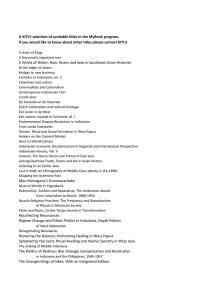

Investments in Indonesia

advertisement

Investments in Indonesia “Neocolonialism and destruction of small-scale economy” Poor people are fighting over charity of $US 3 before Idul Fitri 21 people died in the distribution of Zakat before Idul Fitri in East Java province distribution of charity in moments close to 2009 presidential election People queued for cash transfers of Rp 100,000 / family/month palm desert in Kalimantan Newmont is the richest gold mining company in the world Queuing to get fuel Judicial Review of Investment Law Violence against civilians in Papua, at Freeport's mining site Eviction of small traders and street vendors to be replaced by malls and modern shopping centers Protest against beef import (2009) Colonialism large-scale land ownership by big capitalists, especially foreign capital exploitation of natural resources intensively for export purposes the mobilization of cheap labor through the labor market flexibility. Investment History Mercantilism (1600-1800) ; through VOC, the biggest trading company in Dutch, Nusantara (Now Indonesia) had been rough colonialized. Slavery (rodi), cultivation, which mobilized worker under pressure, in order to supply spices to Europe. Liberal Colonialism (1870-1930); the participation of foreign investment to companies in Indonesia which cover : agriculture, plantation, mining and refinery sector. The resources are mobilized to developed countries in Europe in purpose of industrialization. Indonesian people have been in the crisis situation. The teritorry of Indonesia including Java and Sumatra become primary source, while areas outside of Java are only of administrative power. Neocolonialism (1967-2009) ; right now, the foreign investment is controlling all over Indonesia ; Java, Sumatra, Kalimantan and Sulawesi, also including small island. The foreign investment has covered all sectors : agriculture, plantation, mineral mining, and coal mining, oil and trade, finance and services. The development of Indonesia’s policy about investment in line with the need of developed countries for raw materials and the market for surplus of production. The act No.1, 1967 about the foreign investment, then act No. 5, 1967 about forestry and act No.11, 1967 about mining, start exploitation of forest and mining in Indonesia by foreign capital in big scale. Incentives for investment The Law no. 25. 2007 about investment in Indonesia gives facility and incentive to the bigger investment especially in foreign capital. Investment is practiced based on equal treatment with no differentiate to the origin Country. All kinds of trading are open to the investment, excluding some sectors that are not important to Indonesia economy. The investment giving the incentive tax like income taxes, fiscal taxes for capital, engine, or equipment, the free tax for raw material, value add tax, the acceleration of amortisation and property tax. The investors can flow the asset into another party according to the term and condition of law. The investor had a right to transfer and repatriate on the foreign exchange. Service and or right license for land by foreign party on the long term (95 years) is very investor-friendly in Indonesia. In fact, the previous law gives only 70 years. Biggest investment investment No Country (USD million) Percentage 1 US 3441 41,28% 2 Japan 1543 18,51% 3 European Union 1543 18,51% 4 China 229 2,75% 5 Korea 239 2,87% 6 Singapore 741 8,89% 7 Australia 56 0,67% 8336 93,47% Total Investasi Indonesia Central Bank, 2006 Amount of Indonesia debts (millions of USD) years Government Private TOTAL 2000 74,916 66,777 141,693 2001 71,378 61,696 133,074 2002 74,661 56,682 131,343 2003 81,666 53,735 135,401 2004 82,725 54,299 137,024 2005 80,072 50,58 130,652 2006 75,809 52,927 128,736 2007 80,609 56,032 136,64 2008 86,576 62,565 149,141 Source : Bank Indonesia, 2009 Foreign Capital Domination The statistic