park gets too crowded no more visitors are allowed. c. The park does not take advantage of the free market to correct for overcrowding. d. If Yellowstone received additional support from the federal government, the overuse problem would be eliminated. ANSWER: d. If Yellowstone received additional support from the federal government, the overuse problem would be eliminated. TYPE: M SECTION: 3 DIFFICULTY: 2 155. Raising the entrance fee at Yellowstone National Park to compensate for overuse would NOT a. potentially increase park revenues. b. potentially decrease the number of visitors. c. allow market forces to correct for the externality. d. make our national park a private good. ANSWER: d. make our national park a private good. TYPE: M SECTION: 3 DIFFICULTY: 2 156. Currently in the United States very few entrepreneurs operate their own wildlife parks because a. urban sprawl is eating up rural areas too quickly. b. government-sponsored national parks set entrance fees below cost. c. restrictive laws invariably prohibit such activity. d. private citizens demand fewer parks each year. ANSWER: b. government sponsored national parks set entrance fees below cost. TYPE: M SECTION: 3 DIFFICULTY: 2 334 Chapter 11/Public Goods and Common Resources 157. Markets fail to allocate resources efficiently when a. prices fluctuate. b. those with the property rights abuse their privileges. c. property rights are not well established. d. the government refuses to intervene in private markets. ANSWER: c. property rights are not well established. TYPE: M SECTION: 3 DIFFICULTY: 2 158. When the absence of property rights causes a market failure, the government can potentially solve the problem a. by clearly defining property rights. b. through regulation. c. by supplying the good itself. d. All of the above are correct. ANSWER: d. All of the above are correct. TYPE: M SECTION: 3 DIFFICULTY: 1 159. Four friends decide to meet at a Chinese restaurant for dinner. They decide that each person will order an item off the menu and they will share all dishes. When the final bill for the meal comes they decide they will split the cost evenly among each of the people at the table. When the food is delivered to the table, each person faces incentives similar to a. consumption of a common resource good. b. production of a public good. c. consumption of a natural monopoly good. d. production of a private good. ANSWER: a. consumption of a common resource good. TYPE: M SECTION: 3 DIFFICULTY: 2 160. Four friends decide to meet at a Chinese restaurant for dinner. They decide that each person will order an item off the menu and they will share all dishes. When the final bill for the meal comes they decide they will split the cost evenly among each of the people at the table. In this particular case, a tragedy of the commons problem is likely because of each of the following EXCEPT a. each person has an incentive to eat as fast as possible since their individual rate of consumption will not affect their individual cost. b. there is an externality associated with eating the food on the table. c. when one person eats he may not take into account how his choice affects his friends. d. each dish would be both excludable and rival. ANSWER: d. each dish would be both excludable and rival. TYPE: M SECTION: 3 DIFFICULTY: 2 161. Four friends who love to ski decide to pool their financial resources and equally share the cost of a one-week timeshare condominium in Alta, Utah. Unfortunately the condominium does not come with maid service. Everyone values clean dishes, but the fact that unwashed dishes pile up in the sink would best be explained by an economist who understands that clean dishes in the cupboard reflect a. a common resource problem. b. a problem similar to cost-benefit analysis for public projects. c. household behavior of the invisible hand. d. All of the above are correct. ANSWER: a. a common resource problem. TYPE: M SECTION: 3 DIFFICULTY: 2 162. Ten friends who love to ski decide to pool their financial resources and equally share the cost of a one-week timeshare condominium in Alta, Utah. If lift lines at the ski resort become more congested when these ten additional people start to ski, then which is NOT true? a. Use of the ski resort by all of these ten new skiers will yield a negative externality. b. The ski resort can reduce the congestion externality by raising lift ticket prices. c. An increase in lift ticket prices could be viewed as a Pigovian tax on the externality of congestion. d. Everyone would have been better off to stay at