Course Outline

advertisement

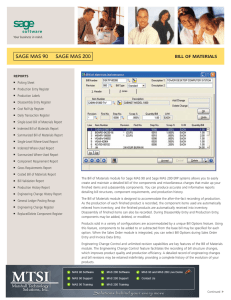

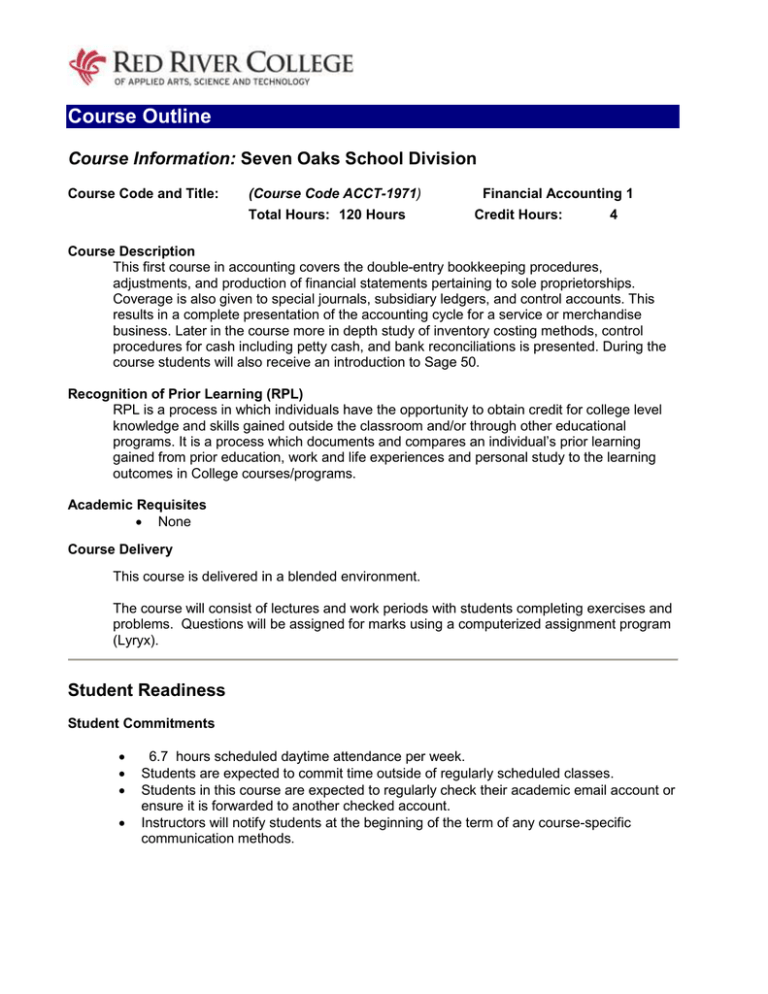

Course Outline Course Information: Seven Oaks School Division Course Code and Title: (Course Code ACCT-1971) Total Hours: 120 Hours Financial Accounting 1 Credit Hours: 4 Course Description This first course in accounting covers the double-entry bookkeeping procedures, adjustments, and production of financial statements pertaining to sole proprietorships. Coverage is also given to special journals, subsidiary ledgers, and control accounts. This results in a complete presentation of the accounting cycle for a service or merchandise business. Later in the course more in depth study of inventory costing methods, control procedures for cash including petty cash, and bank reconciliations is presented. During the course students will also receive an introduction to Sage 50. Recognition of Prior Learning (RPL) RPL is a process in which individuals have the opportunity to obtain credit for college level knowledge and skills gained outside the classroom and/or through other educational programs. It is a process which documents and compares an individual’s prior learning gained from prior education, work and life experiences and personal study to the learning outcomes in College courses/programs. Academic Requisites None Course Delivery This course is delivered in a blended environment. The course will consist of lectures and work periods with students completing exercises and problems. Questions will be assigned for marks using a computerized assignment program (Lyryx). Student Readiness Student Commitments 6.7 hours scheduled daytime attendance per week. Students are expected to commit time outside of regularly scheduled classes. Students in this course are expected to regularly check their academic email account or ensure it is forwarded to another checked account. Instructors will notify students at the beginning of the term of any course-specific communication methods. Disability Statement If you are a student with a disability and require reasonable accommodations, you are encouraged to discuss this privately with your instructor to facilitate greater understanding of your learning needs. To receive accommodations, you also must connect with Counselling and Accessibility Services who will assist in developing and implementing your accommodation plan. Course Resources Textbook(s) Required: Fundamental Accounting Principles, Volume 1, 14th Canadian Edition, Larson & Jensen, McGraw-Hill Ryerson (with Lyryx), ISBN 9781259104886 package includes working papers to accompany the text. Sage 50 2013 M. Purbhoo References Lyryx (pin card with textbook package) (requires Internet access) Note: Lyryx may be paid for online or through the bookstore Student Learning Learning Outcomes By the end of this course of study, you should be able to.... 1. Complete the accounting cycle for a sole proprietor ship service and merchandising business. 2. Prepare financial statements and closing entries for a service and merchandising business. 3. Complete the accounting cycle using special journals. 4. Determine the cost of inventory using perpetual and periodic methods of inventory valuation. 5. Explain internal control procedures. 6. Operate a petty cash fund, record bank debit and credit card transactions and prepare a bank reconciliation. 7. Use Sage 50’s General Ledger, Accounts Payable and Accounts Receivable modules. Assessment and Evaluation Assessment Letter Grade Distribution Weight A+ 4.5 90 to 100% Lyryx assignments 10% A 4.0 80 to 89% Quizzes (best 5 of 8) 10% B+ 3.5 75 to 79% Midterm Test 30% B 3.0 70 to 74% Final Exam 40% C+ 2.5 65 to 69% Sage 50 Assignment 10% C 2.0 60 to 64% 100% D 1.0 50 to 59% F 0.0 0 - 49% Total: Course Policies Research shows that regular attendance and completion of course work is a strong predictor of academic success. Regular attendance is expected in all programs. All assignments must be submitted by their specified due dates. Failure to complete an assignment by its due date will result in a mark of zero (0) for that assignment. Exceptions may be made when students are unavoidably absent or late because of illness or some other cause acceptable to the Teacher. Medical certificates or other documentation may be required. Students absent from an exam without a valid reason acceptable to the Teacher will receive a mark of zero (0) on that exam. Exam deferrals are at the discretion of the Teacher or designate. Students unable to write a midterm or final exam due to illness or other unavoidable situation must notify the Teacher within 24 hours, and provide the Teacher with documentation (e.g. medical certificate) within seven days of the exam date. If approved by the Teacher, a grade of DNW (Did Not Write) will be posted until the student has completed a deferred exam. Teachers must authorize the use of electronic devices (i.e. smart phones, electronic translators) or the Internet during class or in any test or exam room. Students who do not comply will be asked to leave the classroom. Teachers may maintain possession of graded tests and exams. All final examination papers will be kept by Teachers for a minimum of one month into the next semester. By appointment, students may view major term work or examination papers which have not been returned to them. Any audio or video recording in class is prohibited without the permission of the Teacher. Students who have approved accommodations from Student Support Services are allowed to record lectures for their own personal use. Any questions regarding this issue can be directed to the Teacher. Academic Integrity Submitting as one’s own work anything that has been copied from another student or source (e.g. the Internet) without proper reference, or providing anything to another student for submission as his/her own work, are violations of academic integrity that may lead to disciplinary measures. Authorization This course is authorized for use by: Effective Date