View/Open - DukeSpace

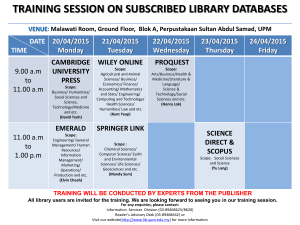

advertisement