Doing Business in Brazil () - TECSI

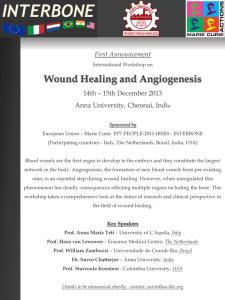

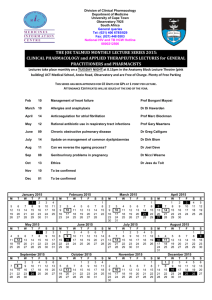

advertisement

Doing Business in Brazil Prof. Dr. Edson Luiz Riccio 1 Prof.Dr. Edson Luiz Riccio Very Important Before conducting business in another country, you must: • • • • Know its territorial and political details Understand the history and ethnic formation Understand its culture (hofstede) Acquire information about: – Economy, Industry, major accomplishments, Inflation, major on going actions – Laws, Business setting, Accounting regulations – Specific industry chamber information – Visit and meet people 2 Prof.Dr. Edson Luiz Riccio Brazil – Political Division Aracaju (SE) Palmas (TO) Porto Alegre (RS) Belém (PA) Belo Horizonte (MG) Boa Vista (RR) Brasília (DF) Campo Grande (MS) Porto Velho (RO) Recife (PE) Rio Branco (AC) Rio de Janeiro (RJ) Salvador (BA) São Luis (MA) São Paulo (SP) Cuiabá (MT) Curitiba (PR) Florianópolis (SC) Fortaleza (CE) Goiânia (GO) João Pessoa (PB) Macapá (AP) Maceió (AL) Manaus (AM) Natal (RN) Teresina (PI) Vitória (ES) Population 3 Prof.Dr. Edson Luiz Riccio Country's Location and Language • Located in eastern South America- bordering the Atlantic Ocean • 8.5 million square kilometres – 6th the in the world • 40% of Latin America • Larger than the continental United States • Population: 181 millions inhabitants • Language: Portuguese • Major religion: Catholicism 4 Prof.Dr. Edson Luiz Riccio Form of Government • • • • • Federal Republic since 1891 Independent from Portugal since 1822 Monarchy system from 1822-1889 Presidential system Two Legislative Chambers – Senate and House of Representatives 5 Prof.Dr. Edson Luiz Riccio Political System Political System • Constitutional democracy and its political power is divided into the Executive, Legislative and Judiciary branches. Political/Administrative Divisions • 27 partially autonomous states • One Federal District, located in the center of the country - Brasília • 5 geo-economical regions: North, South, Southeast, Northeast and Mid- West. 6 Prof.Dr. Edson Luiz Riccio Geography and Climate Geographic and Population Data • 181.8 million, consisting of nearly 80% urban and 20% rural • Immigrants: Portuguese, Italians, Germans, Spanish, Japanese, french • Life expectancy for men is 65,1 years and 72,9 for women. Climate and Natural Resources • Climate is mostly tropical, but it is temperate in the south. • Natural resources, such as bauxite, gold, iron ore, manganese, nickel, phosphates, platinum, tin, uranium and petroleum. 7 Prof.Dr. Edson Luiz Riccio Economy Currency • Currency unit is the "Real" (R$). Current rate: 1US$= R$, • Fluctuating exchange rate Main Economic Sectors • Well-balanced economy with virtual self-sufficiency in agriculture and industrial production, diversified markets and inexpensive labour. Current government information 1 , 2 8 Prof.Dr. Edson Luiz Riccio Industry The installed capacity of heavy and basic industries (heavy industrial machinery and equipment, shipbuilding, road building equipment, railway equipment, equipment for hydroelectric plants, offshore drilling equipment, steel, cement, aluminium, pulp, paper, etc.) is significant and provides the infrastructure to manufacture the capital goods necessary to increase the country's productive capacity or to earn additional foreign currency from exports. Capital investments had been increased in recent years, in light of the new currency. 9 Prof.Dr. Edson Luiz Riccio Power Generation Brazil's electricity is almost entirely generated by water power even though a considerable proportion of the nation's hydroelectric potential remains untapped. Total hydropower potential amounts to 259.7 gig watts, of which only 25 percent has been tapped 10 Prof.Dr. Edson Luiz Riccio Motor Vehicles • The renewed dynamism and modernization of the Brazilian automotive industry has caused Brazil to move up from tenth to eighth place in world output. 11 Prof.Dr. Edson Luiz Riccio Aircraft Industry Today the success of planes wholly designed and manufactured in Brazil, mainly by Embraer, and exported to countries on every continent, makes Brazil's aircraft industry one of the largest in the world. Most of Embraer's planes have been sold to customers in the United States (more than 700 aircraft currently in service) and in Europe. 12 Prof.Dr. Edson Luiz Riccio AGRICULTURE AND ENVIRONMENT Agriculture Record of harvest in 2003 with more than 123 millions of tons of crops, like corn, and soy beam. Environmental Protection Increasing adoption of environment friendly farming practices. One example is the direct planting technique, where croplands make use of organic waste from previous harvests 13 Prof.Dr. Edson Luiz Riccio Inflation Rate and GNP • Annual rate around 6/7 per year and under control • GNP of about US$1.000 billion – 9th economy in the world 14 Prof.Dr. Edson Luiz Riccio PRIVATIZATION PROGRAM • The National Privatization Program (PND) was created in 1990 • The constitutional reform of 1995 may be highlighted, for the establishment of: • the flexibility of state monopolies in telecommunications, electric power, oil and natural gas; • the widening of the definition of a "Brazilian company", allowing for foreign companies headquartered in Brazil to exploit services, that until then were restricted to Brazilian companies of national capital; and • the opening of mining activities and the exploitation of hydraulic power potentials for foreign investors. 