home. ANSWER: d. Everyone would have been better off to stay at home. TYPE: M SECTION: 3 DIFFICULTY: 2 Chapter 11/Public Goods and Common Resources 335 163. According to experience, the most effective solution to highway congestion is to a. build more roads. b. set a price for access to roads, which is paid by those who use them. c. discourage urban sprawl by subsidizing urban apartment rents. d. All of the above are correct. ANSWER: b. set a price for access to roads, which is paid by those who use them. TYPE: M SECTION: 3 DIFFICULTY: 2 164. One of the most pressing concerns associated with implementation of road congestion pricing policies can be resolved by a. only charging tolls to those users who earn above a certain income. b. allowing free access to bicyclists and those who use fuel efficient cars. c. employing bar code and debit card technologies to charge users. d. only charging tolls to visitors. ANSWER: c. employing bar code and debit card technologies to charge users. TYPE: M SECTION: 3 DIFFICULTY: 2 165. Residents of Hong Kong are able to find restaurants that advertise a dish that contains grizzly bear paws. Since it is unlikely that grizzly bear paws are purchased from a private producer of animal paws, we can likely conclude that a. international laws making it illegal to sell grizzly bear paws are likely to be very effective at eliminating these offerings at Hong Kong restaurants. b. penalties for poaching grizzly bears are likely to be very small. c. there are likely to be very few grizzly bear poachers. d. allowing individuals to own and raise grizzly bears for meat would likely reduce the threat of extinction to grizzly bear populations. ANSWER: d. allowing individuals to own and raise grizzly bears for meat would likely reduce the threat of extinction to grizzly bear populations. TYPE: M SECTION: 3 DIFFICULTY: 2 166. Which of the following statements best describes the cause of "overrun and overtrampled" national parks? a. Park administrators do not use the best science available to manage park resources. b. National parks are treated as free goods by their visitors. c. National parks have never increased park visitation fees. d. The price of entrance to national parks has kept pace with other forms of recreation. ANSWER: b. National parks are treated as free goods by their visitors. TYPE: M SECTION: 3 DIFFICULTY: 2 167. A common theme among examples of market failure is a. the good being provided always harms society in some systematic way. b. some item of value does not have an owner with the legal authority to control it. c. cost-benefit analysis is likely to lead to implementation policies that promote private provision of goods and services. d. there are regulations that prohibit the efficient functioning of private markets. ANSWER: b. some item of value does not have an owner with the legal authority to control it. TYPE: M SECTION:4 DIFFICULTY: 2 168. It is commonly argued that national defense is a public good. Nevertheless, the weapons used by the U.S. military are produced by private firms. We can conclude that a. resources would be used more efficiently if the government produced the weapons. b. resources would be used more efficiently if private firms provided national defense. c. weapons are rival and excludable but national defense is not rival and not excludable. d. who can most efficiently provide a good does not depend on concepts such as rivalry or excludability. ANSWER: c. weapons are rival and excludable but national defense is not rival and not excludable. TYPE: M SECTION: 1 DIFFICULTY: 2 336 Chapter 11/Public Goods and Common Resources 169. The town of Sointenly does not have any public snow-plows. Anyone who wants their street cleared of snow must hire a private snow-plow company to do it for $75. Curly, Larry and Moe all live on a dead-end street, with Curly living at the very end of it. Each one values snow removal at $50. At present, the snow is never cleared from the street. We can conclude that a. the current situation is best because the cost of snow removal exceeds what each of them is willing to pay for it. b. Larry and Moe should wait for Curly to pay for the service because if the snow is cleared all the way to Curly’s house, Larry and Moe will get the service for free. c. the fee charged by the snow removal company is unfairly high. d. Curly, Larry and Moe could all be better off if they acted collectively. ANSWER: d. Curly, Larry and Moe could all be better off if they acted collectively. TYPE: M SECTION: 2 DIFFICULTY: 2 170. Which of the following is