Annual Report

advertisement

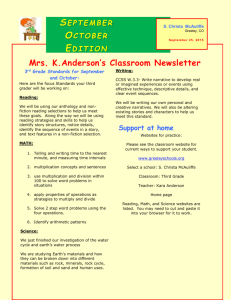

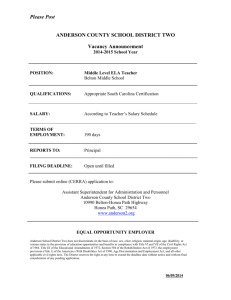

2014 ANNUAL REPORT Making Summer Count 0 INVESTING IN OUR FUTURE Who we are? Mission Statement Our mission at Project One, Inc. is to help prevent, as early as possible, the academic failure of economically disadvantaged children and youth, and the unemployment of youth and young adults in Louisville Metro neighborhoods. What we do? Saving Our Children and Youth -- One Child and One Youth at a time--- Project One was formed in 1985 to improve and nurture the educational and work-based learning skills of economically disadvantaged elementary, middle- and high-school students, by providing before- and after-school [Out-of-school Time] (OST) educational and work-force developmental services. Project One services include academic tutoring; leadership training; mentoring; college selection assistance; employ-ability skills training; exposure to jobs through job shadowing/work experiences, summer jobs placement, and employment internships. Project One aims to provide healthy, social skills development that support life-long learning, economic empowerment and selfsufficiency. 1 TABLE OF CONTENTS MISSION STATEMENT 1 WHAT WE DO? Letter to our Stakeholders 3 Study: Summer Jobs Reduce Violent Crime 4 2014 Data and Numbers 8 A- Summer Jobs Program B – Community Scholars C – Ages 9 Board of Trustees 10 Donor List 11 Auditor's Report 2 A LETTER TO OUR STAKEHOLDERS --PROJECT ONE, INC.------------------- 30 Years Now Making Summer Count for over 15,000 Youths!!! Bishop C. James King, Jr. The 63rd Bishop in The Christian Methodist Episcopal Church Elected: July 1, 2014 in Baltimore, Maryland President and CEO of Project One, Inc. From 1985 - 2015, "Making Summer Count" continues to be our mantra for 15,000 plus economically disadvantaged youth in the Metro Louisville, Kentucky community. It is my esteemed honor and pleasure to present to each of you our 2014 Annual Report. This report shares with you the programmatic and fiscal aspects of our work. We would like to thank all our Board of Trustee members, foundations, corporations, employers, families and youth for making this report possible. Thank you for answering the call and continuing to be our partner at Project One, Inc in preparing our youth for successful transitions in adulthood. Charles J. King, Jr. President and CEO, Project One, Inc. 3 Study: Summer Jobs Reduce Violent Crime Among Disadvantaged Youths By Ross Pomeroy - December 4, 2014 Comments Give a disadvantaged youth a summer job, and he or she will be much less likely to commit a violent crime. That's the conclusion from a randomized controlled trial just published to the journal Science. University of Pennsylvania criminologist Sara Heller oversaw the study, which took place in 13 high-violence schools in areas of Chicago. 1,634 students participated in the summer of 2012. Almost all of them were minorities, and more than 90% were on free or reduced lunch. 350 students were randomly assigned to 25-hour per week summer jobs, another 350 were given 15-hour per week jobs along with 10 hours of social-emotional learning classes "aimed at teaching youth to understand and manage the aspects of their thoughts, emotions, and behavior that might interfere with employment," and the remaining students carried on with their lives as normal. Jobs were paid at the Illinois minimum wage and lasted 8 weeks. With the help of the Chicago Police Department, Heller observed arrest data for the duration of the study and 13 months after. Arrests for violent crime decreased 43% among the two treatment groups compared to the control group. Property and drug-related crimes slightly increased, but the differences were statistically insignificant. 