commencement of winding up

advertisement

THE INSTITUTE OF COMPANY SECRETARIES OF INDIA AHMEDABAD CHAPTER MEMBERS VOLUNTARY WINDING UP UNDER SECTION 484 OF THE COMPANIES ACT, 1956 Papers prepared and Complied by Shri D. N. Motwani Practicing Company Secretary SMTP 17.09.2008 at 1.45 P.M. Winding up is a process by which a company registered under the Companies Act ceases to be one after the conclusion of the proceedings and the Company is removed from the list of Companies kept by the Registrar of Companies. Till the passing of the Companies ( Second Amendment ) Act, 2002, the winding up of Companies was done by or under the supervision of the High courts. Now pursuant to the Second Amendment, 2002 winding up petitions shall be presented to the National Company Law Tribunal constituted under section 10 FB of the Companies Act, 1956. PART-7 Winding up of Companies Contains 5 Chapters Applicable provisions Sec. 425 to 560. Chapter 1 Sec. 425 _ 432 Chapter 2 Sec. 433 _ 483 Chapter 3 Sec. 484 _ 521 Chapter 4 Sec. 522 _ 527 Chapter 5 Sec. 528 _ 560 MODES OF WINDING UP [Section 425 ] A Company may be wound up : voluntarily by the concerned company distinguished as members’ voluntary winding up and creditors’ voluntary winding up. ( Section 488) by the Tribunal under any of the circumstances as prescribed. ( section 433) VOLUNTARY WINDING UP – RESOLUTION [Sections 484 & 485 ] A Company, which was formed for a particular duration or event as per its Articles, may wind up voluntarily after the expiry of the period or occurrence of the event by passing an ordinary resolution in a general meeting. Any other company may wind up voluntarily by passing a special resolution. Within 14 days of passing of the resolution, the company shall give notice of the resolution in the Official Gazette and also in a news paper circulating in the District where the registered office of the company is located. If default is committed in publishing the notice as above, the company and the officer in default shall be punishable with fine up to Rs. 500 for every day during which the default continues. COMMENCEMENT AND EFFECT OF WINDING – UP A voluntary winding up is deemed to have commenced from the day when the resolution is passed at the general meeting. The Company shall cease to carry on its business from that day except such business as may be required for the beneficial to winding up. The corporate status and the corporate powers of the Company shall continue until it is dissolved. FILING WITH THE REGISTER OF COMPANIES DECLARATION OF SOLVENCY AND REGISTRATION. A member’s voluntary winding up is solely dependent on a declaration to be made at a meeting of the Board duly verified by an affidavit to the effect that the Directors have made a full inquiry into the affairs of the Company and having done so they have formed the opinion that the company has no debts or that the Company will be able to pay its debts in full within such period not exceeding three years from the commencement of winding up as may be specified in the declaration. The rules for the conduct of business of the tribunal is expected to be issued shortly. See for the time being Form 149 of the erstwhile Companies Rules, 1959. The declaration shall be made by the Board within five weeks preceding the date of the general meeting resolution for winding up of the Company as per section 484. The declaration shall be accompanied by a copy of the report of the Auditors of the Company on the profit and loss account for the period from the date up to which the last such account was prepared to a date as latest as possible before making the declaration. The statement of the Company’s assets and liabilities as at that date will also be covered by the report of the Auditors. The declaration including the affidavit and the report of the Auditors shall be delivered to the Registrar for registration before the date of the general meeting for passing the resolution. Summing up, the position is as under: The Board of Directors shall make the declaration at a meeting of the Board and it should be approved by a majority of the Directors where the Company has more than two Directors and by all Directors in other cases. The declaration shall be verified by an affidavit by the Directors on non- judicial stamp paper as in Form No. 149 of erstwhile Companies Rules or in the form prescribed by the Tribunal. The declaration shall be made within five weeks preceding the date of the general meeting at which the resolution is proposed to be passed. The declaration must specify a date not exceeding three years from the commencement of winding up for payment of debts of the Company on full. There shall be attached to the declaration copy of the report of the Auditors of the Company as prescribed. The declaration, affidavit, the Report of the Auditors and Statement of Assets and Liabilities must be delivered to the Registrar before the date of the general meeting.