1285424549_411387

advertisement

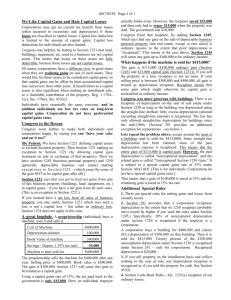

Chapter 8 Capital Gains and Losses Income Tax Fundamentals 2014 Student Slides Gerald E. Whittenburg Martha Altus-Buller Steven Gill 2014 Cengage Learning 1 Define a Capital Asset Capital assets are defined by exception A capital asset is any asset other than inventory, receivables, copyrights, certain U.S. Government publications and depreciable or real property used in a trade or business. 2014 Cengage Learning 2 Realized Gains/Losses vs. Recognized Gains/Losses Realization of gain or loss requires the “sale or exchange” of an asset. less: less: Amount realized Adjusted basis of property Realized gain (loss) Allowed gain deferral Recognized gain (loss) 3 2014 Cengage Learning Tax Treatment for Net Long-term Capital Gains Study “Capital Gains & Applicable Tax Rates” chart on p. 8-7 Net long-term capital gain (LTCG) rates depend upon regular tax bracket* ◦ ◦ ◦ Taxed at 0% for taxpayers in 10% or 15% brackets Taxed at 15% for taxpayers in 25-35% brackets Taxed at 20% for taxpayers in 39.6% bracket Unrecaptured depreciation on real estate is taxed at a maximum rate of 25%* Collectibles held more than 12 months are taxed at a maximum rate of 28%* *Additionally, a 3.8% Medicare tax on net investment income, including qualifying dividends, applies to high-income taxpayers with income over certain thresholds. 4 2014 Cengage Learning Section 1231 Assets §1231 assets are not capital assets, but they are given special tax treatment Asset must be held > 12 months and used in a trade or business and include: ◦ Depreciable real or personal property used in trade or business ◦ Timber, coal, or domestic iron ore ◦ Livestock (not poultry) held for certain purposes ◦ Unharvested crops on land used in a trade or business 2014 Cengage Learning 5 Depreciation Recapture Prevents taxpayers from receiving the dual benefits of a depreciation deduction and capital gain treatment upon sale of the asset o Requires gains to be treated as ordinary to the extent of prior depreciation deductions • • • §1245 recapture §1250 recapture “Unrecaptured depreciation” previously taken on real estate 2014 Cengage Learning 6 §1245 Depreciation Recapture § 1245 applies to property such as o o Depreciable personal property (such as furniture, machines, computers and autos) Nonresidential real estate placed in service between 19811986 with accelerated depreciation Gains are treated as ordinary income to the extent of any depreciation taken ◦ Any gain in excess of depreciation is netted with §1231 gains/losses and given beneficial tax treatment Very complex rules, this is an overview only 2014 Cengage Learning 7 Casualty Gains & Losses: Personal Casualty loss is the lesser of o Property’s adjusted basis or o Decline in the value of the property (repair cost) o Deductible loss is reduced by o • Insurance proceeds received • $100 floor (per event) • 10% of AGI per year Shown as an itemized deduction on Schedule A Casualty gain occurs when insurance reimbursement > adjusted basis of property 2014 Cengage Learning 8 Casualty Gains & Losses: Business Business casualty and theft losses result from damage caused by a sudden, unexpected and/or unusual event o For property fully destroyed, deduct adjusted basis o For property partially destroyed, deduct the lesser of the property’s adjusted basis or the decline in the value • Any insurance reimbursement reduces loss • May cause gain 2014 Cengage Learning 9 Installment Sales - Form 6252 An installment sale occurs when ◦ Real or personal property or business/rental property is sold and ◦ Congress allows taxable gain to be reported as cash received, not when sale completed ◦ Note is signed and payments are collected over time However, can elect to report all the gain in the year of sale Otherwise, use Form 6252, Installment Sale Income ◦ Must recapture any §1245 or §1250 first ◦ Then calculate gross profit percentage ◦ Then multiply percentage by cash received each year 2014 Cengage Learning 10 §1031 Like-Kind Exchanges No gain/loss recognized when an exchange of like-kind property occurs (deferred gain/loss) ◦ Like-kind property transactions occur when Exchanging real property for real property or ◦ Exchanging personal property for personal property of the same asset class Rules only apply to business or investment property May have some recognized gain if “boot” is received ◦ ◦ Boot is defined as cash received in an exchange or any property (inventory, stocks, bonds, or other securities) that is not like-kind Relief from a liability is also treated as boot received 2014 Cengage Learning 11