4 Importantly, Heller found that the largest decreases in violent crime rates came months after the jobs program ended, meaning that it wasn't specifically being in the program that prevented crime; the experience may have engendered lasting behavioral change. There was little difference in effect size between the two treatment groups -- either the job-alone or the job plus classes -- which indicates that the classes weren't the sole reason for the reduction in violent crime. So what was? In societal studies like these, the answer is very open to interpretation. "The experimental design cannot tease out which program element or elements generate the decrease in violence," Heller admitted. Youth employment programs have been studied in the past with mixed results. Most of the time, the program costs seem to outweigh the societal benefit. In this case, the program cost an estimated $3,000 per student ($1,400 for wages and $1,600 for administrative costs) while yielding around $1,700 in benefits from reduced crime. So the benefits did barely outweigh the administrative costs. However, Heller insists that preventative programs like these are still more cost-effective than remediative punishment like prison. "The results echo a common conclusion in education and health research: that public programs might do more with less by shifting from remediation to prevention. The findings make clear that such programs need not be hugely costly to improve outcomes for disadvantaged youth; well-targeted, low-cost employment policies can make a substantial difference, even for a problem as destructive and complex as youth violence." Source: Sara B. Heller. "Summer jobs reduce violence among disadvantaged youth." Science. 5 DECEMBER 2014 • VOL 346 ISSUE 6214 (Images: AP, Science) 5 Penn study: Summer jobs seem to lower teens' violent crime rate By Tom Avril, Inquirer Staff Writer POSTED: DECEMBER 06, 2014 A summer jobs program for teenagers appears to cut the rate of violent crime, according to a new study by a University of Pennsylvania researcher. And not because the youths were too busy working to break the law. Those who were randomly chosen to get the eight-week positions were arrested for violent offenses 43 percent fewer times than their peers, and most of that difference occurred during the 13 months after the jobs were finished. The findings by Sara B. Heller, an assistant professor of criminology at Penn, are reported in Friday's issue of the journal Science. Teens in the study were generally from lower-income families, and one-fifth of them had previously been arrested. Heller, who conducted the study in Chicago in cooperation with the city government, said it was not entirely clear why the summer jobs seemed to have a lingering positive impact after they concluded, at the end of summer in 2012. One factor may have been "soft skills" learned on the job, such as conflict resolution and self-control, said Heller, who came to Penn from the University of Chicago in 2013. Each youth was partnered with a mentor, who may have helped teach those skills, she said, calling the results "surprising and really exciting." "We don't have a lot of success stories for reducing violence among disadvantaged youths," she said. Indeed, there is scant evidence that teen jobs programs can have a lasting impact on crime, said Dan Bloom, a policy area director for MDRC, a New York-based nonprofit policy research group. A few programs have been found to lower crime rates but they had a residential component and were costly, he said. The Chicago program, dubbed One Summer Plus, cost less than $3,000 per youth, said Evelyn Diaz, commissioner of the city's Department of Family and Support Services, which oversaw it. Of that total, about half went toward the teen's wages ($8.25 an hour - the minimum in Illinois - for 25 hours a week) and the rest went toward paying the mentors and administrative costs, she said. "You just don't expect for a short-term, relatively low-cost program to have such enduring effects," Diaz said. Bloom, who was not involved with the Chicago research, said he would want to see additional research to make sure that such programs reduce crime, but he said that Heller's study was well-designed and that its findings promising. "It's always better to replicate a finding like this, but this is already a lot more than we knew before," Bloom said. He also credited the administration of Chicago Mayor Rahm Emanuel for a willingness to see whether the program was effective. Heller, the study author, said the same. "There are some policymakers who are afraid of finding out if programs they like don't work," she said. 6 The 730 teens who were offered jobs were picked at random from among 1,634 applicants. Their number of arrests for violent crimes was slightly lower than that of the remaining 904 teens while the jobs lasted, but the difference did not become statistically significant until six months into the study - three months after the jobs were completed. From there, the gap continued