NOT a reason that the findings of cost-benefit analysis on public goods are only rough approximations? a. Without prices, it is difficult to be sure how much people really value a good. b. One can’t be sure that respondents to surveys are telling the truth. c. Such analysis must include not only the cost of building the project but also the cost of maintenance, if any. d. People value goods differently if they are publicly, as opposed to privately, provided. ANSWER: d. People value goods differently if they are publicly, as opposed to privately, provided. TYPE: M SECTION: 2 DIFFICULTY: 2 171. Suppose a human life is worth $10 million. Installing a better lighting system in the city park would reduce the risk of someone being murdered there from 2.6 to 1.9 percent over the life of the system. The city should install the new lighting system if its cost does not exceed a. $70,000. b. $260,000. c. $190,000. d. $10,000,000. ANSWER: a. $70,000. TYPE: M SECTION: 2 DIFFICULTY: 3 172. Highway engineers have proposed improving a dangerous stretch of highway at a cost of $2 million. They expect that it will reduce the risk of someone dying in an accident over the life of the highway from 22.1 percent to 5.7 percent. The project would be worth doing as long as a human life is worth at least a. $328,000. b. $9.05 million. c. $10 million. d. $12.20 million. ANSWER: a. $328,000. TYPE: M SECTION: 2 DIFFICULTY: 3 173. The local fire department wants to buy some new equipment at a cost of $1 million. If a human life is worth $10 million, the equipment is worth buying if it reduces the risk of someone dying in a fire over the life of the equipment by at least a. 1 percentage point. b. 5 percentage points. c. 7 percentage points. d. 10 percentage points. ANSWER: d. 10 percentage points. TYPE: M SECTION: 2 DIFFICULTY: 3 Chapter 11/Public Goods and Common Resources 337 174. You are the mayor of a small town with 2,000 residents. The head of your economic development agency recently conducted a survey in which the 2,000 residents said that a public concert in the center of town would be worth $20 to each of them. Since the concert cost only $5,000 to hold, you organized and held the concert, which everyone in town enjoyed. But when you asked for donations to pay for the concert, you only collected $30. You are convinced that a. the survey certainly overstated how much the concert was worth to each resident. b. from the standpoint of total costs and benefits, the cost of the concert certainly exceeded the benefit. c. the concert was an example of the tragedy of the commons. d. residents of the town were probably free-riders. ANSWER: d. residents of the town were probably free-riders. TYPE: M SECTION: 2,3 DIFFICULTY: 2 175. The Ogallala aquifer is a large underground pool of fresh water under several western states in the United States. Any farmer with land above the aquifer can at present pump water out of it. Which of the following statements about the aquifer is most likely to be true? a. The aquifer is a public good which must be publicly owned to be used efficiently. b. The aquifer is a private good which must be privately owned to be used efficiently. c. The aquifer is a common property resource, which will be overused if nobody owns it. d. The aquifer is a natural monopoly, which should be left as it is. ANSWER: c. The aquifer is a common property resource, which will be overused if nobody owns it. TYPE: M SECTION: 3 DIFFICULTY: 2 176. The Ogallala aquifer is a large underground pool of fresh water under several western states in the United States. Any farmer with land above the aquifer can at present pump water out of it. We might expect that a. over time, the aquifer is likely to be overused. b. each farmer has sufficient incentive to use the water efficiently. c. individual states have an incentive to insure that their farmers do not overuse the water. d. resources would be used more efficiently if the government paid for the pumps farmers use to get the water. ANSWER: a. over time, the aquifer is likely to be overused. TYPE: M SECTION: 2 DIFFICULTY: 2 177. A stairwell in a certain office building is always congested at 12:00 P.M. and 5:00 P.M. The congestion is so bad that people have been complaining to the building’s owner. Which of the following methods would be the most efficient way of reducing congestion? a. Charge everyone who uses the stairwell when it is congested a fee based on their income, with richer people paying more than poorer people. b. Encourage people to voluntarily keep off the stairwell during peak