15 Prof.Dr. Edson Luiz Riccio PRIVATIZATION PROGRAM (CONT) • exploit services, that until then were restricted to Brazilian companies of national capital; and • the opening of mining activities and the exploitation of hydraulic power potentials for foreign investors. • private sector participation into cellular telephone system, satellite services, limited services and services of added value; • Decree 2003/96, which established the rules applicable the independent production and the self-production of electrical power, as well as to Cable TV and Multipoint Multichannel Distribution Service-MMDS. 16 Prof.Dr. Edson Luiz Riccio PRIVATIZATION PROGRAM (CONT) • Since the creation of the PND, 64 companies owned by the federal government and other companies under minority control have been transferred to the private sector especially from the steel, chemical, petrochemical, fertilizer, electricity and telecommunications sectors, as shown in the chart below: 17 Prof.Dr. Edson Luiz Riccio Proceeds (US$ million) by Sectors - PND Sector Sale Proceeds Debt Transferred Total Steel 5,562 2,625 8,187 Petrochemi cals 2,698 1,003 3,701 Fertilizers 418 75 493 Electricity 3,907 1,670 5,577 Railroads 1,697 - 1,697 Mining 3,305 3,559 6,864 Ports 421 - 421 Financial 3,844 - 3,844 Technology 50 - 50 Other 344 268 612 Total 26,279 9,201 35,480 Decree 1,068/94 1,101 - 1,101 Total 27,414 9,201 36,615 Source: BNDES - Position at 31/12/2000 18 Prof.Dr. Edson Luiz Riccio Source: BNDES - Position at 26/08/2002 19 Prof.Dr. Edson Luiz Riccio • For the year 2000, the main event in the privatization program was the sale of Brazil's sixth largest bank, Banespa, originally owned by the State of São Paulo but under federal administration since 1998. The total proceeds from this operation were over US$ 3 billion. 20 Prof.Dr. Edson Luiz Riccio TRADE OPPORTUNITIES • • • • • • Brazil is the leader country of Mercosur (Southern Common Market), a common market created by the Treaty of Asunción signed by Argentina, Brazil, Paraguay and Uruguay on March 26, 1991 Chile, Bolivia were associated in 1996. Some of the objectives settled in this Treaty are: the free transit of production goods and services between the member states; the elimination of customs rights and lifting of non tariff barriers on the flow of goods; the adoption of a common trade policy with regard to non-member states or groups of states; and the coordination of positions in regional and international commercial and economic meetings. 21 Prof.Dr. Edson Luiz Riccio Brazil advantages as a partner • When compared to other emerging economies, Brazil relies on major comparative advantages such as: • huge territorial extent, with plenty of natural resources, some of them entirely unexplored; • enormous population with a dynamic and fast growing internal consumer market, a tendency being boosted by the income resulting from the sharp drop in the inflation rate; • economical integration within Mercosur, with the corresponding expansion of market and business opportunities; • deep-rooted, dynamic, and profitable capitalist economy with availability of skilled labour force, including management levels; 22 Prof.Dr. Edson Luiz Riccio Brazil advantages as a partner • relevant presence of foreign capital, particularly on the industrial structure, that accounts for 30% of the production; • well-developed industrial center, with a diversified export agenda that ranges from iron ore and orange juice to highly value-added manufactured products such as cars, airplanes, ships and capital goods; • diversified export markets; • modern and integrated agriculture presenting one of the world's largest harvests of around 115 million tons; • stability of the democratic political institutions. 23 Prof.Dr. Edson Luiz Riccio BUSINESS PRESENCE Types of Business Presence • • • • • Normally, prior permission is not required to establish a business in Brazil, except for some areas requiring government agency to analyze the project from an environmental standpoint. Also, certain limitations are imposed on foreign companies, in areas such as shipping, newspapers and other publications, radio and television, health care, mining, banking and alcohol production. Foreign investors may organize their entrepreneurial activities in Brazil as: a Corporation ("Sociedade Anônima"), a limited liability companies ("Sociedade por Quotas de Responsabilidade Limitada") or a branch. Operating through a branch is also quite uncommon, since setting up a branch in Brazil involves enormous bureaucratic requirements, including presidential authorization. 