to widen. At 16 months, police data revealed 5.1 arrests for violent crimes per 100 youths who were offered jobs, compared with 9.1 violent-crime arrests per 100 teens who were not. Heller said that the results may underestimate the impact of the jobs program, as a quarter of the teens who were offered jobs did not accept them, though some of those teens found other jobs on their own. Some of the teens who were not offered jobs also found employment on their own, but Heller she did not yet know how many. She said the number was likely to be low, citing a past study that found just 9 percent of African American teens were employed. Of the teens in the study, 95 percent were black. Heller said it was too soon to perform a full analysis of whether the program paid for itself, as she would need to know whether the program yielded any long-term effects on employment, among other factors. Still, she said, early evidence suggests that the program's price tag may already be outweighed by such benefits as reduced costs to the justice system and less suffering by victims. The jobs program did not appear to have an impact on the rates of nonviolent crimes. Heller said the reason might be that although the jobs may have taught teens to resolve conflicts, those other types of offenses do not involve conflict. The jobs included serving as a day-camp counselor, cleaning vacant lots, planting community gardens, and performing clerical work for nonprofit groups and government offices. Those in office jobs had some tedious tasks, such as paper-shredding. "We explained that everybody's first job is a horrible job," Diaz said. "You've got to do some of that." One mentor was assigned to every 10 youths. These adults were available to give advice around the clock, and some went beyond the call of duty, Diaz said. When one young man got into trouble with the law and had to go to court, the mentor appeared before the judge to recommend that the teenager stay on probation rather than go to a detention center, she said. Philadelphia also is known for having a strong teen-jobs program, Diaz said. She said her office had exchanged ideas with Philadelphia Youth Network, a local nonprofit that works to get teens employed. A key to both cities' approaches is that the teenage years are not too late to make a difference, she said. "Lots of people will write off teenagers, especially if they've already gotten in trouble with the law," Diaz said. "We don't give up on any child." tavril@phillynews.com 215-854-2430 7 Making Summer Count Project One - 2014 - Data Based on 336 in Placements Program Project One Summer Jobs Campaign for Youth 2014 Performance Flow Chart Recruitment Enrollment Training Placement Actual Goal Actual Goal Placement Actual SEEP, TAG and Community ScholarsYEAR ROUND Grades: 7-10 938 344 312 123 248 Summer Jobs ONLY Grades: 10College 138 116 104 51 88 1,076 460 416 174 336 Summer ONLY Community Scholars Grades: 1-6 18 18 18 18 18 Total 18 18 18 18 18 Total 8 Age Age 17 Age 18 5% 1% Age 16 10% Age 13 28% Age 15 28% Age 14 28% Project One - 2014 - Data Based on 336 in Placements Project One Summer Jobs Campaign for Youth 2014 Performance Flow Chart Making Summer Count 9 Project One, INC Board of Trustees --- 2014 - 2015 Dr. Jonathan Lott, Chair Mr. Jim Strickland, Vice Chair Mrs. Marita Willis- Past - Co- Chair President, Community Ventures Dr. Allene Gold – Past Co-Chair Director, Talent Center, JCPS Mrs. Andrea Jackson, Secretary Mr. Michael Anderson, Treasurer Miss Alice Lucille Martin-Immediate Past Secretary and Treasurer Retired Teacher, JCPS Mrs. Lula Green, Assistant Treasurer Dr. Charles King President and CEO Project One, Inc. Dr. Raymond Burse Attorney President, Kentucky State University Mrs. Kim Sweazy Community Relations Toyota Ms. Vickie Greathouse Human Resources Housing Authority Dr. Ralph Fitzpatrick Vice President University of Louisville Dr. Keith Knapp President Christian Care Communities Mr. Greg Nichols President Automatic Air Mr. Jim Strickland President Computer Support Miss Edith Thrower Insurance leader Cincinnati,OH Mrs. CheRhonda Greenlee President Reality First Mrs. Debra Rayman Human Resources, Mgr Norton Healthcare Mr. Varick Tucker Human Resources, Mgr MSD Ms. Reba Doutrick Retired, Executive Insight Cable Mrs. Gail Strange Retired, Executive Brown and Williamson Mr. Ben Ruiz Co-Owner AdHawks Mr. James Crook Businessman Cincinnati, OH 