[ Hitherto, relevant Form No. 149 of Companies ( Court ) Rules]. PRELIMINARY ACTION TO BE TAKEN BY THE LIQUIDATOR The Liquidator in a member’s voluntary winding up will not be able to exercise the following powers to proceed with the Winding up unless the same is approved by a special resolution of the members of the Company: To institute or defend any suit, prosecution or legal proceeding (civil or criminal) in the name and on behalf of the Company. To carry on the business of the Company as may be necessary for the beneficial winding up. To sell the movable and immovable property and actionable claims of the Company in any manner that may be advantageous To sell the whole undertaking as a going concern. To raise money on the security of the assets of the Company for the purpose of winding up. OTHER POWERS OF THE LIQUIDATOR In order to proceed with the winding up, the liquidator can exercise the following powers and duties without the need for any prior approval. To settle a list of contributories. To make calls, if any, on the contributories. To do the day to day activities of the company for the purpose of winding up and to execute deeds and documents and to issue receipts. Where necessary, to inspect the return and record filed by the company with the Registrar of Companies, without payment of any fee. To prove and claim in the insolvency of any contributory for monies due to the company from any contributory. To draw, accept or endorse bills of exchange. To pursue with the estate of a deceased contributory for any monies due to the company. To appoint an agent to do any business which the liquidator is unable to do himself. DUTY OF LIQUIDATOR TO KEEP THE CONTRIBUTORIES INFORMED [ Section 496 ] Where a members’ voluntary winding up is continuing for more than a year, the liquidator shall call a general meeting of the company at the end of the first year from the commencement of winding – up, namely when the resolution for voluntary winding – up is passed and at the end of each succeeding year, latest within three months of conclusion of the year. The liquidator will lay before the meeting the progress of the matters of winding up in the preceding year and also a statement in the prescribed form in respect of the position of liquidation. If the annual meeting cannot be held within three months of the end of the year, the Central Government has got power to grant extension. This power has been delegated to the Regional Director. STATEMENT OF AFFAIRS AT THE TIME OF WINDING UP [ Section 511A / 454 ] A statement of affairs of the company as on the date of the commencement of winding up shall be submitted to the liquidator duly verified by an affidavit by one or more persons who are as on the said date, the Directors, Manager, Secretary or other Chief Officer of the Company. The statement shall contain the following particulars : the assets of the company, cash balance in hand and at bank, if any, and the negotiable securities, if any, held ; its debts and liabilities names, residences and occupation of its creditors, the amount due, whether secured or unsecured and if secured, particulars of the securities given, whether by the company or an officer, their value and date when given. Debts due to the company and the names, residence and occupation of the debtors and the amount likely to be realized. SUBMISSION OF THE STATEMENT OF AFFAIRS The statement shall the submitted within 21 days from the date of commencement of voluntary winding up as per section 486 namely when the resolution for voluntary winding up is passed. POWER OF THE TRIBUNAL TO APPOINT OR REMOVE LIQUIDATOR [ Section 515 ] This section has been wholly modified by the Second Amendment Act, 2002. Where in a voluntary winding up no Liquidator is acting, the Tribunal may appoint the Official Liquidator or any other person as Liquidator. For sufficient reasons the Tribunal may remove a Liquidator and appoint the Official Liquidator or any other person as Liquidator where a Liquidator is appointed by the Tribunal as mentioned above, the Liquidator shall within 30 days of his appointment publish a notice in the Gazette and also deliver to the Registrar for registration copy of the notice of his appointment in the form prescribed. ( Section 516). If the Official Liquidator is appointed as the Liquidator under section 516, his remuneration will be fixed by the Tribunal and shall be credited to the Central Government. ANY AGREEMENT WITH CREDITORS WHEN BINDING ON THE COMPANY Any arrangement entered in to between a company being wound up and its creditors shall be binding on all concerned if : it is approved by a special resolution of the Company. it is also accepted to by three – fourths in number and value of the creditors. Any creditor or contributory may prefer an appeal to the Tribunal against the arrangement and this appeal shall be made within three weeks of completion of the arrangement. POWER OF THE TRIBUNAL TO DETERMINE ANY QUESTION [Section 518 ] On an application being made by the Liquidator or creditor or contributory, the Tribunal may : determine any