24 Prof.Dr. Edson Luiz Riccio BUSINESS PRESENCE Types of Business Presence • A Corporation must, upon its incorporation: • deposit 10% of its capital in a bank. In addition, it must • allocate 5% of its annual profits to a legal reserve until the reserve reaches 20% of capital • a minimum of two shareholders and two directors is required. • the directors must be Brazilian residents and the shareholders, if they are not residents, must have legal representatives in Brazil. 25 Prof.Dr. Edson Luiz Riccio BUSINESS PRESENCE Types of Business Presence • Open (public) corporations ("Companhia de Capital Aberto") must have external auditors. A corporation must pay several registration fees and emoluments upon incorporation. The major advantage offered by a corporation structure is that capital may be raised through the public offering of shares or debentures. Limited-liability companies may not raise capital through public offerings. • Unlike the "Sociedade Anônima", a limited-liability company is not required to maintain a legal reserve. There is only one class of ownership, the registered quota (the amount to which each partner limits his liability). The limited-liability company must have a minimum of two quota holders. There is no nationality or residence requirement to participate in a limited liability company. A quota holder may not sell his quota without the consent of all quota holders. However, non-resident quota holders need to have a resident legal representative in Brazil. 26 Prof.Dr. Edson Luiz Riccio BUSINESS PRESENCE Types of Business Presence • The limited-liability company is the corporate structure most often used by foreign investors. Foreign investors generally do not have any commercial or other interest in making public the administrative acts and financial statements of their Brazilian subsidiaries, and are not required to do so under Brazilian law. In addition, because limited liability companies have fewer bureaucratic requirements than corporations, companies operating as limited liabilities can make corporate decisions more quickly, which is a significant advantage in the constantly changing legal and economic environment of Brazil. 27 Prof.Dr. Edson Luiz Riccio Joint Venture and Economic Interest Groups • In Brazil, a joint venture may be set up in several ways, but the main type is the equity joint venture. • This type of joint venture is by far the most common form of partnership involving foreign investment. They occasionally involve participation by two or more partners in the equity company, but much more frequently in the incorporation of a new company in which each partner owns a certain portion of the equity capital. • A joint venture may be established through a corporation or a limited-liability company. 28 Prof.Dr. Edson Luiz Riccio Tax Year, Financial Reporting and Accounting Standards • Corporate entities and individuals engaged in commercial activities must maintain proper accounting books and record transactions in these books as required by law. • Corporate entities must keep the following books and records: • - a general journal (diário); - federal and state VAT books; - book of calculation of taxable income (LALUR); and - registry of inventory and goods shipped and received. • Official records must be written in Portuguese with values expressed in Reais. Transactions must be recorded in chronological order. Manual or computerized subsidiary journals for cash receipts and disbursements and for purchases and sales are permitted if they are properly registered. Records must be clear and without erasures. Blank lines and alterations are not permitted. 29 Prof.Dr. Edson Luiz Riccio Tax Year, Financial Reporting and Accounting Standards • Companies in Brazil must use the accrual method for computing the results of their activities. • Corporations must prepare financial statements annually, transcribing them into the general journal. Limited liability companies are not subject to reporting requirements (Exception are companies with more than 10 quota holders – by the new Civil Law (2003) . • Corporations with publicly traded shares or other securities must have their financial statements audited and publish the independent auditor's report together with the statements. Financial institutions, including leasing companies, must publish semi-annual audited financial statements. All publicly held companies must prepare and publish consolidated financial statements in addition to their own financial statements. 30 Prof.Dr. Edson Luiz Riccio Tax Year,Location Financial Reporting and Country's and Language Accounting Standards • Brazilian accounting principles are established by Law 6404 of 1976(changed by Law 10303 of 2001) and by accounting professionals, by means of the Brazilian Institute of Accountants (IBRACON) and the Federal Board of Accountancy (CFC). IBRACON issues technical pronouncements and guidelines for all basic generally accepted accounting principles (GAAP). • The Securities Commission has the authority to specify the accounting and reporting practices for publicly traded companies. The commission establishes disclosure requirements for the quarterly and annual financial reports of publicly held companies. Although the commission has determined some accounting rules, it generally relies on IBRACON and the CFC to establish accounting standards. 