10 The Annual Report 2014 Donor List Project One, Inc. wishes to thank the following foundations, companies and individuals for their generosity and support of children and youth in the Annual Summer Jobs Campaign and After School programs. The Gheens Foundation, Inc. Kosair Charities Foundation Toyota Motor Manufacturing Kentucky Mrs. Sandy Metts The Cralle Foundation MSD Kindred Healthcare Dr. Ed Wimberly Mr. David Jones, Sr. Miss A. Lucille Martin Housing Authority of Louisville AT&T Jefferson County Public Schools PNC Bank Owsley & Christy Brown Foundation Norton Healthcare The Hon. Jim King - Metro Council Brown Forman Christian Care Communities, Inc, TARC The Christian Methodist Episcopal Church Fifth Third Bank Bishop Sylvester Williams, Sr. Chase Bank University of Louisville LG&E The Metro Council Members GLI Fourth Street Live Dr. Kevin W. Cosby Mr. & Mrs. Louis Leveston United Parcel Service Ms. Andrea Jackson Mr. George Merrifield Bishop C. James King, Jr. Dr. Robert Peoples 11 Financial Statements and Independent Auditor’s Review Report December 31, 2014 ANDERSON & ANDERSON Certified Public Accountants 12 Financial Statements And Independent’s Auditor’s Review Report Project One, Inc. December 31, 2014 CONTENTS Page Cover Page………………………………………………………….…..1 Inside Cover Page……………… ………………………………….…..2 Table of Contents Page…………… ……………………………… … 3 Independent Auditor’s Letter... ……………………………………….4 Independent Auditor’s Review Report……………………………..…5 Statement of Financial Activities…….…………. …………………….6 Statement of Financial Position …………………… …………….…...7 Notes to Financial Statements………………………………………….8 13 Anderson & Anderson Post Office Box1822 Quincy, FL 32353 ANDERSON & ANDERSON March 10, 2015 Project One, Inc. Board of Trustees We have reviewed the accompanied financial statements for THE PROJECT ONE, INC. FOR THE 2014 AUDIT REVIEW and performed certain other tests to ensure that the financial statements and related notes to the financial statements are reasonable, I can attest that PROJECT ONE, INC. appears to be operationally and financially sound. Given the fact that PROJECT ONE, INC. has had outstanding audit reviews over the years, I can assume that this organization will continue to provide quality service and the supporting documentation for accountability and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatements. Given that this PROJECT ONE, INC. 2014 Audit Review Report shows the continuing improvement in the financial accounting of which is a testament to the continuing devotion of the Project One, Inc. administration, staff and stakeholders. Thank you for your cooperation. Sincerely, Fred Anderson, Jr. Certified Public Accountant 14 ANDERSON & ANDERSON, CPA’S Post Office Box 1822 Quincy, Florida 32353 (850) 627-2920 INDEPENDENT AUDITOR’S REVIEW REPORT ON COMPILATION OF FINANCIAL STATEMENT ______________________________________________________________ We have compiled the accompanying statement of financial position of PROJECT ONE, INC., as of December 31, 2014, and the related statement of activities and cash flow of the year. These financial statements are the responsibility of the Project One, Inc. management. Our responsibility is to express an opinion on the financial statements base on our review. We conducted our review in accordance with auditing standards generally accepted in the United States of America. These standards require that we plan and perform the review to obtain reasonable assurance about whether the financial statements are free of material misstatement. A review includes consideration of internal controls over financial reporting as a basis for designing review procedures that are appropriate in circumstances, but not for the purpose of expressing an opinion on the effectiveness of the programmatic operations. A compilation is limited to presenting in the form of financial statements’ information that is representation of management. We have not audited but reviewed the accompanying financial statements. We believe that the Audit Review evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. OPINION In our opinion, the financial statements reviewed and referred to above present fairly, in all material respects, the financial position of PROJECT ONE, INC as of December 31, 2014, and the changes in its assets and its cash flow for the year ended in accordance with accounting principles generally accepted