question of winding up. Set aside any order of attachment or any other order against the estate of the company. Accede to the staying of the proceedings of winding up. Copy of the order staying the winding up will be forwarded by the company to the Registrar of Companies. This section has been wholly modified. PUBLIC EXAMINATION OF PROMOTERS, DIRECTORS ETC. [Section 519 ] This section has been entirely changed. During the course of winding up if the Liquidator is of opinion that a fraud had been committed by any person in the promotion or formation of the company or by an officer in relation to the company since its formation, the Liquidator may make a report to the Tribunal. The Tribunal after considering the report may order that the person concerned shall be publicly examined. In this connection, the following provisions of sub sections (2) to (11) of section 478 will also apply : The Liquidator shall take part in the examination and employ legal assistance as may be sanctioned by the Tribunal. Any creditor or contributory may take part in the examination either personally or by Chartered Accountants or Company Secretaries or Cost Accountants or legal practitioners entitled to appear before the Tribunal under section 10 GD. The Tribunal may put such questions to the person as it thinks fit and the person shall answer all questions on oath. The person being examined shall be furnished, at his cost, copy of the Liquidator’s report and he is free to employ any of the person listed in clause (b) above to assist him. An examination under this provision may, if the Tribunal directs, be held before any person or authority authorized by the Tribunal as per new sub section (10) of section 478. ACCEPTANCE OF SHARES FOR SALE OR PROPERTY [Section 507 & 494 ] Where in a members’ voluntary winding up the Liquidator is authorized by a special resolution of the company, he may transfer the whole or part of its business or property to another company ( call the transferee company ) and receive as consideration the shares, policies or like interest in the transferee company or he may enter in to arrangement where by the members of the transferor company may receive any other benefit form the transferee company. SANCTION OF TRIBUNAL OR COMMITTEE OF INSPECTION In addition to the approval of the company in general meeting by special resolution, the acceptance of shares or other benefit from the transferee company as consideration for sale of the property of the company in voluntary winding up also seems to require the sanction of the Tribunal in a members’ voluntary winding up of the committee of Inspection in a creditors’ voluntary winding up as provided in section 507. RIGHT OF DISSENTIENT MEMBER Pursuant to sub section (3 ) of section 494, a member of the transferor company, who did not vote in favor of the special resolution, may convey his dissent in writing to the Liquidator within 7 days of the passing of the resolution and may require him to abstain from carrying into effect the resolution or he may require him to purchase his interest. In the light of what is provided in section 507, the Liquidator shall take such further action as may be directed by the Tribunal. FINAL MEETING AND DISSOLUTION [Section 497 ] As soon as the affairs of the company are wound up, the Liquidator shall take the following steps : make an account as to how the winding up has been conducted and how the property of the company has been disposed of . call a general meeting of the company and a meeting of the creditors for the purpose of placing the accounts before the meetings. PROCEDURE FOR CALLING THE MEETINGS A meeting of the members of the company will be held. The meeting shall be called by advertisement in a news paper circulating in the district where the registered office is situate at least one month before the meeting. The time, place and object of the meeting will be specified in the advertisement. See Forms 155 and 156 which were earlier applicable. The notice of the meeting shall also be published in the Official Gazette at least one month before the meeting. Within one week after the date of the meeting, the Liquidator shall send a report to the Registrar of Companies and Official Liquidator about the date on which the meeting was held and send a copy of the account to them. The quorum for the meeting shall be two members or creditors, as the case may be. If the quorum was not present at the meeting, the Liquidator shall make a return to the Registrar and Official Liquidator to the effect that the quorum was not present and that the meeting was not held. REPORT BY OFFICIAL LIQUIDATOR On receipt of the account and return about the meeting, whether held or not, the Official Liquidator shall examine the books and papers of the company and if he finds that everything is in order, he shall make a report to Tribunal that the affairs of the company have not been conducted in a manner prejudicial to the interests of its members or to the interests of its members or to public