SASSA

advertisement

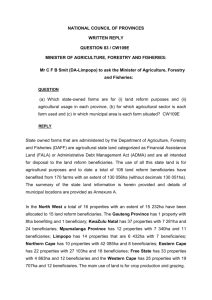

Presentation on SASSA’s Strategic Plan for the fiscal Years 2012/132016/17 and Annual Performance Plan Outline of the presentation • • • • • • • • • Purpose of the presentation Background Strategic overview Situational Analysis Key priority for 2012/13 – 2016/17 Strategic objectives for the next 5 years Branch Strategic objectives and Targets Financial plan Recommendations 2 Purpose of the presentation • To present to the Select Committee on Social Services: – SASSA’s Strategic Plan for the financial Years 2012/13-2016/17; and – Annual Performance Plan 2012/13. 3 Strategic Overview Mandate • The mandate of SASSA is to ensure the provision of comprehensive social security services against vulnerability and poverty within the constitutional and legislative framework. Vision • A leader in the delivery of social security services. Mission • To administer quality customer centric social security services to eligible and potential beneficiaries. 4 Values • • • • • • Social cohesion; Transparency; Equity; Integrity; Confidentiality; and Customer Care-centered approach. 5 Structure of the Agency • The structure of the Agency is as follows: – Branch 1 : Grants Administration; – Branch 2 :Strategy and Business Development; – Branch 3 :Information and Comm. Technology; – Branch 4 : Internal Audit and Risk Management; – Branch 5 : Corporate Services; and – Branch 6 : Finance. – 9 REGIONAL OFFICES 6 Background • SASSA has been consistent in the provision of monthly income support to a significant number of South Africans. • As at end of March 2012, over 15.5 million South Africans are benefiting from social grants. These are as follows: – – – – – – Child support – Older Persons – Disability – Foster Care Grant Card Dependency War Veteran - Source: Daily stats March 2012 10 927 731 2 750 857 1 198 131 536 747 114 993 753 7 Situational Analysis • The Agency has over the last year intensified its efforts towards improving service delivery. Our initiative include: • Appointment of service provider to effect payment of social grants in all provinces. – This will eliminate fragmentation in the payment process; – Reduce cost - The Agency will also achieve a saving of R800m per annum; and – Establish a national payment database. 8 Situational Analysis (cont…) • Standardisation of the Application process; – The project is aimed at ensuring uniformity of services at the local office level; – Grant application forms have been reviewed and reduced, to eliminate capturing information which does not add value to the processes; – Business processes have been reviewed and mapped to eliminate duplication in functions; – All provinces have standardised the application process on a 4-step process; and – Front line staff trained on the improved processes. 9 Situational Analysis • Improvement of Local offices and pay-point infrastructure; – 75 local offices were upgraded to suit the new standardised application process; and – Improvements in this regard included changing the office layout, installation of ICT infrastructure, branding and provision of adequate seating space for applicants and beneficiaries. • Improvement of pay-point infrastructure – The main aim of the project is to improve pay points nationally; – Improvement entails repairing, building and/or upgrading of the ablution facilities; purchasing of seats; erection of shelter (Tents), access ramps and fencing; and – 370 pay points were upgraded for the 2011/12 financial year. 10 Situational Analysis cont.… • Audit for the 2010/11 final year, identified exceptions in the grant administration which led to audit qualification of the DSD; • Audit exceptions included among others significant numbers of missing files, loose correspondence which still has to be placed on the files and captured on the Management Information System; missing the critical documents; files which still needed to be transferred between regions; and old inactive files that needed to be destroyed; and • Significant progress has been made in addressing the AG findings and the exceptions were reduced by more than 60% across the board. 11 Strategic Objectives • Strategic Objectives for SASSA over the next 5 Years are: – To ensure that eligible beneficiaries receive benefits due to them; – To improve the quality of service delivery to our customers; – To achieve a fully integrated and automated social assistance service; and – To ensure that the Agency is optimally capacitated for optimal service delivery. 