data shows that the investment in Indonesia runs into significant decrease in the last 10 year. Foreign capital becomes dominant in the structure of Indonesia’s investment. The amount of foreign capital is 86.79 % from the total investment in 2008. The investment in Indonesia includes all economic sectors; agriculture, plantation, forestry, oil and gas mining and mineral mining. Over 85% the investment of oil and gas, 100% mineral mining and 70% coal and over a half of plantation investment are controlled by foreign capital. Distribution of mining concessions Control of land by investment No. The effectiveness Total area (million ha) 1. Oil and gas contract 95.45 2. Work contract (minerals) 6.47 3 Minerals contract 7.67 4 Coal exploitation (coal right by Local Government) 24.77 5 Coal contract (KKB/ PKP2B by Central Government) 6 Rights to control forest (HPH) natural 5.2 27.72 Forest for Industrial Cultivation 3.4 7 National Plantation * 3.3 8 Private Plantation* 1.08 Sources Total 175.06 Total of Land area 192,26 : the data process from all sources, 2005 * Data year 2003 Agricultural Production Land for Peasants Year Supporting Land for Agricultural Production Rice area Growth (millions of hectare) % (thousands of ton) % 1996 11,6 1,1 51.101 2,7 1997 11,1 -3,7 49.377 -3,4 1998 11,7 5,3 51.490 4,3 1999 12 2 50.866 -1,2 2000 11,6 -3 51.899 2 2001 11,5 -0,9 50.461 -2,8 2002 11,5 0,2 51.490 2 2003 11,5 -0,3 52.137 1,3 2004 11,9 3,8 54.089 3,7 2005 11,8 -0,9 54.056 -0,1 source : Statistic 2007 Production Growth Natural Resource Exploitation Plantation sector ; Indonesia is the world’s biggest production of seeds number 6, tea biggest production no.6, coffee biggest production no 4, chocolate on number 4 biggest production and number 1 CPO production, white pepper number 1, black pepper number 2, nutmeg number 1, natural rubber number 2, synthetic rubber number no.4, plywood number 1 and fish produce number 6 in the world. Oil and gas mining sector, Indonesia is among the 20 world’s oil producing country compared to the Asia Oceania, Afrika in 2005. Also, Indonesia is 10th gas produce country in the world (after Rusia, Afrika, US, Canada, Algeria, UK, Norway, Montenegro, Netherlands). In the 2008, Indonesia is on 7th gas exporting country in the world. Besides, Indonesia is the 20th crude oil producing country in the world (2005). Indonesia is at the 7th rank on the coal produce in the world. Second order in terms of coal exports in the world after Australia. Mineral mining sector ; Indonesia is 7th world’s bauxite production. 2nd world copper produce and 6th gold produce, 3rd world nickel produce, 11th silver produce, 2nd tin world’s produce right after China. Oil production by company 2005 VICO Petrocina 3% 3% BP 4% Unocal 6% Total Fina / ELF 9% EXSPAN 6% Exonmobil 2% Connocophilips 3% CNOOC 9% Sumber : US Embassy, Tahun 2005 Caltek 55% Gas Production by company 2005 Sumber : US Embassy, Tahun 2005 crude and condensate exports by country Thailand, 3.76% Taiwan , 2.97% Singapore, 6.13% Australia, 16.07% Newzealand, 0.82% Malaysia, 4.32% AS, 3.51% Korea, 14.20% China , 11.91% Source : ESDM, 2007 Jepang, 36.10% Gas Export By Countries 2005 Singapura 0% Philiphina 3% China 9% Other 6% Australia 2% Taiwan 2% Hongkong 2% Jepang 76% Coal Export By Country UNITED KINGDOM 2% TAIWAN 15% SWITZERLAND 4% UNITED STATES 2% CHINA 1% THAILAND 4% HONG KONG 9% INDIA 9% SPAIN 4% ITALY 3% SINGAPORE 1% PHILIPPINES 3% JAPAN 25% NETHERLANDS 1% MALAYSIA 4% KOREA, R. 10% Gross Domestic Product of Indonesia Year Annual Amount 1999 1.009,732,00 2000 1.389.769,59 2001 1.684.280,49 2002 1.897.799,96 2003 2.045.853,49 2004 2.273.141,50 2005 2.784.960,40 2006 2.967.303,10 2007 3.540.950,10 2008 4.426.385,00 GDP and Consumption Indonesia’s GDP is contributed by the big consumption, foreign investment, and government expenditure and netto export, a half of which come from natural resources such as ; oil and gas, mineral, coal