interest. The company shall be deemed to be dissolved from the date of submission of the report to the Tribunal. The Registrar, on receiving the account and the return in respect of the meeting, shall forthwith register them. IF LIQUIDATOR IS OF OPINION THAT COMPANY WILL NOT BE ABLE TO PAY ITS DEBTS. If the Liquidator in a members’ voluntary winding up is of the opinion that the company will not be able to pay its debts in full, then the provisions in sections 508 and 509 will apply as if the winding up were a creditor’ voluntary winding up. In that case the provisions of sections 496 & 497, explained above, will not apply. PETITION FOR WINDING UP BY TRIBUNAL IN A VOLUNTARY WINDING UP [Section 440 & 441 ] Section 440 & 441 have been substituted by new sections as per The second Amendment Act, 2002. Pursuant to Section 440 , where a company is being wound up voluntarily, a petition for its winding up by the Tribunal may be presented by : any person authorized to do so under section 439. This has been explained in another chapter. The Official Liquidator. The Tribunal may pass a winding up order on the petition if it is satisfied that the voluntary winding up, already commenced, cannot be continued taking in to account the interests of the creditors or contributories or both. COMMENCEMENT OF WINDING UP Where in a voluntary winding up a resolution has already been passed, the Tribunal may agree that the winding up shall be deemed to have commenced on the passing of the resolution even when a petition is presented under section 440. But where the Tribunal feels otherwise on proof of fraud or some mistake, the Tribunal may order that the winding up shall be deemed to commence at the time of presentation of petition for winding up under section 440. If the official liquidator, however, makes a report that the affairs of the company have been conducted in a manner prejudicial to the interests of members or to public interest, the Tribunal may by order direct the Official Liquidator to make a further investigation of the affairs of the company. The Tribunal, on receipt of the report of the Official Liquidator on further investigation, may order that the company may stand dissolved or may make such other order depending on the nature of the further report of the Official Liquidator. LIABILITY OF LIQUIDATOR FOR FAILURE TO CALL MEETINGS In case the Liquidator fails to call a general meeting, he shall be punishable with fine up to Rs. 5000.where copy of the account or return is not sent to the Registrar and Official Liquidator as required in sub section (3), the Liquidator shall be punishable with fine up to Rs. 500 for every day during which the default continues. STATEMENT OF AFFAIRS AT THE TIME OF WINDING UP A statement of affairs of the company as on the date of the commencement of winding up shall be submitted to the liquidator duly verified by an affidavit by one or more persons who are as on the said date, the Directors, Management, Secretary or other Chief officer of the company. The statement shall contain the following particulars: a)The assets of the company, cash balance in hand and at bank, if any, and the negotiable securities, if any, held; (b) Its debts and liabilities; Names, residences and occupation of its creditors, the amount due, whether secured or unsecured and if secured, particulars of the securities given, whether by the company or an officer, their value and date when given. Debts due to the company and the names, residence and occupation of the debtors and the amount likely to be realized. ANY AGREEMENT WITH CREDITORS WHEN BINDING ON THE COMPANY Any arrangement entered into between a Company being would up and its creditors shall be binding on all concerned if: It is approved by a special resolution of the Company and It is also accepted to by three-fourths in number and value of the creditors. Any creditor or contributory may prefer an appeal to the tribunal against the arrangement and this appeal shall be made within three weeks of completion of the arrangement. VOLUNTARY WINDING UP UNDER SECTION 484 OF THE COMPANIES ACT, 1956 Before five weeks of passing special resolution the Directors of the Company has to give declaration of solvency that company will be able to pay its debts within such period not exceeding three years from the commencement of winding up. Such declaration is to be filled with R.O.C. before passing of special resolution and shall be accompanied by a copy of the report of the auditor on profit and loss account and on balance sheet of the Company from the last accounting date till the date of the declaration of solvency. Such declaration shall also be accompanied by the affidavits of the directors. Within 14 days of passing of the special resolution notice to this effect should be published in Official Gazette and in local news paper. The Company will cease to carry on the business from the date of passing of special resolution. Draft of special resolution is as under : RESOLVED THAT pursuant to the provisions