12 Key priorities for 2012/13 - 2016/17 • To deliver quality social security services by focusing on the following: – – – – – Excellent customer care; The automation of systems; Improving organisational capacity; Promoting good governance; and Re-registration of current beneficiaries. 13 Objectives and Targets BRANCHES 14 Grants Administration Strategic To improve the effectiveness and efficiency of the Objective administration of the social assistance programme. Objective • To ensure that eligible beneficiaries receive Statement their benefits timeously with respect to: OAG, DG, CDG, FCG, CSG, WVG and GIA • To provide quality customer- centric services at all times. • To provide strategic direction for the effective implementation of the social assistance 15 programme. Grants Administration: Performance Indicators Annual Targets for 2012/13 – 2014/15 SO: To ensure that eligible beneficiaries receive their benefits timeously with respect to: OAG, DG, CDG, FCG, CSG, WVG and GIA Performance indicator (Source:ENE2012) Projected total number of grants in payment No. of old age grants in payment No. of war veteran’s grants in payment No. of disability grants in payment No. of grants-in-aid in payment No. of foster child grants in payment No. of care dependency grants in payment No. of child support grants in payment Medium-term target 2012/13 2013/14 2014/15 16 069 007 16 489 577 16 756 905 2 772 745 706 1 192 444 65 724 671 307 2 835 018 621 1 195 629 70 325 768 645 2 881 146 551 1 195 966 75 247 874 001 131 246 140 965 146 658 11 300 559 11 548 698 11 658 553 16 Grants Administration: Annual Targets SO: To provide quality customer- centric services at all times • Social Relief of Distress (SRD) funds will be disbursed in accordance with the approved guidelines • Continued improvements in the turnaround times for new grant applications processed – 90% of new grant applications processed within 21 days and the percentage will increase to 100 % in 2013/14 • Reviews will be conducted to clear backlog on both medical reviews and foster child grants and at least 20% of current foster child grant will be completed 17 Grants Administration: Annual Targets • Improvement in the payment processes – The Agency will re-register all beneficiaries capturing biometrics and update basic data, by – Beneficiaries will be issued with SASSA smart card that can operate in formal banking environment and designated SASSA cash pay-points. 18 Implementation of new payment solution Key focal areas: – Re-registration – Uninterrupted Payment services – Communication with beneficiaries and key stakeholders – Managing litigation 19 Implementation phases Phase 1 Phase 1: From 01 March to March 31 2012 •Phase 1 – Preparatory processes – it involved the enrolment of all new applications in all provinces; and re-registration of Sekulula beneficiaries A.Enrolment of new applications – 35 431 new applications for social grants were enrolled in 9 Provinces from the 01 March. – These beneficiaries were issued with SASSA payment card. – The beneficiaries first payments were effected in April 2012. B.Registration of Sekulula beneficiaries – Registration of Sekulula beneficiaries commenced on the 01 March 2012 – This are beneficiaries previously paid by Allpay where a special arrangement was made to pay them through ABSA bank. – At least 820 330 beneficiaries were re-registered by end of March 2012. – Those who could not register are still encouraged to visit their closest SASSA office or pay-point •Arrangements were made to pay unregistered beneficiaries through their old cards 20 Phase 2 Phase 2: From 01 April – May 2012 • Phase 2 commenced on the 01 April until end of May 2012. • Payments of all beneficiaries and swapping of old cards for cash beneficiaries • During this phase, all beneficiaries will receive their payments at the places where they normally receive their payments. – Cash Beneficiaries will continue at their designated pay-points . More than 96% of the cash beneficiaries were paid by the 20 April 2012. – Banked beneficiaries will receive all their payments in their bank accounts and they will be able to make withdrawals at banks, or ATMs or point of sale. 99% of banked beneficiaries have been paid already. 