and plantation commodities. The consumption supports over 70% of Indonesia’s GDP, which are ; mass consumption, government and company’s consumption The value of Indonesian oil consumption in 2007 was 2,285,189.74 rupiahs per capita per month (total of Indonesian population reached 220 million people). Thus oil consumption equals to 72 percent of per capita food consumption in Indonesia. High Cost Economic Oil Consumption 2007 (PSO) Oil quantity Price/Litre Value (kilo liter) (Rp.) (Rp.) Premium 17.929.843 6000 107.579.058.000.000 Kerosene 9.851.812 2500 24.629.530.000.000 Solar 10.883.740 5500 59.860.570.000.000 Sub Total 38.665.395 189.424.514.052.000 Non PSO Premium 16.582.173 7870 130.501.701.510.000 Kerosene 9.591.264 9572 91.807.579.008.000 Solar 9.857.880 9232 91.007.948.160.000 Sub Total 36.031.317 8891 313.317.228.678.000 Total 74.696.712 502.741.742.730.000 poverty Unemployment Structure of Labour Labor’s composition Formal Sector Informal Sector Total 36,073,000 59,104,102 95,177,102 37,90% 62,09% 100 % Formal Sector Labor Non-proverty Proverty Total 19,291,000 16,782,000 36,073,000.00 53,48% 46,52% 100% FDI and Employment The number of labors in all kinds of foreign investments are 608 thousand people, and of the domestic investment are 364 thousand people or just 1% from 94 billion of labor in all kinds of economic sector in the year of 2005. Most of labors in informal sector which doesn’t have relation with the investment in Indonesia. From the total of 95,117 million labor in Indonesia 2006 in all kinds of economic sector, 59,104 million work on the informal sector or almost 62,09% from the total employed. Conclusion Indonesia’s Position on the chain of global trade has not been moved since 200 years ago. This country is the source of mineral, gas, and plantation in order to support industry in the developed country. On the other hand, domestic economy moves into de industrialization. The entrance of big scale investment makes threat to the livelihoods of farmers. The case study held by IGJ relate to the mining investments of Newmont Corporation, Lombok Tourism Development Corporation and the making of Special Economic Zone Batam, show that big scale of investment causes taking over of farmers’ land areas, taking of natural resources and taking the benefit by foreign capital and ecological impact and social conflict. Large scale of investment makes the access of community vanish to the natural resources especially the productivity of community decrease. As a result, Indonesia becomes importer of food such as : rice, soybean, meat, milk, wheat, sugar, salt on the big amount. Before that case, this food products can be produced by domestic farmers. Case study of West Nusa Tenggara found per capita income amounted to 5,500 rupiahs per day, that is below the poverty line stated by World Bank (USD 1- 2 in a day) And last, overall the economic liberalization through WTO and FTA make the loss of access of farmers, labor, and small scale economy to the natural resources and market Solution Agrarian Reform ; Indonesian society needs real agrarian reform in the form of land distribution, agriculture production tools, capital, technology and access to the price and market in order to increase their income. National Industrialization ; In the last 20 years, Indonesian economy entered de-industrialization phase where more than 70 percent component of Indonesian industry came from import. National industry grew in a form of footloose industry. Indonesia has experienced deindustrialization before reaching the phase of industrialization. Thus, to build strong economic structure, it needs good industrial policy. Protection dan Subsidy ; at production level and productivity in which farmers need subsidy from the state, WTO and FTA cause farmer ‘s access to market and natural resources to decline. Protection and subsidy should be provided by the government. Terima kasih Thank you