of section 484(1)(b), consent of shareholders be and is hereby given for winding up the Company. RESOLVED FURTHER THAT Shri…………. be and is hereby appointed as Liquidator of the Company for the purpose of winding up on a remuneration of Rs…… plus out of pocket expenses at actual. RESOLVED FURTHER THAT Shri………………, the liquidator be and is hereby empowered to exercise all powers as provided in sub – clauses (i) to (iv) of sub – section (2) of section 457 of the Companies Act, 1956. PROVISION APPLICABLE TO MODE OF WINDING UP OVERRIDING PREFERENTIAL PAYMENTS [ SECTION 529 & 529 A ] Where a Company being wound up is insolvent, the security of every secured creditor shall be deemed to be subject to a pari passu charge in favour of the workmen to the extent of the workmen’s portion therein. A secured creditor, who remains outside the winding up, can realize his security but he will have to share his realization to the extent of the workmen’s dues with the Official Liquidator. In view of this provision, unless the secured creditor realizes an amount, by sale of the secured property which is equal to the secured debt and the dues of the workmen called “ workmen’s portion “, the secured creditor will have to prove for the balance of his debt along with other creditor. The debts due to: workmen and secured creditors will be paid in priority to all debts. The said debts will also be paid in full if the value of the sale proceeds of the security is sufficient. If the sale proceeds are not sufficient, the two debts shall be paid proportionately. PREFERENTIAL PAYMENT [SECTION 530] In a winding up the first two preferential payments are secured creditors and workmen’s dues. The other preferential payments, subject to section 529A, are given below : all revenues, taxes, cesses and rates due to any State or Central Government or to a local authority at the relevant date, namely the date of appointment of Provisional Liquidator or the date of winding up order, as the case may be, or the date of passing the resolution in a voluntary winding up. all wages or salary of an employee (including wages for time or piece – work and salary earned by way of commission) due for a period not exceeding four months within 12 months before the relevant date as mentioned above up to an amount of Rs. 20,000 for any one claimant as per the Notification No. GSR 80 (E) dt. 17-2-97 issued by the Central Government pursuant to sub – section (2). all holidays remuneration accrued to an employee due on date of winding up order or resolution, as the case may be, as required to above. all dues under the Employee’s State Insurance Act, 1948 payable during 12 months before the relevant date as mentioned above. all amounts due in respect of Workmen’s Compensation Act, 1923 on the date of winding up order. all sums due to an employee from a Provident Fund, pension, gratuity or any other fund. OTHER CONDITIONS TO BE MET 1.The above debts will be reduced in equal proportion if the assets are insufficient to pay them in full. 2.The above debts shall have priority over the claim of holders of debentures under a floating charge and be paid out of such property if the assets available for payment of general creditors are insufficient to pay them. 3. The above debts shall be met forthwith if the assets are adequate to meet them after making provision for costs and expenses of winding up. 4. If any goods of the company are distrained ( legal seizure of goods ) by a landlord or other person, within 3 months before the date of winding up order, the proceeds of sale of such goods will be first utilized to pay the above debts. SETTLEMENT OF PREFERENTIAL CLAIMS MENTIONED ABOVE The provisions of section 530 will be subject to the provisions of section 529A. In other words unless there is a surplus available after meeting the debts under section 529A, the other preferential creditors covered by section 530 will not get anything _ See Giovanola Binny Ltd. ( In Liquidation ) In re : (1990) 67 comp. Cas. 441 ( Ker). REVENUES, TAXES, CESSES AND RATES DUE [ Clause (a) of section 530 (1) ] The above items must have become due during 12 months before the relevant date. It must be shown that the revenues etc., payable has become due and payable within 12 months before the relevant date. The three conditions to be satisfied are : the debt of the kind mentioned in clause (a) must be outstanding on the relevant date ; the debt must have become due, in the sense, it must have been incurred at any time within 12 months before the relevant date ; and the debt must have become payable at any time within 12 months before the relevant date. SECTION 178 OF THE INCOME – TAX ACT, 1961 OVERRIDES THE PROVISIONS IN SECTION 530 (1) (a) Section 178 of the Income – Tax Act, 1961 requires every liquidator to give notice of his appointment to the Assessing Officer within 30 days of his appointment. The Assessing Officer, after making necessary enquiries, shall notify to the Liquidator within three months of the receipt of notice of