21 Phase 3 • Phase 3: 01 June to 31 December 2012 – Full enrolment of all existing beneficiaries, including banked beneficiaries and children – SASSA will conduct home visits for beneficiaries over 75 years of age and bedridden beneficiaries and those beneficiaries who are in institutions – All beneficiaries will be issued with SASSA branded smart card that is endorsed by Mastercard. 22 Grants Administration: Annual Targets • Implementation of file management by ensuring that all files that needs to transferred are transferred, inactive files destroyed, missing files resolved and filing of loose and critical correspondence • 26 000 of beneficiary records corrected for identity numbers by 2014. 16 000 beneficiary of these records will be corrected in 2012/13 • Internal Reconsiderations and Appeals – All applications for internal reconsideration will be finalised within 90 days – All tribunal decisions will be implemented 23 Grants Administration: Performance Indicators and Annual Targets for 2012/13 – 2014/15 cont… • Community outreach programme – 40 poverty wards will be targeted annually through ICROP – 60 000 people will be assisted to access social assistance services annually. Services provided will include new applications, enquiries , special requests and reviews • Phelophepa – 34 identified railway stations targeted in 4 regions in 2012 where all special requests and enquiries will be addressed • Customer Care Charter standards implemented: – All special requests, enquiries and complaints received through this programme will be addressed within 7 working days. 24 Information and Comm. Technology Strategic Objective To achieve a fully integrated and automated social assistance service; • Develop a fully secured, integrated and automated end- to-end system by 2014/15. 40% of the systems development will be completed in 2012/13. • In order to improve operational efficiency and the quality of ICT service delivery to our customers. – All grant officials and system users will be provided with workstations at points of service delivery and system users will be biometrically authenticated by end of 2012/13 to eliminate the use of password and fraud related activities; and – Grant beneficiary biometric system developed in 2012/2013. 25 Information and Comm. Technology • 5 internal grant administration systems will be integrated – SOCPEN, MIS (National Registry, Eastern Cape, Free State) MIS National, IGAP, Livelink. • Phased in interface with other government systems – Real-time interface with Department of Home Affairs (HANIS), and NPR system in 2012/13; and – Real-time interface with South African Revenue Service (SARS), Department of Justice and Constitutional Development 2013/14. 26 Internal Audit and Risk Management Strategic Objective To promote good governance in the administration of the Agency Objective To provide independent assurance on the Statement adequacy, effectiveness and efficiency of management implemented controls. To facilitate and monitor the development and implementation of the risk management strategy. To entrench a culture of integrity in the Agency. 27 Internal Audit and Risk Management • To provide independent assurance on the adequacy, effectiveness and efficiency of management implemented controls. – 20 internal audit reviews conducted on high-risk areas; and – Number of Internal Audit monitoring reports produced - 30 Internal Audit monitoring reports produced. • To facilitate and monitor the development and implementation of the risk management strategy. – Strategic and operational risk register updated annually ; and – Percentage of identified fraud cases investigated. • To entrench a culture of integrity in the Agency. • 50% of identified fraud cases and suspicious grants investigated and verified for validity; and 28 • 3 ethics interventions implemented. Strategy and Business Development Strategic Objectives Objective To provide strategic direction for the effective Statement implementation of the social assistance programme. • Compliance with the planning framework; • Service delivery monitoring and consolidated evaluation reports produced quarterly; • Social grant projection reports produced (2 per annum); • Five institutional performance assessments reports produced (1 Annual and 4 quarterly performance reports); and • Periodic and thematic evaluation and research reports. 