31 Prof.Dr. Edson Luiz Riccio Tax Year, Financial Reporting and Accounting Standards • • Companies in banking, insurance and other specialized business sectors must comply with the specific accounting practices established by the regulatory agencies with responsibility for their sectors. Publicly held companies, under control of CVM, must publish audited financial statements annually, together with the auditors' report. The financial statements consist of a balance sheet, an income statement, a statement of retained earnings (usually provided as a part of the statement of shareholders' equity), a statement of the source and application of funds (working capital), and notes to the financial statements. The audited financial statements must be submitted to the CVM annually, to the appropriate government agency if the company is of public utility, and to the BACEN and other regulatory agencies if the company is engaged in banking, leasing or insurance activities. 32 Prof.Dr. Edson Luiz Riccio Significant Accounting Principles and Practices • In Brazil, the fundamental accounting concepts of going concern, consistency and prudence must be respected. The FIFO method and average cost method are permissible. The LIFO method can not be used for financial tax accounting. • Brazil is a member of the International Accounting Standards Committee (IASB). In general, accounting principles prescribed in Brazil are comparable to those prescribed by the IASB because IBRACON and the CFC take IASB pronouncements into consideration when preparing accounting pronouncements. The main areas in which Brazilian standards differ significantly from international standards are summarized below. 33 Prof.Dr. Edson Luiz Riccio Research and Development Costs • International Accounting Standard (IAS) 9 on research and development activities requires that research and development expense be deducted in the year incurred, that the amount charged as expense be disclosed and that any deferral of costs comply with the criteria expressed in the standard. These requirements are not imposed in Brazil. In general, research and development costs are not substantial and are deducted without further disclosure. 34 Prof.Dr. Edson Luiz Riccio Pensions and Inter-company Transactions • IAS 5 on financial statement disclosure requires disclosure of the method of providing for pension plans and disclosure of significant inter-company transactions. Brazilian GAAP does not include an equivalent requirement for disclosure of the method of providing for pension plans. In addition, in Brazil, only publicly held companies must disclose significant inter-company transactions. 35 Prof.Dr. Edson Luiz Riccio Leases • Brazilian accounting principles governing leases do not follow IAS 17 on accounting for leases. In Brazil, lease contracts are recorded as rental expenses by lessees (as the lease installments are paid) and as property, plant and equipment by lessors, regardless of whether the contract provides for a finance lease or an operating lease. However, the BACEN and the CVM require that the income of lessors be adjusted through a provision to reflect the substance of finance lease agreements. 36 Prof.Dr. Edson Luiz Riccio Consolidated Financial Statements • IAS 3 on consolidated financial statements requires companies to supplement consolidated statements with separate financial statements of subsidiaries excluded from the consolidation. In Brazil, only publicly traded companies must prepare consolidated financial statements. However, an investment in an excluded subsidiary is carried at equity, and the notes to the consolidated financial statements must disclose relevant data concerning such an investment. 37 Prof.Dr. Edson Luiz Riccio Inflation Accounting • • • Prior to 1 January 1996, all companies were required to recognize the effect of changing prices in their statutory books through the monetary restatement of all "permanent assets" (fixed assets, investments and deferred charges) and shareholders' equity, using an index authorized by the tax authorities. The net effect of this monetary restatement was credited or charged to income. Due to the decrease in the inflation rate, the government enacted Law 9,249/95, which prohibits the recognition of any inflationary effect for accounting or tax purposes. Publicly traded companies are nonetheless encouraged by the CVM to disclose the effects of inflation. The CVM suggests that publicly traded companies provide supplementary information in the form of condensed financial statements prepared using the constant currency approach. The current Brazilian accounting procedure of not recognizing the effects of inflation through monetary restatement does not follow IAS 15, which requires that price level changes be disclosed in the financial statements. 