appointment of the liquidator the amount which in his opinion would be sufficient to provide for income – tax which is then payable or likely thereafter to become payable by the company. Sub – section (6) also provides that the provisions of the said section 178 shall have effect notwithstanding anything to the contrary contained in any other law for the time being in force. SECTION 179 OF THE INCOME TAX ACT LIABILITY OF DIRECTOR IN CASE OF WINDING UP: THIS SECTION OVERRIDES ALL THE PROVISIONS OF COMPANIES ACT 1956, IN RESPECT OF WINDING UP OF COMPANY AND IMPOSES PERSONAL LIABILITY ON DIRECTOR IN CASE OF PRIVATE COMPANY IN RESPECT OF ANY TAX LIABILITY OF PRIVATE COMPANY FOR PREVIOUS YEAR IN CASE OF INABILITY OF PRIVATE COMPANY TO CLEAR THE INCOME TAX DUES. IN CASE OF CONVERSION OF PRIVATE COMPANY INTO PUBLIC COMPANY THE AFORESAID LIABILITY CONTINUES TILL THE COMPANY WAS PRIVATE COMPANY . IN CASE OF CONVERSION OF PRIVATE COMPANY INTO PUBLIC COMPANY THE AFORESAID LIABILITY CONTINUES TILL THE COMPANY WAS PRIVATE COMPANY . SECTION 46 OF THE INCOME TAX ACT PROVIDES EXEMPTION IN RESPECT OF CAPITAL GAIN ON DISTRIBUTION OF ASSETS BY COMPANY IN LIQUIDATION OVERRIDING THE PROVISION OF SECTION 45 OF THE I.T ACT. 1961. HOWEVER, ANY MONEY OR OTHER ASSET RECEIVED BY THE SHAREHOLDER OF THE COMPANY THE VALUE OF WHICH EXCEEDS THE DISTRIBUTABLE PROFIT AS DEFINED IN SUB CLAUSE C OF CLAUSE 22 OF SECTION OF 2 OF I.T. ACT. 1961 THEN THE EXCESS AMOUNT WOULD BE LIABLE TO CAPITAL GAIN AS CALCULATED U/S 48 OF I.T. ACT. 1961. SECTION 2 (22)(c) OF I.T. ACT 1961 STATES THAT DIVIDEND INCLUDES ANY DISTRIBUTION TO THE SHAREHOLDER WHICH IS ATTRIBUTABLE TO ACCUMULATED PROFITS BEFORE LIQUIDATION WHETHER CAPITALIZED OR NOT. ILLUSTRATIONS OF CERTAIN AMOUNTS WHICH ARE NOT PREFERENTIAL The following amounts due have been held not entitled to priority : (a) Loans advances by a State Government under State Aid to Industries Act. (b) Guarantee commission due to a State Government for guaranteeing loan advanced to the company. (c) Debts due to a State Government in respect of trading activity was not considered for priority. (d) Arrears of rent due to government. (e) Ex – gratia payments are not entitled to priority. (f) Sums payable after the closure of the business as compensation was not considered “ wages”. (g) Taxes etc. due outside the period stated in section 530(1) (a) are not entitled to priority and must rank as unsecured creditors. ILLUSTRATIONS OF SOME PREFERENTIAL PAYMENTS (a) Retrenchment compensation falling within the definition “ wages” is preferential payment. (b) Sums due to an employee from provident fund, pension fund and gratuity fund are preferential payments (c ) Section 530(4) creates a right of priority to creditor whose advance is utilized for the payment of wages or holiday remuneration to an employee subject to the condition that if the said amount is not paid, the employee or legal representative would have been entitled to a right of priority himself – Mysore Spun Silk Mills Ltd. (1964) 34 Comp. Cas. 1005 ( Mys) (d) Bonus would seem to come under wages for preferential payment. FRADULENT PREFERENCE [ Section 531 ] The following acts of a company within six months before the presentation of winding up petition or the passing of a resolution in the case of voluntary winding up be deemed to be fraudulent preference of its creditors and they will be invalid Transfer of property, movable or immovable Delivery of goods. Payment, execution or other act relating to property. AVOIDANCE OF VOLUNTARY TRANSFER [ Section 531 – A ] Any transfer of property of a company, movable or immovable or any delivery of goods made not in the ordinary course of business or for valuable consideration within one year before the presentation of winding up petition or the passing of a resolution shall be void and ineffective. An application for setting aside a transfer will be allowed by the court if it is proved that there was inadequate consideration and there was lack of good faith. LIQUIDATOR’S DISCRETION TO MOVE THE TRIBUNAL TO ANNUAL THE TRANSFER It is provided in the section 531 – A that any transaction which is hit by the section shall be void against the liquidator. It is left to the Liquidator to move the Tribunal to avoid the contract. When the Liquidator does not choose to take action for avoiding the transfer, it is not open for any other person to move the court – See in this Connection K.N.Narayana Iyer V. CIT (1993) 78 Comp. Cas. 156 ( Ker ). INTERVAL OF TIME BETWEEN PRESENTATION OF PETITION ( SECTION 441) RESOLUTION OF MEMBERS ( SECTION 486 ) AND WINDING UP ORDER In a voluntary winding up, in terms of section 491 the powers of the Board of Directors shall cease on the appointment of a Liquidator. On the other hand, in terms of section 445, in winding up by the Tribunal the powers of the Board shall cease from the date of communication of the order of winding up by the Tribunal. There will thus be some interval of time in winding up by Tribunal between presentation of petition