Essentials of Accounting for

Governmental and

Not-for-Profit Organizations

Chapter 14

Financial Reporting by the Federal Government

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Overview of Chapter 14

Federal government reporting standards

Reporting requirements of federal agencies

Consolidated Financial Report of the U.S.

government.

Journal entries for typical transactions of a

federal government unit, applying budgetary

and proprietary accounting practices.

14-2

Federal Accounting

Standards

The Office of Management and Budget, together with the

Government Accountability Office (GAO) and the

Department of the Treasury are the primary organizations

charged with financial management of the federal

government. Together they created the Federal Accounting

Standards Advisory Board.

14-3

Federal Accounting

Standards

Federal Accounting Standards Advisory Board (FASAB).

The purpose of the FASAB is to develop and issue federal

accounting standards. The Board is comprised of ten

members; two from the executive branch, two from the

legislative and six who are not employees of the federal

government.

14-4

Federal Accounting

Standards Advisory Board

The standards (called Statements of Federal

Financial Accounting Standards) are recognized as

the highest level of authoritative standard in the

AICPA’s Code of Professional Conduct for federal

government entities.

Like the FASB and GASB, the FASAB has developed a

conceptual framework to guide the Board in the development

of new standards

14-5

Reporting requirements of federal

agencies – Financial Statements

Balance Sheet,

Statement of Net Cost

Statement of Changes in Net Position

Statement of Budgetary Resources

Statement of Custodial Activity (if applicable),

and

Statement of Social Insurance (if applicable).

14-6

Reporting requirements of federal

agencies – Financial Statements

Balance Sheet - Assets and liabilities are measured on the

accrual basis. The difference between assets and liabilities is net

position and is comprised of unexpended appropriations and the

cumulative result of operations.

Statement of Net Cost - This statement displays the cost

(measured on the accrual basis) of the federal agency by strategic goal.

Statement of Changes in Net Position - identifies all

financing sources used to support its operations. The statement

articulates with net position appearing on the balance sheet.

14-7

Reporting requirements of federal

agencies – Financial Statements

Statement of Budgetary Resources - The statement

provides information on how budgetary resources were obtained and

the status (e.g. expended, obligated, etc.) of those resources at year

end.

Statement of Custodial Activity (if applicable) This statement is required only if the government agency collects nonexchange funds to be turned over to Treasury and is analogous to an

agency fund of a state or local government. The SEC, U.S. Customs

and Border Protection and the IRS prepare this statement.

14-8

Reporting requirements of federal

agencies – Financial Statements

Statement of Social Insurance (if applicable). - A

statement of social insurance is required for federal agencies

administering social insurance programs such as Social Security and

Medicare. The Statement projects income and benefit payments so that

users of the statements can evaluate the long-term viability of the

programs

14-9

CONSOLIDATED FINANCIAL REPORT

OF THE U.S. GOVERNMENT

The consolidated report presents the financial

position and results of operation of the federal

government, measured on the accrual basis.

The report includes

Managements’ Discussion and Analysis,

Financial Statements,

Supplemental and Stewardship Information (unaudited), and

the Auditor’s (i.e. GAO’s) Report

14-10

CONSOLIDATED FINANCIAL REPORT

OF THE U.S. GOVERNMENT

Financial Statements include:

Balance Sheet,

Statement of Net Cost,

Statement of Operations and Changes in Net Position,

Reconciliation of Net Operating Cost and Unified Budget

Deficit,

Statement of Changes in Cash Balance from Unified Budget

and Other Activities,

Statement of Social Insurance

14-11

CONSOLIDATED FINANCIAL REPORT

OF THE U.S. GOVERNMENT

The consolidated report is over 200 pages long.

For this reason, the federal government also publishes an

annual Citizen’s Guide to the Financial Report of the U.S.

Government .

The Guide presents plain language explanations of key terms

It provides graphic displays of revenues by source and the cost of

operating the government by function.

Finally, it includes an abbreviated financial report, called a Snapshot of the

Government’s Financial Position and Condition.

14-12

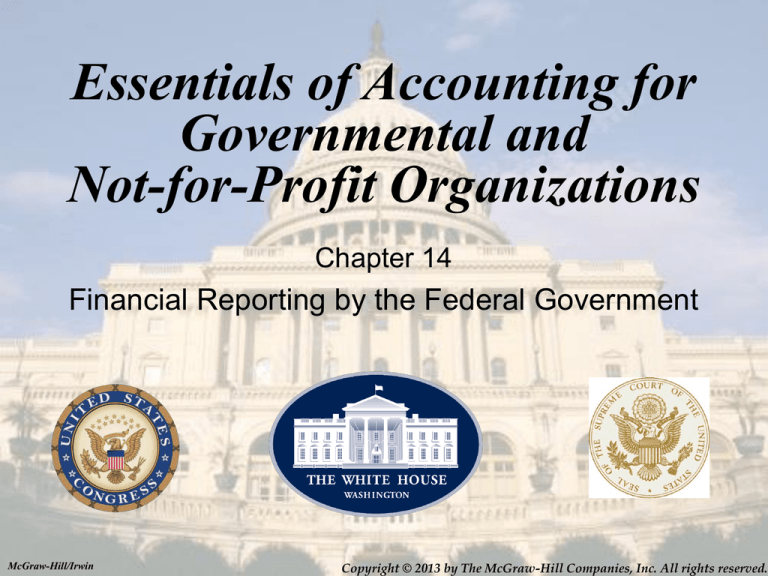

Citizen’s Guide to the Financial Report

of the United States Government

A Snapshot of

The Government’s Financial Position and Condition

2010

Gross Costs

Earned Revenues

Loss from Assumptions

2009

$ (4,472.3)