38 Prof.Dr. Edson Luiz Riccio Segment Reporting and Preoperating Costs • Segment Reporting Brazilian accounting principles do not require the disclosure of financial information by segment, as prescribed by IAS 14 on reporting by segments. • Pre-operating Costs Costs related to pre-operating activities may be deferred and amortized on a systematic basis after the operation begins. 39 Prof.Dr. Edson Luiz Riccio General Requirements for Financial Reporting • • Corporations must prepare financial statements annually, transcribing them in the general journal. Required financial statements include a balance sheet and statements of results of operations, changes in financial position and changes in shareholders' equity (if not disclosed in the notes). Assets and liabilities are presented in the order of liquidity. In addition, notes to the financial statements are required, including disclosures of the accounting policies adopted by the company. All Corporations must publish two-year comparative financial statements in the Official Gazette and in at least one wellknown newspaper. Closely held corporations are subject to disclosure requirements similar to those of publicly traded companies, but their statements are not required to be audited. Limited-liability companies are not required to disclose their financial statements to the public. 40 Prof.Dr. Edson Luiz Riccio Balance Sheet • Balance sheets must disclose the following items: - Current assets; - Long-term assets; - Permanent assets (investments, fixed assets and deferred assets); - Current liabilities; - Long-term liabilities; - Results of future years; - Share capital; - Reserves; and - Retained earnings. 41 Prof.Dr. Edson Luiz Riccio Income Statement • At a minimum, the income statement must disclose the following items of income and expense: - Gross income from sales of goods and services, sales deductions, discounts and taxes on sales; - Net proceeds from sales of goods and services, cost of goods and services sold, and gross profit; - Selling expenses, financial expenses (less financial income), administrative expenses and other operational expenses; - Income (or losses) from operations, non-operational income and expenses; - Income for the year before income taxes; - Income taxes; - Participation in profit payable to employees and directors and contributions to employees' pension and welfare funds; - Net income; and - Net income per share (outstanding at end of period). 42 Prof.Dr. Edson Luiz Riccio Statement of Cash Flows • The statement of cash flows must include the sources and applications of funds, any increase or decrease in net working capital, and the balance of current assets and liabilities at the beginning and end of the fiscal year. 43 Prof.Dr. Edson Luiz Riccio Notes to the Financial Statements • To comply with Law 6,404 of 1976 (changed by Law 10303 of 2001) and subsequent accounting regulations, corporations must provide the following information in the notes to their financial statements to the extent the information is applicable: - the main accounting policies used in preparing and presenting the financial statements, including the method used for valuing inventories and determining depreciation, amortization and depletion; the basis for provision for expenses and risk; and adjustments made to cover losses expected to be incurred on the disposal of assets; - the basis of consolidation and the companies included in consolidation; - the major categories of all significant accounts, for example, inventories and fixed assets. 44 Prof.Dr. Edson Luiz Riccio Notes to the Financial Statements - details of material investments in other companies; - increases in the carrying values of fixed assets as a result of spontaneous revaluation; - pledges of assets, guarantees given to third parties and other contingent liabilities; - interest rates, maturity dates and guarantees for long-term loans; - the number, type and classes of the company's shares; - dividend distribution policies; - prior year adjustments, which are made for a variety of reasons (often involving immaterial amounts); - significant events occurring after the balance sheet date that have or might have a material effect on the company's financial position or on the results of future operations. 45 Prof.Dr. Edson Luiz Riccio Directors' Report • Publicly traded companies must issue directors' report containing basic information about the company, any significant changes and information on the business segments in which the company is engaged. In addition, they must supply detailed annual and quarterly information to the CVM, information that is similar to but much less extensive than that required by the Securities and Exchange Commission (SEC) of the United States. Independent auditors must review the quarterly financial information submitted to the commission by publicly traded companies with gross sales of R$ 100 million or more. 46 Prof.Dr. Edson Luiz Riccio TAXATION General Description of the Tax System • The concept of doing business in Brazil is related to the existence of permanent establishment in the country, i.e., subsidiary or a branch. 47 Prof.Dr. Edson Luiz Riccio STUDENT EXCHANGE PROGRAM WITH FEA/USP 48 Prof.Dr. Edson Luiz Riccio