for winding up and the issue of winding up order or the appointment of Liquidator. Only during such interval will the Board of Directors be in a position to exercise power of management in the company. Section 536 seeks to provide that the action taken by the Board of Directors during the above interval of time will be void unless the sanction of the Liquidator ( in voluntary winding up ) or the sanction of the Tribunal is taken. Lease of part of property of the company after petition of winding up is filed. In Kanchan Kumar Dhar, Official Liquidator V. Dr. L. M. Visarai (1986) 60 Com. Cas. 746 ( Bom ), the Director of the Company granted lease of building owned by the company after winding up petition is presented. This was not specifically disclosed to the Official Liquidator when he was appointed although he was accepting the rent even after winding up order was issued. The court held that the transaction was entered in to after commencement of winding up proceedings and it was void and that the acceptance of rent cannot validate the transaction. Arbitration award made after presentation of winding up petition held void The arbitration proceedings started when the winding up proceedings had not formerly started. The arbitration award was made when the company was ordered to be wound up. It was held that the award was not valid – Durga Das Nayyar V. Bombay Thread Mills Co. Ltd., ( 1957) 27 Comp. Cas. 556 ( Punj). Court has power to validate transactions hit by section 536(2) Even when a property of the company was sold after a petition for winding up was presented, the court on application revalidated the sale – J. Sen Gupta ( p.) Ltd., In re : (1962) 32 Comp. Cas. 876 ( Cal ). See also Aryodaya Spg. & Wvg. Co. Ltd., In re / Simka Engg. Co., In re : (1986) 60 Comp. Cas. 897 ( Guj.). CONNOTATION OF PROMOTERS OR OFFICER COVERED BY SECTION 543 A person who originates the scheme for the formation of a company, has the Memorandum and Articles prepared executed and registered, finds the first Directors and places initial capital is a promoter in the fullest sense. He controls the formation and future of the company and it is this control which lies at the root of the fiduciary relation to the promoter of the company. On the other hand, a share broker has nothing to do with the management of the company. Therefore, to classify him as an ‘ officer of the company’ within the meaning of the section would be putting too great a strain on the wording of the section – Official Liquidator, National Live Stock Registration Bank Ltd. V. Velu Mudaliar ( 1938) 8 Com. Cas. 7 ( Mad). ALL DIRECTORS ARE COLLECTIVELY RESPONSIBLE. MOST OF THEM CANNOT PLEAD THAT A DOMINANT DIRECTOR CALLED THE SHOTS The Directors are the trustees of the company and they should act like prudent men. In a case they allowed one Director to deal with the funds of the company as he pleased with the result that huge loss was caused to the company. It was held that their responsibility was collective. Had they exercised their rights and asserted, things would have been different. As such they could not disown their responsibility jointly or severally. The Directors were accordingly, held liable to compensate the company – F. & C. Osler ( India) Ltd., In re : ( 1978) 48 Comp. Cas. 698 ( Cal). Period of limitation of five years in sub section (2) may be extended by one more year As a result of section 458 A, the period of 5 years prescribed in section 543 may be extended by one more year. LIQUIDATOR MAY FINALISE MATTERS IN WINDING UP With the sanction of the Tribunal in a winding up by Tribunal or with the sanction of the general meeting of company in a voluntary winding up, the Liquidator is authorized to take action as under Pay any classes of creditors in full. Make any compromise or arrangement with creditors or persons claiming to be creditors. Compromise any call or debt from a contributory. The power at (ii) above exercised by the Liquidator in Voluntary Winding up is appealable to the Tribunal by any aggrieved person. See also Rules 270 & 271 of erstwhile Rules for information. In this connection it may be noted that in a creditor’s voluntary winding up, in terms of section 517, the compromise or arrangement with its creditors shall have to be sanctioned not only by a special resolution referred to in section 546 but also acceded to by three – fourths in number and value of the creditors. DISSOLUTION OF A COMPANY It has already been stated that pursuant to section 481, when the affairs of a company have been wound up by order of the Tribunal, the Tribunal shall make an order that the company be dissolved. The liquidator shall forward a copy of the order to the Registrar. In a voluntary winding up, in terms of sections 497 and 509 when the Official Liquidator makes a report to the Tribunal that the affairs of the company have not been conducted in a manner prejudicial to the interests of its members or to public interest, the company shall be deemed to be dissolved form the date of the