29 Strategy and Business Development Strategic Objectives • Strategy on future payment model for SASSA developed. – Advisory Committee established towards end of 2012; – Consultative document and Research report produced in 2012; and – Design options developed and piloted 2013 and 2014. • Business Process Reengineering (BPR) – Review and restructuring for finance branch completed in 2012; and – Plans for re-engineering of the Grant administration will commence in 2012 and actual implementation will be effected in 2013. 30 Corporate Services Objectives Strategic Objective To ensure that the Agency is optimally capacitated for optimal service delivery Objective Statement To promote and ensure sound human capital management systems. Provide efficient and effective legal services to the Agency To provide facilities and auxiliary support services that enable the Agency to function optimally. Security: To promote security risk management practices in the Agency. Communication: To market, inform and educate internal and external stakeholders on the social assistance programme. To provide effective, efficient and economical financial management service. 31 Human Capital Management • Filling of critical posts, in particular level 5-8 posts at the regions to ensure that there is sufficient and appropriately skilled human capital for improved and more efficient service delivery; • Recruitment of EPWP workers to support current staffing gaps; • HIV and AIDS support programmes will be implemented in all Regions and Head Office; and • Conduct review of the performance management system. 32 Facilities • Improvement of local offices and pay-points – 216 local offices will be upgraded over a period of 3 years (i.e., 72 offices per annum); and – 928 pay-points will be upgrading over 3 years (400 in year 1 and 2 and 128 in the last year. • Registries – Ensure that MIS Registries complying with targeted elements of the National Archives Act and directives; and – Disposal guidelines for SASSA records approved in 33 2012/13. Communication and Marketing Strategic Objective • Implement the Integrated Communication Strategy. Marketing and – Ensure all existing are informed about development relating to their grants payments, re-registration and reviews; and – Eligible beneficiaries are informed about SASSA benefits and eligibility criteria. • Focused and targeted communication services to support the re-registration process. 34 Finance Objectives and targets • Compliance with financial prescripts. – Estimates on National Expenditure document developed in accordance with National Treasury’s budget cycle; – All eligible suppliers paid within 30 days; – Expenditure monitoring including submission on 12 inyear monitoring reports to National Treasury and DSD; and – Ensuring compliance to procurement processes. 35 Finance Objectives and targets (cont…) • Allocation of resources to strategic priorities; • Unqualified audit opinion achieved for all the years; • Increase the percentage of social assistance debts recovered; and • 50% of staff debts recovered as per the terms of AoDs. 36 Finance Plan 37 Overview of the 2012/13 budget and medium-term expenditure framework estimates Medium Term Expenditure Estimates Revised Audited outcome R thousand Ex ecutiv e Management 2008/09 2009/10 estimate 2010/11 2011/12 Medium-term estimate 2012/13 2013/14 2014/15 46 901 235 020 257 438 193 557 203 235 213 396 224 066 618 214 739 288 699 370 941 442 989 404 1 038 917 1 090 862 3 096 964 2 770 030 2 539 350 2 941 084 2 771 309 2 910 294 3 058 262 443 102 472 505 347 396 425 195 446 455 468 778 492 217 1 151 169 1 140 345 1 224 458 1 538 883 1 671 160 1 775 160 1 879 788 Strategy & Busines Dev elopment 43 257 21 453 22 468 45 485 47 759 50 147 52 653 Internal Audit 81 130 86 818 85 840 67 575 70 948 74 495 78 220 5 480 737 5 465 459 5 176 320 6 153 221 6 200 270 6 531 188 6 876 069 Corporate Serv ices Finance Information Technology Grants Administration and Customer Serv ices Total expense 38 Overview of the 2012/13 budget • The Agency receives its administration budget transfers from the Department of Social Development and the transfers in respect of the grants disbursed to grant beneficiaries is managed through the Department. • Total allocation for Administration starts at R6,2bn in 2012/13 and increases to R6,8bn in 2014/14. • The bulk of the administration budget goes towards payments to cash contractors who are contracted to the Agency to disburse grant monies to beneficiaries. • The second largest allocation on the budget is on personnel expenditure while the remaining balance caters for other operational expenses, which include various contractual obligations. 