CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

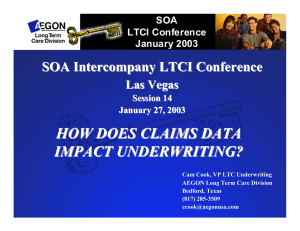

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE SMUJAN15 ASSESSMENT_CODE MF0018_SMUJAN15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16593 QUESTION_TEXT Explain the different forms of intermediaries operating in the market place. SCHEME OF EVALUATION Insurance agent Insurance broker Insurance consultant Home service representative Reinsurance broker Underwriter QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16595 QUESTION_TEXT Explain some popular insurance plans. Limited payment plans Participating policies s Convertible plans SCHEME OF EVALUATION Joint life policies s Children plans Variable insurance plans QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 16598 QUESTION_TEXT Write short note on life insurance underwriting and non life insurance underwriting. SCHEME OF EVALUATION Life insurance underwriting: (5 M) Life insurance underwriting is not merely the selling of life insurance products. It involves a process to find out such individuals who qualify to buy insurance. It assesses the proposers’ needs and paying capacity to determine the price rate.---------------------------products and the risk. In life insurance, underwriting is done by insurance agents or advisors on the basis of disclosures of the proposal forms and medical reports………………………………………….. expenses and interest . Mortality Expenses Interest Non life insurance underwriting : (5 M) Underwriting needs a type of discipline that can exist on pure risk. Commercial considerations are adjusted for the purpose. …………………………………….expected moral hazards. QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 72856 QUESTION_TEXT Explain the duties to be performed by the agents of an insurance company? SCHEME OF EVALUATION The agents are considered to be the frontline or grass-root workers of any insurance company. The duties of the agents include the following: a. To search and find out the prospective customers b. To meet the prospective customers in order to explain the availability of different products offered by the company as well as its pros and cons c. To help the prospect to select the best suited one to meet the personalized needs and to close the selling process d. To forward the proposal to the designated branch of the company for the acceptance of the proposal and also to issue the policy document following the acceptance of the same. e. To attend the requirements for the acceptance of the proposal by the insurance company f. To render after-sales services, if any, as required by the customer and also to sell more and more number of policies to a satisfied one. Insurance agents use to approach the businessman, employees, executives and self-employed professionals to sell the various types insurance policies to suit their personalized needs. For many of them, selling the insurance policies may be considered as a matter of earning for the livelihood while some of agents are working hard to have an additional source of income. QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 72858 QUESTION_TEXT Discuss about the different types of documents required to put up a claim. SCHEME OF EVALUATION At the time of putting a claim, the following documents are required: a. Certificate of the Policy of Insurance b. Bill of Lading that indicates the scope of the contract of carriage c. Bill or Invoice mentioning the terms and conditions of sale d. Copy of Protest is also considered to be an important document. In the event of stranding of or accident to the vessel, the master of the ship notes ‘protest’ before a counsel or a notary public. The protest states that everything was done to bring to safety the ship and cargo and the loss or damage was not due to the lack of diligence on the part of the master or crew. e. Certificate of survey is necessary to find out whether the necessary franchise is reached or not in case of particular average. f. Account sales or bill of sales is a similar document where goods have been sold. The difference between gross sound value and the proceeds as per accounts sale might be accepted as the amount of loss. g. Letter of subrogation gives the underwriter to sue the third party and to recover compensation where the same is due QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126196 QUESTION_TEXT What is pure risk? Mention different types of pure risk The risk that can be insured is generally referred to as pure risk. The risk management function has traditionally focused on the management of pure risk. The major types of pure risk that affect businesses include: (1) Property Risk: The risk of reduction in value of business assets due to physical damage, theft, and expropriation (i.e., seizure of assets by foreign governments). SCHEME OF EVALUATION (2) Legal Liability Risk: The risk of legal liability for damages for harm to customers, suppliers, shareholders, and other parties. (3) Other Risks: The risk associated with paying benefits to injured workers under workers’ ¾compensation laws and the risk of legal liability for injuries or other harms to employees that are not governed by workers’ compensation laws. The risk of death, illness, and disability to employees (and sometimes family members) ¾for; which businesses have agreed to make payments under employee benefit plans, including obligations to employees under pension and other retirement savings plans.