in the United States of America. Fred Anderson, Jr., CPA March 10, 2015 15 Project One, Inc. STATEMENT OF FINANCIAL ACTIVITIES For The Year Ended December 31, 2014 FINANCIAL REPORT JANUARY 1, 2014 – DECEMBER 31, 2014 Income 2014 Metro Louisville Grants Corporations Foundation $40,000.00 70,000.00 119,000.00 Individual Gifts 68,952.00 CME Church 50,000.00 The 29th Anniversary Gala 63,138.00 Other Income- including the Job-A Thon 50,158.00 Total Income 461,248.00 Operational Expenses Expense Items Personnel Salaries and Fringe Benefits 21,400.00 Utilities 33,774.00 Office Supplies & Equipment Maintenance 15,250.00 Computer Lab Expansion Program Outreach and Development 25,000.00 201,000.00 Client Assistance 81,303.00 Other Expenses Include - 29th Anniversary Gala 12,419.00 Insurance & Workman's Comp $8,000.00 16 After School University & Community Scholars 45,000.00 Accounting Services and Tax Preparation 3,000.00 Evaluation 5,000.00 Payroll Taxes 2,046.00 Telephone 2,962.00 Legal Fees 1,000.00 Postage & Shipping Total Expenses Overall Net Gain(Loss) 594.00 457,748.00 3,500.00 Balance Sheet as of December 31, 2014 Assets Cash Property Scholarship Fund 3,500.00 220,572.00 4,000.00 228,072.00 Liabilities Equipment 120,909.00 New Computers 25,000.00 Total Liabilities 145,909.00 Equity in the property Total Liabilities and Equity 82,163.00 228,072.00 17 NOTES TO STATEMENT OF ACTIVITIES AND POSITION For The Year Ended December 31, 2014 NOTE 1 NATURE OF ACTIVITIES Project One, Inc. is a 501c3 organization exempt from income tax. The corporation is organized and operated exclusively for charitable and public purposes. In carrying out its corporate purposes, the corporation shall have all the powers enumerated in Chapter 273.171, ET. seq., of the Kentucky Revised Statutes. In furtherance of the general purposes of the corporation, the purposes of the corporation are to facilitate the economic, educational and social development of inner city youth through training, educational and job development programs. After School Programs and Summer Jobs for economically disadvantaged youth are cornerstones of the organization. NOTE 2 BASIS OF ACCOUNTING FOR THE REVIEW The accompanying reviewed financial statements were conducted in accordance with auditing standards generally accepted in the United States of America. A. The Project One classifies its net assets and revenues, gains and losses based on the existence or absence of donor - imposed restrictions. B. Unrestricted: These net assets are not subject to donor-imposed stipulations, and are fully available at the discretion of Project One management and Board of Trustee (the “Board”) to utilize in any part to its mission, program or supporting services. NOTE 3 INCOME TAXES As stated in the Nature of Activities, Project One, Inc. is a non-profit organization pursuant to Section 501 (c) (3) organization of the IRS, and therefore is tax-exempt. 18 NOTE 4 EQUIPMENT AND OFFICE FURNITURE The Book Value of the equipment and office furniture at Project One has been estimated by the management at a cost of $220,572.00. This estimation was based upon depreciation as laid out by the Tax Consultant in line with the value asset by the Internal Revenue Service. NOTE5 MANAGEMENT REVIEW However, based on the review and preparation of the financial statements, Anderson & Anderson have found no irregularities involving the administration of officers who have significant roles in the financial internal control structure. NOTE6 PROGRAM OUTREACH AND DEVELOPMENT The Project One, Inc. Program Outreach and Development category of expenses consist of 12 programmatic enterprises and they are as follows: 1. The Fatherhood Programs, 2. My Brother's Keeper and My Sister's Keeper, 3. The After-School University for Tutoring and Mentoring 4. Talent and Gifted Scholars Programs, 5. JET (Junior Executive Training) Programs, 6. SEEP (Summer Earning and Enrichment Programs), 7. Community Scholar's Programs for Elementary students, 8. The Mayor's Summer Jobs Program for ages 16 and above, 9. Summer Jobs with The State of Kentucky and Financial Education for youth and adults, 10. EEATT (Early Employment And Training Time) Programs for ages 13-15. 11. State funded programs with The State of Kentucky. 12. STEM (Science, Technology, Engineering and Math) Programs. Fred Anderson Jr. Fred Anderson, CPA 205 N Love St, Quincy, FL 32351 Phone: 850-627-2920 19