times. c. Charge everyone who uses the stairwell when it is congested the same fee. People who value the use of the stairs the most will be the ones who use the stairwell at peak times. d. Hold a lottery to determine who wins the right to use the stairwell at peak times. ANSWER: c. Charge everyone who uses the stairwell when it is congested the same fee. People who value the use of the stairs the most will be the ones who use the stairwell at peak times. TYPE: M SECTION: 3 DIFFICULTY: 3 178. On hot summer days, electric-generating capacity is sometimes stretched to the limit. At these times, electric companies sometimes ask people to voluntarily cut back on their use of electricity. An economist might say that a. every electric customer has an incentive to prevent the system from overloading, so this voluntary approach is the most efficient. b. it would be more efficient if the electric company raised its rates for electricity at peak times. c. it would be more efficient to have a lottery to decide who had to cut back their use of electricity at peak times. d. it would be more efficient to force everyone to cut their usage of electricity by the same amount. ANSWER: b. it would be more efficient if the electric company raised its rates for electricity at peak times. TYPE: M SECTION: 3 DIFFICULTY: 3 338 Chapter 11/Public Goods and Common Resources 179. Consider the following problems: Overcrowded public highways, overfishing in the ocean, polluted air, and the near-extinction of the wild rhinoceros. What do these problems all have in common? a. Private markets could easily solve them if governments let the markets function. b. They would all go away if an intensive public-information campaign were made. c. They are all the result of a failure to establish clear property rights over something of value. d. They are all the necessary result of market economies. ANSWER: c. They are all the result of a failure to establish clear property rights over something of value. TYPE: M SECTION: 4 DIFFICULTY: 2 TRUE/FALSE 1. There are no goods in this day and age that can be consumed without paying for them. ANSWER: F TYPE: T SECTION: 1 2. Most goods in our economy are allocated in markets, where buyers pay for what they receive and sellers are paid for what they provide. ANSWER: T TYPE: T SECTION: 1 3. When goods are available free of charge, the market forces that normally allocate resources in our economy are absent. ANSWER: T TYPE: T SECTION: 1 4. Government policy is of little use for properly allocating those goods that do not have prices attached to them. ANSWER: F TYPE: T SECTION: 1: 5. When one person enjoys the benefit of national defense, he (or she) reduces the benefit to others. ANSWER: F TYPE: T SECTION: 1 6. A fireworks display is not excludable because it is virtually impossible to prevent someone from seeing the show. ANSWER: T TYPE: T SECTION: 2 7. A free-rider is someone who receives the benefit of a good but avoids paying for it. ANSWER: T TYPE: T SECTION: 2 8. In some cases the government can make everyone better off by raising taxes to pay for certain goods that the market fails to provide. ANSWER: T TYPE: T SECTION: 2 9. Even economists who advocate small government agree that national defense is a good that the government should provide. ANSWER: T TYPE: T SECTION: 2 10. The government developed the patent system so that private inventors could make a reasonable profit from their own inventions. ANSWER: T TYPE: T SECTION: 2 11. Advocates of antipoverty programs claim that fighting poverty is a public good. ANSWER: T TYPE: T SECTION: 2 12. Some goods can switch between being public goods and private goods depending on the circumstances. ANSWER: T TYPE: T SECTION: 2 13. Private markets usually provide lighthouses because ship captains have the incentive to navigate using the lighthouse and therefore will pay for the service. ANSWER: F TYPE: T SECTION: 2 14. The free-rider problem arises when the number of beneficiaries is large and exclusion of any of them is impossible. ANSWER: T TYPE: T SECTION: 2 15. Apparently, human life does have an implicit dollar value, due to the observable fact that people take voluntary risks every day. ANSWER: T TYPE: T SECTION: 2 Chapter 11/Public Goods and Common Resources 339 16. If we can conclude that human life has a finite value, cost-benefit analysis can lead to solutions in which human life is worth less than the cost of a potential project. ANSWER: T TYPE: T SECTION: 2 17. One person’s use of common resources does not reduce the enjoyment other people receive