39 Budgeted key priorities/cost drivers • Compensation of Employees - The budget allocation for CoE caters for current posts, and critical additional posts (In particular level 5-8 posts at the regions) to ensure the recruitment of appropriately skilled for more efficient service delivery. • Cash Payment Contractors’ fees - Awarded a new 5 year contract to service provider Cash Paymaster Services, which caps the cost per grant at R16.44 will assist in realising savings on this expenditure item. • Grants Process Automation - A specific ring-fenced allocation has been made available for the automation of the grant business process. 40 Budgeted key priorities/cost drivers • Media Campaigns – Funding of dedicated campaigns to support the re-registration process. • Improvement of local offices and pay point infrastructure – The Agency strives to ensure that the conditions under which our grant beneficiaries are serviced are humane. Specific allocation has been made available for the upgrade of local offices and the improvement of infrastructure at the pay points. • Grant Fraud Investigations – As part of combating fraud within our system the Agency will work in close collaboration with the law enforcement agencies. A specific allocation has been made for this purpose. • Bulk Notification – In terms of the law, the Agency must notify grant applicants of the outcome of their application by registered mail. Also grant beneficiaries must be notified of the status. In this regard registered mail is used. The budget allocation caters for this function. 41 Budgeted key priorities/cost drivers • Medical assessment fees – This allocation caters for the payment towards contracted medical doctors who perform medical assessments on disability grant applicants on behalf of SASSA. • ICT infrastructure deployment - As SASSA acquires new office accommodation, there is a need to install the necessary ICT connectivity to these premises. There is a specific allocation for this purpose. - Various contracts necessary for the running of the Agency - The budget allocation in this regard caters for the leasing of office accommodation including all the other related costs such as security services, cleaning service charges and maintenance and repairs. The allocation also includes the leasing of motor vehicles from the government garage, which forms part of the Agency’s fleet strategy. Furthermore, there are Information Technology related contracts such as contracts for the VPN connectivity, SITA contracts (for the SOCPEN) etc. 42 Overview of the 2012/13 budget and mediumterm expenditure framework estimates Revised Statement of financial performance estimate Audited outcome R thousand Revenue Tax revenue 2008/09 2009/10 2010/11 2011/12 Medium-term estimate 2012/13 2013/14 2014/15 – – – – – – – 11 053 13 260 7 669 9 564 1 116 1 226 1 350 – – 712 1 490 651 715 787 Admin fees – – 712 705 649 713 785 Sales by market establishments – – – 3 2 2 2 Other sales – – – 782 – – – 11 053 13 260 6 957 8 074 465 511 563 Transfers received 4 630 292 5 168 896 5 631 387 6 143 657 6 200 270 6 531 188 6 875 069 Total revenue 4 641 345 5 182 156 5 639 056 6 153 221 6 201 386 6 532 414 6 876 419 Current expense 5 326 401 5 452 922 5 157 030 6 133 710 6 180 899 6 510 800 6 853 724 Compensation of employees 1 396 847 1 563 502 1 623 468 1 729 142 2 007 731 2 024 861 2 125 146 Goods and services 3 838 169 3 835 733 3 472 322 4 345 178 4 109 917 4 419 587 4 658 908 Depreciation 48 020 51 535 59 441 57 501 61 267 64 270 67 483 Interest, dividends and rent on land 43 365 2 152 1 799 1 889 1 983 2 083 2 187 Non-tax revenue Sale of goods and services other than capital assets of which: Other non-tax revenue Expenses Transfers and subsidies Total expenses 154 336 12 537 19 290 19 511 20 487 21 614 22 694 5 480 737 5 465 459 5 176 320 6 153 221 6 201 386 6 532 414 6 876 418 43 Recommendations • It is recommended that the Select Committee on Social Services: – Note SASSA’s plans and priorities; and – Support the Agency’s • Strategic Plan (2012/13 – 2016/17); • Annual Performance Plan (2011/12 – 2013/14); and • MTEF Budget for 2011/12 to 2013/14. 44 45