said report to the Tribunal. MINIMUM PERIOD FOR KEEPING THE BOOKS The power of the Tribunal, the company in general meeting or the committee of Inspection / Creditors referred to above will be subject to the condition that the books and papers will be kept in good order for a period of not less than five years from the dissolution of the company. Pursuant to rule 15 of the Companies ( Central Government’s ) General Rules and Forms, 1956, any creditor or contributory or the Liquidator of a company wound up may make a representation to the Central Government if it is desired that all or any of the books and papers may be destroyed earlier that five years. After considering the matter and after giving opportunity to all concerned, the Central Government may direct in writing that the period of five years may be or need not be reduced. Please also see the said rule in respect of the provision for appeal in this regard. VOLUNTARY WINDING UP The statement referred to above prepared by the Liquidator audited in respect of a company being wound up will have to be filed with the Registrar of Companies. DUTY OF THE LIQUIDATOR TO MAKE RETURNS ETC. [ SECTION 556 ] The duty of the Liquidator under various sections to file returns or other documents with the Tribunal or the Registrar or to others in respect of a company being wound up for which he is Liquidator has been explained against each such section. Section 556, which generally refers to the duty of the Liquidator, provides that where he makes a default and fails to make good, the default within 14 days after service of a notice to him, any contributory or creditor or the Registrar may make an application to the Tribunal and the Tribunal may direct the Liquidator to make good the default within the time specified. MEETINGS OF CONTRIBUTORIES OR CREDITORS [SECTION 557 ] Some provisions of the Act which require a liquidator to call a general meeting of the company or a meeting of the creditors are those in sections 496, 508 and 512. Section 460 also provides that the Liquidator shall have regard to any direction which may be given by resolution by a meeting of creditors or general meeting of the company or by the Committee of Inspection ( Section 464 and 503). In addition to above provisions, in terms of section 557 in all matters regarding winding up, the Tribunal may take in to account the wishes of contributories and creditors and for ascertaining their wishes the Tribunal may direct such meetings to be called and held and may appoint a person as Chairman for such meetings. The value of the debt due to the creditors and the number of votes that may be cast by each contributory will be taken in to the account by the Tribunal. POWER OF COMPANY TO DECLARE DISSOLUTION VOID [ SECTION 559 ] Section 559 gives power to the Tribunal to declare that a company dissolved under Part VII dealing with winding up of companies is void. This shall be done within two years of the date of dissolution. This power of the Tribunal also extends to orders under section 394, under part VI of the Act. The application for this purpose may be made to the Tribunal by the Liquidator or by any other person who appears to the Tribunal to be interested in the matter. The period of two years is for making the application to the Tribunal and the Tribunal may pass orders at any time thereafter. Bombay Stamp Act, 1958 has defined the term conveyance in Section 2(g). Pursuant to sub section (iv) the conveyance includes the order of High court under section 394 of the Companies Act, 1956 which deals with reconstruction/ Amalgamation etc. The defination is specific. It does not cover the order/ report under section 497 of the Companies Act which relates to Winding up. Section 53 of the Gujarat Value Added Tax Act, 2003 has casted responsibility on Liquidator of the Company under Liquidation. Accordingly within 30 days of his appointment as Liquidator he has to give intimation of his appointment to the Commissioner. Within 3 Months of from the date of receipt of the intimation about the appointment, the commissioner after due inquiry inform the liquidator about the Amount of Out standing tax, Interest or penalty payable by the Company. In case of Private Company if the aforesaid amount is not recoverable than every Director of the Company who was the Director of the Company at any time during the period for which Tax is due shall be jointly and severally liable for the outstanding due unless the Commissioner is satisfied that such non- recoveries is not attributable to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the Company. With Best Wishes D.N. Motwani & Co. COMPANY SECRETARIES B-212 Nandan Apartment, B/H ISRO, Ramdevnagar, Satellite Road, Ahmedabad – 380 015. Mobile No. 9327023666 Office Ph. No.: 079- 40025664 E-Mail: dnmotwanicsp@yahoo.co.in

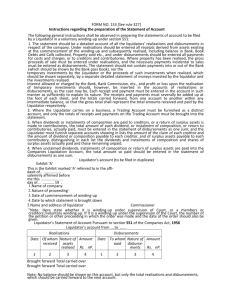

![FORM NO. 157 [See rule 331] COMPANIES ACT. 1956 Members](http://s3.studylib.net/store/data/008659599_1-2c9a22f370f2c285423bce1fc3cf3305-300x300.png)