309.2

250.9

(3,735.6)

300.9

247.8

(4,296.0)

(3,434.7)

2,216.5

(0.8)

2,198.4

(17.4)

$ (2,080.3)

(1,253.7)

$ 2,883.8

2,667.9

Debt Held By the Public

(9,060.0)

(7,582.7)

Federal Employee & Veteran Benefits

(5,720.3)

(5,283.7)

Other Liabilities

(1,576.3)

(1,257.4)

Total Liabilities

(16,356.6)

(14,123.8)

$ (13,472.8)

(11,455.9)

Net Cost

Total Taxes and Other Revenues

Other

Net Operating Cost

Assets

Less: Liabilities, comprised of:

Net Position (Assets Minus Liabilities)

BUDGETARY AND PROPRIETARY

ACCOUNTING

The accounting systems of federal agencies must

serve both the external financial reporting needs

mandated by the Chief Financial Officers’ Act and

the necessity of having internal budgetary controls

over the spending of public resources.

This is accomplished through the maintenance of two selfbalancing sets of accounts, termed budgetary and

proprietary accounts.

14-14

BUDGETARY AND PROPRIETARY

ACCOUNTING

The purpose of budgetary accounts is to provide a

record by which federal expenditures may be traced

back to the budgetary authority granted by Congress

through appropriations.

Proprietary accounts are those accounts which

comprise the accrual basis financial statements

prepared by the federal governments and its

agencies.

14-15

Federal Government Budgetary Authority Process

Typical Journal Entries - Federal Agency

Comparison of Budgetary and Proprietary Accounting

Event Description

Budgetary Accounting

Debits

Credits

Appropriations: Treasury notifies the agency

Appropriations

realized

12,000,000

that Congress passed legislation (signed by

Unapportioned authority

12,000,000

the President) granting budgetary authority

to fund its activities

Apportionment: OMB apportions ¼ of the

appropriated amount which may now be

expended for first quarter activities.

Unapportioned Authority 3,000,000

Apportionments

3,000,000

Allotment: The head of the agency allots a

Apportionments

portion of the apportionment to the heads

Allotments

of subunits within the agency. The subunits

may now expend resources.

Obligations (commitments): A unit of the

agency places orders for goods and

services related to its activities.

Expenditure: Some of the items ordered

above (equipment of $ 100,000 and

services of

$ 800,000) are received

and approved for payment.

2,500,000

Proprietary Accounting

Debits

Credits

Fund balance with Treasury 12,000,000

Unexpended appropriations

12,000,000

No journal entry required

No journal entry required

2,500,000

Allotments

1,900,000

Obligations – undelivered orders 1,900,000

No journal entry required

Obligations

– undelivered orders

900,000

Expended Appropriations

900,000

Equipment

100,000

Operating (program) expense 800,000

Accounts payable

900,000

Accounts payable

900,000

Fund balance with Treasury

900,000

How the budgetary accounts work

Under federal budgetary accounting, budgetary

resources (appropriations) are represented by

debits. Credits reflect the status of the

resources within the spending process.

14-18

Credits reflect the status of the resources

within the spending process

Amount

Status

$ 9,000,000 - Unapportioned authority: this amount will be apportioned to the agency

by OMB over the remaining 3 quarters of the year.

500,000 - Apportionments: current quarter resources that have not yet been allotted

by the head of the agency to specific subunits of the agency.

600,000 - Allotments: resources currently available to agency offices, but have not

yet been committed by placing orders for goods or services.

1,000,000 - Obligations for undelivered orders: commitments for outstanding

purchase orders for goods and services that have not yet been received.

900,000 - Expended appropriations: amounts that have been expended on goods

and services received.

$ 12,000,000

Total appropriation

14-19

How the proprietary accounts work

Proprietary accounts measure assets, liabilities,

revenues and expenses (including depreciation)

in much the same manner as accrual basis

accounts of state and local governments.

14-20

How the proprietary accounts work

Unexpended appropriations, represents a source of funds to

the federal agency and is similar to a transfer in account in a

state or local government fund.

Fund Balance with Treasury. Federal agencies do not

typically maintain cash balances. Instead, the ability to draw

cash from the Treasury is recognized as an asset at the time of

an appropriation with this account.

Payments made by Treasury on behalf of the agency are reflected with a

credit to this account.

14-21