from the resource. ANSWER: F TYPE: T SECTION: 3 18. If Toby and Pete are the only two fishermen in town, and neither is bothered by the other’s fishing, the lake they fish in is not a common resource. ANSWER: T TYPE: T SECTION: 3 19. One possible solution to the problem of protecting a common resource is to convert that resource to a private good. ANSWER: T TYPE: T SECTION: 3 20. Clean air and clean water are both public goods. ANSWER: F TYPE: T SECTION: 3 21. In the Tragedy of the Commons, joint action among the individual citizens would be necessary to solve their common resource problem, if government did not intervene. ANSWER: T TYPE: T SECTION: 3 22. Roads can be considered either public goods or common resources, depending on how congested they are. ANSWER: T TYPE: T SECTION: 3 23. Tolls could not be used to alter people’s incentives to drive during rush hour. ANSWER: F TYPE: T SECTION: 3 24. Historically speaking, when a city builds more roads its traffic problems decrease. ANSWER: F TYPE: T SECTION: 3 25. Road tolls have allowed Singapore to enjoy uncongested roads and practically no auto-induced pollution problems. ANSWER: T TYPE: T SECTION: 3 26. The profit motive that stems from private ownership has proven to be detrimental to elephant populations. ANSWER: F TYPE: T SECTION: 3 27. Depending on congestion, national parks can be either a common resource or a public good. ANSWER: T TYPE: T SECTION: 3 SHORT ANSWER 1. Rival? Yes No Private Goods Natural Monopolies Common Resources Public Goods 340 Chapter 11/Public Goods and Common Resources Yes Excludable? No Given the table, place each of the following in the correct location in the table. a. Congested toll roads b. Knowledge c. Fish in the ocean d. National defense e. Congested nontoll roads f. Cable TV g. The environment h. Fire protection i. Ice-cream cones j. Uncongested toll roads k. Clothing l. Uncongested nontoll roads ANSWER: Yes Excludable? No Rival? Yes Private Goods Ice-cream cones Clothing Congested toll roads No Natural Monopolies Fire protection Cable TV Uncongested toll roads Common Resources Fish in the ocean The environment Congested nontoll roads Public Goods National defense Knowledge Uncongested nontoll roads 2. The creation of knowledge is a public good. Because knowledge is a public good, profit-seeking firms tend to freeride on the knowledge created by others and, as a result, devote too few resources to the creation of knowledge. How does the U.S. government correct for this apparent market failure? ANSWER: Specific, technological knowledge can be patented. The inventor thus obtains much of the benefit of his invention. Our government also subsidizes basic research in many different fields. TYPE: S SECTION: 2 3. Some advocates of antipoverty programs claim that fighting poverty is a public good. Explain what these advocates mean by classifying charity as a public good. What does this have to do with the need for government intervention? ANSWER: Eliminating poverty is not a good that the private market can provide. No single individual can solve the problem of poverty, and those who do not donate to charity can free-ride on the generosity of others. If we all prefer to live in a society without poverty, taxing the wealthy to raise the living standards of the poor may be able to make everyone better off. TYPE: S SECTION: 2 4. The government often intervenes when private markets fail to provide an optimal level of certain goods and services. For example, the government imposes an excise tax on gasoline to account for the negative externality that drivers impose on one another. Why might the private market not reach the socially optimal level of traffic on the road without the help of government? ANSWER: It is possible that everyone can agree that the roads are too crowded, but no one is willing to make the sacrifice to stay home to help solve the congestion problem. The private incentive to fix the problem yourself is small, though everyone may be better off by letting the government control the flow of traffic. TYPE: S SECTION: 3 Chapter 11/Public Goods and Common Resources 341 5. Why do salmon populations face the threat of extinction while goldfish populations are in no such danger? ANSWER: Nobody owns the salmon, while private individuals own goldfish. Profit motivations lead to different allocations of the resources. Salmon fishermen have an individual incentive to catch as many salmon as possible before somebody else does. Pet shop owners have a profit incentive to breed goldfish to sell to consumers. TYPE: S SECTION: 3